- Most Partners Claim to Make Financial Decisions Together, although 1-in-5 Primary Decision Makers Resent Handling Financial Matters Alone

- More than Half of Respondents Feel Very Good or Excellent about their Financial Health and 27% of Boomers Claim Building a Financial Plan is their “Love Language”

- Fidelity Offers Resources to Help Drive Communication on Retirement and Financial Goals

The spotlight on love and relationships becomes very bright every February as Americans celebrate their commitment to one another and yet, Fidelity Investments® 2024 Couples and Money study reveals couples may not be as aligned as they think, with 45% of partners admitting they argue about money at least occasionally. While more than 1-in-4 couples identify money as their greatest relationship challenge, the good news is more than half of respondents feel very good or excellent about their financial health and 27% of boomers say building a financial plan together is their love language.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240201922762/en/

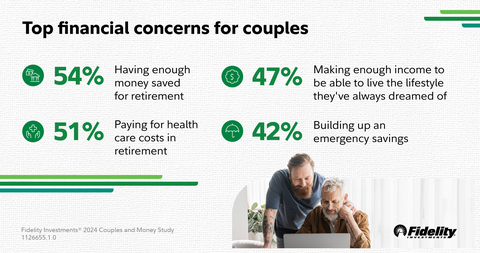

Financial Concerns for Couples (Graphic: Business Wire)

Fidelity’s study, which has been conducted since 2007, is unique in how it surveys couples individually before bringing their answers together to analyze and identify where couples are doing well with their communication and finances, and where they can focus more attention to make progress on their priorities – from balancing bills to paying down debt. When it comes to the basics of any relationship, couples give themselves high marks with nearly 9-in-10 claiming they communicate well or very well with their partner, showing a promising link to navigating financial success through open communication.

“Money conversations can be daunting for couples, especially when they have competing priorities or different visions for how they should be spending, saving, and investing,” said Meredith Stoddard, vice president, Education at Fidelity Investments. “Open lines of communication are the building blocks to any successful partnership and help people feel more confident, especially as they navigate financial conversations and expectations.”

Beyond ‘I do’: navigating financial tensions, dreams and retirement expectations

While most partners claim to make financial decisions together, 1-in-5 primary decision makers admit to feeling resentful about handling financial matters alone. Additionally, more than a third of couples miss the mark when it comes to how much income their significant other makes; 27% admit to being often frustrated by their partner’s money habits, but say they let it go for the sake of keeping the peace. Beyond the breakdown in communication, partners express concerns about retirement, emergency savings and living the lifestyle they’ve always dreamed. In addition, Gen Z also shows concern about having enough money to buy a home (57%) and feeling financially secure enough to have and support children (54%).

When it comes to having a vision for retirement, couples are mostly aligned on how they want to be spending their time – with family, friends, traveling, and their hobbies. Still, more than half (53%) of couples who have not yet retired express conflicting views on how much they need to have saved to retire. Furthermore, while most partners expect to retire around age 63, nearly half anticipate at least working part-time post-retirement – perhaps out of necessity, or as some couples choose to pursue new passions in retirement.

Agree to disagree: mismatched financial perspectives

The study results show a need for improved communication and shared decision-making to manifest financial harmony within relationships. Among other noteworthy trends, more than a third of couples report disagreements on their upcoming major financial goals. Additionally, women are far more likely to credit their partners with having a better understanding of investing matters with 57% of women indicating their partner is savvier when it comes to these matters, versus themselves (40%).

Communication dynamics: the key to financial success and well-being

The study also reveals that effective communication can be crucial for financial success and well-being for couples. Among other things, those who claim they communicate well are more likely to discuss their finances and anticipate living a comfortable lifestyle in retirement. This is key as retirement income plans and health care costs continue to be top stressors in retirement and a clear plan that couples can align on can help ease any burden. To help couples achieve financial mobility, channel healthy communication and financial harmony, Fidelity has assembled several resources to build a strong financial foundation, including:

- Fidelity’s learning center is an online experience designed to help people plan for, anticipate and react to major moments in their lives – where and when they need it. The hub offers a wealth of material to help couples make sound financial decisions, available at fidelity.com/couples. In addition, there is a helpful checklist to make it easier for couples to start talking about money matters and planning.

- Fidelity’s Women Talk Money community offers a forum for real talk about money, investing, careers, and other topics top of mind for women, through live events, online checklists and other actionable resources to help members take their next best steps with their finances. It’s free to join for everyone.

- Online retirement planning tools provide easy ways for couples to tell if they are on track to meet their financial targets. Including, Fidelity’s annual Retiree Health Care Cost Estimate, which highlights ways Americans can prepare to meet future health care costs in retirement.

- In-person appointments at Fidelity’s more than 200 nationwide investor centers or by calling 800-FIDELITY.

About the 2024 Couples and Money Study

The 2024 Fidelity Investments Couples Study analyzes retirement and financial expectations and preparedness among 1,794 couples (3,588 individuals), using findings from a survey conducted by Ipsos using the probability based KnowledgePanel® between October 31, 2023, and November 22, 2023, on behalf of Fidelity Investments. The Ipsos KnowledgePanel® is the largest and most well-established online probability-based panel that is representative of the adult US population. Respondents were required to be at least 18 years old, married or in a long-term committed relationship and living with their respective partner. This online, biennial study was launched in 2007 and is unique in that it tests agreement of both partners in a committed relationship on communication, as well as their knowledge of finances and retirement planning issues.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. With assets under administration of $11.5 trillion, including discretionary assets of $4.4 trillion as of September 30, 2023, we focus on meeting the unique needs of a diverse set of customers. Privately held for 77 years, Fidelity employs over 73,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to emailed news from Fidelity

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

1126655.1.0

©2024 FMR LLC. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240201922762/en/

Contacts

Fidelity Media Relations

FidelityMediaRelations@fmr.com

Katie Crimmins

(617) 563-9498

katie.crimmins@fmr.com