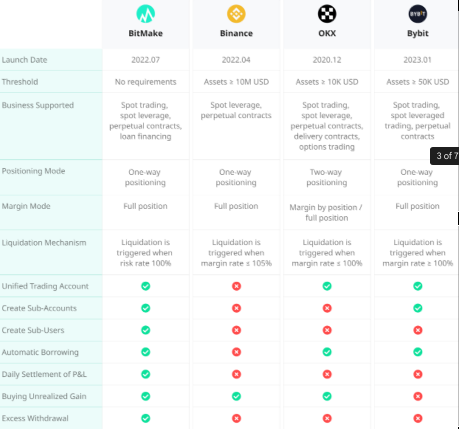

To address the latest innovation, BitMake emerges as A Derivatives Trading Platform Designed for Professional Traders. The platform has developed a refined product strategy and innovative direction, aiming to provide various cryptocurrency trading services, including spot trading, spot margin trading, Perpetual Futures Contracts trading, and wealth management lending. The emergence of BitMake provides professional traders with a comprehensive derivative trading platform, which helps them achieve greater success in the cryptocurrency trading market.

The core feature of BitMake is its support for a unified trading account, where traders can collateralize multiple currencies and convert them into US dollars to use as collateral for spot margin trading and Perpetual Futures Contracts trading, maximizing capital utilization.

BitMkae set a new standard for derivative products with a unified trading accounts mechanism in the cryptocurrency derivative market. This mechanism offers a major advantage of the platform as it supports multiple currency spot trading, spot leverage trading, Perpetual Futures Contracts trading, and lending and financing businesses in a single trading account. It also allows cross-currency spot and Perpetual Futures Contracts trading, eliminating the need for cumbersome fund transfers, increasing capital utilization, and reducing liquidation risk.

In addition, BitMake's unified trading account model is more complete, with higher capital utilization and better security margins. BitMake's suitable trading account mechanism does not limit the type of assets used as a margin or the settlement standards. Its product structure is also highly flexible, supporting features such as automatic borrowing of currency and over-withdrawal, which improves the convenience of trading.

Various features are mainly reflected in the BitMake platform, including:

-

More Convenient Trading Experience - BitMake's unified margin mechanism eliminates the financial barriers between different product lines, enabling users to trade in multiple currencies for spot trading, leveraged spot trading, futures trading, and lending and finance businesses, all within a single trading account. This simplifies the trading process and enhances the user experience.

-

Multi-Currency Support - BitMake's unified trading account supports trading in multiple currencies. If the trader has any margin currency asset under the trading account, they can perform leveraged spot and futures trading. This provides users with more trading options and increases the efficiency of fund utilization.

-

Reduced Liquidation Risk - BitMake's unified trading account mechanism allows for the offsetting of profits and losses between different business lines. The spot holding under the same trading account, all Perpetual Futures Contracts holdings, and borrowing assets can be merged and offset against each other.

-

Increased Asset Utilization - BitMake's unified trading account can use unrealized profits and losses from Perpetual Futures Contracts positions as margin, increasing asset utilization. This gives users more options for fund management, which helps optimize trading strategies and increase profitability.

-

Automatic Borrowing and Overdraft Withdrawal - BitMake's unified trading account supports automatic borrowing and overdraft withdrawal functions. When transferring funds from the trading account to the wallet account, users can borrow assets to achieve an overdraft withdrawal.

BitMake strives to provide users with high-quality Perpetual Futures Contracts trading services. Its trading system is based on a unified account, providing users with perpetual contract products with USDT as the settlement standard and supporting leverage up to 125 times. With the support of the unified account system, all assets available as margin will serve as the margin for positions and share the same margin to maximize the utilization of funds and reduce the risk of derivative trading.

To better protect users' trading security, BitMake also adopts more inclusive liquidation and settlement mechanisms. In BitMake, forced liquidation is only triggered when a user's risk rate reaches 100%. The user's trading risk rate is determined by multiple dimensions, such as account margin and position value, thus more comprehensively reflecting the user's risk situation.

In addition, BitMake conducts daily automatic position settlement at UTC 0:00, converting unrealized profits and losses of current positions into realized profits and losses. Therefore, users may see their unrealized profits and losses become zero after each settlement. This settlement method helps to more accurately display the user's daily position cost, enabling better risk management and decision-making.

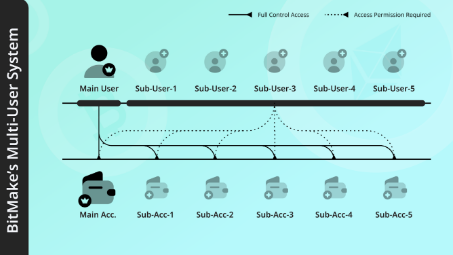

Apart from that, in cryptocurrency trading, BitMake is a preferred choice for institutional users' trading and risk hedging. To meet the special needs of institutional users, BitMake has designed a more flexible account system. Newly registered users automatically create one wallet account and one main trading account and can create up to five independent sub-accounts to achieve risk isolation. In addition, BitMake supports the creation of up to five sub-users, and institutional users can assign different account permissions to each sub-user for further fund management, satisfying the usage requirements of institutional users.

In addition, BitMake's powerful and stable API function can support trades in under 10ms, enabling professional, institutional users to reduce latency, improve trading accuracy, and ensure fund security. At the same time, institutional users can also apply for institutional certification through the official website to obtain lower fees and further reduce trading costs. It provides users with a secure, convenient, and efficient cryptocurrency trading experience with its high-quality Perpetual Futures Contracts trading services and flexible account system tailored to institutional users.

Including more, the BitMake platform supports the function of excess withdrawal, which allows users to withdraw more than their available balance by collateralizing their assets. For example, if a user wants to withdraw USDT but only has ETH in their account, they can choose to collateralize their ETH and select "borrow" to withdraw USDT. This innovative feature greatly improves the utilization of user assets, provides greater convenience for asset management, and significantly reduces the transaction cost of currency exchange. In addition, this function enables mainstream digital assets to be withdrawn at any time without holding multiple assets, providing users with more flexible operational space.

About BitMake:

BitMake is a derivatives trading platform that serves professional traders, launched in July 2022. BitMake, as a new force in the derivatives market, although founded not long ago, its core team members are all veterans in the cryptocurrency industry with many years of experience. With sophisticated product design and strong technical capabilities, BitMake has maintained smooth operation since its launch and has never experienced downtime, even under extreme market conditions. Although the leading platforms have already taken the lead in capturing part of the market share, derivative innovation companies like BitMake still have the opportunity to break through in the increasingly competitive derivatives market and inject new impetus into the industry's development.

Media Contact

Company Name: BitMake

Contact Person: ALINA CHU

Email: Send Email

Country: HongKong

Website: www.bitmake.com