Santa Helena environmental and metallurgical programs to rapidly advance

LONDON, UK / ACCESSWIRE / June 11, 2024 / Meridian Mining UK. S (TSX:MNO )(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to provide an update on its drilling activities at the Cabaçal and Santa Helena mines, part of the greater 50km Cabaçal Cu-Au-Ag VMS belt-scale project ("the Belt") in Mato Grosso, Brazil.

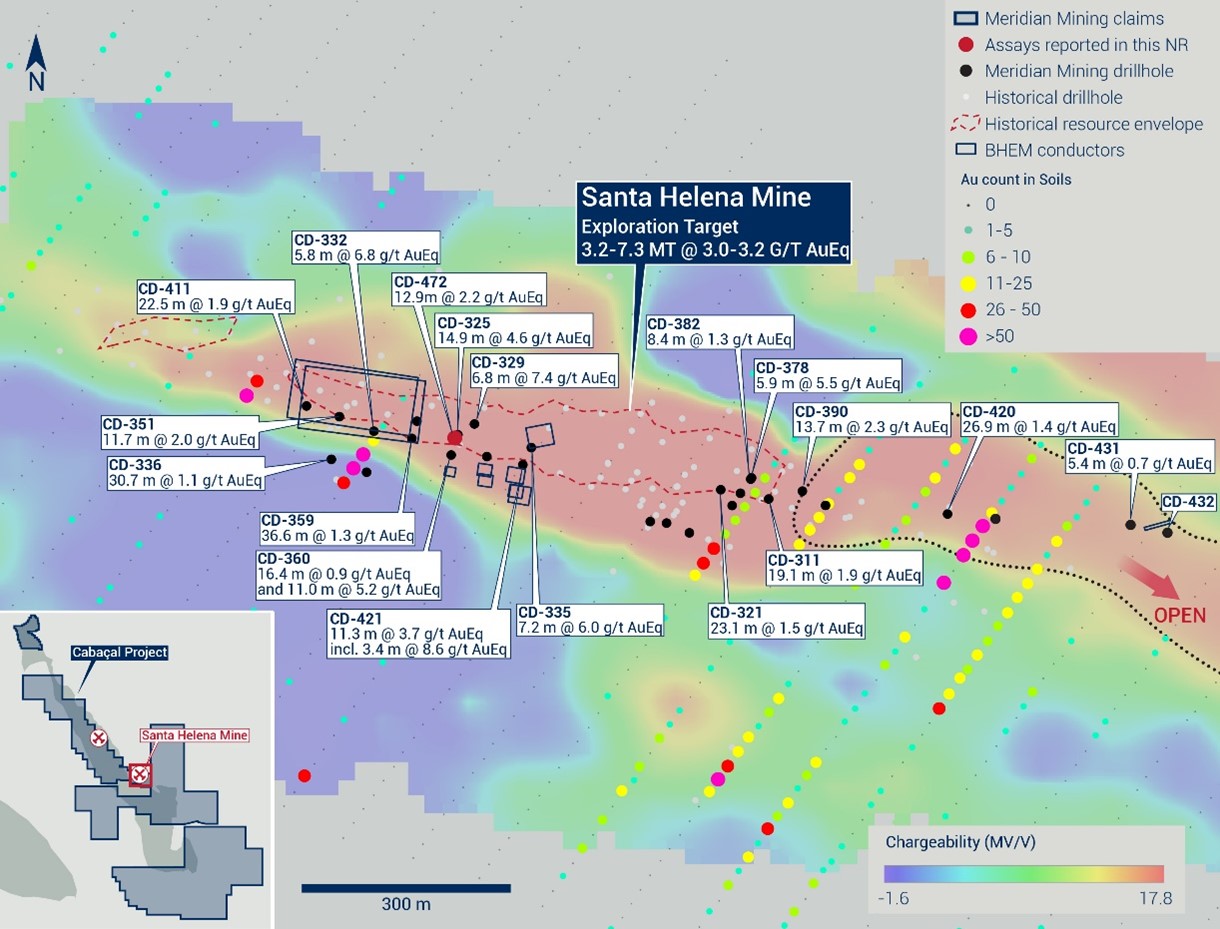

At the Santa Helena Cu-Au-Ag & Zn project ("Santa Helena"), first results are starting to be received following re-initiation of the drilling program, with CD-472 returning a strong interval of 5.0m @ 4.0g/t AuEq from 24.1m ("Figure 1"). Meridian is initiating the environmental impact studies for open-pit development at Santa Helena, as part of its hub and spoke development strategy for the broader belt. The Company also reports that Santa Helena's metallurgical testwork is to commence shortly and focus on developing a flow sheet to optimise production of clean copper + gold-silver concentrate, gold doré and zinc concentrates. Drilling continues and further assays are pending.

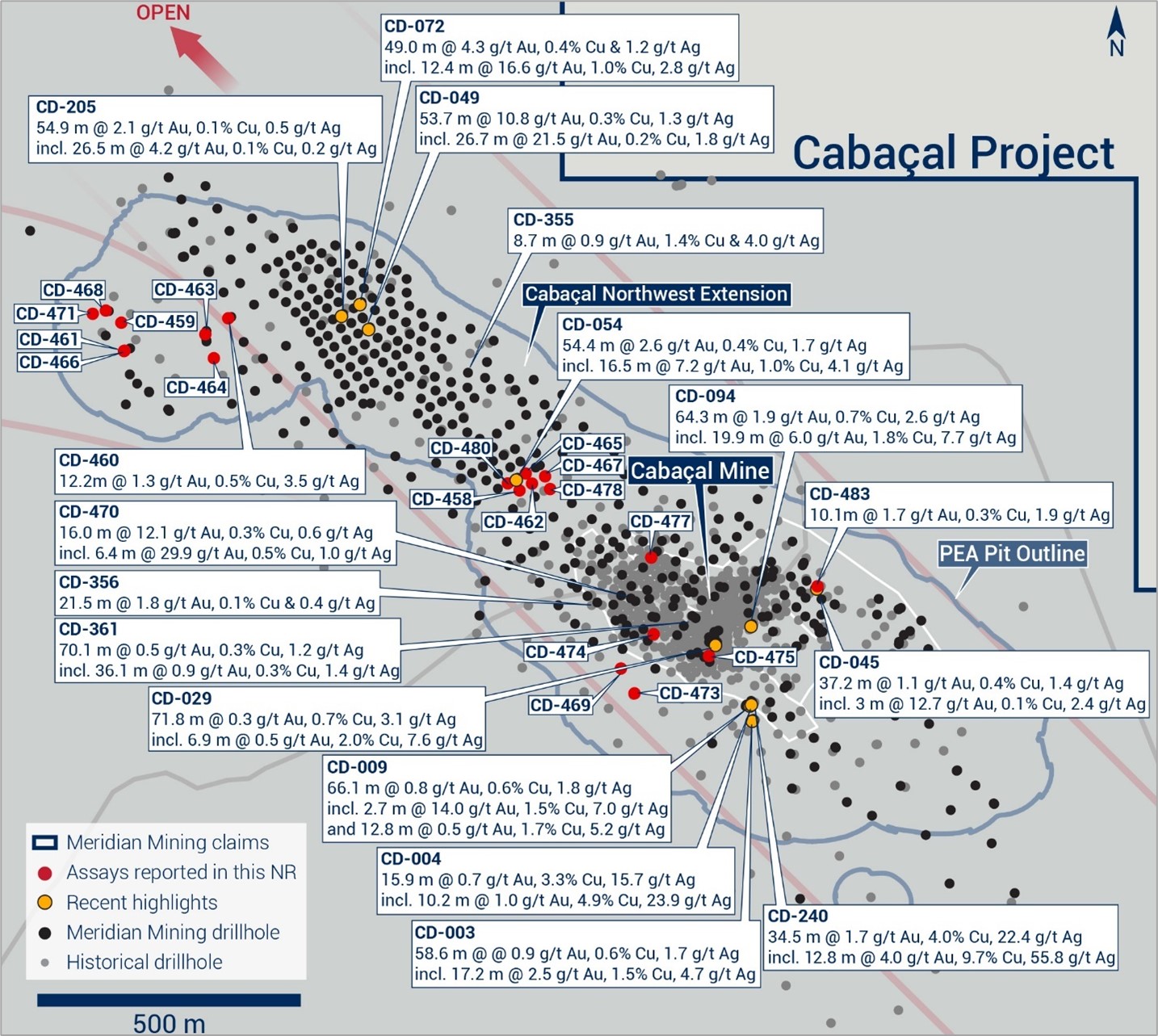

The infill drilling at the advanced Cabaçal Cu-Au-Ag project 1 ("Cabaçal") includes holes targeting historical positions where data has been lost and which were not included in the 2022 resource statement 2 . Drilling results defining extensions of near surface Cu-Au-Ag mineralization are highlighted by CD-483's 10.1m @ 2.1g/t AuEq from 9.4m, amongst broader intersections ("Figure 2"). Meridian has now completed over 50,000 metres of drilling at Cabaçal which pushes the project database to a total of over 125,000 meters.

Highlights Reported Today

- Meridian reports further strong shallow mineralized intercepts at Santa Helena and Cabaçal deposits;

- Santa Helena continues to advance as the next open pit target for the hub and spoke development strategy of the Cabaçal VMS belt;

- Shallow high-grade Cu-Au-Ag & Zn mineralization continues to be intercepted;

- CD-472 returns 12.9m @ 2.2g/t AuEq from 24.1m at Santa Helena; including:

- 5.0m @ 4.0g/t AuEq from 24.1m;

- Environmental impact, hydrogeological and metallurgical studies commencing; and

- Cabaçal drilling defines more shallow high-grade mineralization;

- CD-483 returns 10.1m @ 2.1g/t AuEq* from 9.4m at Cabaçal.

*See technical note for separate AuEq equations for Santa Helena and Cabaçal.

Mr. Gilbert Clark, CEO, comments: "We are pleased to see a continuing flow of solid results from both Santa Helena and Cabaçal. Our focused strategy of investing into the development of near-term production from Cabaçal and Santa Helena, whilst continuing "near-mine" exploration, outlines the potential for the Belt to become a multi decade producer. Santa Helena continues to advance as the second open pitable target, and another potential source of quality clean copper concentrates with high grades of gold and silver. With multiple new copper smelters being built internationally and the demand for clean copper concentrates growing, the Cabaçal Cu-Au-Ag VMS belt presents one of the only near-term projects of scale that can help bridge this supply gap for clean copper concentrates."

Santa Helena Update

Drilling continues at Santa Helena with two rigs, and the first result has been returned with further results pending. Drilling is continuing with an infill pattern to achieve systematic coverage over the deposit, particularly in up-dip extensions where the system was more sparsely tested. The first result is reported from CD-472 ("Figure 1"), from a position between CD-360 (16.4m @ 0.9g/t AuEq from 6.0m & 11.0m @ 5.2g/t AuEq from 30.0m) and CD-325 (14.9m @ 4.6g/t AuEq from 26.3m). CD-472 crosses a position where only partial sampling records were available from a historical surface hole. The new result has returned:

- CD-472 (Santa Helena):

- 12.9m @ 2.2g/t AuEq (1.0g/t Au, 0.5% Cu, 24.6g/t Ag & 1.4% Zn) from 24.1m; including:

- 5.0m @ 4.0g/t AuEq (1.7g/t Au, 1.3% Cu, 53.7g/t Ag & 1.7% Zn) from 24.1m;

- 4.7m @ 1.2g/t AuEq (0.1g/t Au, 0.2% Cu, 6.5g/t Ag & 1.9% Zn) from 48.3m; and

- 11.1m @ 0.8g/t AuEq (0.1g/t Au, 0.1% Cu, 5.3g/t Ag & 1.2% Zn) from 58.9m.

- 12.9m @ 2.2g/t AuEq (1.0g/t Au, 0.5% Cu, 24.6g/t Ag & 1.4% Zn) from 24.1m; including:

By comparison, the historical vertical hole it crosses, PM-15A had returned:

- 2.2m @ 0.9g/t AuEq (0.1g/t Au, 0.1% Cu, 8.0g/t Ag, 1.7% Zn) from 25.0m;

- 2.1m @ 1.4g/t AuEq (0.3g/t Au, 0.2% Cu, 9.9g/t Ag, 1.9% Zn) from 32.1m

The results provide more continuous sample coverage for resource modelling and show importantly that the sampling gaps are mineralized.

The Company has engaged Sete Soluções e Tecnologia Ambiental Ltda and Hidrovia Hidrogeologia e Meio Ambiente to initiate baseline environmental assessments for open-pit development. The Company's metallurgical consultant, Mr Norman Lotter, is advising on the formulation of a program to test the various mineralization styles.

Figure 1: Santa Helena results location map.

Cabaçal Update

Further drill results continue to be delivered from the Company's programs at Cabaçal, including holes from the northwest extension, the mine area flank, and the mine area ("Figure 2"). Some of the recent drilling has included further twinning on holes where data has only been partially preserved or lost. The first of these results reported was CD-470, which returned 16.0m @ 12.5g/t AuEq from 53.3m, including 6.4m @ 30.6g/t AuEq 3 . Additional holes have targeted a range of positions (and expected grade distributions), in the Eastern, Central and Southern Copper Zones. Highlights from the recent drilling include:

- CD-483 (ECZ twin of JUSPD-587):

- 10.1m @ 2.1g/t AuEq (1.7g/t Au, 0.3% Cu & 1.9g/t Ag) from 9.4m; including:

- 1.9m @ 8.8g/t AuEq (7.6g/t Au, 0.8% Cu & 4.2g/t Ag) from 12.7m;

- 18.2m @ 0.9g/t AuEq (0.6% Cu & 1.9g/t Ag) from 26.4m;

- 4.9m @ 1.2g/t AuEq (0.2g/t Au, 0.7% Cu & 3.1g/t Ag) from 59.9m;

- 10.1m @ 2.1g/t AuEq (1.7g/t Au, 0.3% Cu & 1.9g/t Ag) from 9.4m; including:

- CD-478 (Central Area of the CNWE):

- 6.5m @ 1.0g/t AuEq (0.2g/t Au, 0.5% Cu & 4.0g/t Ag) from 22.5m;

- 10.7m @ 1.5g/t AuEq (0.4g/t Au, 0.8% Cu & 3.7g/t Ag) from 51.3m; including:

- 2.5m @ 4.4g/t AuEq (1.3g/t Au, 2.1% Cu & 13.1g/t Ag) from 59.2m;

- 4.0m @ 1.1g/t AuEq (0.3g/t Au, 0.5% Cu & 2.3g/t Ag) from 65.0m;

- 3.1m @ 1.4g/t AuEq (0.4g/t Au, 0.7% Cu & 4.0g/t Ag) from 114.3m;

- CD-477 (CCZ; twin of JUSPD-484; void from 25.1 - 32.7m):

- 9.8m @ 1.6g/t AuEq (0.4g/t Au, 0.9% Cu & 4.3g/t Ag) from 47.3m; including:

- 2.8m @ 3.4g/t AuEq (0.6g/t Au, 1.9% Cu & 10.5g/t Ag) from 54.3m;

- 5.2m @ 1.6g/t AuEq (0.5g/t Au, 0.8% Cu & 3.6g/t Ag) from 69.9m;

- 9.8m @ 1.6g/t AuEq (0.4g/t Au, 0.9% Cu & 4.3g/t Ag) from 47.3m; including:

- CD-474 (SCZ orthogonal hole; void from 76.5 - 83.8m):

- 11.8m @ 1.0g/t AuEq (0.2g/t Au, 0.6% Cu & 2.3g/t Ag) from 55.9m;

- 3.7m @ 4.7g/t AuEq (4.7g/t Au, 0.1% Cu & 1.0g/t Ag) from 70.4m;

- 10.0m @ 1.1g/t AuEq (0.4g/t Au, 0.5% Cu & 2.2g/t Ag) from 138.7m;

- CD-469 (JUSPD-580 twin; SW flank of mine area):

- 23.2m @ 0.5g/t AuEq (0.1g/t Au, 0.3% Cu & 0.6g/t Ag) from 85.6m; including:

- 2.0m @ 1.9g/t AuEq (0.3g/t Au, 1.2% Cu & 2.8g/t Ag) from 106.8m; and

- CD-460 (CNWE):

- 12.2m @ 1.9g/t AuEq (1.3g/t Au, 0.5% Cu & 3.5g/t Ag) from 71.2m; including:

- 4.5m @ 4.5g/t AuEq (3.1g/t Au, 1.0% Cu & 6.6g/t Ag) from 72.0m.

- 12.2m @ 1.9g/t AuEq (1.3g/t Au, 0.5% Cu & 3.5g/t Ag) from 71.2m; including:

Figure 2: Cabaçal results location map.

The twin drilling is providing some useful context in areas where targeted historical holes have gaps in information where data is lost, incomplete, or depicted only in graphic charts. Some additional drilling will target the down-plunge projection of the shallow CD-483 position. Some additional select infill drilling will also be conducted on a staggered pattern in the resource area, to further consolidate grade distribution and continuity.

CD-460 returned a solid intersection from the CNWE, although this area is exhibiting some nuggetty characteristics in gold distribution, making definition more challenging. Sample CBDS63645 (76.12 - 76.45m) from this hole returned 6.2g/t Au. Its duplicate pair, which was not used in the composite calculation, returned tenfold the grade at 72.9g/t Au. A screen-fire assay check will be further conducted on the remaining sample. The locally steep topography of this area makes certain areas more challenging to access, and the position may potentially be better targets for under-ground development with closer spaced drilling off the floor of an open pit.

The Company is also running through an update of its quality control program through a third round of umpire analysis. Results generally compare well, although some punctual outliers may also indicate a nugget effect, or an analytical issue, with one sample in particular (CBDS02391) originally reporting 0.279 g/t and repeating with 9.25 g/t Au. Visual inspection of the sampled interval showed that visible gold was present, and further evaluation continues.

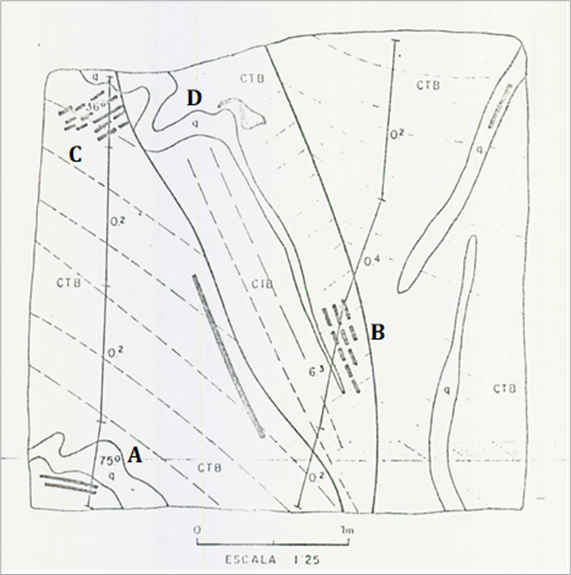

The Company has been reviewing historical records submitted to the ANM when the project was originally operated by BP Minerals and RTZ. These records have provided some additional information on production and development, but unfortunately an annex of assay results from a technical report has not yet been located. The technical reports include some further examples of face mapping and sampling of the variably oriented vein and shear arrays encountered in the underground room and pillar mining. Geometries created challenges for selective high-grade extraction, and steep structures are present that were not coupled well with the dominantly vertical drilling ("Figure 3"). A number of holes orthogonal to the main strike, and scissor holes, will be conducted to test for potential structural arrays in trends not typically intersected in the moderately dipping NE-trending drilling.

Figure 3: Historical Cabaçal underground face sampling for gold illustration looking south from technical report recently retrieved for ANM archive search, showing (A) moderately dipping mineralization and vein arrays (75g/t Au channel sample in lower left), and (B) subvertical cross-cutting shear with vein arrays (6.3g/t Au sample; (C) 36.6 g/t vein selvedge in upper left, and (D) unsampled subvertical vein sets to the right).

About Meridian

Meridian Mining is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- The initial resource definition at the second high-grade VMS asset at Santa Helena as first stage of Hub and Spoke development strategy;

- Regional scale exploration of the Cabaçal VMS belt to expand the Hub and Spoke strategy; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade). Santa Helena mine area generated an initial Exploration Target with a tonnage range of 3.2 -7.2 Mt grading between 3.0 - 3.2g/t AuEq*, which gives a potential high-grade metal inventory range of between 306,000 to 763,000 AuEq ounces, located within 10km of the proposed Cabaçal mill site.

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca .

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with 70% passing <2mm, split off to give a mass of approximately 250g, and pulverized to >85% passing 200#. Routine gold analyses have been conducted by Au-AA23 (fire assay of a 30g charge with AAS finish). High-grade samples (>10g/t Au) are repeated with a gravimetric finish (Au-GRA21). Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Gold equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. AuEq (g/t) = (Au_(g/t) * 65%Recovery) + (1.492*Cu(%) * 89%Recovery) + (0.474*Zn% * 89%Recovery)) + (0.013Ag(g/t) * 61%Recovery)).

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca . While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Assay results reported in this release.

Santa Helena

Hole-id |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CD-472 |

59 |

189 |

82.8 |

SHM |

|||||||||

12.9 |

2.2 |

1.5 |

1.0 |

0.5 |

24.6 |

1.4 |

1.1 |

24.1 |

|||||

Including |

5.0 |

4.0 |

2.7 |

1.7 |

1.3 |

53.7 |

1.7 |

2.2 |

24.1 |

||||

4.7 |

1.2 |

0.8 |

0.1 |

0.2 |

6.5 |

1.9 |

0.2 |

48.3 |

|||||

11.1 |

0.8 |

0.5 |

0.1 |

0.1 |

5.3 |

1.2 |

0.3 |

58.9 |

Cabaçal

Hole-id |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

From (m) |

|---|---|---|---|---|---|---|---|---|---|---|---|

CD-483 |

-89 |

000 |

91.7 |

ECZ |

|||||||

2.8 |

0.5 |

0.3 |

0.4 |

0.1 |

0.5 |

2.1 |

|||||

10.1 |

2.1 |

1.4 |

1.7 |

0.3 |

1.9 |

9.4 |

|||||

Including |

1.9 |

8.8 |

5.9 |

7.6 |

0.8 |

4.2 |

12.7 |

||||

18.2 |

0.9 |

0.6 |

0.0 |

0.6 |

1.9 |

26.4 |

|||||

1.8 |

0.4 |

0.3 |

0.0 |

0.3 |

0.8 |

51.6 |

|||||

0.9 |

0.7 |

0.4 |

0.1 |

0.4 |

1.2 |

56.1 |

|||||

4.9 |

1.2 |

0.8 |

0.2 |

0.7 |

3.1 |

59.9 |

|||||

3.2 |

1.1 |

0.8 |

0.2 |

0.6 |

3.2 |

73.8 |

|||||

CD-480 |

-49 |

061 |

124.8 |

CWNE |

|||||||

4.5 |

0.4 |

0.2 |

0.1 |

0.2 |

1.1 |

14.4 |

|||||

2.1 |

0.5 |

0.4 |

0.3 |

0.2 |

1.2 |

27.5 |

|||||

1.6 |

0.3 |

0.2 |

0.1 |

0.2 |

0.6 |

45.4 |

|||||

2.1 |

0.7 |

0.5 |

0.2 |

0.4 |

0.8 |

50.5 |

|||||

0.7 |

0.5 |

0.3 |

0.2 |

0.3 |

2.1 |

54.9 |

|||||

5.8 |

1.3 |

0.8 |

0.5 |

0.6 |

1.9 |

62.6 |

|||||

4.3 |

0.5 |

0.4 |

0.2 |

0.2 |

0.4 |

75.2 |

|||||

1.0 |

2.0 |

1.3 |

0.2 |

1.3 |

2.8 |

86.7 |

|||||

0.5 |

4.3 |

2.9 |

1.3 |

2.1 |

11.3 |

97.2 |

|||||

7.2 |

0.4 |

0.3 |

0.1 |

0.2 |

1.9 |

100.6 |

Hole-id |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

From (m) |

|---|---|---|---|---|---|---|---|---|---|---|---|

CD-478 |

-48 |

060 |

133.7 |

CWNE |

|||||||

6.5 |

1.0 |

0.7 |

0.2 |

0.5 |

4.0 |

22.5 |

|||||

Including |

0.4 |

7.5 |

5.0 |

1.2 |

4.2 |

20.2 |

27.0 |

||||

2.5 |

0.6 |

0.4 |

0.1 |

0.4 |

1.5 |

38.0 |

|||||

10.7 |

1.5 |

1.0 |

0.4 |

0.8 |

3.7 |

51.3 |

|||||

Including |

2.5 |

4.4 |

3.0 |

1.3 |

2.1 |

13.1 |

59.2 |

||||

Including |

1.0 |

9.3 |

6.2 |

2.2 |

4.7 |

30.0 |

59.2 |

||||

4.0 |

1.1 |

0.7 |

0.3 |

0.5 |

2.3 |

65.0 |

|||||

3.0 |

0.5 |

0.3 |

0.1 |

0.3 |

1.7 |

78.4 |

|||||

7.7 |

0.4 |

0.3 |

0.1 |

0.2 |

0.5 |

102.3 |

|||||

3.1 |

1.4 |

0.9 |

0.4 |

0.7 |

4.0 |

114.3 |

|||||

Including |

0.8 |

3.7 |

2.5 |

1.0 |

1.9 |

11.9 |

116.5 |

||||

CD-477 |

-89 |

000 |

87.7 |

CCZ |

|||||||

1.7 |

1.3 |

0.9 |

0.1 |

0.8 |

1.2 |

11.2 |

|||||

1.0 |

2.0 |

1.3 |

0.8 |

0.8 |

1.6 |

18.4 |

|||||

3.5 |

0.7 |

0.5 |

0.4 |

0.3 |

0.3 |

37.7 |

|||||

9.8 |

1.6 |

1.1 |

0.4 |

0.9 |

4.3 |

47.3 |

|||||

Including |

2.8 |

3.4 |

2.3 |

0.6 |

1.9 |

10.5 |

54.3 |

||||

5.2 |

1.6 |

1.1 |

0.5 |

0.8 |

3.6 |

69.9 |

|||||

Including |

2.3 |

2.9 |

1.9 |

1.0 |

1.3 |

6.0 |

70.4 |

||||

CD-475 |

-89 |

000 |

133.9 |

SCZ |

|||||||

2.0 |

0.4 |

0.2 |

0.4 |

0.0 |

0.1 |

66.8 |

|||||

6.5 |

0.6 |

0.4 |

0.5 |

0.1 |

0.4 |

71.6 |

|||||

7.7 |

1.3 |

0.8 |

0.2 |

0.7 |

2.9 |

81.4 |

|||||

Including |

2.4 |

2.5 |

1.7 |

0.6 |

1.4 |

6.2 |

81.4 |

||||

13.8 |

0.7 |

0.5 |

0.1 |

0.4 |

2.5 |

91.1 |

|||||

Including |

1.5 |

2.1 |

1.4 |

0.3 |

1.2 |

8.9 |

95.8 |

||||

3.7 |

1.1 |

0.7 |

0.2 |

0.6 |

2.7 |

106.6 |

|||||

CD-474 |

-49 |

091 |

166.4 |

SCZ |

|||||||

11.8 |

1.0 |

0.7 |

0.2 |

0.6 |

2.3 |

55.9 |

|||||

Including |

3.5 |

2.2 |

1.5 |

0.2 |

1.4 |

5.3 |

60.6 |

||||

3.7 |

4.7 |

3.2 |

4.7 |

0.1 |

1.0 |

70.4 |

|||||

Including |

2.2 |

7.2 |

4.8 |

7.1 |

0.1 |

1.1 |

70.4 |

||||

2.5 |

0.9 |

0.6 |

0.4 |

0.4 |

0.6 |

83.8 |

|||||

3.6 |

1.6 |

1.1 |

0.4 |

0.8 |

4.0 |

89.3 |

|||||

Including |

0.4 |

11.1 |

7.4 |

2.4 |

5.7 |

32.0 |

92.5 |

||||

1.4 |

1.0 |

0.7 |

0.1 |

0.7 |

2.4 |

95.8 |

|||||

0.9 |

4.2 |

2.8 |

0.6 |

2.4 |

9.0 |

100.6 |

|||||

0.7 |

1.4 |

0.9 |

0.3 |

0.8 |

2.9 |

105.9 |

|||||

1.7 |

0.4 |

0.2 |

0.4 |

0.0 |

0.2 |

109.6 |

|||||

10.0 |

1.1 |

0.7 |

0.4 |

0.5 |

2.2 |

138.7 |

Hole-id |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

From (m) |

|---|---|---|---|---|---|---|---|---|---|---|---|

CD-473 |

-89 |

000 |

142.9 |

SCZ |

|||||||

2.3 |

0.3 |

0.2 |

0.1 |

0.2 |

0.4 |

96.7 |

|||||

5.2 |

1.0 |

0.7 |

0.2 |

0.6 |

1.7 |

110.2 |

|||||

Including |

1.4 |

2.8 |

1.9 |

0.3 |

1.8 |

5.1 |

112.0 |

||||

CD-471 |

-59 |

060 |

142.1 |

CWNE |

|||||||

3.2 |

0.4 |

0.3 |

0.0 |

0.3 |

0.3 |

42.4 |

|||||

0.8 |

0.7 |

0.5 |

0.0 |

0.5 |

0.2 |

89.6 |

|||||

2.9 |

0.3 |

0.2 |

0.1 |

0.2 |

0.8 |

110.8 |

|||||

CD-469 |

-89 |

000 |

127.9 |

SCZ |

|||||||

2.7 |

0.5 |

0.3 |

0.0 |

0.3 |

1.1 |

44.5 |

|||||

23.2 |

0.5 |

0.3 |

0.1 |

0.3 |

0.6 |

85.6 |

|||||

Including |

2.0 |

1.9 |

1.3 |

0.3 |

1.2 |

2.8 |

106.8 |

||||

1.4 |

0.4 |

0.3 |

0.1 |

0.2 |

0.8 |

113.2 |

|||||

CD-468 |

-44 |

054 |

133.6 |

CWNE |

|||||||

0.6 |

1.3 |

0.9 |

1.1 |

0.2 |

1.1 |

87.0 |

|||||

CD-467 |

-50 |

057 |

132.4 |

CWNE |

|||||||

10.4 |

0.7 |

0.4 |

0.0 |

0.4 |

1.7 |

48.0 |

|||||

1.2 |

1.2 |

0.8 |

0.1 |

0.7 |

6.0 |

63.1 |

|||||

2.5 |

0.4 |

0.3 |

0.1 |

0.2 |

2.0 |

71.2 |

|||||

2.3 |

0.2 |

0.2 |

0.1 |

0.1 |

1.0 |

83.3 |

|||||

1.5 |

0.3 |

0.2 |

0.1 |

0.2 |

0.2 |

92.9 |

|||||

5.9 |

0.7 |

0.5 |

0.3 |

0.3 |

0.8 |

97.0 |

|||||

Including |

2.0 |

1.6 |

1.1 |

0.7 |

0.7 |

1.5 |

100.8 |

||||

8.3 |

0.6 |

0.4 |

0.1 |

0.3 |

1.4 |

107.6 |

|||||

CD-466 |

-35 |

060 |

140.5 |

CWNE |

|||||||

0.5 |

3.0 |

2.0 |

0.1 |

2.0 |

5.9 |

68.0 |

|||||

1.0 |

0.5 |

0.3 |

0.2 |

0.3 |

0.3 |

113.5 |

|||||

2.8 |

2.4 |

1.6 |

1.8 |

0.4 |

1.0 |

118.2 |

|||||

Including |

0.5 |

10.1 |

6.8 |

8.2 |

1.3 |

1.6 |

118.2 |

||||

CD-465 |

-46 |

062 |

142 |

CWNE |

|||||||

3.9 |

1.2 |

0.8 |

0.2 |

0.7 |

0.8 |

23.0 |

|||||

4.7 |

0.6 |

0.4 |

0.1 |

0.4 |

0.7 |

44.6 |

|||||

10.9 |

0.5 |

0.3 |

0.1 |

0.3 |

1.1 |

52.5 |

|||||

25.3 |

0.6 |

0.4 |

0.3 |

0.3 |

0.8 |

100.0 |

|||||

Including |

3.3 |

1.6 |

1.1 |

1.1 |

0.4 |

0.9 |

105.1 |

||||

Including |

1.9 |

1.9 |

1.3 |

0.4 |

1.0 |

3.9 |

118.9 |

||||

CD-464 |

-80 |

239 |

106 |

CWNE |

|||||||

5.7 |

0.4 |

0.2 |

0.0 |

0.2 |

0.2 |

38.3 |

|||||

3.8 |

0.7 |

0.5 |

0.6 |

0.1 |

0.2 |

63.0 |

|||||

0.5 |

0.9 |

0.6 |

0.3 |

0.5 |

1.5 |

71.0 |

|||||

1.7 |

0.5 |

0.4 |

0.2 |

0.2 |

6.3 |

78.6 |

Hole-id |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

From (m) |

|---|---|---|---|---|---|---|---|---|---|---|---|

CD-463 |

-80 |

235 |

115 |

CWNE |

|||||||

2.1 |

0.3 |

0.2 |

0.0 |

0.2 |

0.1 |

37.4 |

|||||

2.0 |

0.4 |

0.3 |

0.0 |

0.3 |

0.5 |

43.5 |

|||||

0.4 |

1.1 |

0.7 |

0.1 |

0.7 |

0.7 |

48.9 |

|||||

1.9 |

2.8 |

1.9 |

1.6 |

0.9 |

1.3 |

61.9 |

|||||

CD-462 |

-50 |

055 |

141 |

CWNE |

|||||||

6.6 |

0.6 |

0.4 |

0.1 |

0.3 |

0.9 |

20.5 |

|||||

7.8 |

0.6 |

0.4 |

0.2 |

0.3 |

1.2 |

29.2 |

|||||

3.9 |

0.6 |

0.4 |

0.1 |

0.4 |

0.6 |

41.9 |

|||||

4.4 |

0.3 |

0.2 |

0.0 |

0.2 |

0.3 |

52.0 |

|||||

8.0 |

0.4 |

0.3 |

0.1 |

0.2 |

0.8 |

65.1 |

|||||

16.7 |

0.3 |

0.2 |

0.2 |

0.1 |

0.2 |

81.6 |

|||||

4.2 |

0.7 |

0.4 |

0.1 |

0.4 |

1.3 |

104.3 |

|||||

7.4 |

0.6 |

0.4 |

0.3 |

0.2 |

1.4 |

114.6 |

|||||

CD-461 |

-20 |

060 |

154 |

CWNE |

|||||||

0.7 |

0.8 |

0.5 |

0.0 |

0.5 |

2.6 |

72.5 |

|||||

5.0 |

0.3 |

0.2 |

0.0 |

0.2 |

0.2 |

114.0 |

|||||

5.5 |

0.6 |

0.4 |

0.4 |

0.1 |

0.3 |

122.0 |

|||||

1.3 |

1.4 |

0.9 |

0.8 |

0.4 |

10.2 |

136.9 |

|||||

CD-460 |

-51 |

308 |

112 |

CWNE |

|||||||

13.2 |

0.4 |

0.2 |

0.0 |

0.2 |

0.2 |

25.1 |

|||||

5.2 |

0.3 |

0.2 |

0.1 |

0.2 |

0.5 |

43.2 |

|||||

3.6 |

0.5 |

0.3 |

0.1 |

0.3 |

0.5 |

53.0 |

|||||

12.2 |

1.9 |

1.3 |

1.3 |

0.5 |

3.5 |

71.2 |

|||||

Including |

4.5 |

4.5 |

3.0 |

3.1 |

1.0 |

6.6 |

72.0 |

||||

CD-459 |

-20 |

060 |

138 |

CWNE |

|||||||

1.3 |

0.5 |

0.3 |

0.1 |

0.3 |

0.4 |

72.7 |

|||||

1.5 |

0.3 |

0.2 |

0.0 |

0.2 |

0.2 |

84.2 |

|||||

0.9 |

0.4 |

0.3 |

0.0 |

0.3 |

0.3 |

87.6 |

|||||

5.6 |

0.5 |

0.4 |

0.1 |

0.3 |

0.7 |

105.0 |

|||||

CD-458 |

-50 |

060 |

133 |

CWNE |

|||||||

8.8 |

0.7 |

0.5 |

0.1 |

0.4 |

1.4 |

19.0 |

|||||

6.0 |

0.4 |

0.3 |

0.1 |

0.2 |

0.6 |

45.0 |

|||||

10.4 |

1.0 |

0.7 |

0.8 |

0.1 |

0.6 |

62.9 |

|||||

Including |

1.1 |

7.7 |

5.1 |

7.3 |

0.3 |

2.7 |

62.9 |

||||

30.7 |

0.6 |

0.4 |

0.1 |

0.3 |

1.2 |

78.3 |

|||||

Including |

2.2 |

1.8 |

1.2 |

0.3 |

1.0 |

4.5 |

96.0 |

1 See Meridian news release March 06, 2023

2 See Meridian news release September 26, 2022

3 Meridian Mining News release of May 07, 2024.

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com