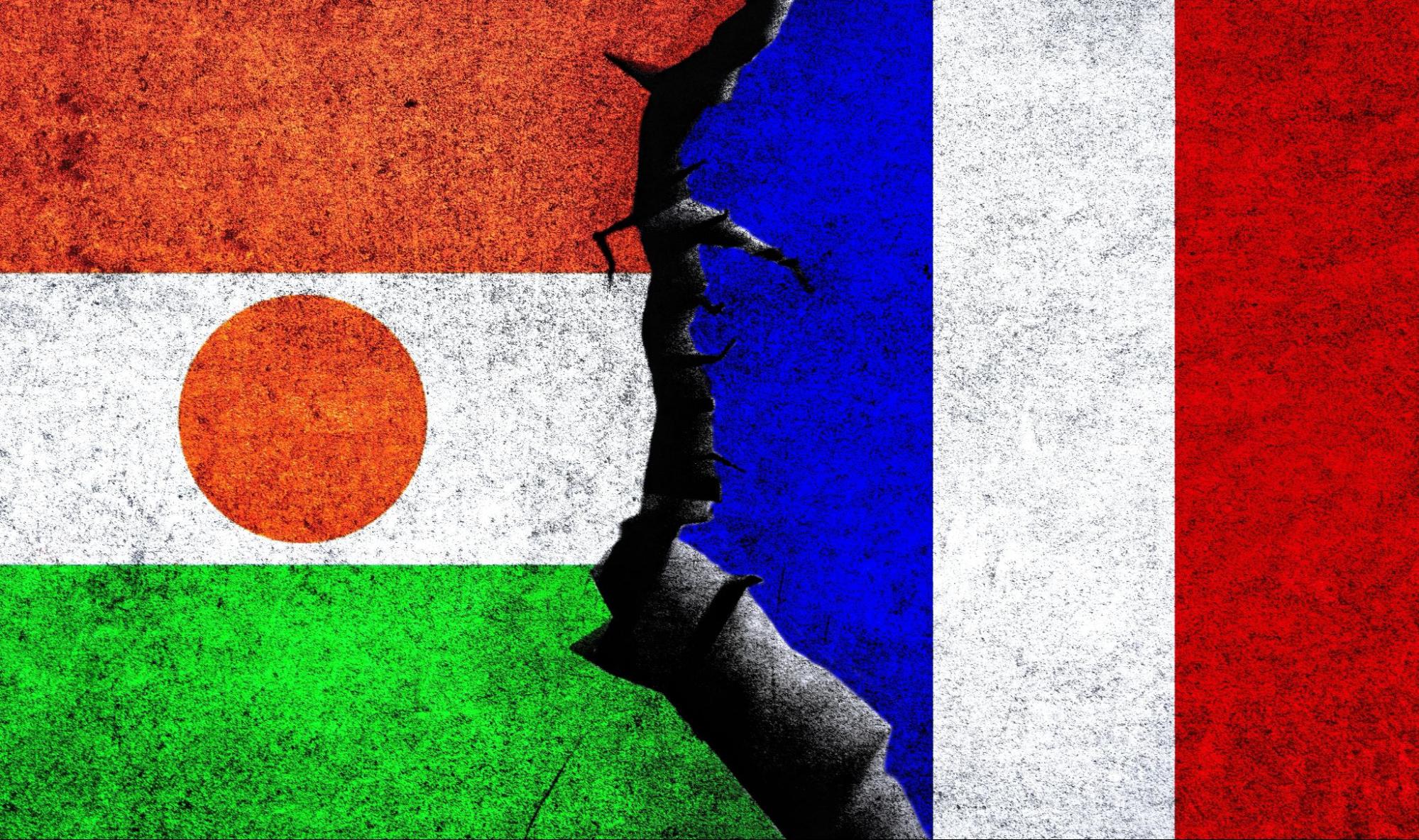

In an unexpected twist, France has pulled its ambassador and troops out of Niger in a rapid response to the ousting of President Mohamed Bazoum.

Amid escalating tensions after the coup, France, initially hesitant, eventually agreed to withdraw its 1,500 troops from Niger by the end of the year. As the ambassador and six colleagues left Niamey for Paris, President Macron expressed unwavering support for Bazoum.

This move isn’t just a political shake-up; it’s a potential uranium crisis. France’s abrupt exit disrupts a balance of power the nation has held in the Sahara for over 100 years. With such significant upheaval, a burning question emerges: Where will France and, by ripple effect, the EU, turn to sustain their uranium thirst?

Niger, despite its poverty, is a major producer of high-grade, radioactive material used for reactors and nuclear weaponry. In 2022 alone, 20% of France’s uranium imports streamed from Niger’s vast uranium reserves —mines that feed France’s nuclear energy which generates 70% of its electricity.

France’s energy giant, Orano (formerly Areva), largely state-owned, has dominated Niger’s mines in the Sahara Desert for five decades. These mines, especially those near Arlit, contribute significantly to uranium supplies in the EU.

But with this abrupt withdrawal, there’s bound to be a supply gap. Sure, France might have backup plans, sourcing uranium from Kazakhstan, Uzbekistan, or Namibia, but forging newer, stronger bonds with these nations will be imperative. Meanwhile, as Niger grapples with the ‘resource curse,’ China and Russia, both with vested interests in uranium, are closely watching, ready to jump in.

Concerns about uranium supply for French nuclear energy will likely act as yet another catalyst for upward movements in uranium prices, considering the current tight supply and demand dynamics in the uranium market.

In September uranium prices surged to $72 per pound,1 marking their highest point since the 2011 Fukushima disaster and signaling the start of a new uranium bull market.

According to Sprott Asset Management, which has been buying up physical uranium at a record pace, the run to last several more years as the demand/supply imbalance continues growing.

Experts anticipate that uranium prices may reach $80 per pound by the end of this year,2 and they are expected to continue rising annually for the next 10 to 20 years, or until a viable alternative for large-scale, uninterrupted, low-carbon power generation becomes available.

A Unique Opportunity to Capitalize on the Uranium Gold Rush

Uranium prices are soaring, and while many are eyeing uranium ETFs and stocks, a recent analysis by Katusa Research has spotlighted a company that might just eclipse the competition.

Katusa Research, a highly reputable investment research firm founded by the illustrious Marin Katusa, has just released an in-depth report on Uranium Royalty Corp. (NASDAQ:UROY) (TSX:URC), a pioneering force in the uranium sector that boasts considerable stakes in several of the world’s premier uranium mines.

At the helm of Uranium Royalty Corp. is Scott Melbye, a seasoned expert with four decades in the uranium sector. His expansive resume spans from pivotal roles at Cameco to advisory positions with the national uranium company of Kazakhstan. Melbye’s commitment is evident in his hands-on approach, with his efforts dedicated to seeking new royalty investments.

Melbye is supported by Co-Founder Amir Adnani, the visionary behind Uranium Energy Corp. (UEC). Adnani’s accolades, including being recognized as a top “40 under 40” entrepreneur by Fortune and a nomination for “Entrepreneur of the Year” by Ernst & Young, highlight his prowess. Beyond his achievements, Adnani’s ability to forge strategic partnerships ensures that Uranium Royalty Corp. has ties with all the significant entities in the uranium sector.

Only six years into its inception, Uranium Royalty Corp. is already a force to be reckoned with. Its impressive portfolio boasts 18 royalty interests including the world’s premier uranium mines, Cameco’s (NYSE:CCJ) McArthur River and Cigar Lake, which is a testament to its strategic foresight and dynamic approach.

McArthur River boasts ore grades 100 times the global average. It’s licensed to produce 25 million pounds yearly, with a 2023 target of 15 million. Uranium Royalty’s (NASDAQ:UROY) (TSX:URC) strategic 2021 investment capitalized on its resurgence by Cameco in 2022, now promising revenues of over $1 million annually. Cigar Lake, which produced 14% of the total global uranium in 2022, stands out not only for its high grade but also for its competitive operating costs of just $15.98/lb. CEO Scott Melbye estimates that Cigar Lake could translate into a $5 million annual cash inflow within the next three years

Under Melbye’s astute leadership, Uranium Royalty Corp. (NASDAQ:UROY) (TSX:URC) made a calculated play, investing a hefty $65 million in physical uranium during favorable market conditions. These investments not only bolstered capital gains but also ensured a war chest that could be tapped into as opportunities arose. The company’s eyes, however, remain fixed on intensifying its footprint through acquisitions of new royalties and streams.

As the global compass points increasingly towards nuclear energy, Uranium Royalty, the world’s only uranium royalty conglomerate, is primed to harness the immense potential of the burgeoning uranium landscape.

You can delve into Katusa’s in-depth report here for further insights into the new uranium bull market and Uranium Royalty Corp. (NASDAQ:UROY) (TSX:URC)

Featured Image @ Shutterstock

Disclaimer

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Katusa Research. Market Jar Media Inc. has or expects to receive from Katusa Research’s Digital Marketing Agency of Record (Native Ads Inc) one thousand one hundred USD for this article.

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. All investments carry risk and each reader is encouraged to consult with his or her individual financial professional. Any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on PressReach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on PressReach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Katusa Research.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Katusa Research.’s industry; (b) market opportunity; (c) Katusa Research’s business plans and strategies; (d) services that Katusa Research intends to offer; (e) Katusa Researchs milestone projections and targets; (f) Katusa Research’s expectations regarding receipt of approval for regulatory applications; (g) Katusa Research’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Katusa Research’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Katusa Research’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Katusa Research’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Katusa Research’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Katusa Research’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Katusa Research to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Katusa Research’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Katusa Research’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Katusa Research’s business operations (e) Katusa Research may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Katusa Research undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Katusa Research nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Katusa Research nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Katusa Research or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Katusa Research or such entities and are not necessarily indicative of future performance of Katusa Research or such entities.

8) Investing is risky. The information provided in this article should not be considered as a substitute for professional financial consultation. Users should be aware that investing in any form carries inherent risks, and as such, there is a possibility of losing some or all of their investment. The value of investments can fluctuate significantly within a short period, and investors must understand that past performance is not indicative of future results. Additionally, users should exercise caution as transactions involving investments may be irreversible, even in cases of fraud or accidental actions. It is crucial to acknowledge that rapidly evolving laws and technical issues can have adverse effects on the usability, transferability, exchangeability, and value of investments. Furthermore, users must be cognizant of potential security risks associated with their investment activities. Individuals are strongly encouraged to conduct thorough research, seek professional advice, and carefully evaluate their risk tolerance before engaging in any investment endeavors. Market Jar Media Inc. is neither an investment adviser nor a broker-dealer. The information presented on the website is provided for informative purposes only and is not to be treated as a recommendation to make any specific investment. No such information on PressReach.com constitutes advice or a recommendation.

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube