Midsize companies in the U.K. report a decline in economic optimism while managing rising energy price rises and supply chain challenges

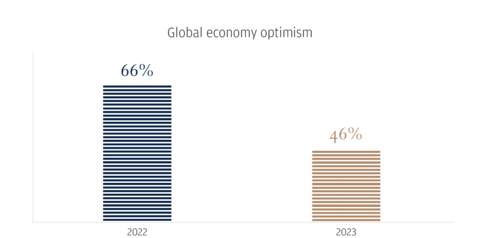

Nearly three-in-four (74%) U.K. midsize business leaders plan to grow in the year ahead by either adding to or maintaining their current headcount, according to J.P. Morgan’s second annual U.K. Business Leaders Outlook survey released today. This is in spite of less than half (46%) of U.K. midsize business leaders feeling upbeat about the global economy in the year ahead, down 20% from 2022—and nearly seven in ten (69%) bracing for a recession in 2023, more than any other country polled in this year’s survey.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230111005027/en/

Global economy optimism (Graphic: Business Wire)

“We know 2022 was a challenging year for many businesses as they tried to recover from the pandemic amid fierce economic headwinds, and this upcoming year will bring its own set of challenges,” said Catherine Pierre, Head of Commercial Banking, U.K., J.P. Morgan. “However, it’s heartening to see the resilience U.K. decision makers are showing by focusing on recession-proofing and remaining optimistic about growth. It gives hope that U.K. businesses can weather the storm ahead and emerge on the other side stronger.”

In a survey of more than 300 senior executives from U.K. midsize companies, many are feeling confident in what they can control: their own companies. Nearly three in four (73%) business leaders say they’re optimistic about their company’s performance, down 7% from 2022, and nearly nine in ten (89%) expect their revenues to increase or remain the same in the year ahead.

“While optimism for the greater economy may have trended down, local decision makers are still planning for a brighter future with expected business growth,” said Vis Raghavan, Chief Executive Officer EMEA, J.P. Morgan. “British business leaders are pragmatic and are having to make strategic decisions with challenging choices given the current cards dealt and what’s expected ahead.”

Energy Prices Threaten Business Success

While businesses are focusing on resilience, they remain concerned about threats beyond their control.

- The top threat: Energy prices were cited as the biggest external threat to businesses by a quarter (25%) of respondents, overshadowing general market volatility (15%), the cost of debt and interest rates (13%) and threats of competition (11%).

- The business impact: Seven in ten business leaders concerned by inflationary challenges and rising costs reported that the increased cost of energy was making doing business more expensive, far outstripping the pressures of rising interest rates (53%) and increasing costs of raw materials (56%).

- The consumer impact: With costs soaring from inflation, almost half (48%) said they’d already had to raise prices. Many (68%) have raised prices up to 50%, while just under a quarter (22%) of those who’ve had to raise prices have done so by between 51% and 75%.

Supply Chain Challenges Lead to Business Change

Although energy price concerns dominate, supply chain issues remain.

- Supply chain woes: While some acute supply chain problems linked to the pandemic and Brexit have faded from the headlines, nearly two thirds (63%) of business leaders say supply chain pressures have worsened in the last year. A similar number (62%) say increased costs related to supply chain issues are driving the cost of business higher.

- Nearshoring: As supply chain worries worsened throughout the year, more U.K. businesses have taken decisive action to address it with nearly half (42%) moving manufacturing and distribution nearer to their key markets, up 12% from 2022.

- Other adjustments: Nearly half (46%) are now allocating more money to cover rising costs of moving products, up 10% from 2022, and less than one third (32%) have taken to strategic stockpiling to manage the issues.

The Rise of the ‘S’ in ESG

The range of considerations for business leaders is broad and the focus on environmental, social and governance (ESG) measures remains strong. In fact, social concerns around employees and customers now match the concern for environmental issues.

- Increased focus on social standards: Social factors like customer satisfaction, workplace health and safety and data privacy were reported by 56% as important to their business strategy, up 25% from 2022. They now rank as highly as environmental factors (56%), like reducing carbon emissions and energy efficiency.

- The benefits: The most commonly cited reason for the focus on corporate responsibility was to improve employee retention (52%). Cited nearly as often were the desire to reinforce the company’s position in the community (51%) and to enhance marketing and find new customers (49%).

Business Transitions Decline As Leaders Hold On Through Tough Times

The number of leaders with no plans to sell or transfer ownership of their company in the next year has increased significantly to 45%, up 16% from 2022.

- Future plans: Among those considering a full or partial transfer, more than half (56%) are seeking to do so through a sale or gift to family, and 74% expect the transition to be complete withing the next two years, up 24% from 2022.

For more information on the 2023 Business Leaders Outlook, visit jpmorgan.com/business-outlook-GBR.

Survey Methodology

J. P. Morgan’s Business Leaders Outlook survey was conducted online from November 21 – December 8, 2022. In total, 306 business leaders (CEOs, CFOs, heads of finance and owners) from U.K. midsize companies (annual revenues ranging from £20 million to £2 billion) across various industries participated in the survey. Results are within statistical parameters for validity, and the error rate is +/- 5.6% with a 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had $3.8 trillion in assets and $288 billion in stockholders’ equity as of September 30, 2022. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

© 2023 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. is organized under the laws of USA with limited liability. Visit jpmorgan.com/cb-disclaimer for full disclosures and disclaimers related to this content.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230111005027/en/

Contacts

J.P. Morgan United Kingdom: Alice Gasson, alice.gasson@jpmorgan.com

J.P. Morgan Commercial Banking: Bentley Weisel, bentley.r.weisel@chase.com