- Assets in Fidelity® Health Savings Accounts (HSA) Exceed $16 Billion1 as Americans Report Using the Triple-Tax Advantages to Manage Expenses and Prepare for the Long-Term

- 1,600+ Employers Tap Fidelity Health for Benefits Solutions to Attract and Retain Talent

Fidelity Investments® today reported significant growth in its health business, including a 27% increase in funded health savings accounts (HSAs) to 2.8 million, and more than $16 billion in total HSA assets, up from nearly $14 billion last year. This represents just one aspect of the Fidelity Health business, which works to help more than 1,600 employers and millions of Americans with health decisions so they can navigate the journey with ease. From HSAs to reimbursement accounts (like FSAs), health and welfare administrative services, voluntary benefits, and Medicare, Fidelity Health aims to drive confidence among plan sponsors and consumers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230412005049/en/

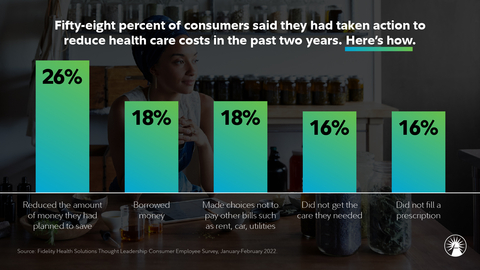

58 percent of consumers said they had taken action to reduce health care costs in the past two years, according to Fidelity Investments. Here's how. (Graphic: Business Wire)

“Today, health care decisions are inextricably linked to our financial well-being,” said Steve Betts, head of Fidelity Health. “The complexity of the health care system can be staggering, which is why we’re focused on helping plan sponsors and individuals achieve greater clarity by providing innovative benefits that help employees find, save for, and pay for health care – all through dynamic digital experiences.”

Bringing Confidence to Savers

Whether planning for future health care needs or managing current expenses, Americans identify rising health care costs as a top concern in 20232. In fact, Fidelity data shows more than half (58%) of consumers say they’ve taken steps to reduce health care costs over the last two years3. This includes nearly one-in-five (18%) who say they made choices not to pay other bills such as rent, car payments, or utilities to cover health care expenses.

In today’s challenging economic environment, there are a few simple steps consumers can take to help make the most of available benefits. These include understanding the full array of health benefits available outside of traditional insurance coverage (for example, telehealth or live navigation services), leveraging tools that interact with the system to help find the best care, and saving and paying for health care using a health savings account. HSAs stand out due to the ”triple-tax advantage,” meaning that contributions may be tax-deductible, the money in an HSA can be spent tax-free on qualified medical expenses, and any growth is tax-free4.

“Meeting the rising cost of health care continues to be a concern for Americans, particularly as inflation impacts household budgets,” said Begonya Klumb, head of health and benefit accounts at Fidelity. “We see time and again that savers with access to an HSA are able to use the triple-tax advantage to become better prepared for the cost of health care, both today and in the future.”

When it comes to the next generation, there’s good news – 88% of Gen-Zers with a high deductible health plan say they’ve opened an HSA, far above the 71% of eligible respondents who say the same5. And for those nearing retirement, recent Fidelity data shows those with an HSA feel more prepared to meet expenses in retirement and are more likely to say they expect to live a comfortable lifestyle when they retire.

For those seeking to grow their HSA savings, Fidelity offers a range of investment options including “Funds to Consider6,” a list of mutual funds designed for use in a health savings account. Over one-in-five HSA account owners on Fidelity’s platform are investing a portion of their HSA assets, far above the 8% average for the rest of the industry. Furthermore, nearly half of the HSA assets on Fidelity’s platform are invested7, providing an opportunity for potential growth.

Bringing Clarity to Employers and the People They Support

While the workplace climate has shifted over the last year, the war for talent persists as employers look to attract and retain employees. A comprehensive benefits package addressing all the health needs of employees – physical, mental, and financial – is increasingly imperative for employers. Yet only 35% of employees strongly agree that their health benefits meet their own or their family’s needs, and fewer than one-in-five (17%) health benefits leaders say their company offers navigation services that help coordinate employees’ care across multiple providers8.

“We know having the right health benefits strategy can help combat rising costs and drive employee engagement,” said Betts. “It’s not simply about the benefits themselves, but how they all work together to help employees navigate their health benefits choices with confidence.”

To accomplish this, Fidelity Health delivers offerings such as Digital Care Navigation powered by Amino, a tool to help employees find in-network, high quality, yet lower-priced providers. Additionally, with over 70,000 users in the last year, the Fidelity Health® App helps employees find and pay for health care in an integrated digital experience.

Enabling Seamless Digital Experiences

Top of mind for both employers and consumers is the complexity inherent in the health care landscape. By reducing friction in how people save and pay for health care needs with a seamless digital platform, Fidelity Health makes it easier to navigate the health care journey. Digital innovations including fractional share trading within HSAs, the Fidelity Go® HSA managed account, access to the Fidelity Health app, and dedicated HSA investment options make it simpler to save for the future while addressing costs today.

Fidelity Resources for Managing Health Care Benefits

Fidelity has a variety of resources available for employers and Americans to as they make decisions about their health and financial well-being, including:

- For individuals new to Medicare as well as those who’d like to review their coverage, Fidelity Medicare Services provides education and impartial guidance from a non-commissioned associate. In 2023, Fidelity Medicare Services will expand to be available to residents of 28 states and the District of Columbia.

- Thought leadership including the recent “Health Benefits Navigator: Five simple steps to make the most of your health benefits in 2023” and “Paying for Care: Learn how to use health benefit accounts and manage the costs”

- A dedicated learning path on Fidelity.com to help manage health care needs, including articles like What is an HSA” or “How to plan for rising health care costs.”

- Fidelity’s Health & Welfare offering brings wellness solutions, administrative services, and individual and group voluntary benefits.

- Fidelity’s Workplace Consulting team offers a dedicated health care consulting practice, with data-driven insights and research to inform health care strategy, plan design and employee engagement.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $10.3 trillion, including discretionary assets of $3.9 trillion as of December 31, 2022, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs nearly 67,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The information provided here is general in nature. It is not intended, nor should it be construed, as legal or tax advice. Because the administration of an HSA is a taxpayer responsibility, customers should be strongly encouraged to consult their tax advisor before opening an HSA. Customers are also encouraged to review information available from the Internal Revenue Service (IRS) for taxpayers, which can be found on the IRS Web site at www.IRS.gov. They can find IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans, and IRS Publication 502, Medical and Dental Expenses (including the Health Coverage Tax Credit), online, or you can call the IRS to request a copy of each at 800.829.3676.

Fidelity Go® provides discretionary investment management for a fee. Advisory services offered by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. FPWA, FBS and NFS are Fidelity Investments companies.

Amino and Fidelity Investments are independent entities and not legally affiliated.

Fidelity Medicare Services is operated by Fidelity Health Insurance Services, LLC ("FHIS"), and FMR LLC ("FMR") is the parent company of FHIS. Unless otherwise indicated, the information and items published in this document are provided by FHIS for informational purposes only and are not intended as tax, legal, or investment advice.

Fidelity Medicare Services ("FMS") and Fidelity Brokerage Services LLC ("FBS") are separate business entities. FMS is not a product or service of FBS. Other than certain demographic information such as name, address, and date of birth, the information you provide to FMS or FBS will not be shared with the other entity. Therefore, if you want FBS to consider the information you have provided to FMS in your investment planning with FBS, you must separately provide that information to FBS.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company, LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport Boulevard, Boston, MA 02110

1077447.2.0

©2023 FMR LLC. All rights reserved.

1 As of January 31, 2023

2 Source: Fidelity Investments 2023 Financial Resolutions Study

3Source Fidelity Health Solutions Thought Leadership Consumer Employee Survey, 2022

4Any post-tax money you contribute to an HSA is tax-deductible, up to the IRS limit. If payroll deduction is an option for you, those contributions are usually pre-tax. Using your HSA money to pay for qualified medical expenses is always free from federal income taxes. If you choose to invest your HSA money, any growth is free from federal income taxes. This is with respect to federal taxation only. Contributions, investment earnings and distributions may or may not be subject to state taxation.

5 Fidelity Retirement Savings Assessment Study, 2023

6 In identifying investment options to include in the Fidelity HSA Funds to Consider, Fidelity only considered Fidelity open-end mutual funds and open-end mutual funds offered by a limited universe of third-party fund companies that participate in an exclusive marketing, engagement and analytics program with Fidelity for which they pay Fidelity an annual fee. The only third-party fund companies whose funds were eligible for this program were companies that generally have a track record of generating the strongest customer demand for their products from across Fidelity's customer channels and have been paying Fidelity a sufficient level of compensation for the shareholder servicing performed by Fidelity.

7 Fidelity record kept data of health savings accounts

8 Fidelity Health Solutions Thought Leadership Employer Survey, January–February 2022

View source version on businesswire.com: https://www.businesswire.com/news/home/20230412005049/en/

Contacts

Corporate Communications

(617) 563-5800

FidelityMediaRelations@fmr.com

Deanna Spaulding

617-563-8359

deanna.spaulding@fmr.com

Follow us on Twitter @FidelityNews

Visit our online newsroom