As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the engineered components and systems industry, including Park-Ohio (NASDAQ:PKOH) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 1.9% below.

In light of this news, share prices of the companies have held steady as they are up 4.1% on average since the latest earnings results.

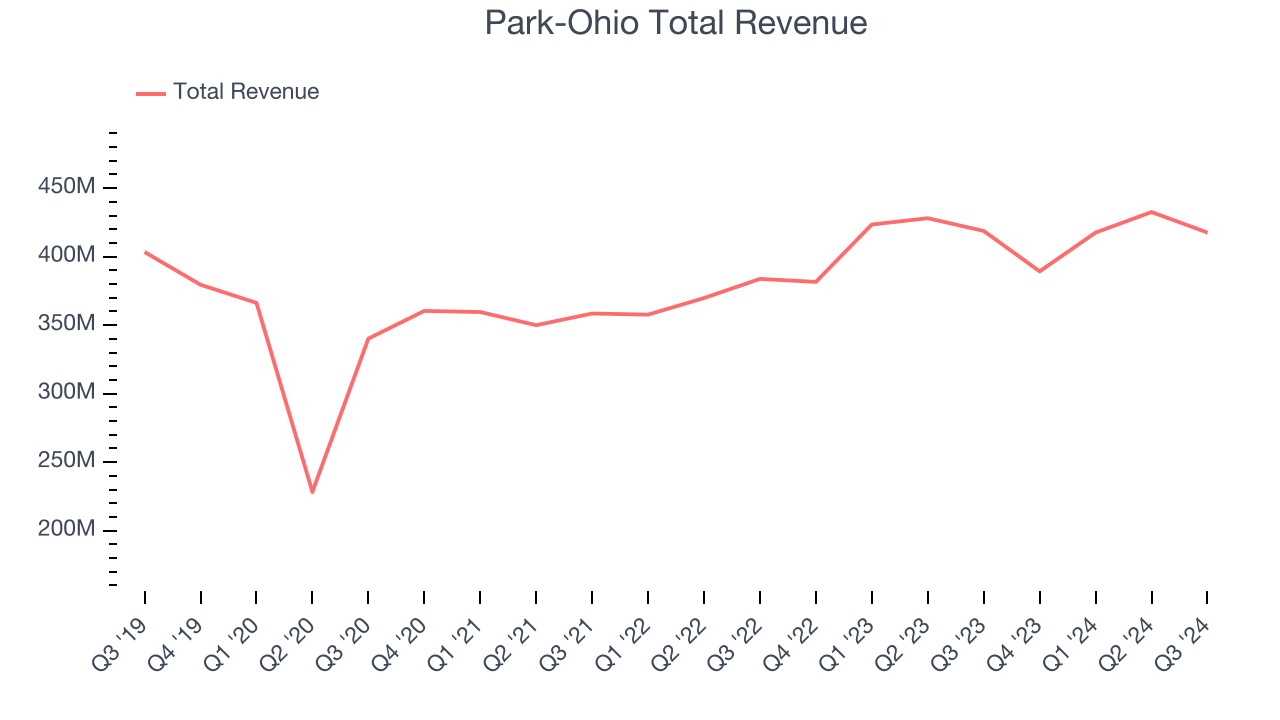

Park-Ohio (NASDAQ:PKOH)

Based in Cleveland, Park-Ohio (NASDAQ:PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $417.6 million, flat year on year. This print fell short of analysts’ expectations by 4.8%, but it was still a strong quarter for the company with an impressive beat of analysts’ EBITDA and EPS estimates.

“We are pleased with the performance of our Company during the third quarter. While demand was stable overall, we continue to see challenges in some of our varied end markets. Regardless, we delivered improved profitability and additional progress towards our margin and debt reduction goals. We anticipate modest growth to return in the fourth quarter and into 2025, as well as continued progress on our debt reduction initiatives," said Matthew V. Crawford, Chairman and Chief Executive Officer.

Unsurprisingly, the stock is down 3.1% since reporting and currently trades at $32.28.

Is now the time to buy Park-Ohio? Access our full analysis of the earnings results here, it’s free.

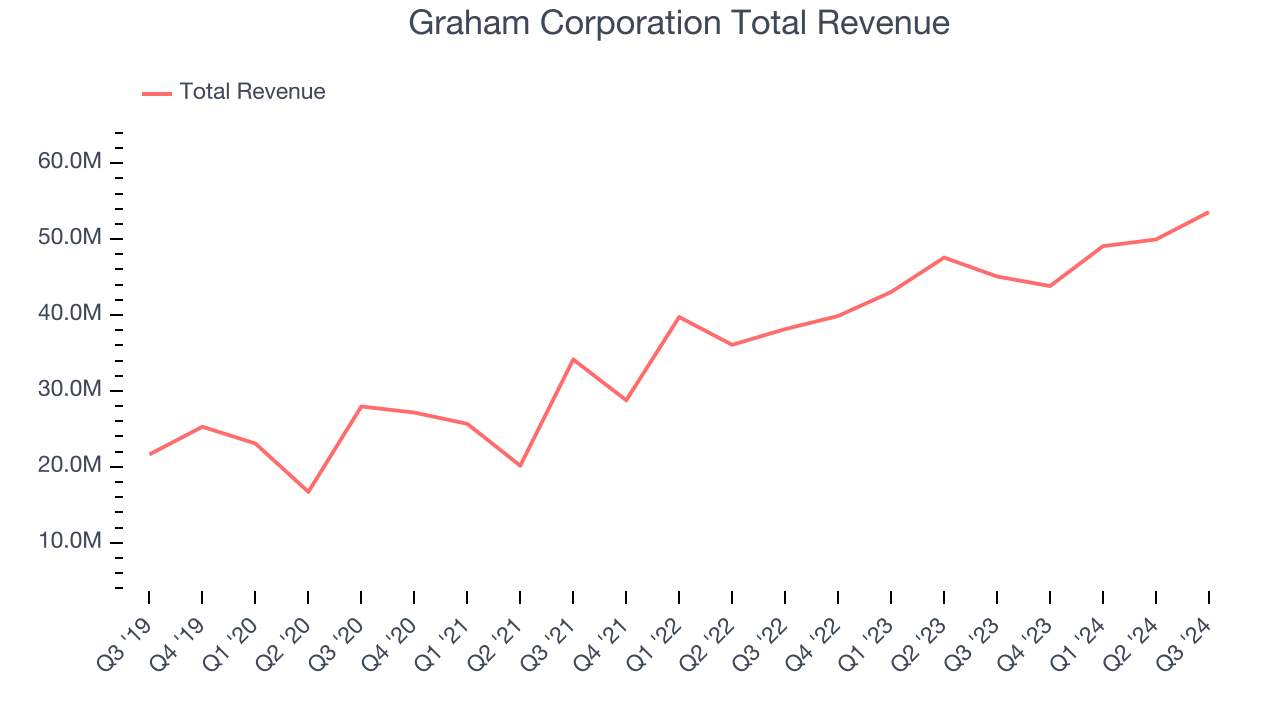

Best Q3: Graham Corporation (NYSE:GHM)

Founded when its founder patented a unique design for a vacuum system used in the sugar refining process, Graham (NYSE:GHM) provides vacuum and heat transfer equipment for the energy, petrochemical, refining, and chemical sectors.

Graham Corporation reported revenues of $53.56 million, up 18.8% year on year, outperforming analysts’ expectations by 7.8%. The business had an exceptional quarter with a solid beat of analysts’ EPS and EBITDA estimates.

Graham Corporation delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 30.3% since reporting. It currently trades at $43.35.

Is now the time to buy Graham Corporation? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Mayville Engineering (NYSE:MEC)

Originally founded solely on tool and die manufacturing, Mayville Engineering Company (NYSE:MEC) specializes in metal fabrication, tube bending, and welding to be used in various industries.

Mayville Engineering reported revenues of $135.4 million, down 14.4% year on year, falling short of analysts’ expectations by 14.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Mayville Engineering delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 23.9% since the results and currently trades at $16.56.

Read our full analysis of Mayville Engineering’s results here.

Timken (NYSE:TKR)

Established after the founder noticed the difficulty freight wagons had making sharp turns, Timken (NYSE:TKR) is a provider of industrial parts used across various sectors.

Timken reported revenues of $1.13 billion, down 1.4% year on year. This result topped analysts’ expectations by 0.8%. Taking a step back, it was a softer quarter as it produced full-year EPS guidance missing analysts’ expectations.

The stock is down 9.8% since reporting and currently trades at $75.22.

Read our full, actionable report on Timken here, it’s free.

Enpro (NYSE:NPO)

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE:NPO) designs, manufactures, and sells products used for machinery in various industries.

Enpro reported revenues of $260.9 million, up 4.1% year on year. This number missed analysts’ expectations by 1.3%. It was a disappointing quarter as it also recorded full-year EBITDA guidance missing analysts’ expectations.

The stock is up 22.9% since reporting and currently trades at $180.13.

Read our full, actionable report on Enpro here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.