Tangerine Bank Ranks Highest for Fourth Consecutive Year

Although consumers in Canada are generally satisfied with their credit cards, they are using them less frequently and are looking to alternatives like buy now, pay later (BNPL) and personal loans as the economy starts to sputter. According to the J.D. Power 2022 Canada Credit Card Satisfaction Study,SM released today, more than one-third (36%) of credit card customers say they would consider other financing options when making a large purchase and among those planning to switch cards, 20% say they would do so for a lower interest rate on purchases.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220915005075/en/

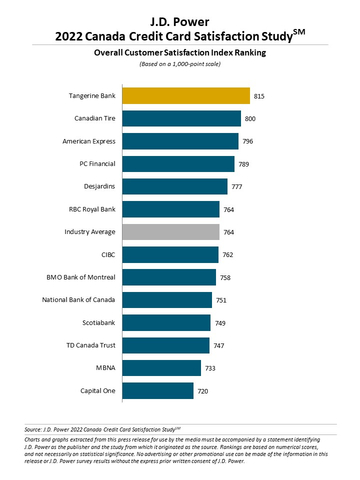

J.D. Power 2022 Canada Credit Card Satisfaction Study (Graphic: Business Wire)

“Overall credit card customer satisfaction in Canada has been remarkably steady for the past several years, and we’re even seeing some increases in satisfaction with product and benefit-level satisfaction, but macroeconomic trends and growing competition from alternative lending providers should raise concern for card issuers,” says John Cabell, managing director of payments intelligence at J.D. Power. “Steps taken now to tighten up problem resolution, better align rewards and benefits with customer needs and improve customer engagement will be critical for customer retention and growth as we enter a potentially difficult economic cycle.”

Following are some key findings of the 2022 study:

- Overall credit card satisfaction flat despite product improvement: Overall customer satisfaction with credit cards is 764 (on a 1,000-point scale), which is roughly in line with overall satisfaction scores during the past five years. Customer satisfaction with credit card terms (+5 points), benefits and services (+3) and rewards (+2) all increase this year, but these gains are offset by a 2% increase in problem incidence and challenges with digital problem resolution.

- Spending on primary card declines: The average credit card customer spent $1,144 per month on their primary card this year, which is down $11 from a year ago. During the last five years, average monthly spend is down $23. Meanwhile, cash, debit card and other non-credit card-related spending is up 51% this year.

- BNPL and personal loans emerge as hot alternatives, especially for large purchases: When making a large purchase, 36% of credit card customers say they would consider other financing options such as personal loans, BNPL or flexible financing/installment loans. Personal loans are the most popular of these lending alternatives, considered by 21% of customers entertaining a large purchase, followed by BNPL at 17%. Reasonable fees and competitive interest rates are drivers for considering these borrowing alternatives.

- Consumer financial health is suffering: More than half (54%) of credit card customers are now classified as financially unhealthy,1 up nine percentage points from a year ago. This shift is even more pronounced than the trend observed in the United States where the proportion of financially unhealthy credit card customers has risen 4 percentage points this year. Additionally, 24% of credit card customers in Canada say they are worse off financially in 2022 than the year before—up from 16% in 2021—and 31% of credit card customers say they are carrying revolving debt on their primary cards, up from 24% in 2021. Notably—and contrary to overall trends—indebted cardholders’ product feature satisfaction declines in 2022.

- Time for customers to reassess their credit card choices: Just 27% of credit card customers feel they completely understand the benefits and card features available to them with their current credit card. Among cashback cardholders, satisfaction with rewards declined significantly in 2022. As the economy tightens and new lending alternatives continue to emerge, it is an ideal time for customers to reevaluate their current card choices to ensure alignment between spending and rewards/benefits.

Study Ranking

Tangerine Bank ranks highest in overall customer satisfaction for a fourth consecutive year, with a score of 815. Canadian Tire (800) ranks second and American Express (796) ranks third.

The Canada Credit Card Satisfaction Study measures satisfaction of cardholders’ primary credit card issuer. The study measures performance in six factors critical to the customer experience (in alphabetical order): benefits and services; communication; credit card terms; customer interaction; key moments; and rewards. The study was fielded in May-June 2022 and includes responses from 6,478 cardholders who used a major credit card in the past three months.

For more information about the Canada Credit Card Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-credit-card-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022122.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, credit worthiness and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220915005075/en/

Contacts

Media Relations Contacts

Gal Wilder, NATIONAL; 416-602-4092; gwilder@national.ca

Nicole Herback, NATIONAL; 403-200-1187; nherback@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com