Shareholders Should Vote FOR Blackwells’ Nominees Jessica Schell, Craig Hatkoff and Leah Solivan on the GREEN Proxy Card

Shareholders Invited to Visit www.TheFutureOfDisney.com to Review Important Information About Blackwells’ Campaign

WITHHOLD Your Vote from Trian Nominees Peltz and Rasulo, Discard Any BLUE Trian Proxy Card You May Receive

NEW YORK, Feb. 06, 2024 (GLOBE NEWSWIRE) -- Blackwells Capital, LLC (“Blackwells”), a shareholder of The Walt Disney Company (“Disney” or the “Company”) (NYSE:DIS), filed its definitive proxy statement with the Securities and Exchange Commission (“SEC”) in connection with its nomination of Jessica Schell, Craig Hatkoff and Leah Solivan for election to the board of directors of Disney (the “Board”) at the Company’s 2024 annual meeting of shareholders, and released a letter which can be found below, and at www.TheFutureOfDisney.com.

“Jessica Schell, Craig Hatkoff and Leah Solivan bring invaluable expertise and experience to Disney’s Board as it faces the challenges and opportunities of a generational transformation. Voting for Blackwells’ nominees will ensure the Board has the support it requires across critical areas: media and content, real estate and asset optimization, and the proficiency to guide Disney through a new world where Physical, Spatial Computing and AI-driven Experiences converge,” said Jason Aintabi, Chief Investment Officer of Blackwells.

“Only two of Disney’s non-executive directors have significant media experience, and, as a whole, the Board lacks the qualifications that our candidates possess. The Trian nominees, for their part, are uninspiring; Mr. Rasulo is a former Disney employee who plainly lacks relevant expertise. Mr. Peltz has spent the last two years begging Disney for a Board seat, and seems to focus his efforts on soliciting endorsements from Elon Musk- who doesn’t own a single Disney share, and is aggrieved at Disney for withholding advertising dollars from his struggling social media platform. These are not winning strategies for Disney Shareholders,” concluded Mr. Aintabi.

February 6, 2024

Dear Fellow Walt Disney Company Shareholders,

Blackwells Capital LLC (“Blackwells”) is soliciting your vote to elect three individuals to join the Disney board of directors (the “Board”) as the Company navigates through a vast and novel opportunity set offering a near limitless potential.

The purpose of our campaign is simple: we want to ensure that Disney has the right collection of minds around the boardroom table, working constructively together to make decisions that will benefit ALL shareholders for decades to come.

Disney has one of the most attractive portfolios of beloved brands and businesses, that have delighted generations of people around the world. However, Disney has not delivered for its shareholders over the last few years.

In our letter, and throughout the course of our campaign, we will offer fellow shareholders perspective on why Disney’s share price has underperformed and, more importantly, what the future of Disney means for investors, and why our nominees are best suited to help deliver that future.

If elected, our three nominees for the Board have pledged to continue to support Disney’s transformation efforts under the leadership of the current Board and CEO, Robert A. Iger. In addition to an approach of constructive collaboration, our three nominees will bring unique skills, expertise and perspectives to the Board that draw on a range of experiences that the future of Disney depends on:

1) Media and Content

2) Real Estate and Strategic Asset Review

3) Disney’s Physical, Spatial Computing, and AI-Driven Experiences

Media and Content

Disney’s content engine is positioned to shine - with the right bench strength in the Boardroom. Disney is widely recognized as the preeminent media company in the world, but has lagged in adding meaningful media expertise to its Board. In its 2024 proxy statement, the Company lists only two non-executive directors on a board of twelve individuals who have significant media experience,1 and in the Company’s 2023 proxy statement, Disney did not even have a skill set marked for media experience.2

Blackwells' nominee Jessica Schell is one of America’s preeminent experts in content monetization, and would be a valuable addition to the Board. Ms. Schell spent 20 years in strategic and operating roles at three major entertainment companies - Warner Bros., NBC Universal, and The Walt Disney Company - focusing on the impact of technological change on content distribution and monetization. She served as Executive Vice President and General Manager of Warner Bros. Home Entertainment where she led the over one-billion-dollar global film division of home entertainment and expanded her remit over time to include television and originals. Ms. Schell transformed the primarily physical DVD business into a global digital transactional business, driving years of double digit annual digital growth. She also led Warner Bros’ top entertainment franchises into markets enabled by new technologies, including Virtual Reality, Internet of Things (IOT) connected entertainment devices, and non-fungible tokens (NFTs). Ms. Schell was also an original member of the NBC Universal management team that launched Hulu.

Ms. Schell’s expertise will enable her to contribute insight in the Boardroom on day one. We believe there is no better suited person for the rest of the Board and management to leverage as Disney navigates the complex issues of integrating Hulu and Disney+ and the unbundling and transitioning of ESPN to a DTC service, and doubles down on producing extraordinary content for current and future franchises that has served as the creative engine driving all of Disney’s businesses.

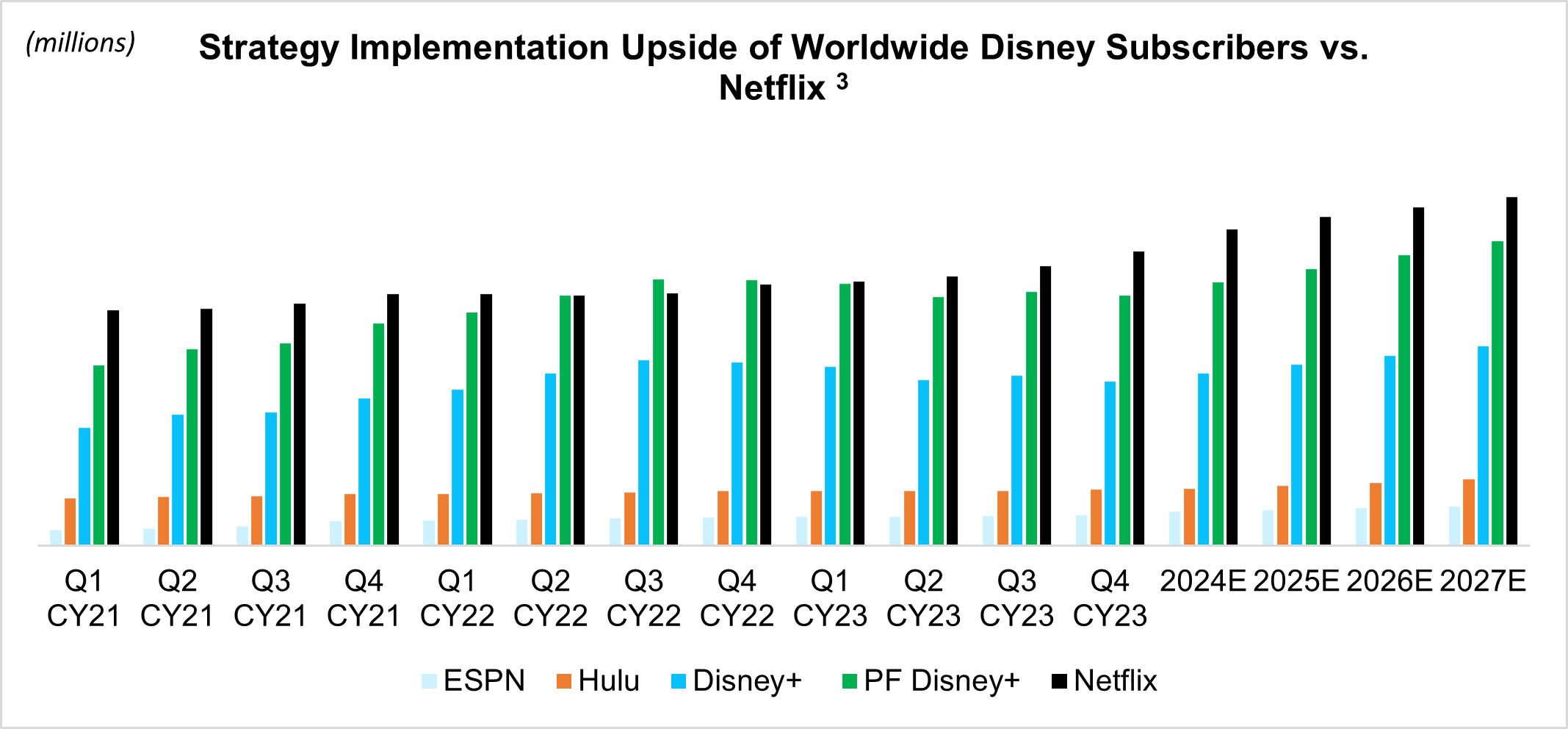

Making the right choices about how to best use premium content to balance profitability, fan engagement, franchise strength and streaming subscriber acquisition and retention are skills that fall squarely in Ms. Schell’s wheelhouse, and she intends to deliver for Disney shareholders. We firmly believe Ms. Schell’s contributions as a director will help Disney attain Netflix like growth rates on subscribers and pricing for Disney+ based on her expertise, with meaningful upside to be unlocked by integrating Disney +, Hulu, and ESPN+.3

Real Estate and Strategic Asset Review

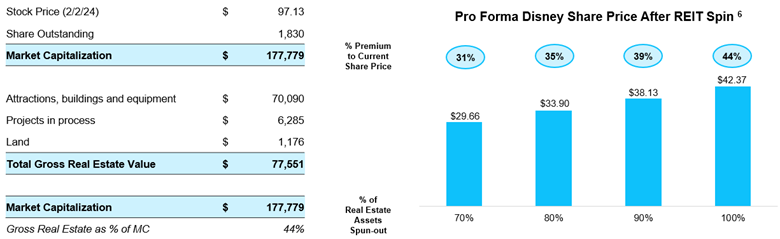

Disney has an almost unimaginable portfolio of real estate around the world. The Company owns tens of thousands of acres of land, more than 30,000 of the world’s most profitable hotel rooms, thousands of vacation club units and more. The value of Disney’s real estate holdings is obscured by the Company’s conglomerate structure. But, Disney’s real estate is also the potential source of long duration capital to address balance sheet and income statement challenges and opportunities.

Our nominee, Craig Hatkoff, has extensive real estate and capital markets experience, which would prove invaluable to the Board in evaluating and implementing, for example, a unique world class hotel and hospitality real estate investment trust (a “REIT”). For the last 13 years, Mr. Hatkoff has been an independent director of SL Green Realty Corp., Manhattan’s largest office landlord. He has nearly 50 years of public company service as an independent director, which cannot be said for any of the current Disney directors.4

Disney could separate its owned real estate, which represents approximately 44% of its market capitalization5 at cost, into an independent publicly listed REIT or a series of investment vehicles in which the shares, cash and/or interests could be distributed to shareholders. 6

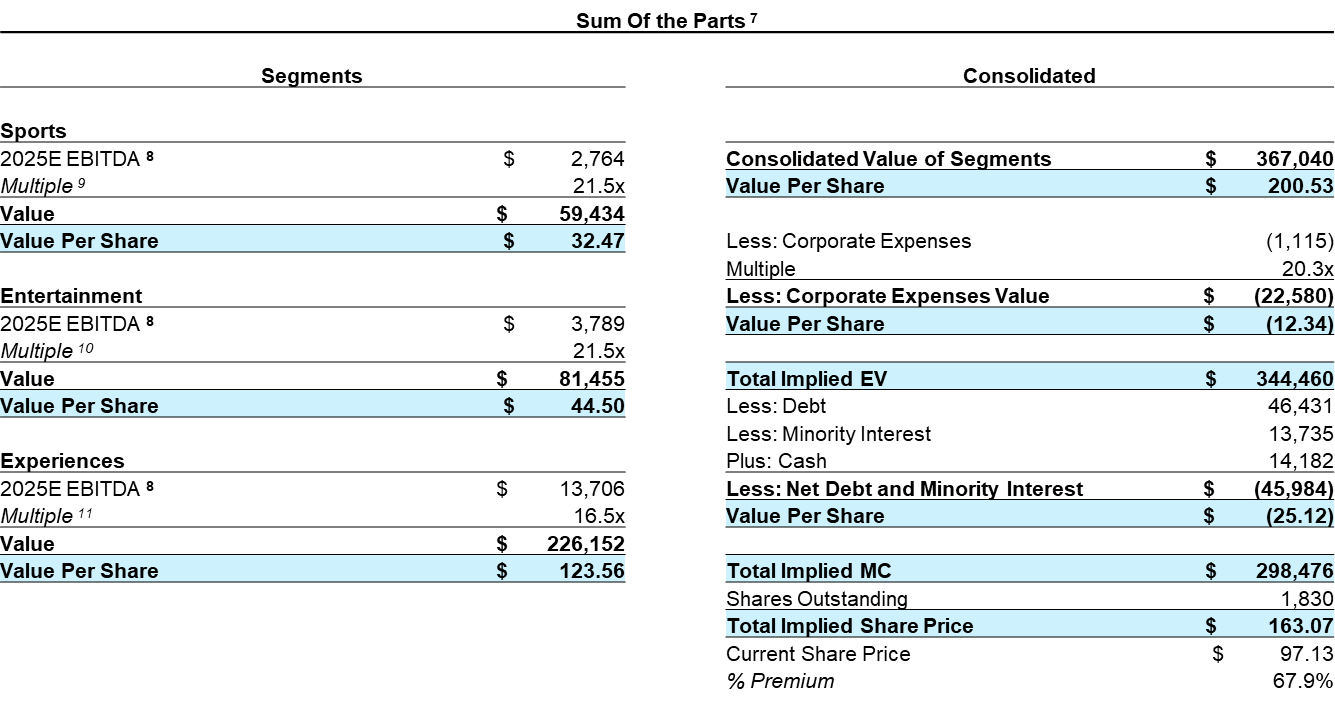

Mr. Hatkoff’s substantial expertise extends to exploring all strategic possibilities with cold eyes, including the potential separation of Disney into three entities, beginning with a management reorganization and leadership selection for each business and resulting in standalone public companies. Disney may simply be too complex for any one successor to Mr. Iger to manage holistically, and Blackwells believes that it is the responsibility of the Board to oversee these types of analyses in the ordinary course.

Disney’s Physical, Spatial Computing, and AI-Driven Experiences

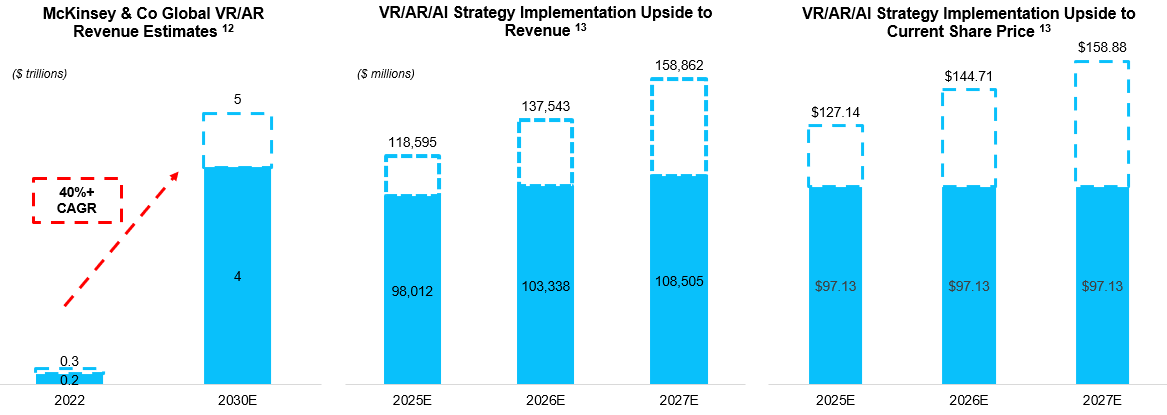

Disney has arguably the greatest opportunity set of any media company in the world as it pertains to AR/VR given its breadth of media content. Imagine a Disney World where you could have a lightsaber spar with a Jedi on Tatooine, or team-up with Simba and traverse the African plains!

The Board must be more focused on this once in a lifetime shift in consumer behaviour and interaction. Our nominee Leah Solivan has built her career on imagining, and creating. She is precisely the candidate that this Board needs to continue imagining the future of Disney as we navigate a world that sees physical, digital, and virtual worlds converging.

Ms. Solivan is deeply immersed in the latest AR/VR and AI trends as a General Partner at Fuel Capital. She is surrounded by cutting edge AR/VR and spatial computing technologies, and the founders that are making it all possible. Prior to Fuel Capital, Ms. Solivan created TaskRabbit, Inc. (“TaskRabbit”), a pioneering on-demand marketplace company she founded in 2008. As TaskRabbit’s CEO for eight years, she scaled the company into an international business with operations in 44 cities, prior to overseeing TaskRabbit’s sale to IKEA.

The Blackwells Nominees Fill Critical Gaps on the Board

Blackwells has been vocal in its support for Disney’s Board, including its recent additions. However, the Board can benefit from critical experience and expertise that our nominees exclusively represent.

The Board today has an abundance of former large company CEOs and executives from industries such as automobile manufacturing, pharmaceuticals, banking, and corporate infrastructure technology, but only one entrepreneur/founder, Amy L. Chang.

Even a gifted leader like Mr. Iger requires oversight and accountability. The current Disney Board is especially reliant on management’s expertise and assurances about the Company’s strategy and execution. The Board has also struggled with succession, which, as the tumultuous tenure and haphazard exit of Mr. Chapek as CEO demonstrated, cannot be driven or planned by management without direct Board input and oversight.

Moreover, recent concerns surrounding an information sharing agreement between Disney and ValueAct, are proof positive that independent and new perspectives are necessary. Disney’s share price suffers from a significant information discount, as recently noted by several key market analysts. Showering one shareholder with information that is withheld from all other shareholders, will only make matters worse.

We intend to ensure for all shareholders that this arrangement is terminated or that shareholders are given the same access to information that ValueAct seems to enjoy.

The Trian Distraction

Shareholders are faced with three competing candidate slates at the 2024 Annual Meeting: Disney’s, Blackwells’ and Trian’s.

We urge our fellow shareholders to be on high alert with respect to Trian’s campaign and its two nominees, Nelson Peltz and Jay Rasulo. Mr. Peltz has requested a seat on Disney’s Board no less than 24 times in the last year and half. During that time, Mr. Peltz has not offered a single strategic idea that would benefit shareholders.14 Mr. Rasulo also lacks the relevant skills and expertise that we firmly believe Disney could use additional support with.

Begging for Board seats is not a strategy that will make any money for shareholders. We strongly urge our fellow shareholders to vote “WITHHOLD” on the Trian nominees.

Your vote will ensure Blackwells’ three nominees are elected to serve the shareholders equally and with needed expertise that the Disney Board needs, working collaboratively with their fellow Board members and never defensively prioritizing one shareholder over all the others.

To learn more about Ms. Schell, Mr. Hatkoff and Ms. Solivan, we encourage shareholders to visit www.TheFutureOfDisney.com. Our campaign website will also include materials for shareholders to evaluate and help make the best voting decisions.

Disney Shareholders – Please vote your proxy today on the GREEN universal proxy card “FOR” each of the Blackwells nominees and the Blackwells proposal.

If you have any questions about voting your proxy or need replacement proxy materials, contact:

Morrow Sodali LLC

+1 (800) 662-5200 (toll-free for shareholders)

+1 (203) 658-9400 (call collect for banks, brokers, trustees and other nominees)

About Blackwells Capital

Blackwells Capital was founded in 2016 by Jason Aintabi, its Chief Investment Officer. Since that time, it has made investments in public securities, engaging with management and boards, both publicly and privately, to help unlock value for stakeholders, including shareholders, employees and communities. Throughout their careers, Blackwells’ principals have invested globally on behalf of leading public and private equity firms and have held operating roles and served on the boards of media, energy, technology, insurance and real estate enterprises. For more information, please visit www.blackwellscap.com.

Contacts

Media:

Gagnier Communications

Dan Gagnier & Riyaz Lalani

646-569-5897

blackwells@gagnierfc.com

Shareholders:

Morrow Sodali

Michael Verrechia & William Dooley

(800) 662-5200

blackwells@morrowsodali.com

IMPORTANT ADDITIONAL INFORMATION

Blackwells Onshore I LLC, Blackwells Capital LLC, Jason Aintabi, Craig Hatkoff, Jessica Schell and Leah Solivan (collectively, the “Participants”) are participants in the solicitation of proxies from the shareholders of The Walt Disney Company (the “Company”) for the 2024 Annual Meeting of Shareholders. On February 6, 2024, the Participants filed with the U.S. Securities and Exchange Commission (the “SEC”) their definitive proxy statement and accompanying GREEN Proxy Card in connection with their solicitation of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders. ALL SHAREHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT, THE ACCOMPANYING GREEN PROXY CARD AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY THE PARTICIPANTS, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND THEIR DIRECT OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR OTHERWISE.

The definitive proxy statement and an accompanying GREEN proxy card will be furnished to some or all of the Company’s shareholders and is, along with other relevant documents, publicly available at no charge on the SEC’s website at http://www.sec.gov/. In addition, the Participants will provide copies of the definitive proxy statement without charge, when available, upon request. Requests for copies should be directed to Blackwells Onshore I LLC.

1 Source: Proxy Statement filed with the Securities and Exchange Commission by The Walt Disney Company on February 1, 2024 (the “Disney Proxy Statement”).

2 Source: The Disney Proxy Statement.

3 Source: Company Filings, S&P Capital IQ Pro, and analyst estimates. Pro Forma Disney+ comprises of ESPN, Hulu, and Disney+.

4 Source: Company Filings, S&P Capital IQ.

5 Source: Annual Report on Form 10-K with the SEC by The Walt Disney Company on November 21, 2023 (the “2023 Annual Report”).

Note (1): Market capitalization calculated as of February 2, 2024. Based on the quotient resulting from dividing (i) the Company’s gross real estate value of $77,551 million, as disclosed in the 2023 Annual Report, by (ii) the Company’s market capitalization.

Note (2): Assumes no tax leakage

6 Source: Company filings. Note: Assumes the value ascribed to the REIT spin-off is equivalent to the gross real estate value and there is no dyssynergies or incurrence of tax leakage.

7 Source: Company’s 2023 10k and analyst estimates.

8 2025 Estimated EBITDA pulled from analyst consensus estimates.

9 Note: Sports segment EBITDA multiple on par with Netflix, Inc. according to S&P Capital IQ Pro as Netflix has begun to enter into the sports streaming world with its deal with the WWE.

10 Note: Entertainment segment EBITDA multiple on par with Netflix, Inc. according to S&P Capital IQ Pro.

11 Note: Experiences segment EBITDA multiple on par with Hilton Worldwide Holdings Inc. according to S&P Capital IQ Pro.

12 Source; McKinsey & Co, June 2022.

13 Source: Company filings, analyst consensus estimates. Note: Assumes a 10% uplift to analyst consensus revenue estimate from a successful implementation of a VR/AR/AI strategy based on comparative analysis from analysts using AAPL, META integration of VR/AR/AI to Disney.

14 Source: The Walt Disney Company 2024 Proxy Filing.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca9c7fe3-fdb6-4157-bf79-6abf50d95e5a

https://www.globenewswire.com/NewsRoom/AttachmentNg/724607f3-818b-4f1f-b57f-0c92d3f54fb1

https://www.globenewswire.com/NewsRoom/AttachmentNg/bf9c5bfd-5e20-4b29-bf3c-30764e17c727

https://www.globenewswire.com/NewsRoom/AttachmentNg/b4bc5243-c0c3-461e-a32e-ec17b56e7d6e