Vancouver, BC – August 16, 2022 – Traction Uranium Corp. (CSE: TRAC) (OTC: TRCTF) (FRA: Z1K) (the “Company” or “Traction”) is pleased to announce that it has entered into a property option agreement (the “Option Agreement”) with UGreenco Energy Corp. (the “Vendor”) dated August 15th, 2022 (the “Effective Date”), pursuant to which the Company has been granted the right to acquire up to a 75% interest in and to the Key Lake South Property, which consists of a series of mineral disposition parcels located in Athabasca Basin, Northern Saskatchewan, Canada (the “Property”).

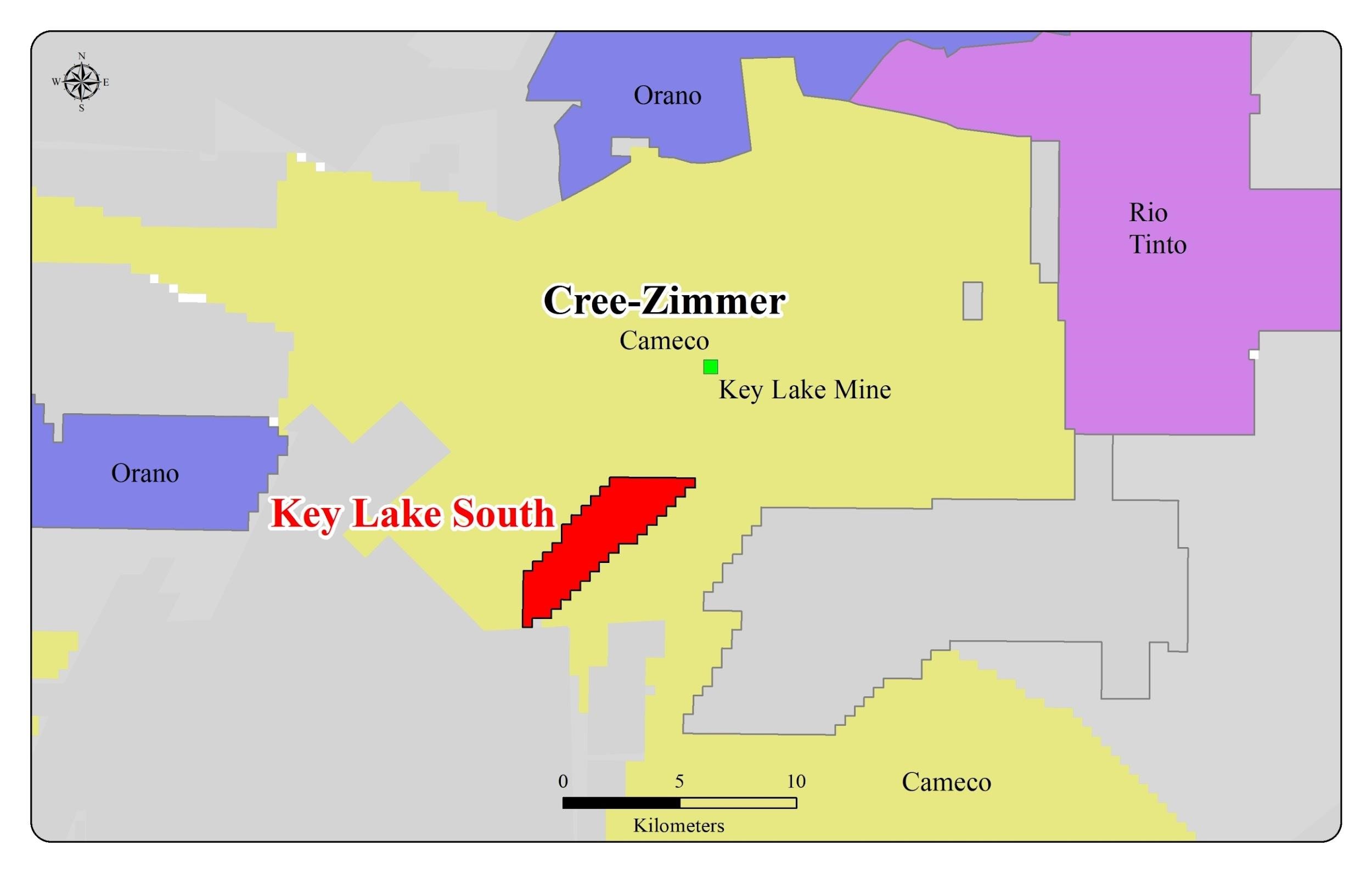

The Key Lake South Uranium Project is located approximately 6 kilometers to the southwest of the Key Lake uranium mill and in close vicinity to modern uranium mining facilities and highway transportation in northern Saskatchewan. Geologically, it sits at the southeastern edge of the Proterozoic Athabasca Basin – home of the world’s largest and highest grade uranium deposits and operations. Recent discovery of Tripple R and Arrow deposits has demonstrated further potential of high-grade uranium at the edge of the basin.

Figure 1:

Lester Esteban, Chief Executive Officer, stated “An extraordinary uranium anomaly was outlined in the early 70’s known as the “Hot” Island and was believed to be transported from a source in the northeast, which led to the discovery of the Key Lake uranium deposit, the world’s largest high-grade uranium deposit mined with open-pit producing a total of 209.8 million pounds of uranium at the average grade of 2.32% U3O8 between 1983 and 2002. Advanced airborne geophysical surveys from both government and industry during the 2000’s depict a coincidence between this surface anomaly and underlying structures supporting a thesis that this anomaly is in-situ controlled by structures rather than erratically transported by glacier. Since the discovery of the Key Lake deposit, this area has been underexplored and we are looking forward to getting to work to unlock its potential for an unconformity-type uranium deposit.”

Terms of the Option Agreement:

In consideration for a series of cash and share payments and the incurring of exploration expenditures, separated into two phases.

Phase One

In phase one, the Company shall be entitled to acquire a 51% interest in and to the Property by:

- paying $50,000 in cash to the Vendor within seven (7) days following the Effective Date;

- paying an additional $200,000 in cash to the Vendor on or before December 31, 2023;

- paying an additional $750,000 in cash to the Vendor on or before December 31, 2024;

- issuing, within sixty (60) days following the Effective Date, such number common shares in the capital of the Company (the “Shares”) to the Vendor as is equal to $100,000 equity converted on the date of issuance at the market price of the Shares trading on the Canadian Securities Exchange (the “CSE”);

- issuing, on or before December 31, 2023, such number of additional Shares to the Vendor as is equal to $200,000 converted on the date of issuance at the market price of the Shares trading on the CSE;

- issuing, on or before December 31, 2024, such number of additional Shares to the Vendor as is equal to $750,000 converted on the date of issuance at the market price of the Shares trading on the CSE;

- incurring, on or before December 31, 2022, $150,000 worth of exploration expenditures on the Property;

- on or before December 31, 2023, either (1) completing 2,000 metres of diamond drilling on the Property or (2) incurring an additional $1,500,000 worth of exploration expenditures on the Property; and

- on or before December 31, 2024, either (1) completing an additional 7,500 metres of diamond drilling on the Property or (2) incurring an additional $6,500,000 worth of exploration expenditures on the Property.

Phase Two

Upon completion of phase one, the Company shall be entitled to acquire an additional 24% interest in and to the Property, for a total interest of 75%, by:

- paying an additional $750,000 in cash to the Vendor on or before December 31, 2025;

- issuing, on or before December 31, 2025, such number of additional Shares to the Vendor as is equal to $750,000 converted on the date of issuance at the market price of the Shares trading on the CSE; and

- on or before December 31, 2025, either (1) completing an additional 7,500 metres of diamond drilling on the Property or (2) incurring an additional $6,500,000 worth of exploration expenditures on the Property.

Upon satisfaction of phase two and commencement of commercial production on the Property, the Company will grant the Vendor a net smelter returns royalty totaling two percent (2%) on commercial production from the Property (the “NSR Royalty”), with the Company retaining the right to buy back from the Vendor one percent (1%) of the NSR Royalty for $2,000,000.

About Traction Uranium Corp.

Traction Uranium Corp. is in the business of mineral exploration and the development of discovery prospects in Canada, including its two flagship uranium projects in the world renowned Athabasca Region.

We invite you to find out more about our exploration-stage activities across Canada’s Western region at www.tractionuranium.com.

Qualified Person

The technical content of this news release has been reviewed and approved by Linglin Chu, M.Sc., P. Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.

On Behalf of The Board of Directors

Lester Esteban

Chief Executive Officer

+1 (604) 561 2687

Forward-Looking Statements

This news release includes forward-looking statements that are subject to risks and uncertainties, including with respect to the Company completing phase 1 and phase 2, the Company acquiring any interest in the Property, timing of cash payments, share issuances and expenditure requirements, and development of the Property. The Company provides forward-looking statements for the purpose of conveying information about current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections, or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited those identified and reported in the Company’s public filings under the Company’s SEDAR profile at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

The CSE has neither approved nor disapproved the information contained herein.

SOURCE: Traction Uranium Corp.

The post Traction Uranium and UGreenco Energy Announce Option Agreement for Key Lake South Property appeared first on Financial News Media.