- Warren Buffett has criticized trading platforms for gamifying investing and resembling gambling parlours1

- Buffett Mode is designed to gamify thoughtful long-term investing by giving investors the behavioral edge they need to minimize gambling and speculating, and focus on value investing

- Discipline at every step – the user experience includes embedded prompts to interrupt speculative behaviours

- Flat-fee monthly subscription model with zero commission fees and zero added FX fees align platform with investors’ needs

Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO), a digital wealth and payments business, wants Canadians to stop losing money through frequent and speculative trading that the self-directed investing industry promotes, and has launched the world’s first ever “Buffett Mode” self-directed investing app to help entrench the discipline, patience and approach that legendary investor Warren Buffett has long promoted.

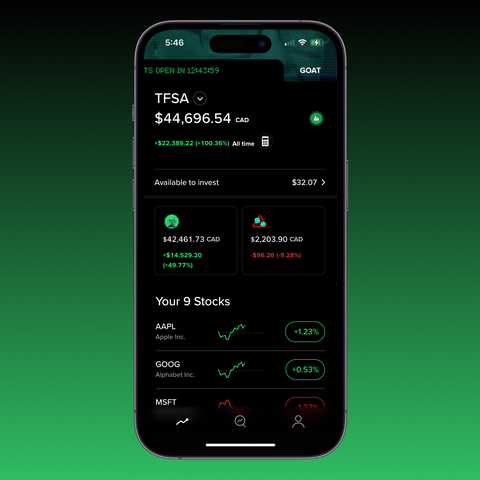

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240515988924/en/

(Photo: Business Wire)

“The meme stock craze is yet another example of the issue we’re trying to combat: investors have been tricked into thinking that the next ten-bagger stock is around the corner, and that a FOMO-style of investing is the best way to generate outsized returns, when the reality can’t be further from the truth,” said David Feller, Mogo’s Founder and CEO. “The fact is, many investors lose money and the vast majority would be better off simply investing in the S&P 5002. Most of these trading apps look more like gambling apps because they make way more money by getting you to gamble than to invest. Buffett Mode is designed to gamify patient, long-term value investing based on the principles of Warren Buffett.”

The new Mogo app includes a powerful combination of features to help Canadians become better investors.

- “Buffett Mode”: Warren Buffett is widely considered the greatest investor of all time. Beginning with $114, he built a fortune of over $100 billion. His strategy is credited by many successful investors as the key to their success. It’s about buying company shares at a price below their intrinsic value. “Buffett Mode” is designed to help anyone invest based on the principles of Warren Buffett, including helping them reduce trading and speculating which is often a driver of underperformance. While most trading apps focus on reducing friction to drive more trading, Buffett Mode adds friction to help users make more thoughtful decisions when buying or selling stocks, avoiding the natural instinct to gamble.

- Behavioural edge on tap: Warren Buffett credits much of his success not to high IQ but to the right temperament. He believes that most investors fail because they lack the patience and discipline needed to be successful. The Mogo app leverages behavioral science to help gamify thoughtful long-term investing, while also helping to minimize the speculation and gambling that get many investors into trouble. A “Build Your Legacy” calculator, also helps inspire investors to focus on a long-term wealth building strategy versus a get rich quick approach that usually leads to losses.

- Free of the wrong features: Most trading apps have features designed to drive trading activity instead of help investors improve their returns. Mogo has omitted many of the features that drive speculation including margin and options trading.

- Learn more every day: As Buffett said, “The more you learn, the more you earn” and Mogo has incorporated Warren Buffett teachings throughout the app.

- Simple pricing model: As Charlie Munger said many times “show me the incentive and I’ll show you the outcome”. Mogo's unique $15/month subscription helps align the Company’s economic model with our users’ success, as opposed to traditional models that are focused on driving trading activity. Mogo charges a flat fee whether you make 1 trade or 20 trades, with zero commission fees and zero added FX fees.

- More money, more impact: Buffett is not only one of the greatest investors ever, he is one of the greatest philanthropists ever. Mogo users make a positive impact every month by helping replant Canadian forests devastated by wildfires. Our community has already planted approximately 3 million trees.

Canadians can open a Mogo account today by downloading the app: App Store and Google Play.

The Mogo app incorporates the investing principles of Warren Buffett in its features, design and content. The Company is not endorsed by nor affiliated with Warren Buffett.

About Mogo

Mogo Inc. (NASDAQ:MOGO; TSX:MOGO) is a digital wealth and payments company headquartered in Vancouver, Canada with more than 2 million members, $9.9B in annual payments volume and a ~13% equity stake in Canada’s leading Crypto Exchange WonderFi (TSX:WNDR). Mogo offers simple digital solutions to help its members dramatically improve their path to wealth-creation and financial freedom. MOGO offers commission-free stock trading that helps users thoughtfully invest based on a Warren Buffett approach to long-term investing – while also making a positive impact with every investment. Moka offers Canadians a real alternative to mutual funds and wealth managers that overcharge and underperform with a fully managed investing solution based on the proven outperformance of an S&P 500 strategy, and at a fraction of the cost. Through its wholly owned digital payments subsidiary, Carta Worldwide, Mogo also offers a low-cost payments platform that powers next-generation card programs for companies across Europe and Canada. The Company, which was founded in 2003, has approximately 200 employees across its offices in Vancouver, Toronto, London & Casablanca.

Forward-Looking Statements

This news release may contain “forward-looking statements” within the meaning of applicable securities legislation, including statements regarding expected features of the app and results of investing related to the app and Buffett Mode. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management at the time of preparation, are inherently subject to significant business, economic and competitive uncertainties and contingencies, and may prove to be incorrect. Forward-looking statements are typically identified by words such as "may", "will", "could", "would", "anticipate", "believe", "expect", "intend", "potential", "estimate", "budget", "scheduled", "plans", "planned", "forecasts", "goals" and similar expressions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. Mogo’s growth, its ability to expand into new products and markets and its expectations for its future financial performance are subject to a number of conditions, many of which are outside of Mogo’s control. For a description of the risks associated with Mogo’s business please refer to the “Risk Factors” section of Mogo’s current annual information form, which is available at www.sedarplus.com and www.sec.gov. Except as required by law, Mogo disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

____________________________________

[1] Warren Buffett: Berkshire Hathaway Shareholder Annual Meeting, 2021.

[2] Dalbar's "23rd Annual Quantitative Analysis of Investor Behavior, 2017.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240515988924/en/

Contacts

For further information:

Craig Armitage

Investor Relations

investors@mogo.ca

(416) 347-8954

US Investor Relations Contact

Lytham Partners, LLC

Ben Shamsian

New York | Phoenix

shamsian@lythampartners.com

(646) 829-9701