- Fidelity Becomes Second-Largest Health Savings Account Provider1

- American Savers Increasingly Investing in HSAs, with Younger Generations Leading the Way

- Fidelity Health® Brings Clarity to Health Care Through Innovative Benefits and Offerings

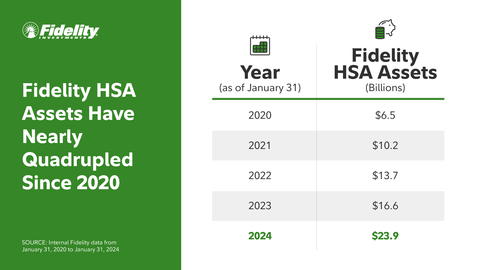

Fidelity Investments® today reported substantial growth in the number of Americans taking advantage of health savings accounts (HSAs), with a 19% increase in funded HSAs year-over-year. This comes as total Fidelity HSA assets increased 44% to a record-high $24 billion, making Fidelity the second-largest HSA provider in the country1. In addition to offering the Fidelity HSA, Fidelity Health® helps nearly 2,000 employers and millions of Americans navigate the health landscape through innovative offerings that aim to bring clarity to the ever-changing, complex health care system.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240423190794/en/

(Graphic: Business Wire)

“Americans and their employers increasingly recognize how important access to comprehensive benefits, including tax-advantaged savings vehicles, can be for managing the financial impact of their health care decisions,” said Steve Betts, head of Fidelity Health. “Whether through an employer or on their own, we are committed to helping individuals build a stronger financial future as they manage the rising cost of health care.”

Fidelity Reports $24 Billion in HSA Assets, as HSAs Celebrate 20 Years

For more than two decades, HSAs have given Americans enrolled in HSA-eligible health plans a tax-advantaged way to save for short- and long-term health expenses, and the utility of an HSA has only increased as health care costs continue to rise. In fact, since Fidelity’s HSA debuted in 2005, the cost of health care has more than doubled2, making the tax-advantaged nature of HSAs more important than ever. Whether saving, spending, or investing, all strategies leverage the fundamental power of an HSA: the triple-tax advantage. This means there are no taxes on contributions, no taxes while money grows in the account, and any withdrawals for qualified medical expenses are tax-free3.

The HSA: a Multi-tool for Health Expenses

As the number of HSA accounts continues to grow—with Fidelity seeing a 19% increase year-over-year to 3.3 million as of January 31, 2024—investors may wonder if there is a “right” way to maximize the benefits of their HSA. There is no one-size-fits-all approach: HSAs can be a multifunctional spending, saving and investing account, helping to pay for current qualified medical expenses; save in an “emergency fund” for unplanned medical emergencies; or invest over the long-term for health care expenses in retirement. Yet, even as employers are making progress in educating employees about the benefits of HSAs4, only half of Americans are familiar with the features of the account that could help alleviate some of their biggest financial concerns5.

“There is always work to be done,” said Karen Volo, head of health and benefit accounts at Fidelity. “We know employees with HSAs are significantly more likely to say they’re prepared to cover unexpected health care expenses6. Providing as much education as possible can help employees build a more resilient savings strategy, now and in the future.”

Building a Stronger Retirement with HSAs

Recent Fidelity research found 17% of Americans say paying medical bills for a health condition is keeping them from reaching retirement goals7, suggesting the high cost of health care is having an impact on retirement preparedness. What’s more, more than a third (36%) of respondents said being able to afford health care is among their top retirement concerns7. The good news is that younger generations are increasingly taking advantage of the opportunity to invest in their HSA and build a nest egg for health care costs in their later years – in fact, according to Fidelity research8, younger HSA holders—those ages 18-35—were more likely to be investors than account holders from older age groups. And Americans of all ages are taking steps to address the rising cost of care, with 71% saying they plan on saving more for retirement out of concern of the high cost of health care6.

Fidelity Resources for American Employers and Savers:

With over a quarter-century of experience in the health benefits space, Fidelity Health® is dedicated to empowering individuals and employers to make better health decisions and build a stronger financial future.

- For employers, new thought leadership including “6 Benefits Trends to Watch in 2024“ and “Investing in HSAs.”

- Fidelity’s Health & Welfare offering brings wellness solutions, administrative services, and individual and group voluntary benefits.

- For individuals nearing or in retirement, Fidelity Medicare Services provides education and impartial guidance from a non-commissioned associate.

- For those looking to learn more about how HSAs can help build a stronger financial future, Fidelity has dedicated learning resources on Fidelity.com, including “Managing unexpected health care costs” and “Three healthy habits for health savings accounts.”

- Fidelity’s Workplace Consulting team offers a dedicated health care consulting practice, with data-driven insights and research to inform health care strategy, plan design and employee engagement.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of $12.6 trillion, including discretionary assets of $4.9 trillion as of December 31, 2023, we focus on meeting the unique needs of a broad and growing customer base. Privately held for 77 years, Fidelity employs more than 74,000 associates across the United States, Ireland, and India. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Investing involves risk, including risk of loss.

The information provided here is general in nature. It is not intended, nor should it be construed, as legal or tax advice. Because the administration of an HSA is a taxpayer responsibility, customers should be strongly encouraged to consult their tax advisor before opening an HSA. Customers are also encouraged to review information available from the Internal Revenue Service (IRS) for taxpayers, which can be found on the IRS Web site at www.IRS.gov. They can find IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans, and IRS Publication 502, Medical and Dental Expenses (including the Health Coverage Tax Credit), online, or you can call the IRS to request a copy of each at 800.829.3676.

Fidelity Medicare Services is operated by Fidelity Health Insurance Services, LLC ("FHIS"), and FMR LLC ("FMR") is the parent company of FHIS. Unless otherwise indicated, the information and items published in this document are provided by FHIS for informational purposes only and are not intended as tax, legal, or investment advice.

Fidelity Medicare Services ("FMS") and Fidelity Brokerage Services LLC ("FBS") are separate business entities. FMS is not a product or service of FBS. Other than certain demographic information such as name, address, and date of birth, the information you provide to FMS or FBS will not be shared with the other entity. Therefore, if you want FBS to consider the information you have provided to FMS in your investment planning with FBS, you must separately provide that information to FBS.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Fidelity Brokerage Services LLC, Member NYSE, SIPC,

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02205

1141059.1.0

©2024 FMR LLC. All rights reserved.

1 Devenir Research 2023 Year-End HSA Market Statistics & Trends

2 Centers for Medicare & Medicaid Services National Health Expenditure, 2005-2022

3 With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

4 Fidelity Health Solutions Thought Leadership HSA Investing Survey, 2024

5 Fidelity 2023 Fall Health Outlook Study

6 Fidelity Health Thought Leadership Benefit Plan Participant Survey, Fall 2023

7 Fidelity Investments 2024 State of Retirement Planning Study

8 Fidelity Health Thought Leadership Benefit Plan Participant Survey, Fall 2023

View source version on businesswire.com: https://www.businesswire.com/news/home/20240423190794/en/

Contacts

Fidelity Media Relations

fidelitymediarelations@fmr.com

Kyle Moynihan

(617) 563-5649

kyle.moynihan@fmr.com

Visit our online newsroom