The biotech sector and its popular ETF, the iShares Biotechnology ETF (NASDAQ: IBB), has lagged the overall market during the year. However, in recent weeks, the sector has enjoyed a significant rally and turnaround off its 52-week lows.

The recent rally in the biotech sector comes when investor optimism and speculation are on the rise, as the overall market and key sectors, like technology and finance, trade in the upper portion of their 52-week range.

If the newfound support and steady uptrend in the biotech sector last, as the new year quickly approaches, the biotech sector could shift from lagger to leader. If that is to happen, an investor armed with a bullish biotech bias might benefit from gaining exposure to some of the ETF’s top holdings with recent and higher timeframe notable strength.

Let's look closely at three industry-leading biotech stocks displaying notable strength.

Regeneron Pharmaceuticals Inc.

Regeneron Pharmaceuticals Inc. (NASDAQ: REGN) is a global company that discovers, develops, manufactures and commercializes medical treatments for various diseases. Its product portfolio includes EYLEA for eye-related conditions, DUPIXENT for dermatitis and asthma, LIBTAYO for skin cancer, Praluent for cholesterol management and KEVZARA for rheumatoid arthritis. Regeneron is the IBB’s fourth-largest holding, with a 7.67% weight in the ETF.

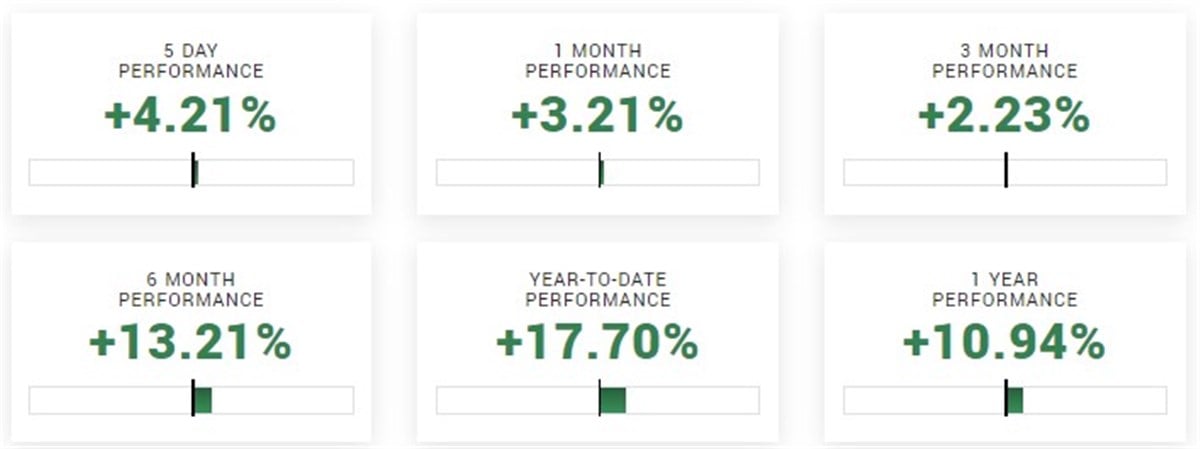

Shares of Regeneron have stood out from the rest, vastly outperforming the sector and IBB year-to-date, with its almost 18% year-to-date performance. You'll have difficulty finding a stock within the sector currently displaying as much relative strength as REGN. The stock not only has outperformed on the year, but it's currently trading at the high end of its 52-week range, looking set to expand further on its already impressive gains YTD.

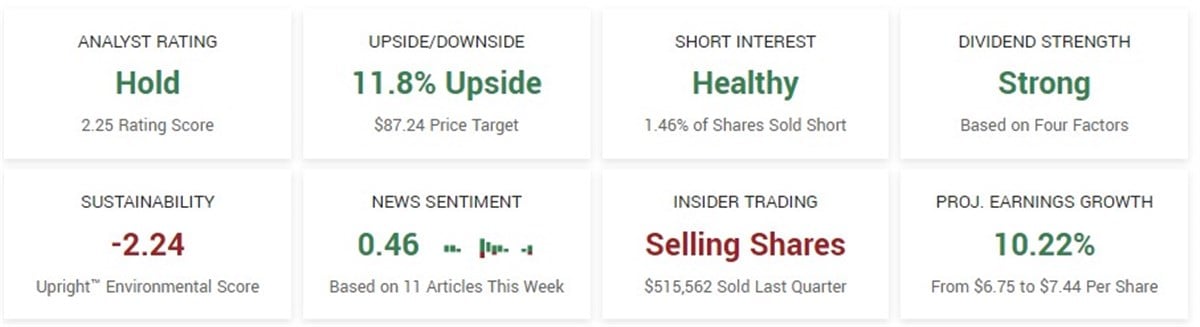

Analysts also favor the stock, as it is among the most-upgraded stocks. Based on 26 analyst ratings, REGN has a consensus rating of "moderate buy" and a price target of $908.12, forecasting an almost 7% upside. Most recently, on December 6, TD Cowen boosted its target from $900 to $1,000, forecasting a nearly 20% upside for the stock.

Gilead Sciences

Gilead Sciences Inc. (NASDAQ: GILD) is a biopharmaceutical company known for pioneering treatments in HIV/AIDS, hepatitis C and other critical health areas. Founded in 1987, they focus on developing innovative medicines to address unmet medical needs worldwide. Gilead is the IBB's third-largest holding, with an 8.18% weighting.

Like the overall sector and IBB ETF, shares of Gilead are slightly negative on the year but have enjoyed notable strength in recent weeks. From a technical analysis perspective, GILD has formed a significant bullish consolidation on its daily, dating back to the beginning of the year. Such a lengthy consolidation signals that the breakout might be substantial.

As Gilead maintains such a considerable weight and influence on the IBB and overall sector, keeping tabs on the stock's performance and potential breakout in the coming weeks or months is vital.

Alnylam Pharmaceuticals Inc.

Alnylam Pharmaceuticals Inc. (NASDAQ: ALNY) is a biopharmaceutical company specializing in RNA interference (RNAi) therapeutics. Alnylam's focus on harnessing RNAi pathways has led to novel treatments for various conditions, aiming to transform patient care in areas with significant unmet medical needs. ALNY is the 11th-largest holding of the IBB ETF, with a 2.19% weighting.

While shares of ALNY have performed worse than the sector year-to-date, the stock has impressed over a higher timeframe and remains in a steady uptrend on its higher timeframe.

While the market has been bearish ALNY on the year, analysts have remained bullish. So if the renewed strength in the sector lasts, ALNY may add to its higher timeframe success. Of the 20 analyst ratings, 13 are buys, and seven are a "hold," placing the stock as a moderate buy. Its consensus price target of $229.90 forecasts a staggering 29.70% upside for the stock.