Wrapping up Q3 earnings, we look at the numbers and key takeaways for the non-discretionary retail stocks, including Dollar General (NYSE:DG) and its peers.

Food is non-discretionary because it's essential for life (maybe not those Oreos?), so consumers naturally need a place to buy it. Selling food is a notoriously tough business, however, as the costs of procuring and transporting oftentimes perishable products and operating stores fit to sell those products can be high. Competition is also fierce because the alternatives are numerous. While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of the product. Still, we could be one startup or innovation away from a paradigm shift.

The 8 non-discretionary retail stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.4% on average since the latest earnings results.

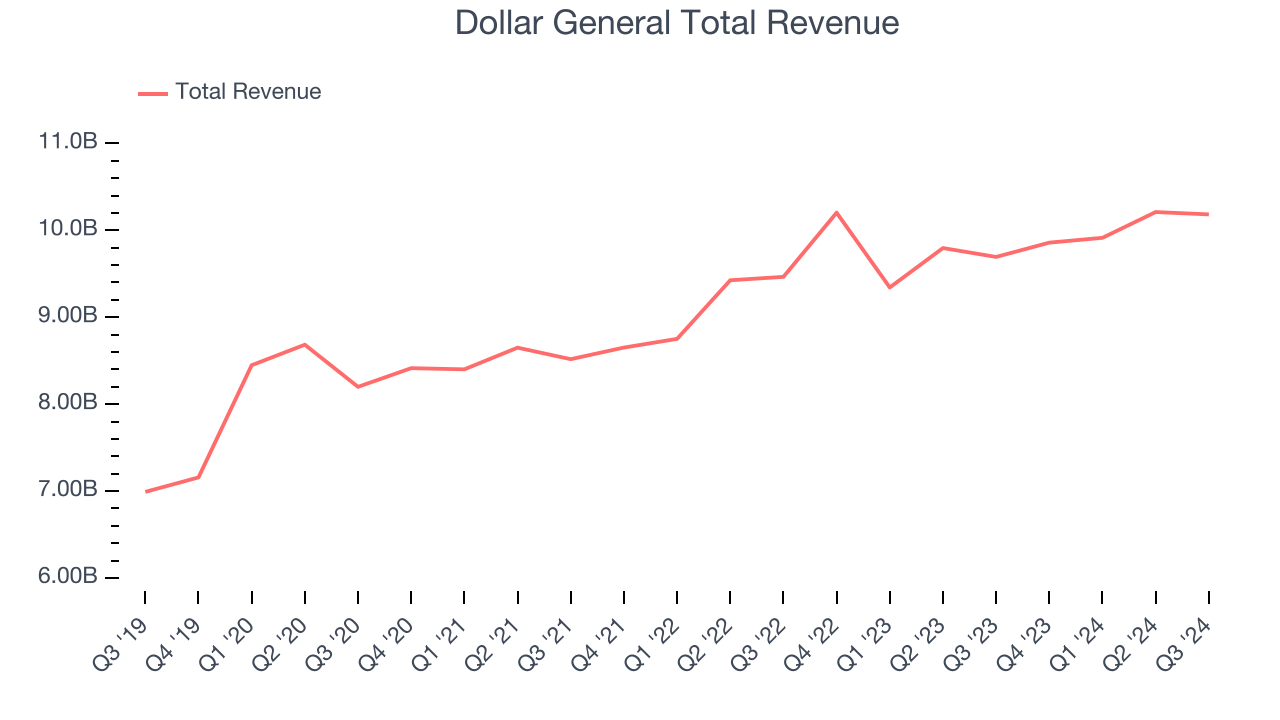

Dollar General (NYSE:DG)

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Dollar General reported revenues of $10.18 billion, up 5% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

“We are pleased with our team’s execution in the third quarter, particularly in light of multiple hurricanes that impacted our business,” said Todd Vasos, Dollar General’s chief executive officer.

Interestingly, the stock is up 1.8% since reporting and currently trades at $81.04.

Read our full report on Dollar General here, it’s free.

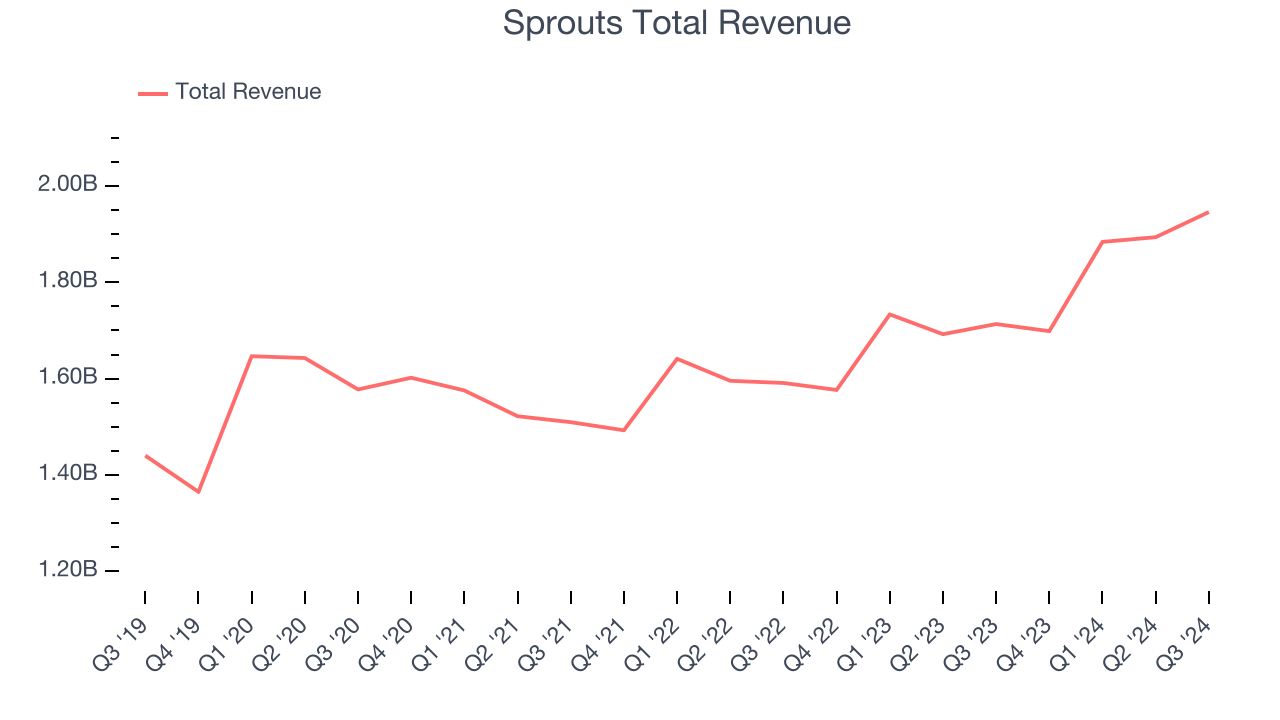

Best Q3: Sprouts (NASDAQ:SFM)

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

Sprouts reported revenues of $1.95 billion, up 13.6% year on year, outperforming analysts’ expectations by 3.7%. The business had a stunning quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Sprouts achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 28% since reporting. It currently trades at $152.11.

Is now the time to buy Sprouts? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Target (NYSE:TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Target reported revenues of $25.67 billion, up 1.1% year on year, falling short of analysts’ expectations by 0.9%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Target delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 17.1% since the results and currently trades at $129.34.

Read our full analysis of Target’s results here.

Dollar Tree (NASDAQ:DLTR)

A treasure hunt because there’s no guarantee of consistent product selection, Dollar Tree (NASDAQ:DLTR) is a discount retailer that sells general merchandise and select packaged food at extremely low prices.

Dollar Tree reported revenues of $7.57 billion, up 3.5% year on year. This number surpassed analysts’ expectations by 1.7%. More broadly, it was a mixed quarter as it also recorded a narrow beat of analysts’ gross margin estimates but EPS guidance for next quarter missing analysts’ expectations.

Dollar Tree delivered the highest full-year guidance raise among its peers. The stock is down 1% since reporting and currently trades at $71.77.

Read our full, actionable report on Dollar Tree here, it’s free.

BJ's (NYSE:BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE:BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

BJ's reported revenues of $5.10 billion, up 3.5% year on year. This number was in line with analysts’ expectations. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

The stock is up 12.1% since reporting and currently trades at $96.

Read our full, actionable report on BJ's here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.