Study identifies access to capital as a primary hurdle for founders.

Research conducted by Endeavor Insight and funded by HSBC USA shows the greatest challenges that climate tech entrepreneurs face in scaling and growing their businesses include access to capital; the availability of qualified managers, engineers and other technical talent; and customer acquisition. Scaling Climate Tech: A Global Study of Entrepreneurs and Networks, released today at the 2022 Breakthrough Energy Summit, is based on the responses of more than 200 entrepreneurs and industry experts from around the world, with comparisons from six hub cities.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221018005252/en/

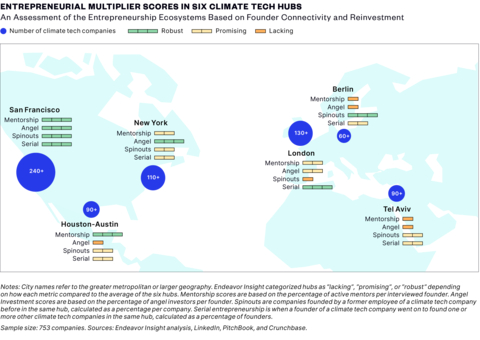

Sample Size: 753 Companies. Sources: Endeavor Insights analysis, LinkedIn, PitchBook, and Crunchbase

Among its key findings, the report uncovered:

- Climate tech founders face persisting funding gaps and global talent challenges

- Climate mitigation cannot happen without hardware-based companies that are facing greater challenges in scaling

- Innovation can come from anywhere in the world, but founders need global connections in order to scale

- Minorities and female entrepreneurs in climate tech face bias and difficulty raising capital

- Good mentors in climate tech are hard to find

“Climate tech entrepreneurs are uniquely positioned to play a critical role in developing solutions needed to address climate change and are a necessary complement to the efforts of governments, universities, corporations and consumers, among others,” said Gerry Keefe, Head of Global Banking, Americas. “HSBC is committed to providing capital to support the growth ambitions of our global clients specializing in climate-friendly, sustainable solutions.”

HSBC provides funding to climate tech entrepreneurs through a variety of channels. For example, HSBC Asset Management recently launched a climate tech fund that provides clients with opportunities to invest globally in technology startups who are addressing the challenges of climate change. The strategy focuses on companies across the energy, transportation, insurance, agriculture and supply chain sectors.

Additionally, HSBC Ventures is a venture debt fund that has allocated $100 million for founders building climate tech companies, with an additional $100 million earmarked for startups founded by women and minorities.

“Founders are driving the technological solutions that are solving some of the world’s most urgent problems, but they are rarely the focus of sector-wide studies,” said Leah D. Barto, Head of Endeavor Insight. “At Endeavor, we've seen how transformative change can come from listening to entrepreneurs and helping them scale, especially through global networks and peer-to-peer connections.” This new research provides actionable recommendations for tailoring support to the needs of scaling climate tech companies and fostering the worldwide exchange of resources that help founders overcome barriers.

Among the companies working toward a net-zero future is Huue, a women-founded startup that makes sustainable dyes for the apparel industry, including indigo blue for the denim makers. Huue received financing through HSBC Asset Management’s Climate Tech Venture Capital Fund. Company Co-Founder Michelle Zhu said the capital will accelerate the commercial scale-up of the company’s sustainable dye for fashion industry partners.

“We believe strongly in the need we see in the world for our innovative solutions.” said Michelle Zhu, CEO and co-founder of Huue. “But a key element is the opportunity to accelerate our mission with support from existing and new investors, Material Impact and HSBC Asset Management’s Climate Tech VC Fund, who share our vision for a sustainable and scalable future for consumer goods.”

Entrepreneurs, like Michelle Zhu, face key challenges (outlined in Scaling Climate Tech) as they mobilize resources to mitigate climate change and decarbonize the planet.

Click here to read the complete report.

About HSBC

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 63 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of US$2,985bn at 30 June 2022, HSBC is one of the world’s largest banking and financial services organisations.

About Endeavor Global

Endeavor Global is the leading global community of, by, and for high-impact entrepreneurs — those who dream bigger, scale faster, and pay it forward. Driven by our belief that high-impact entrepreneurs transform economies, Endeavor has been on a mission to build thriving entrepreneurial ecosystems in emerging and underserved markets around the world since its creation in 1997. Endeavor creates a Multiplier Effect by inspiring high-growth founders to dream bigger, supporting and investing in them to scale faster, and providing a platform to pay it forward — thereby compounding their individual impact.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221018005252/en/

Contacts

Media enquiries to:

Matt Kozar

Vice President, U.S. External Communications

matt.kozar@us.hsbc.com

Leah D. Barto

Head of Endeavor Insight

insight@endeavor.org