The Founder of a top-10 national single-family property management company sounded the alarm at an IMN industry-leading real estate conference this week that inflation fears may be overblown in America. Laviter asked the audience: "What are you doing to prepare for a real economic slide?"

PHOENIX, AZ / ACCESSWIRE / December 4, 2024 / At a time when the real estate industry is consumed by concerns of low-housing supply, multi-year high inflation, and surging mortgage rates, IMN Panelist Speaker John M. Laviter warned a crowd of real estate professionals Tuesday at the 12th annual single-family rental conference in Scottsdale, Arizona, that present-day asset values are on the verge of change, and not for the better. Reporter Nora Seastrand covered the Large Property Management panel discussion at the event.

"Real estate professionals need to pay attention to the similar hype now that led up to the massive real estate crash of 2008," said Laviter. "We haven't had a real recession in over 16 years," Laviter continued. He expressed that he doesn't consider 2020 a real recession and that real estate professionals may have become too accustomed to trending inflation.

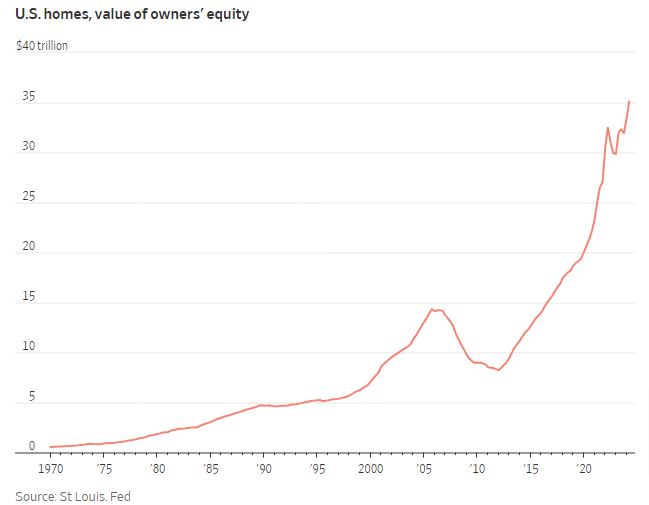

The Producer Price Index (PPI) and Personal Consumption Expenditure Index (PCE) have shown double-digit increases in recent years. U.S. home values and owners' equity have surged. "If you think this is normal, think again," said Laviter.

Recent readings indicate pricing pressures continue to hold on their path to the Federal Reserve's 2% inflation target, "if there's a destruction of demand," said Laviter, "from any one of the current world problems we face, it could result in the long-feared hard landing that many think has been avoided."

Some economists speculate that a sustained pullback in consumer spending, world wars, trade changes, and the effects of global economic inter-dependence could change the direction of the economy. "Especially with higher tariffs, I'm concerned that the recent economic instability in China could be that trigger," said Laviter.

History shows a far worse situation stemming from deflation than inflation. The Price Index of all goods and services fell by greater than 20% from 1930 to 1933 during the great depression. "When has anything ever remained stable in recorded history books?" Laviter asked the audience.

Many of the usual statistics that indicate recession have shown signs in recent years. For instance, the inverted yield curve starting in 2021, the Case-Shiller Home Price index, and decreasing money supply. But it's not all grim, Laviter thinks there's opportunity in the real estate market during a serious economic decline. Last month he announced commitments to fund a $2 billion Real Estate Investment Trust (REIT) with Kunz Investments, Inc., a venture capital group out of Marin County, California.

Media Contact:

Nora Seastrand, editor, interviewer and publicist.

nseastrand@seastrandpublishing.com

+1 (801) 477-0798

SOURCE: Seastrand Publishing Co.

View the original press release on accesswire.com