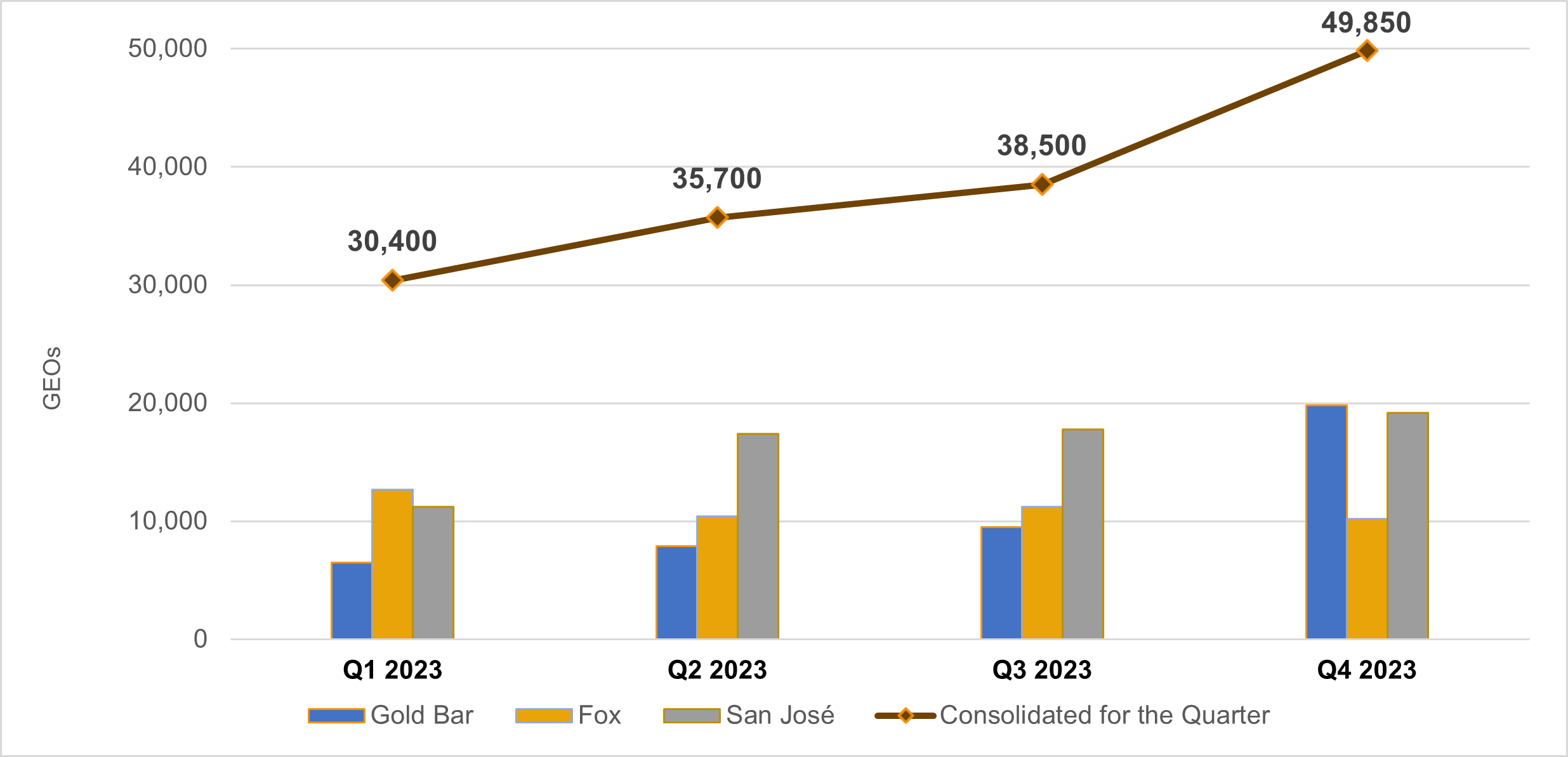

TORONTO, Feb. 12, 2024 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report full year and fourth quarter 2023 production results that represent a significant improvement year-over-year and compared to prior quarters. Consolidated production in Q4 2023 was 49,850 gold equivalent ounces (“GEOs”)(1), and full year production for 2023 was 154,600 GEOs. These results were consistent with our latest forecast (Q3 results press release dated Nov 8, 2023) and within our guidance range for the year (press release dated Mar 14, 2023).

Gold Bar production accelerated during Q4 and the month of December, making new records for the quarter and the month, through the addition of mining crews and the completion of the heap leach pad expansion. At Fox, production continued steady above 10,000 GEOs. San José production continued to strengthen throughout the year, past the operational challenges of the first quarter.

Chart 1: 2023 Quarterly Production - Gold Bar, Fox, San José and Consolidated (GEOs)

In 2023, Gold Bar produced 43,700 gold ounces, within guidance range, Fox produced 44,450 gold ounces, also within guidance range, and San José produced 65,650 GEOs, slightly below guidance range (see Table 1).

| Table 1: Consolidated Production Summary | ||||

| Q4 2022 | Q4 2023(3) | Full Year 2023(3) | 2023 Guidance | |

| Consolidated Production | ||||

| Gold (oz) | 28,970 | 42,400 | 128,650 | 123,000-139,000 |

| Silver (oz) | 702,000 | 635,650 | 2,166,850 | 2.3M-2.6M |

| GEOs(1) | 37,280 | 49,850 | 154,600 | 150,000-170,000 |

| Gold Bar Mine, Nevada | ||||

| GEOs | 7,940 | 19,800 | 43,700 | 42,000-48,000 |

| Fox Complex, Canada | ||||

| GEOs | 9,870 | 10,200 | 44,450 | 42,000-48,000 |

| San José Mine, Argentina (49%)(2) | ||||

| Gold Production (oz) | 11,170 | 11,700 | 39,700 | 39,000-43,000 |

| Silver Production (oz) | 700,850 | 635,650 | 2,166,850 | 2.3M-2.6M |

| GEOs | 19,420 | 19,150 | 65,650 | 66,000-74,000 |

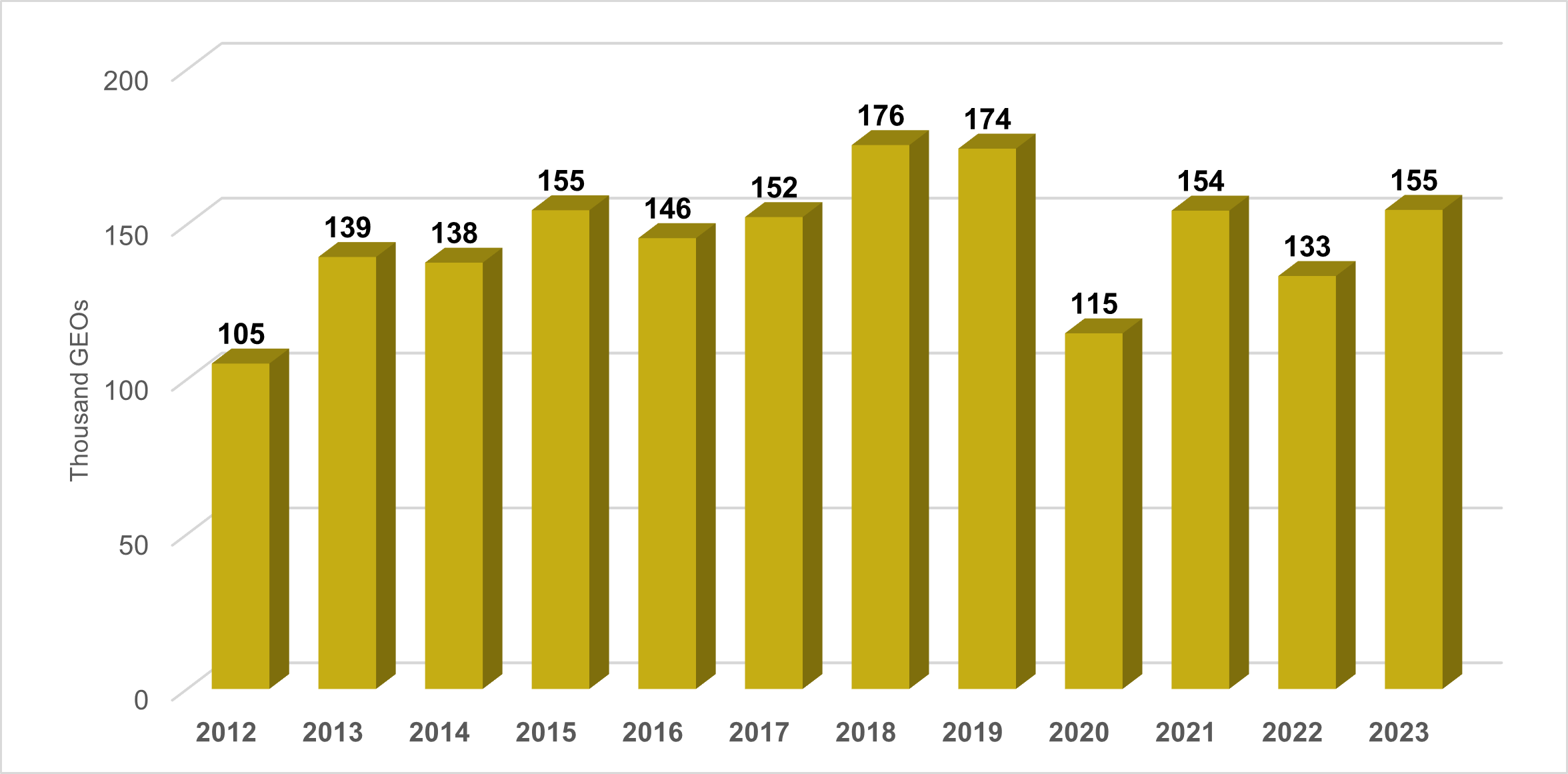

Our consolidated production is recovering after experiencing a challenging period from 2020. Looking ahead, while we forecast lower production in 2024, the historic production trend remains positive.

Chart 2: Historic Consolidated Annual Production (Thousand GEOs)

2024 Production and Cost Guidance

For 2024, we expect to produce in the range of 130,000 to 145,000 GEOs attributable to MUX from all operations (see Table 2). The reduction compared to 2024 is primarily driven by lower output from our Fox operation and from San José, which is operated by our partner Hochschild Mining. We are currently evaluating potential areas for enhancing production and profitability, and we will update our guidance accordingly once any further improvements are implemented.

| Table 3: 2024 Production & Costs per GEO Guidance | |

| 2024 Guidance | |

| 100% Owned Mines (Gold Bar and Fox) | |

| GEOs | 80,000-85,000 |

| Cash Costs/GEO | $1,350-1,450 |

| AISC/GEO | $1,550-1,650 |

| Gold Bar Mine, Nevada | |

| GEOs | 40,000-43,000 |

| Cash Costs/GEO | $1,450-1,550 |

| AISC/GEO | $1,650-1,750 |

| Fox Complex, Canada | |

| GEOs | 40,000-42,000 |

| Cash Costs/GEO | $1,225-1,325 |

| AISC/GEO | $1,450-1,550 |

| 49% Owned San José Mine | |

| GEOs | 50,000-60,000 |

| Cash Costs/GEO | $1,300-1,500 |

| AISC/GEO | $1,500-1,700 |

At Fox in 2024, we will be starting the development of underground ramp access to the Stock orebodies, particularly Stock West, which will become the primary source of feed following the completion of mining the Froome deposit in 2026. This capital investment is partially funded by the US$16.1 million flow-through financing completed in December 2023.

At Gold Bar in 2024, the first half of the year is expected to deliver higher production relative to the second half, due to a scheduled waste stripping phase in the Pick pit, in preparation for the 2025 mining program. The mining sequence continues to be optimized.

McEwen Copper

Twenty drill rigs are currently on site at Los Azules and over 36,000 meters (118,000 ft) of drilling have been completed so far this season, to advance all areas that contribute to the upcoming Feasibility Study (FS), which is expected to be published in Q1 2025.

At the Los Azules Project, we've made significant progress. Our drilling program is over halfway complete, with 36,000 meters drilled out of the 55,000 planned for our comprehensive feasibility study. The work necessary for the completion of the feasibility study includes mineral resource estimation, metallurgical testing, equipment selection, final completion and cost estimation of design for the mine and our facilities. Additionally, we will work to advance our power and road infrastructure plans and establish preliminary site-wide water balance including pit dewatering.

On the ground, we've made tangible progress with the drilling program, construction of our winter camp and improvements to the exploration road facilitating year-round operations. We're also on track with environmental permitting, reflecting our commitment to responsible development.

Financially, we've been diligent in protecting our treasury. The majority of our funds have been invested in depository receipts of foreign and major Argentinean corporations, to shield us from devaluation. This strategic move ensures that the Los Azules project's financial backbone stays robust in supporting our project development.

“We are adapting to a changing environment in Argentina, recognizing the importance of current political and economic reforms for the future stability and growth of the nation. Mining is a vital component of Argentina’s economy and, under the right conditions, one that is poised to grow significantly and support the country’s economic recovery,” said Michael Meding, VP of McEwen Copper and General Manager of the Los Azules Project.

Notes:

(1) 'Gold Equivalent Ounces' are calculated based on a gold-to-silver price ratio of 84:1 for Q1 2023, 83:1 for Q2, 2023, 82:1 for Q3 2023, 85:1 for Q4 2023. 2023 production guidance is calculated based on an 85:1 gold-to-silver price ratio.

(2) The San José Mine is 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc. Production is shown on a 49% basis.

(3) El Gallo Mine (on care and maintenance) produced 704 GEO and 797 GEO in Q4 and FY2023, respectively, from plant and pond cleanout.

Technical Information

The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A., the owner of the San José Mine, is responsible for and has supplied the Company with all reported results from the San José Mine. McEwen Mining’s joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has personally provided the company with $220 million and takes an annual salary of $1.

| WEB SITE www.mcewenmining.com | SOCIAL MEDIA | |

| McEwen Mining | ||

| CONTACT INFORMATION 150 King Street West Suite 2800, PO Box 24 Toronto, ON, Canada M5H 1J9 | Facebook: LinkedIn: Twitter: Instagram: | facebook.com/mcewenmining linkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmining instagram.com/mcewenmining |

| McEwen Copper | ||

| Relationship with Investors: (866)-441-0690 Toll free (647)-258-0395 | Facebook: LinkedIn: Twitter: Instagram: | facebook.com/ mcewencopper linkedin.com/company/mcewencopper twitter.com/mcewencopper instagram.com/mcewencopper |

| Rob McEwen | ||

| Mihaela Iancu ext. 320 info@mcewenmining.com | Facebook: LinkedIn: Twitter: | facebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24 twitter.com/robmcewenmux |

Charts accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ee4cd6c3-acdc-4060-b496-7c7fbfaae533

https://www.globenewswire.com/NewsRoom/AttachmentNg/96105457-4e6c-4637-9762-357fde45774b