The recent report from market intelligence firm IDTechEx, “Li-ion Battery Market 2025-2035: Technologies, Players, Applications, Outlooks and Forecasts”, forecasts the Li-ion battery cell market to reach over US$400 billion by 2035. With battery prices continuing their downward trend, how this will affect the Li-ion battery market long term?

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240926216890/en/

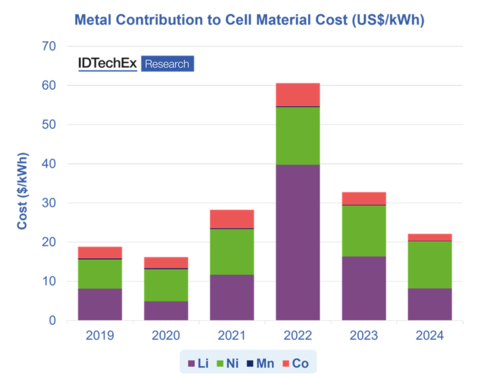

NMC 811 cathode active material prices have fallen since 2022, broadly in line with underlying raw material costs. Source: IDTechEx

The cost of raw materials such as lithium, nickel, cobalt, and graphite play a pivotal role in shaping the overall cost structure of lithium-ion batteries. As these materials are core components of a battery cell and battery production, their market dynamics directly affect battery pricing trends.

Supply and demand dynamics are critical to battery pricing. For example, LFP type Li-ion batteries are widely used due to their comparatively low cost compared to NMC-based battery chemistries but in 2022, LFP cathode prices increased faster than expected based on underlying lithium and material prices due to a surge in demand, especially in China. This led to a fast rise in LFP cathode production capacity in China and overcapacity through 2023 and 2024. Subsequently, LFP cathode prices have fallen to as low as US$5/kg, squeezing margins for producers and highlighting the strong competition in LFP production in a trend seen more broadly across the industry.

While low battery prices are beneficial to consumers, they can curb new investment and creates a challenging environment for new entrants, an issue more keenly felt by European and North American battery industries who remain concerned over the influx of low-cost EVs from China, in part enabled through low-cost LFP batteries.

Despite the challenges ahead, the medium-long-term outlook for the Li-ion market remains positive, with considerable growth opportunities across the supply chain. There continues to be broad policy support for both EVs and renewable deployment, both of which rely heavily on Li-ion battery technology. Policy and regulation, including the US Inflation Reduction Act and emissions performance standards in Europe, and technological advancements will continue to create stable demand for EVs outside of China while increasing deployment of renewable power will continue to drive the adoption of energy and battery storage systems.

For more on lithium-ion battery market trends and outlook, see www.IDTechEx.com/Lithium.

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240926216890/en/

Contacts

Charlotte Martin

Subscriptions Marketing Manager

press@IDTechEx.com

+44(0)1223 812300