( click to enlarge )

( click to enlarge )Last week was a depressed week for small cap investors with a lot of stock reaching extreme oversold conditions not seen since the subprime crisis. The volume was also very low, which leads me to think that it was a possible tax selling reason. With the small-cap index pulling back to test the support zone previous resistance area, we might start to see next week the first signs of a rebound.

( click to enlarge )

( click to enlarge )Clovis Oncology Inc (NASDAQ:CLVS) has been in a tremendous tailspin the last three weeks. The stock has seen a bevy of selling bring the stock to fresh new lows for the year and near historical lows. However, the last two trading sessions reveal an increase in volume, suggesting some capitulation and I think that a sharp rally could follow over the next few days. At $3.38 a share, and considering this stock was trading well over $4.50 last month, the risk for further decline is outweighed by the potential gain an explosive bounce would provide. Plus, historically the stock reacts violently to the upside every time the RSI reaches extreme oversold levels. In fact, this stock is also a short squeeze play. Keep an eye on it next week, it should mount a violent rally from here IMHO. Last week the company said that it expects cash resources, and revenues and available financing sources to be enough to support its operations for at least the next 12 months.

( click to enlarge )

( click to enlarge )Another extreme oversold small bio cap. Arca Biopharma Inc (NASDAQ:ABIO) touched a new 52 week low last week and closed at $2.36 a share on Friday. I think now is the time to start trying to catch this knife. Alone this company has more cash ($4 per share) than current market capitalization. Cash and cash equivalents were $58.3 million as of September 30, 2021, and they believe that its current cash and cash equivalents will be sufficient to fund its operations through 2022. Furthermore, the stock could get a boost from the current increase of the COVID cases worldwide, especially in Europe. According to CEO Dr. Michael Bristow, with rNAPc2’s combination of anticoagulant, anti-inflammatory and potential antiviral properties, he believes it has the potential to be effective in addressing COVID-19 impacts in hospitalized patients. The international Phase 2b clinical trial is nearing completion and they look forward to sharing its results in the first quarter. I have been accumulating shares again.

( click to enlarge )

( click to enlarge )Gaucho Group Holdings Inc (NASDAQ:VINO) Another example of a small cap victim of the current market environment. The company reported a big profit and revenue last week and predicted a strong 2022.- Revenues for the third quarter were $2.6 million compared to $60,228 in the prior year period, a 4,242% increase. - Gross profit for the third quarter was $2.4 million, compared to $21,000 in the prior year period, a 11,505% increase.

Quite a turn around and I think the stock could have plenty of more room to move higher. The stock is clearly under accumulation and I could see it breaking out higher (pivot 3.39). There are not many shares left to go around. Follow The Money.

( click to enlarge )

( click to enlarge )Moving Image Technologies Inc (NYSEAMERICAN:MITQ) has it on watch for a turnaround next week. The company delivered strong year-over-year revenue growth of 98% last week and predicted a revenue guidance of $12 to $15 million, or 67% to 108% growth over fiscal 2021. Plus, they expect to deliver positive cash flow from operations as well. It can be tough to pull the trigger on a stock that has fallen rapidly. But these same stocks can post big moves after they have fallen and GTEC showed this to be true on Friday. It remains on my TOP watchlist.

( click to enlarge )

( click to enlarge )Sharplink Gaming Ltd (NASDAQ:SBET) I really like this stock, although the price sits at lows, I feel it deserves a much higher valuation. Volume looks healthy, and we are seeing up days on heavy volume and down days on very low volume, which is clearly a good sign that the stock is under institutional accumulation.

( click to enlarge )

( click to enlarge )Ocugen Inc (NASDAQ:OCGN) stock posted a nice bullish candle on Friday. This could be the start of a reversal. Considering how far the stock has fallen, a rebound could mean a big move up for this stock. Keep an eye on it.

( click to enlarge )

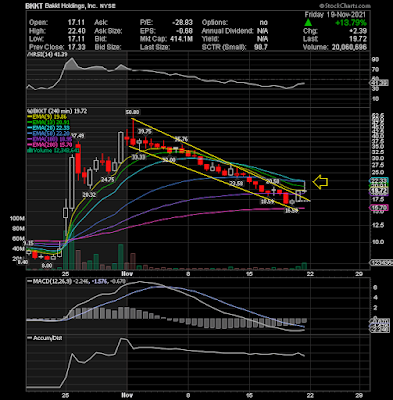

( click to enlarge )Bakkt Holdings Inc (NYSE:BKKT) The chart is looking good now for this stock and we could be looking at the start of a sustained price recovery. Squeeze over 22.4

( click to enlarge )

( click to enlarge )Ironnet Inc (NYSE:IRNT) I think this stock will post a sharp rally from current levels. This was a $47.50 stock in Sept and at $10.5, in my opinion, there is a compelling risk/reward scenario.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC