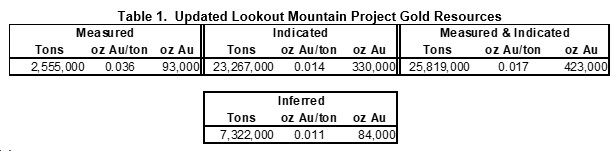

COEUR D'ALENE, ID / ACCESSWIRE / November 15, 2023 / Timberline Resources Corporation (OTCQB:TLRS)(TSXV:TBR) ("Timberline" or the "Company") is pleased to report an updated mineral resource estimate (MRE) for the Lookout Mountain gold deposit at its 100%-controlled Eureka Project in Nevada under National Instrument 43-101, Companion Policy 43-101CP, and Form 43-101F1, which is a Canadian Securities Administrators' requirement for mining projects governing the disclosure of mineral reserves and resources. The updated MRE is summarized in Table 1.

The Company will file the supporting updated technical report on the Lookout Mountain deposit on SEDAR before the end of November. It will also provide a link to the document on its website at www.timberline-resources.com.

A qualified person at RESPEC Company LLC of Reno, Nevada (RESPEC) prepared the mineral resource estimates. The new resource estimate has been constrained by optimized open pits utilizing revenue and cost inputs as summarized in the Notes to Table 1 below.

Notes:

- The Mineral Resources are comprised of oxidized model blocks that lie within optimized pits at a cutoff grade of 0.005 oz Au/ton plus unoxidized blocks within the optimized pits at a 0.055 oz Au/ton cutoff.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The Mineral Resources are potentially amenable to open pit mining methods and are therefore constrained by optimized pits created using a gold price of US$1,800/oz, a throughput rate of 10,000 tons/day, assumed metallurgical recoveries of 80% for heap-leaching of oxidized materials and 86% for toll milling of unoxidized materials, a mining cost of US$2.50/ton, heap-leaching processing cost of $3.60/ton, toll milling cost of $80.00/ton, general and administrative costs of $0.83/ton processed, a reclamation cost of $0.25/ton processed, refining cost of $3.00/oz Au produced, and an NSR royalty of 3.5%. This study does not constitute a preliminary economic assessment under NI 43-101.

- The effective date of the resource estimate is September 1, 2023.

- Rounding may result in apparent discrepancies between tons, grade, and contained metal content.

Patrick Highsmith, Timberline's President and CEO commented, "Our newly updated mineral resource estimate at the Lookout Mountain gold deposit reflects our first limited economic analysis. The MRE Technical Report documents a lot of work that has been accomplished over many years at Lookout Mountain, including solid initial metallurgical, environmental, and engineering studies. Advancing the deposit to pit-constrained resources has also identified opportunities for growth and optimization of the project towards economic viability. The recommendations from this study, as well as the exciting developments in the district, highlight the potential growth for both gold and silver at the Eureka Project."

Growth Opportunities in and around the Lookout Mountain Resource

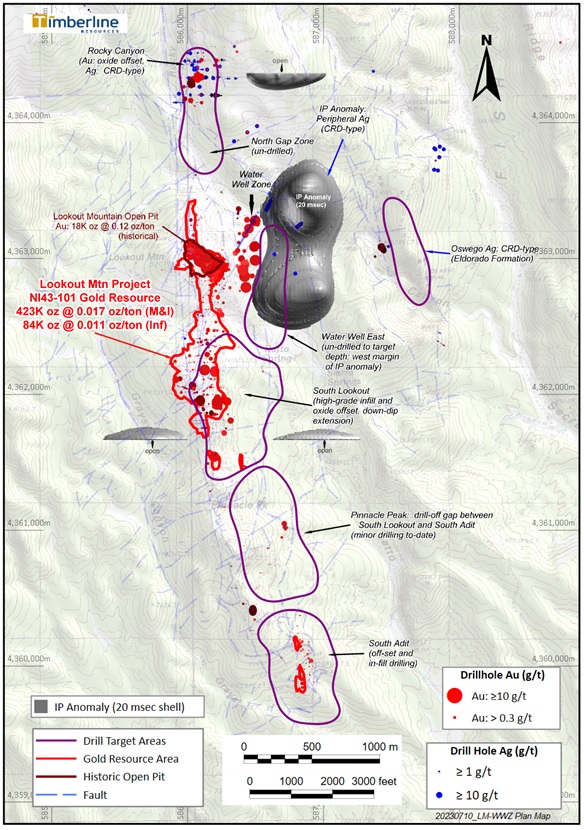

Conclusions and recommendations from the MRE Technical Report include the observation that the resources reported are open along strike in both directions, as well as down dip (Figure 1). Drill holes have intersected mineralized zones along the strike of the resources both to the north (Rocky Canyon) and to the south. The 3,500-foot strike extent between the southern limit of the Lookout Mountain resources and the northern limit of the South Adit resources may afford the best opportunity for potential heap-leach resource expansion in the near term. Encouraging higher-grade drill results downdip to the east of the project resources, at the Water Well Zone (WWZ), also offer an obvious opportunity for resource expansion.

The MRE Technical Report recommends a program of infill drilling, resource-expansion drilling, further metallurgical testing, full three-dimensional geological modeling, and the completion of a preliminary economic analysis based on the current resources.

Timberline's exploration work at Eureka in recent years has been largely outside the resource area, but geologic modeling and the early stages of drilling at the adjacent WWZ suggest that the two systems are related. Carlin-type gold mineralization has been intercepted at more than 1,000 feet (300 meters) deep downdip from the Lookout Mountain deposit in the WWZ. That target remains open to the east and south.

Timberline drilling farther to the northeast from the WWZ target has also intersected silver-lead-zinc mineralization that is consistent with carbonate-replacement type deposits (CRD). A very large induced polarization (IP) chargeability anomaly occupies the corridor adjacent to and below the known Carlin-type gold and CRD-type drill intercepts. The IP anomaly has not been thoroughly drill tested.

Qualified Persons Disclosure

Michael Gustin, C.P.G., a qualified person at RESPEC, has also approved this news release. RESPEC is independent of Timberline.

Steven Osterberg, Ph.D., P.G., Timberline's Vice President Exploration, is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this release. Dr. Osterberg is not independent of the Company as he is an officer.

Figure 1 - Lookout Mountain Resource Area and Nearby Exploration Targets at Eureka Project

About Timberline Resources

Timberline Resources Corporation is a Nevada based exploration company with its flagship gold-silver property in the Eureka District. The Eureka property includes the historical Lookout Mountain and Windfall mines in a total property position of approximately 27 square miles (70 square kilometers).

Near the northern end of the Battle Mountain - Eureka Trend, the Company also jointly holds the Paiute Project with Nevada Gold Mines. Timberline also controls the Seven Troughs Project in northern Nevada, which is one of the state's highest-grade former gold producers.

In total, Timberline controls over 43 square miles (111 square kilometers) of mineral rights in Nevada. Detailed maps and technical materials for the Company's projects may be viewed at http://timberlineresources.co/.

Timberline is listed on the TSX Venture Exchange where it trades under the symbol "TBR", and on the OTCQB, where it trades under the symbol "TLRS".

On behalf of the Board of Directors,

"Patrick Highsmith"

President and CEO

Tel: 208-664-4859

Forward-Looking Statements:

Statements contained herein that are not based on current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. Such forward-looking statements reflect the Company's expectations about its future operating results, performance and opportunities that involve substantial risks and uncertainties. These statements include but are not limited to: statements regarding the Eureka Project resources, exploration targets, and discovery potential, as well as statements regarding future extraction operations. When used herein, the words "anticipate", "believe", "estimate", "upcoming", "plan", "target", "intend", "growth", and "expect" and similar expressions, as they relate to Timberline Resources Corporation, its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company's actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, risks related to exploration projects, risks related to mining activities, risks related to potential future transactions, risks related to the Company continuing as a going concern, risks related to the ability to finance any payments due, risks related to project development decisions, risks related to mineral resource estimates and other such factors, including risk factors discussed in the Company's most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Except as required by Federal Securities law, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE: Timberline Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/803523/timberline-announces-updated-mineral-resource-estimate-at-the-eureka-project-under-ni43-101