American Express Ranks Highest in Overall Customer Satisfaction for Third Consecutive Year

Small businesses are more optimistic about the future; they’re spending more money, and they are more satisfied with their credit card providers. According to the J.D. Power 2023 U.S. Small Business Credit Card Satisfaction Study,SM released today, that growing sense of confidence among small businesses is helping to drive overall satisfaction with business credit card issuers higher than its peak level in 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231207679315/en/

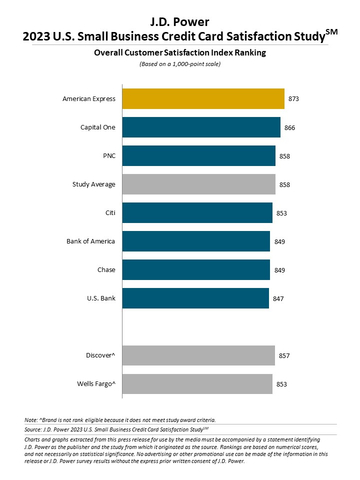

J.D. Power 2023 U.S. Small Business Credit Card Satisfaction Study (Graphic: Business Wire)

“Card issuers have done a great job of delivering to small business owners services and rewards programs that have helped them through a tough economic period, and now, as the business outlook improves, issuers are being rewarded with higher spend and higher levels of customer satisfaction," said John Cabell, managing director of payments intelligence at J.D. Power. "However, with interest rates still elevated, two areas of the customer experience that are still lagging are reasonableness of fees and competitiveness of rates. These will need to be managed carefully by issuers during the next year as more small businesses seek low interest payment plans.”

Following are some key findings of the 2023 study:

- Satisfaction rises as small business outlook improves: Overall satisfaction among small business credit card customers is 858 (on a 1,000-point scale), which is up a significant 7 points from 2022 and up 9 points from 2019. Overall, 38% of small businesses say they are financially better off than they were a year ago, up from 34% in 2022. Also, 41% of small businesses are carrying revolving debt, down from 44% in 2022.

- Business card expenditures increase: With small businesses now spending an average of $13,000 per month1 on their credit cards, 78% are using their business cards for office supplies, 70% are using them for operating expenses, 65% are using them for travel, 55% are using them for inventory, 49% are using them for meals and 37% are using them for raw materials.

- Despite satisfaction gains, credit card terms could be an issue: Business credit card issuers see improvements in customer satisfaction across nearly every factor evaluated in this year’s study, with the exception of credit card terms, which remained flat year over year. Biggest customer concerns with credit card terms are with reasonableness of fees and competitiveness of interest rates, especially among businesses with smaller annual revenues.

- Rewards programs are critical to small business customer satisfaction: Small business customers who spend $20,000 or more per month have higher levels of overall satisfaction with their card issuers, driven largely by increased interaction and improved alignment of spending with reward programs. Highest spenders are also likely to use five or more supplementary card benefits, which further increase overall customer engagement and satisfaction.

Study Ranking

American Express ranks highest in customer satisfaction for a third consecutive year, with a score of 873. Capital One (866) ranks second and PNC (858) ranks third.

The 2023 U.S. Small Business Credit Card Satisfaction Study, now in its fifth year, measures customer satisfaction with the largest small business credit card issuers in the U.S. by examining six factors (in alphabetical order): benefits and services; channel activities; credit card management; credit card terms; key moments; and rewards. The study includes responses from 3,443 small business credit card customers whose businesses have an approximate annual revenue between $10,000 and $10 million. The study was fielded in August-September 2023.

For more information about the U.S. Small Business Credit Card Satisfaction Study, visit

https://www.jdpower.com/business/resource/us-small-business-credit-card-study.

See the online press release at http://www.jdpower.com/pr-id/2023176.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Intuit QuickBooks Small Business Index Annual Report 2023 https://quickbooks.intuit.com/r/small-business-data/index-annual-report-2023/

View source version on businesswire.com: https://www.businesswire.com/news/home/20231207679315/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com