Safe & Green Holdings Corp. (NASDAQ: SGBX) (“Safe & Green Holdings” or the “Company”), a leading developer, designer, and fabricator of modular structures announced that it had publicly released on the Company’s website (www.safeandgreenholdings.com) a fairness opinion issued by ValueScope, Inc. on the previously announced spin-off of thirty percent (30%) of its subsidiary, Safe and Green Development Corporation (Safe and Green Development” or “SG Development”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221228005082/en/

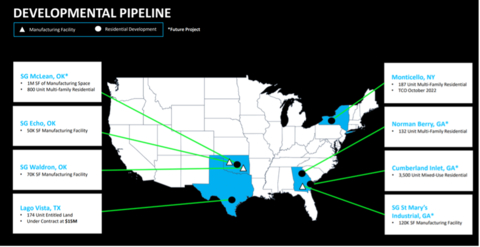

The graphic shows the current developmental pipeline at Safe and Green Development Corporation. (Graphic: Business Wire)

The Company tapped advisory firm ValueScope to conduct an independent valuation of the concluded value and fairness, from a financial point of view, of the planned spin-off of SG Development to the Company’s shareholders. The Analysis is based off of available financial information as of September 30, 2022 and limited financial information between September 30, 2022 through the end of this year. Additional information that contributed to the analyses included, but was not limited to, a discounted cash flow analysis based off of financial projections through 2027 and beyond for specific projects, a review of various real estate appraisals relating to the Company’s projects, interviews with key members of the management team, and review of information relating to the company’s intended industry and comparable companies currently operating in the space.

Based on ValueScope’s opinion, the Safe and Green Development has an estimated fair market value of approximately $74.3 million.

In the proposed spin-off the Company’s shareholders will receive 30% of issued equity in Safe and Green Development, with an estimated value of $22.3 million, with Safe & Green Holdings to retain the balance equity value at the parent company level.

In addition, it is intended that in the proposed spin-off, Safe and Green Development’s existing debt’s principal balance to the Company will be repaid in full with no shareholder dilution occurring in the process.

“After receiving this fairness opinion, we are confident say that the intended spin-off is the right course of action for shareholders and all parties involved,” said CEO and Chairman Paul Galvin. “We encourage shareholders to review the fairness opinion report and contact management with any questions moving forward. We could not be more excited for the value that this transaction is expected to create for all shareholders as well as the projects from the record pipeline of Safe and Green Development that will be able to be funded.”

The Company considers the decision of the spin out to be the most effective route to allow Safe and Green Development to operate and execute its independent business strategy while creating maximum value for both companies. The spin out is intended to stabilize the Company’s earnings and expand on the rate of growth in core divisions.

The valuation of Safe and Green Development does not include the Company’s Denison property which will remain within Safe & Green Holdings, and is expected to provide a sizable and valuable investment to be utilized in the future.

Current CEO of Safe & Green Holdings, Paul Galvin, will serve as Executive Chairman of Safe and Green Development’s board of directors. An independent board of directors for Safe and Green Development will be announced.

ValueScope's opinion was addressed to the Company’s Board, was only one of many factors considered by the Board in its evaluation of the proposed spin-off and only addresses the fairness, from a financial point of view, to the Company of the minimum total consideration to be received by the Company’s shareholders for in the proposed spin-off. ValueScope's opinion does not address the merits of the underlying decision by the Company to engage in the proposed spin-off or related transactions or the relative merits of the proposed spin-off as compared to any other transaction or business strategy in which the Company might engage and is not intended to, and does not, constitute a recommendation to any stockholder as to how such stockholder should act with respect to the spin-off or any other transaction or business strategy in which the Company engage.

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading modular solutions company, operates under core capabilities which include the development, design, and fabrication of modular structures, meeting the demand for safe and green solutions across various industries. The firm supports third party and in-house developers, architects, builders and owners in achieving faster execution, greener construction, and buildings of higher value. Safe and Green Development Corporation is a leading real estate development company. Formed in 2021, the company focuses on the development of sites using purpose built, prefabricated modules built from both wood & steel, sourced from one of Safe & Green Holdings factories and operated by SG Echo. For more information, visit www.safeandgreenholdings.com.

Safe Harbor Statement

Certain statements in this press release constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. These forward-looking statements are based upon current estimates and assumptions and include statements regarding the Company’s plans to spin-off thirty percent of Safe and Green Development Corporation to the Company’s stockholders, Safe and Green Development having an estimated fair market value of approximately $74.3 million, the Company’s shareholders receiving 30% of the issued equity in Safe and Green Development with a value of $22.3 million, Safe and Green Development’s existing debt’s principal balance to the Company being repaid in full with no shareholder dilution occurring in the process, the value that the transaction is expected to create for all shareholders and the projects from the record pipeline of Safe & Green Holdings that will be able to be funded, the spin out stabilizing the Company’s earnings and expanding on the rate of growth in core divisions, the Company’s Denison property providing a sizable and valuable investment to be utilized by the Company in the future, announcing an independent board of directors for Safe and Green Development and the developmental pipeline at Safe and Green Development Corporation . While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are subject to various risks and uncertainties, many of which are difficult to predict that could cause actual results to differ materially from current expectations and assumptions from those set forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current expectations include, among others, the Company’s ability to spin-off Safe and Green Development Corporation to the Company’s stockholders as planned and achieve the benefits expected, the ability of Safe and Green Development to fund and complete the projects in its developmental pipeline, the Company’s ability to expand within various verticals as planned, the Company’s ability to position itself for future profitability, the Company’s ability to maintain compliance with the NASDAQ listing requirements, and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and its subsequent filings with the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this release is provided only as of the date of this release, and we undertake no obligation to update any forward-looking statements contained in this release on account of new information, future events, or otherwise, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221228005082/en/

Contacts

Investor Relations:

Equity Animal

Mark Moran

(646) 363-6567

mm@equityanimal.com