- 4 in 10 Miss the Mark on How Much their Partner Earns

- More than Half Disagree on How Much is Needed to Reach Their Retirement Goals

- Same-Sex Couples Less Likely to Work Together Toward Financial Goals

With so many couples finally getting married this summer after a long year of pandemic proposals and postponed weddings, Fidelity Investments®, a leading lifetime financial planning company, has an important reminder: after the wait, it’s important to begin forever on the right financial footing. And yet, according to Fidelity’s 2021 Couples & Money study, while 57% of respondents say they are joint decision makers on retirement and other long-term financial goals, more than half of all non-retired couples disagree on how much savings is needed to reach their retirement objectives. In addition, 1 in 5 (22%) women report having little or no involvement in retirement planning. What’s more, 40% of those with a same-sex partner report having only one primary retirement decision-maker, compared to only 27% of those with an opposite-sex partner. The solution is clear: make money a team sport.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210715005217/en/

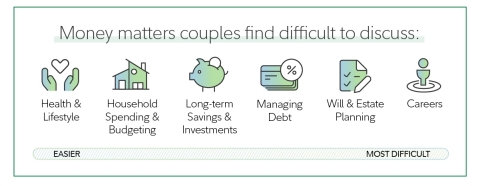

According to the Fidelity Investments 2021 Couples and Money study, some money matters are more difficult than others to discuss.

The study, which has been conducted since 2007 and is unique in testing agreement between married couples on communication and knowledge of finances, uncovered some interesting news: even though 7 in 10 (71%) of partners say they communicate at least very well with their other half—and about 1 in 4 claim to do so exceptionally well—almost 4 in 10 (39%) of respondents couldn’t correctly identify how much their partner makes for a salary. Additionally, 44% admit to arguing about money at least occasionally and nearly 1 in 5 (18%) identify money as their greatest relationship challenge, suggesting for many couples, a bit more practice is necessary before they go for the gold when it comes to financial bliss.

“Money discussions are not always easy, but the fact so many couples feel they are in sync and are comfortable talking about financial topics is encouraging, even if the conversations do occasionally end in disagreement,” said Stacey Watson, senior vice president of Life Event Planning at Fidelity. “Openly discussing financial matters helps people feel more confident, more closely aligned, and better equipped to take on the future. For all couples, the best advice for money conversations is that it’s not a competition, so stick with it and keep the dialogue going.”

Take the Time to Huddle Up

When it comes to communicating as a couple, the events of the past year have driven a third of couples to talk more about both day-to-day and long-term financial planning. Still, some money matters are more difficult than others to discuss, according to the study. The hardest to initiate include discussions around managing debt, will and estate planning, and careers.

As difficult as it may be, there are distinct advantages to keeping the lines of communication open. About 6 in 10 (61%) couples say they discuss their finances at least monthly, a number that has surprisingly declined from 2018 (65%). Perhaps it’s not the frequency but the quality of the conversation, because those who communicate well appear to be in a better financial position.

Execute the Playbook by Boosting Your Team’s Strengths

A critical component of any team sport is having confidence in your teammate’s ability to successfully execute what’s expected of them. And yet, for many financial matters, people tend to have a higher opinion of their own abilities than that of their partner.

Despite the gamesmanship, most respondents generally have about as much confidence in their partner’s ability to assume full financial control of the finances as they do their own, an important factor when considering the differing life expectancy of many couples. For day-to-day finances and short-term goals, almost half of respondents have complete confidence in the ability of either themselves or their spouse to take over decision-making responsibilities. There is far less confidence, however, in taking full control of retirement finances and strategy, with only 4 in 10 feeling completely confident in their partner’s ability to do so—or even their own.

As in years past, the study continues to see women sometimes taking a back seat or doubting their abilities for managing longer-term planning and investing. While more women are taking part in planning as either a primary or joint decision-maker, women are still far more likely to credit their partners with having a better understanding of investing matters, with 56% of women indicating their partner is savvier. In comparison, only 34% of men say the same.

“The good news is over the last few years – this past year in particular – Fidelity has seen a seismic shift in women seeking out greater knowledge about investing and getting more engaged in planning for longer-term goals,” said Watson. “We know when women do invest, they see positive results that can help reach their goals faster, so building on this and encouraging active participation in household investing decisions can help both partners feel more confident about the future.”

Bring on the Coaching Staff

Every couple has trouble communicating in certain areas, so of course money is no exception. For example, one out of four Millennials identify money as their greatest relationship challenge, a higher rate than other generations; one in four in same-sex relationships report the same, compared to 17% of opposite-sex couples. This is an area where a financial professional can be an asset, and compared to other generations, it’s the preference of many Millennials.

Selecting the right financial professional to help guide family finances and serve as an advisor for short- and long-term investment decisions should be made as a team. This year, 47% of couples currently working with an advisor agree they hired their financial professional together, up from 45% in 2018. Once the selection has been made, households are more divided; only 38% of couples agree they interact with their financial professional together, with men more likely to say they take a lead role in the relationship (33% men vs. 20% women).

For same-sex couples, selecting and working with a financial professional is an area where they appear more likely to go it alone. Only 42% of those working with a financial professional and in a same-sex relationship hired the planner together, compared to 48% of those in opposite-sex relationships. A slightly higher proportion of same-sex couples agree one partner takes the lead in interacting with a financial professional—28%, compared to 25% for opposite-sex relationships.

Getting over the Finish Line

Having the ability to retire and enjoy life is mission critical for most couples, and according to the research, many are doing so a bit earlier than expected. Perhaps surprisingly, the average age of retirement among those who have already retired is 60.5 years, while the average expected age for those who had not yet retired is 62.5 years. Of note, however: nearly half (48%) of all couples interviewed disagree on the actual age they expect to retire.

How exactly to get there continues to be a challenge, and while 77% say they expect to live comfortably in retirement, most respondents not yet retired (52%) confess they don't know how much they need to have saved to maintain their current lifestyle once they leave the workforce.

How to afford health care expenses in retirement is by far the biggest concern for all generations. This concern may be justified, because according to the 2021 Fidelity Retiree Health Care Cost Estimate, on average, a retired opposite-gender couple aged 65 in 2021 may need approximately $300,000 saved (after tax) to cover health care expenses in retirement1.

On the matter of having a vision for their ideal retirement, most say there’s no place like home, with 6 in 10 of all couples planning to remain in their own state when they retire, a trend that has increased steadily since 2015. During retirement, the top objectives are to spend time with family and friends, followed by relaxing at home and taking it easy. Travel, which had previously been at the top of many couple’s retirement list in 2018, fell to the third spot, perhaps influenced by the events of the past year.

Fidelity Offers Tips and Resources for Couples at Every Stage

To help partners of all ages achieve their goals, Fidelity offers resources, including:

- Fidelity’s Life Events offering, an online experience designed to help people plan for, anticipate and react to major moments in their lives—where and when they need it. The hub offers a wealth of material to help couples make sound financial decisions, available at fidelity.com/couples. In addition, there is a helpful checklist to help make it easier for couples to start talking about money matters and planning.

- Educational Fidelity Viewpoints® articles, including “Tips for couples: Improving financial communication,” which provides ways to help foster successful money conversations with your significant other. Other related Viewpoints articles include “How to Pay off Debt—and Save too,”“5 financial tips for newlyweds,” and Identifying Financial Goals. For same-sex couples, the site also offers “Financial Planning Tips for LGBTQ+ Couples.”

- Fidelity’s Women Talk Money discussion series provides an interactive forum sharing education and suggested next steps to help address today’s most pressing financial topics and plan for future goals. Register here to tune in live or on-demand.

- Online retirement planning tools provide easy ways for couples to tell if they are on track to meet their financial targets.

- In-person appointments at Fidelity’s more than 200 nationwide investor centers or by calling 800-FIDELITY.

About the Fidelity Investments 2021 Couples & Money Study

The 2021 Fidelity Investments Couples & Money Study analyzes retirement and financial expectations and preparedness among 1,713 couples (3,426 individuals). These are some of the findings of a survey conducted by Ipsos using the probability-based KnowledgePanel® between March 25 and April 22, 2021 on behalf of Fidelity Investments. The Ipsos KnowledgePanel® is the largest and most well-established online probability-based panel that is representative of the adult US population. Respondents were required to be at least 25 years old, married or in a long-term committed relationship and living with their respective partner, and have a minimum household income of $75,000 or at least $100,000 in investable assets. This online, biennial study was launched in 2007 and is unique in that it tests agreement of both partners in a committed relationship on communication, as well as their knowledge of finances and retirement planning issues. For more information, a fact sheet can be found on Fidelity.com.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.0 trillion, including discretionary assets of $4.1 trillion as of June 30, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 wealth management firms and institutions with investment and technology solutions to drive growth. Privately held for 75 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com/about-fidelity/our-company.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 0211

986748.1.0

© 2021 FMR LLC. All rights reserved.

1 Estimate based on a hypothetical opposite-gender couple retiring in 2021, 65-years-old, with life expectancies that align with Society of Actuaries' RP-2014 Healthy Annuitant rates projected with Mortality Improvements Scale MP-2020 as of 2021. Actual assets needed may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Cost Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210715005217/en/

Contacts

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Ted Mitchell

401-292-3084

ted.mitchell@fmr.com