Home prices across the United States rose in the first six months of the year at an annualized rate of 10.7 percent, according to Radian Home Price Index (HPI) data released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN). The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210720006146/en/

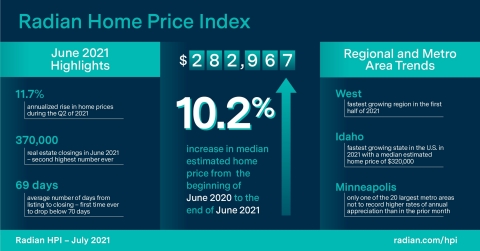

Radian Home Price Index (HPI) Infographic July 2021 (Graphic: Business Wire)

The Radian HPI also rose 10.2 percent year-over-year (July 2020 to June 2021), which was slightly higher than the year-over-year increase of 9.9 percent recorded last month. The annualized increase represents the continuation of record-breaking annualized yearly gains in recent months. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and regions.

“In our last release, the Radian HPI reported that home prices grew at the fastest annual rate in over a decade and a half, and that momentum has not stopped yet,” noted Steve Gaenzler, SVP of Data and Analytics. “During the second quarter, mortgage rates fell by 30 basis points and economic growth accelerated helping to further elevate home prices nationally. It is safe to say that all talk of the reemergence of a “buyers’ market” is not yet supported by the most recent home price data.”

Historically, the spring months help build inventory for the summer season. In the ten years from 2010 to 2019, the lightest month of national listing volume (December) averaged 1.3 million listed properties while the mid-point of the year (June) averaged 1.6 million listed properties. While listing activity has increased in each of the most recent four months, the June 2021 listing inventory was just over 968,000 units, more than 500,000 fewer units than the June historical average. “Taken in historical context, the recent increases in supply represent a very small consolation to buyers when compared to existing price increases,” added Gaenzler.

NATIONAL DATA AND TRENDS

- Median home price in the U.S. rose to $282,967 in June 2021

- Home prices rose an annualized 11.7 percent during the second quarter

Nationally, the median estimated price for single-family and condominium homes rose to $282,967 in June from the $280,002 recorded in May. Across the U.S., home prices rose 11.7 percent in the second quarter, a solid increase compared to the first-quarter increase of 9.4 percent.

Across the U.S., demand for homes does not appear to be subsiding. June 2021 recorded the second highest number of real estate closings ever at more than 370,000 closed sales. And homes continue to close in record time. Nationally, the number of days from listing to closing dropped to 69 days, the first time the measure has been below 70 days in recorded history.

REGIONAL DATA AND TRENDS

- First-half 2020 results are positive for all regions

- All regions grew at 10 percent or faster rates last month

In the first half of 2021, four of the six regional indices recorded positive home price appreciation rates more than 10.0 percent (annualized). While not as strong as these four Regions, the Midwest and MidAtlantic still recorded significant appreciation rates of 8.6 and 7.8 percent respectively over the last six months. All six regions recorded greater than 10 percent rates of annualized appreciation in the last month (May 2021 – June 2021) indicating that recent price appreciation growth is not slowing in any region of the country. Based on recent appreciation data, the median priced U.S. home has gained more than $15,000 in equity value thus far in 2021. Even as the most expensive region, with a median estimate of more than $500,000, the West region was the fastest growing region in the first half of 2021.

The MidAtlantic Region recorded the slowest rate of appreciation in the first half of the year. While Maryland continues to lag the other states in the Region, New York and Pennsylvania have experienced increasingly strong home-price momentum in 2021.

In the South, home prices in hot markets for remote work relocation like West Virginia and North Carolina have led the south in appreciation rates over the first half of the year. Over the same period, Virginia was the weakest performer in the Region.

The median estimated price of a home in Idaho, the fastest growing state in the U.S. this year, stands at $320,000 as of the end of June, growing by nearly +$100,000 in just the last year. In addition to Idaho, the states of Montana, Washington and Colorado have helped make the West the best-performing Region in the first half of the year.

METROPOLITAN AREA DATA AND TRENDS

- Metro areas end quarter on strong note

- 70 percent of largest Core-Based Statistical Areas (CBSAs) had a similar or better Q2 than Q1

In June, all but one of the largest 20 metro areas (Minneapolis, MN) recorded higher rates of annual appreciation than the prior month. During the first six months of 2021, six of the 20 largest metro areas in the U.S recorded price appreciation rates slower than the first quarter. The remaining 14 recorded unchanged or higher rates of appreciation quarter-over-quarter. Of the six metros recording a weaker second quarter as compared to the first, three were in California (Riverside, San Diego, San Francisco) and two were in the MidAtlantic Region (Washington, DC; Baltimore, MD).

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data set along with a client access portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk. Visit http://www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210720006146/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com