Sees 19% Q4 Production Increase Over Q3

VANCOUVER, BC / ACCESSWIRE / January 26, 2023 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(AQUIS:GSVR)(OTCQX:GSVRF) is pleased to announce consolidated production results for the three months ended December 31, 2022. Production results are from the Company's wholly owned El Cubo Mines Complex ("El Cubo"), Valenciana Mines Complex (VMC), and San Ignacio Mine ("San Ignacio") in Guanajuato, Mexico, and the Topia Mine ("Topia") in Durango, Mexico.

Q4 2022 Production Highlights

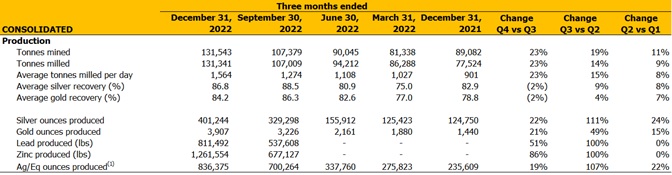

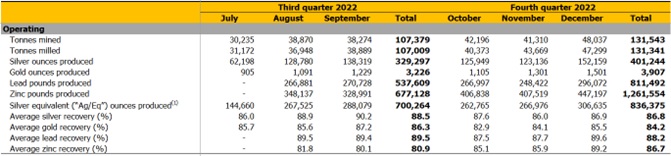

- Record production during the quarter of 836,375 silver-equivalent ("AgEq") ounces derived from 401,244 ounces of silver, 3,907 ounces of gold, 811,492 pounds of lead and 1,261,554 pounds of zinc. Silver-equivalent production for all of 2022 totaled 2.15 million ounces.

- Average silver recoveries of 86.8% continue to surpass historical recoveries.

- The dry stack tailings project at El Cubo has been initiated and advanced engineering has been completed; the Company is awaiting regulatory approval to begin construction of a dry stack facility that would increase tailings capacity at El Cubo from 2.5 years to approximately 15 years of additional tailings storage.

- A new gravity circuit at El Cubo was completed during the quarter with the objective of recovering gold and silver from the Mastrantos IV historical tailings pond (See GSilver news release dated June 22, 2022 - GSilver Discovers High-Grade Historical Tailings Material at El Cubo Assays 727 GPT AgEq Over 1.2m and 711 GPT AgEq Over 1.0m). The new gravity circuit is expected to begin commercial operations in Q1, 2023.

- Installation of a new exhaust fan at El Cubo with the capacity to circulate 250 cubic feet per minute has been completed; ventilation at the mine has been substantially improved.

- Substantial cost reductions were realized during the quarter through the purchase of compressors and a wholly owned scoop tram fleet; further savings were realized as the Company reduced the total number of outside contractors it utilizes in its mining operations.

- All recently acquired mining assets are now in production; all assets acquired through the MMR transaction (San Ignacio, VMC and Topia) in August 2022 are now fully operational. Towards the end of the quarter, the Cata mill at VMC was recommissioned and is currently processing mineralized material from San Ignacio and the Los Pozos mine at VMC; the Topia mine in Durango did not lose a single day of production during the MMR ownership handover.

"We ended 2022 with record production of precious metals from five mines and three processing facilities," said Chairman & CEO, James Anderson. "Capital investments made during Q4 are already generating improved efficiencies and our operations team continues to look for opportunities to enhance profit margins as we strive to continue our trend of quarterly increases in silver production across all of our producing assets."

- Silver equivalents are calculated using an 89.97:1 (Ag/Au), 0.05:1 (Ag/Pb) and 0.08:1 (Ag/Zn) ratio for Q4 and Q3 2022; 83.4:1 (Ag/Au) ratio for Q2 2022; and 80:1 (Ag/Au) ratio for Q1 2022.

Q4 2022 Mine Operations Continue Trend of Quarter over Quarter Production Increases

Consolidated silver production increased 22% to 401,244 ounces in Q4 2022 compared to Q3 2022; similarly, consolidated gold production increased by 21% to 3,907 ounces over the same period. During the fourth quarter, mineralized material from San Ignacio was sent to the El Cubo mill for processing; in 2023 the Company expects to process all mineralized material from San Ignacio at the recently reactivated Cata mill at VMC. (See GSilver news release dated January 17, 2023 - "Guanajuato Silver Restarts the Cata Mill at the Valenciana Mines Complex")

In Durango, third-party mill feed from local operations in the vicinity of the Topia mine added to production during the quarter; this supplemental production amounted to 20% of all tonnes processed at Topia during the quarter and contributed to higher grades. There are several small mining operations located nearby the Topia mine, and the Company intends to use the Topia processing facilities as the centerpiece of a hub & spoke strategy that would bring in supplemental material for processing in partnership with neighboring operations.

Consolidated silver equivalent production in Q4 was 19% higher than the previous quarter. This increase reflects the continuing ramp-up of operations at all of GSilver's mining assets. Total production for 2022 was 2.15 million AgEq; the Company ended the year at a commercial run-rate of 3.5 million silver-equivalent ounces, which was approximately 8% higher than initially anticipated for 2022.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Technical Information

Reynaldo Rivera, VP of Exploration of GSilver, has approved the scientific and technical information contained in this news release. Mr. Rivera is a member of the Australasian Institute of Mining and Metallurgy (AusIMM - Registration Number 220979) and a "qualified person" as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

Gsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, the continuing trend of quarterly increases in production and silver equivalent ounce recoveries in 2023; the construction of a new dry stack tailings facility at El Cubo, the anticipated increase and length of additional tailing storage capacity resulting therefrom and the expecting timing for the construction thereof; the ability of the Company to recover gold and silver from the Mastrantos IV historical tailings pond utilizing the newly constructed gravity circuit at El Cubo and timing for the commencement thereof; the ability of the Company to continue to source and process (and expand) third party mineralized material at Topia; the Company's ability to maintain and improve operating efficiencies at some or all of its mining operations in 2023 and to continue to reduce its reliance on third party mining contractors; the ability of the newly restarted Cata mill to process all of the mineralized material mined from San Ignacio and VMC in the volumes and grades anticipated; and the Company's status as one of the fastest growing silver producers in Mexico.

Such forward-looking statements and information reflect management's current beliefs and expectations and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our estimates of mineralized material at El Cubo, VMC, San Ignacio and Topia and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; the ability of the Company to ramp up processing of mineralized material at Cata at the projected rates and source sufficient high grade mineralized material to fill such processing capacity; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital cost estimates; decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, future prices of gold, silver and other metals, currency rate fluctuations, rising inflation and interest rates, actual results of production, exploration and development activities, actual resource grades and recoveries of silver, gold and other metals, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, geopolitical conflicts including wars, environmental risks, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to successfully discover and mine sufficient quantities of high grade mineralized material at El Cubo, VMC, San Ignacio and Topia for processing at its existing mills to increase production, tonnage milled and recoveries rates of gold, silver, and other metals in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, VMC, San Ignacio, Topia and its other mines is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected production of silver, gold and other metals will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about the continued spread and severity of COVID-19, the ongoing war in Ukraine and rising inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, supplies, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com including the Company's annual information form for the year ended December 31, 2021. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

View source version on accesswire.com:

https://www.accesswire.com/736823/Guanajuato-Silver-Produces-Record-836375-AgEq-Ounces-in-Q4