- ORF Technologies has a portfolio of patents related to mineral extraction, targeting specialty, strategic and rare earth metals producers.

- TiO2 technology developed by ORF proved to be 144.8% more cost-efficient than conventional processes. Company anticipates comparable cost efficiencies in the production of nickel, iron, gold, rare earth metals and many more. The ORF technology suite is capable of supporting Temas’ internal La Blache projects as well as unrelated third-party mining projects.

- More environmentally friendly and offers a significant reduction in carbon footprint when compared to conventional processing methods.

- ORF provides a suite of technologies which will complement and work alongside the licensing agreement with Metaleach™.

Temas Resources Corp. (CSE: TMAS, OTCQB: TMASF, FSE: 26P) (the “Company” or “Temas Resources”), is pleased to announce that it has finalized its 50% acquisition of ORF Technologies Inc (“ORF”). ORF has developed several patented, innovative leaching and solvent extraction processes. With the ORF transaction, in conjunction with MetaLeach™, Temas believes that these combined technologies will make a difference in helping to alleviate the significant environmental impact that results from present-day mineral processing.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210413005505/en/

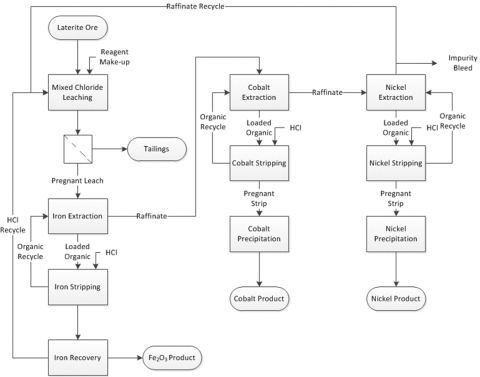

Figure 1 ORF Laterite Process Flowsheet

Pursuant to the Acquisition, Temas acquired 50% of the outstanding shares of ORF in exchange for a cash payment of $600,000. On closing, the parties entered into a shareholders’ agreement governing their rights and obligations going forward, includ-ing development and dividend policies, and pre-emptive rights to existing shareholders to acquire positions of other existing shareholders. With the 50% acquisition of ORF, Temas’ objectives are to achieve and provide the lowest cost processing alternative for specialty, strategic and rare earth metals producers.

Transaction Highlights:

- COST-EFFICIENCIES: TiO2 technology developed by ORF proved to be 144.8% more cost-efficient than conventional processes. Company anticipates comparable cost efficiencies in the production of nickel, iron, gold, rare earth metals and many more.

- MORE ENVIRONMENTALLY FRIENDLY:The Recovery Technologies offer a significant reduction in carbon footprint when compared to conventional processing methods.

- COMPLEMENTARY ACQUISITIONS: ORF provides a suite of technologies which will complement and work alongside the licensing agreement with Metaleach™. The ORF technology suite is also capable of supporting Temas Resources’ internal La Blache projects as well as unrelated third-party mining projects.

“We believe this suite of proprietary technologies are immediately employable and will be integral to the economic delivery of products well into the future. There is a company making opportunity especially when considering the high importance and future demand of the ‘Energy and Battery’ metals needs. The objective is to achieve this from the commercialisation of the proprietary & patented hydrometallurgical metals processing technologies (“Leaching Technologies”).”

“We are confident that the ORF IP library of technologies will position Temas as a clear leader in providing the specialty, strategic and rare earth metals industries with a lower cost, environmentally friendly mineral processing solution for their producing mines,” said Michael Dehn, CEO of Temas Resources.

He added that, “Temas is in active discussions with strategic partners that are pursuing a greener and more cost-effective means of processing their mining assets. With our nickel leaching options from MetaLeach™ and ORF, as well as taking into consideration the current market demand for nickel, we expect to have a busy year in just this one commodity, not including all the other opportunities we are seeing in the market.”

The Company structured the acquisition to ensure the existing principals responsible for the development of the technologies at ORF would have a significant vested in-terest in the ongoing commercial success of the technologies. ORF was established as a holding company for the intellectual property developed by Process Research Ortech (“PRO”), a company established in 1990 during the privatization of the Ontario Re-search Foundation’s (“ONT”) metallurgical testing facilities. ONT was created as an independent corporation by a provincial Act in 1928.

Table 1 Comparison of ORF Laterite Process with Commercial Processes Part 1

Pyrometallurgical process |

Caron process |

HPAL process |

ORF Laterite process |

|

Ores that can be treated |

Med-high Ni (1.8-2.5 %), low-med Fe (10-20 %) ores |

Low Ni (1.2-1.5 %), high iron (>40 %) ores |

Low Ni (1.2-1.5 %), high iron (>40 %) ores |

Both low Fe/MgO and high Fe/MgO ores |

Ni recovery |

~ 95 % |

~ 75 % |

~ 95% |

> 90 % |

Co recovery |

None |

< 50% |

~ 95% |

> 90 % |

Fe recovery |

No |

No |

No |

Yes |

Mg recovery |

No |

No |

No |

Yes |

Capital cost |

High |

Medium |

High |

Can be lower |

Operating cost |

High |

Medium |

High |

Medium |

Table 1 Comparison of ORF Laterite Process with Commercial Processes Part 2

Pyrometallurgical process |

Caron process |

HPAL process |

ORF Laterite process |

|

Energy requirement |

High (due to water removal from ore and high temperature processing) |

High (due to water removal from ore and high temperature processing) |

Low (no water removal from ore and low temperature process) |

Medium (no water removal from ore and low temperature process) |

Reagents |

Not recycled |

Not recycled |

Not recycled |

Recycled |

Residue amount |

High volume |

High volume |

High volume |

Lower volume |

Environmental |

Slag disposal |

Residue disposal containing ammonia |

High volume residue disposal |

Potentially inert residue |

Sulfur price |

No effect |

No effect |

Very dependent |

No effect |

Fuel price |

High effect |

Medium effect |

Lower effect |

Medium effect |

By-product credit |

None |

None |

None |

Fe2O3, MgO and (NH4)2SO4 credit |

The Leaching Technologies have the potential to revolutionize the extraction processes and methods for many base metal deposits. The reduction in capital costs, operating costs, as well as improvement in recoveries and purity can potentially be possible with leaching technologies. These technologies are capable of producing high value metal product on-site and greatly enhance the mine gate economics compared to conventional concentrators. In addition, in many cases, the technologies will enable the treatment of base metals deposits which hitherto have not been possible to treat. The technologies are especially suitable for high-acid-consuming carbonate (oxide) hosted ores.

The merits of the Leaching Technologies and commercial adoption success are based on the potential for major operating and capital cost savings (expected to be a minimum 30-40% vs current technologies). This would be suitable and amenable for mines using the Leaching Technologies as the principal mineral processing method, to produce base metals or high value product, at the mine site.

In addition, these Leaching Technologies offer other significant operational and environmental benefits. This includes more environmentally friendly leaching technologies and a reduction in carbon footprint when compared to conventional processing methods. The base metals of most commercial importance are essential for supplying the raw materials for the electric vehicle revolution, energy generation and storage technologies allied with ESG (Environmental and Social Governance) policies.

La Blache and DAB projects tie in to ORF’s TiO2 technology - More Cost Effective

The ORF TiO2 technology is estimated to be 59.2% lower on a production cost basis compared to The Chemours Company, the world’s largest TiO2 producer with the leading low-cost process. The result is a process 144.8% more cost-efficient.

A 2017 study published by the University of Minnesota’s Natural Resources Research Institute ("NRRI”) on the Patents’ TiO2 recovery process estimated the adjusted production cost per ton of TiO2 was $713 after a credit was applied for the sale of recovered iron oxide, representing a production cost basis 69.7% lower than the industry average estimated production cost of $2,352 per ton, and 59.2% lower than The Chemours Company’s leading low-cost process at $1,746 per ton.

The entire market size for TiO2 is $15.76 billion and is expected to witness a compound annual growth rate of 8.7% until 2025, according to Grand View Research, Inc.

The Patents’ process is less energy-intensive than the industry standard and can create high quality TiO2 from low grade materials, which contain contaminants other industry competitors must discard due to the prohibitive cost of extracting the full value utilizing current processes.

About Temas Resources

Temas Resources Corp. ("Temas Resources") (CSE: TMAS) (OTCQB: TMASF) (FSE:26P) is focused on the advancement of mineral independence and the processes in which minerals are extracted. The Company’s goal is to reduce the environmental impact and carbon footprint of metal extraction by focusing on the uses of processing and leaching technologies.

Temas Resources flagship properties are located in the stable, mining-friendly jurisdiction of Quebec (Canada) bordering Vermont, Maine, and New York State (U.S.) in an area known as the Grenville Geological Province. The Grenville Geological Province is home to Lac Tio, the largest solid ilmenite deposit in the world.

As a mineral exploration company focused on the acquisition, exploration and development of Iron, Titanium, and Vanadium properties in a socially responsible manner, Temas Resources has focused its efforts on advancing two major projects in the Grenville Geological Province area. The first, the DAB Property, is an option for 100% interest consisting of 128 contiguous mineral claims which covers 6,813.72 hectares (68.14 km²) within the Grenville Geological Province. The flagship, the La Blache Property, is 100% ownership of 48 semi-contiguous mineral claims which cover 2,653.25 hectares (26.53 km²) within the Grenville Geological Province. All public filings for the Company can be found on the SEDAR website www.sedar.com. For more information about the Company, please visit www.temasresources.com.

About ORF Technologies Inc.

ORF is a technology holding company for the intellectual property developed by the principals and staff of Process Research Ortech (“PRO”). PRO was establish in 1990 during the privatization of the Ontario Research Foundation’s (“ONT”) metallurgical testing facilities. ONT was created as an independent corporation by a provincial Act in 1928; laboratory facilities were provided at the outset. Although initially academic in outlook, ONT gradually shifted its focus and began to promote industrial development, especially of small companies, through scientific and technological innovations. ORF has developed expertise in ceramics, fuel blends, textile and knitting technology, asbestos analytical methodology, hydro metallurgy, microelectronics, SOLAR ENERGY and POLLUTION research. Its facilities were expanded substantially in 1969.

ONT was also responsible for drawing the attention of government and industry to research opportunities that promise social and economic benefits. ORF plans to continue with these values and opportunities with technology that will provide higher recoveries, higher purity, a lower carbon footprint and an overall environmentally friendly portfolio for the natural resources, water treatment and waste management industries.

About MetaLeach™

MetaLeach™ was set up to own the proprietary and novel leaching technologies AmmLeach®, NickeLeach®, HyperLeach® and MoReLeach® which have been developed over more than 10 years on global research & development. These technologies are all protected by an extensive and rigorous intellectual property strategy, including a comprehensive suite of patent applications in targeted countries around the world. For more information about MetaLeach, please visit www.metaleach.com.

Qualified Person

Rory Kutluoglu, B.Sc, P.Geo, is the Qualified Person as defined by NI 43-101 who has reviewed and approved the technical information contained within this press release.

On behalf of the Board of Directors of Temas Resources Corp.,

“Kyler Hardy”

Director

Forward Looking Statements

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Temas Resources, future growth potential for Temas Resources and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of iron, titanium, vanadium and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Temas Resources’ ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Temas Resources’ respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Temas Resources has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Quebec; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Temas Resources’ management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Temas Resources has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Temas Resources does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210413005505/en/

Contacts

Nick Spencer

Investor Relations

ir@temasresources.com

www.temasresources.com

or

Dave Burwell

Vice President

The Howard Group Inc.

Email: dave@howardgroupinc.com

Tel: 403-410-7907

Toll Free: 1-888-221-0915

For inquiries on using the Temas family of technologies please contact:

Michael Dehn

President and CEO

michael@temasresources.com

Tel: 647-477-2382