McDonald's Corporation (MCD) is pushing past recession worries thanks to its global expansion, menu innovation, strategic pricing, and digitization advancements. The company’s continued emphasis on enlarging its presence in existing markets, as well as entering new ones, can drive continued success.

Plus, its strong dividend payment history is sure to please investors far and wide. Let’s examine a few of the company’s key financial metrics that could help maintain the stock’s momentum.

McDonald's Corporation’s Revenue, Margin & Dividend Increase Over Past Two Years.

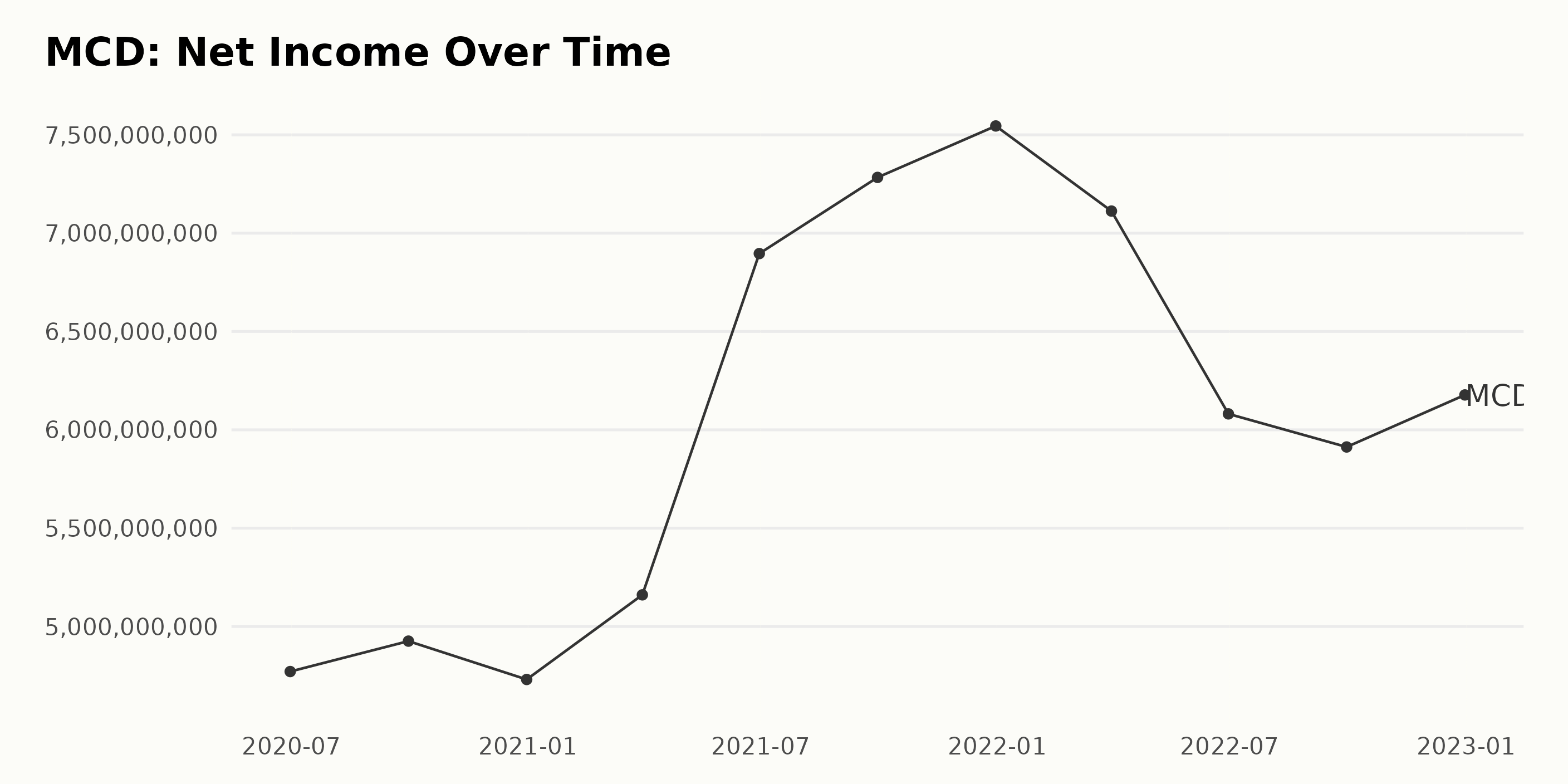

The net income of MCD has seen an upward trend over the past two years, growing from $4.77 billion in June 2020 to $6.18 billion in December 2022. There have been some fluctuations in this time, such as a peak of $7.54 billion in December 2021 and a trough of $5.91 billion in September 2022. Overall, the net income of MCD has grown by 28.5% from June 2020 to December 2022.

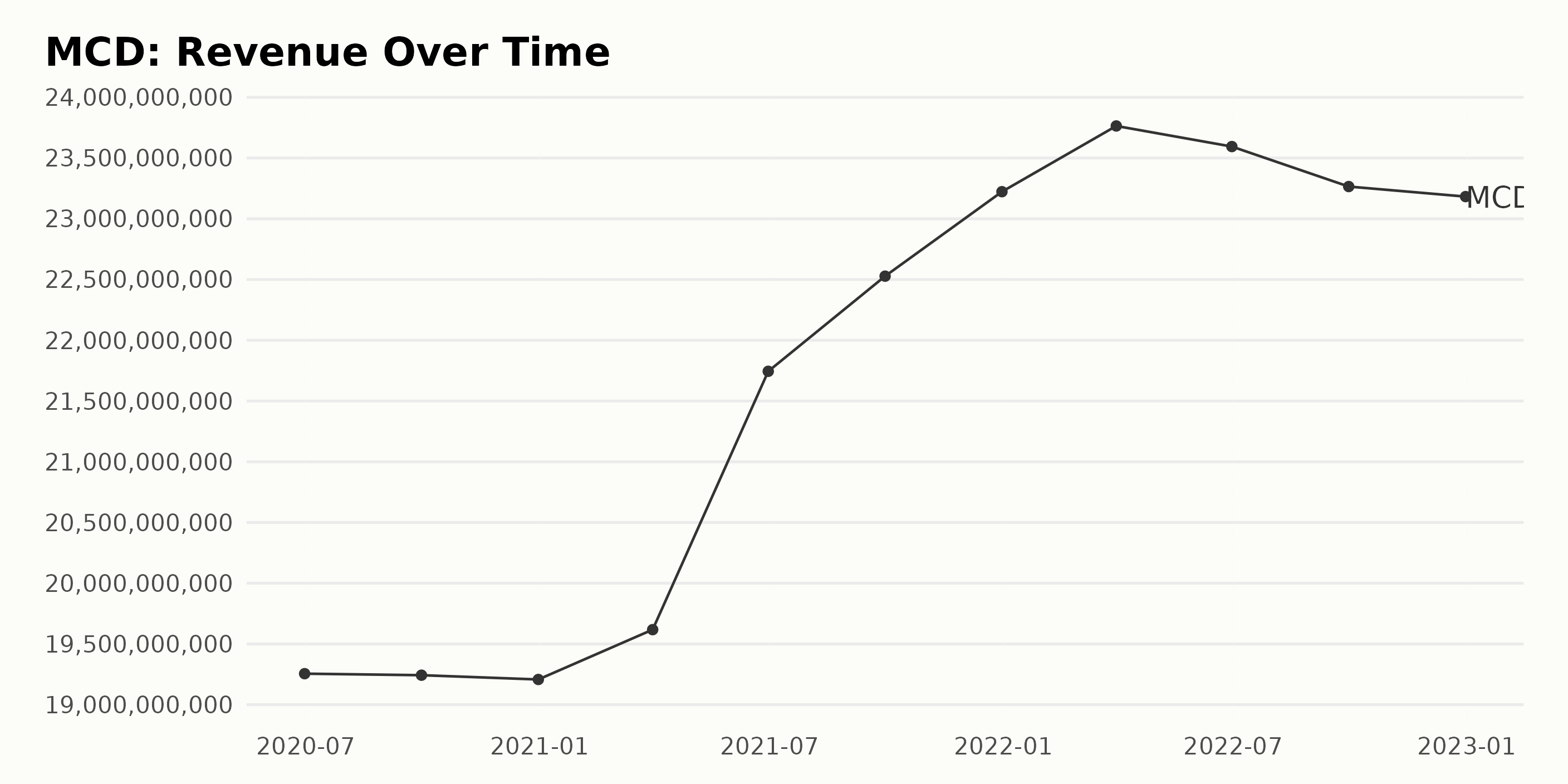

Over the past two years, MCD’s revenue has undergone fluctuations and overall positive growth. From December 2020 to December 2021, there was an increase of 21.5%, and this trend continued as in March 2022, MCD reported a record-high revenue of $237.64 trillion. This equates to an overall growth rate of 21% between June 2020 and June 2022.

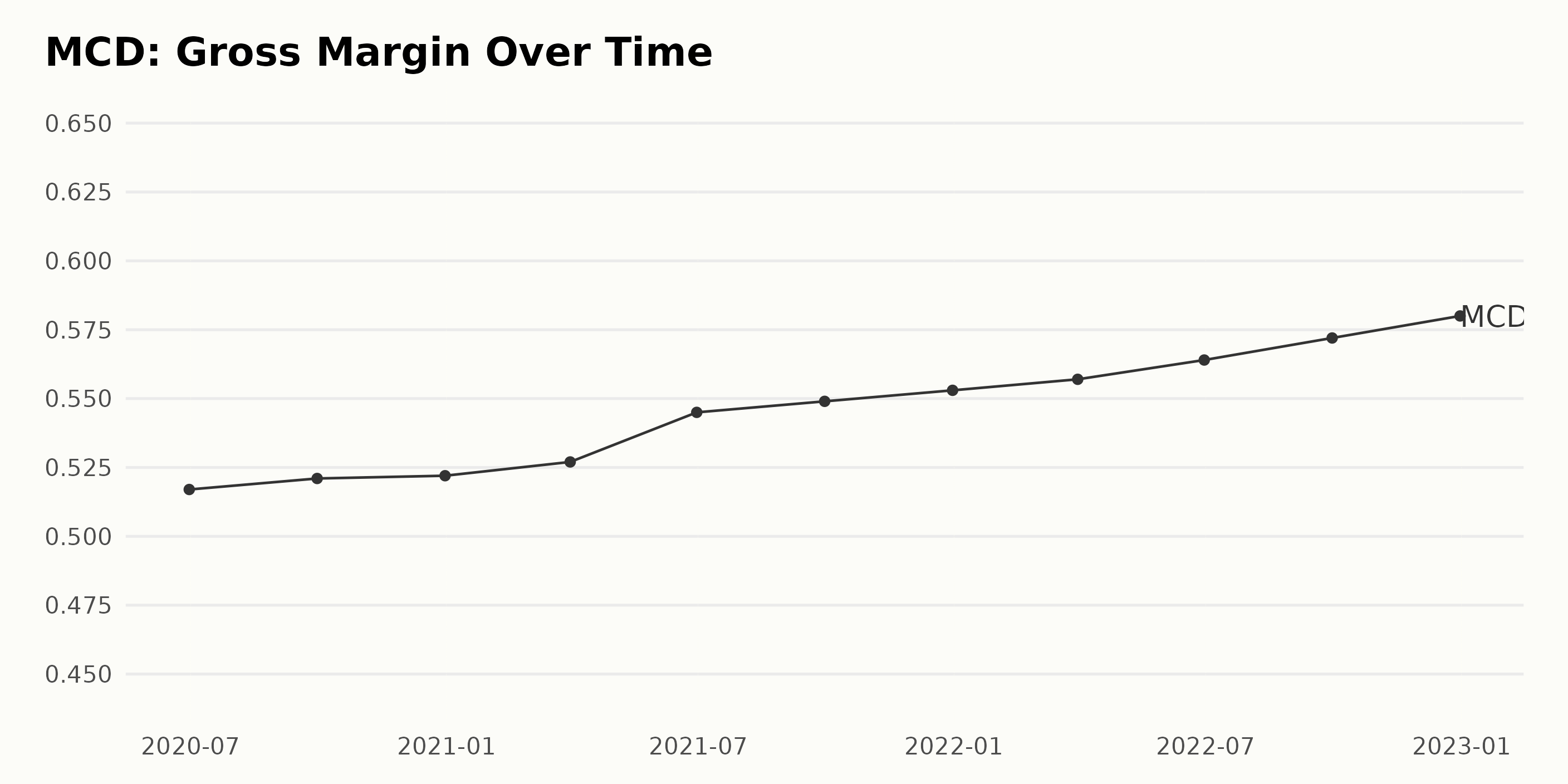

The gross margin of MCD has generally been increasing over the past two years. It began at 51.7% in June 2020, and grew to 58% in December 2022 - an increase of 6.3%. There have also been fluctuations over certain periods - in September 2021, for instance, the gross margin rose from 54.5% to 54.9%. Overall, MCD's gross margin appears to be trending upwards.

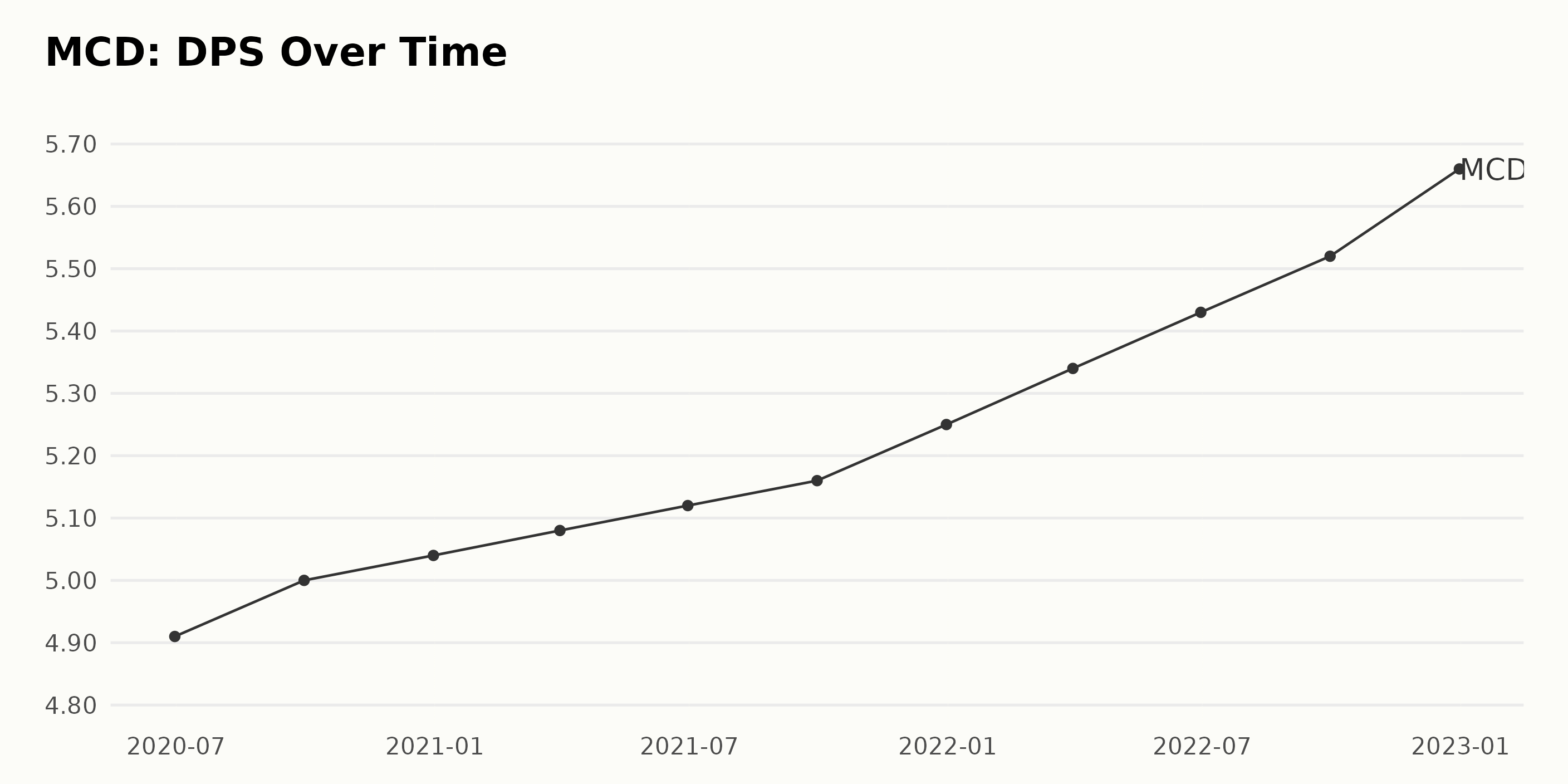

MCD’s DPS (dividend per share) has seen a significant overall increase from $4.91 in June 2020 to $5.66 in December 2022, representing an annual growth rate of approximately 16%. The DPS has remained relatively steady since December 2021, with a slight uptick between the third quarters of 2021 and 2022.

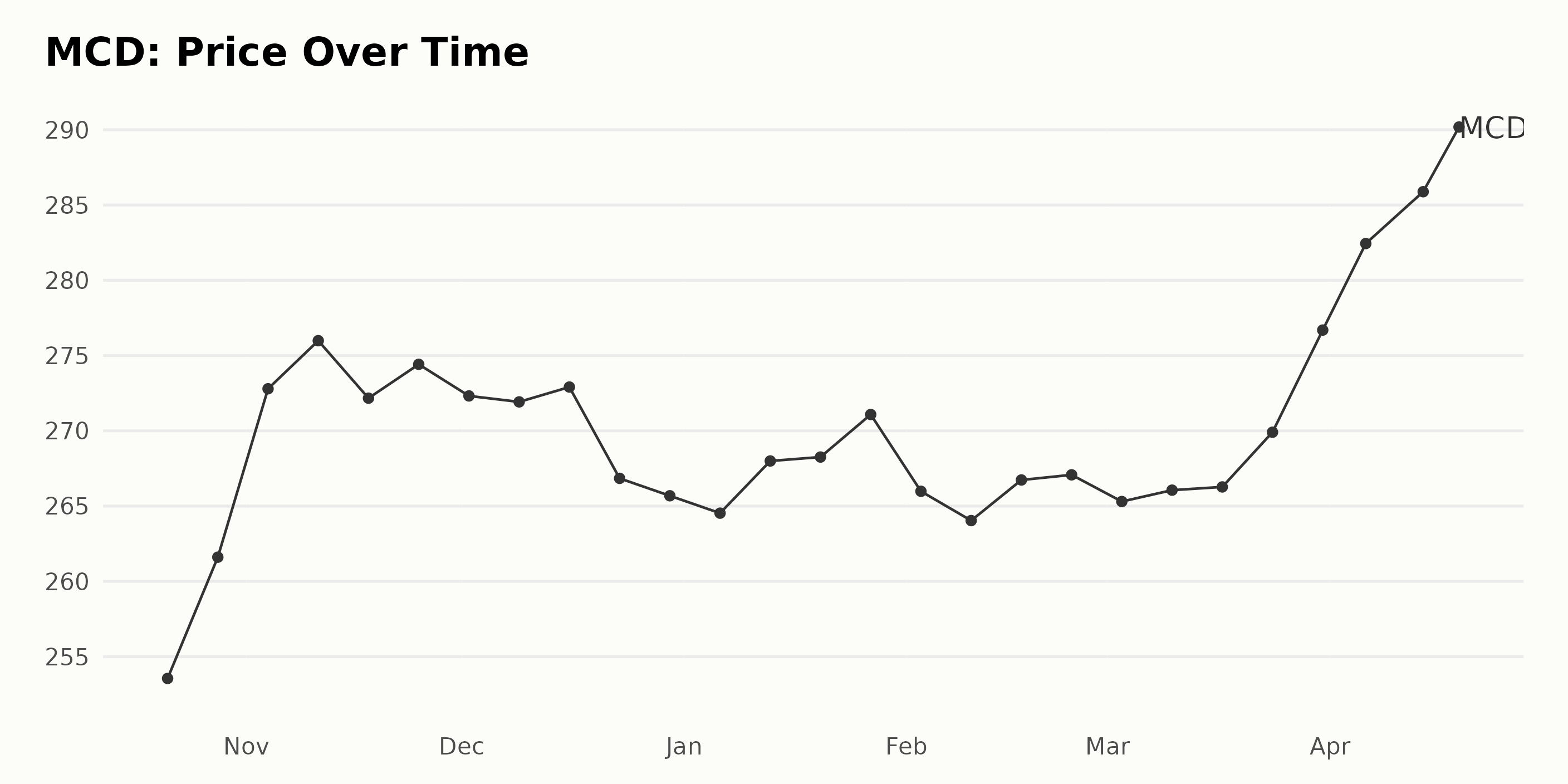

MCD Share Price Shows 14.38% Increase

The share price of MCD appears to be displaying an overall increasing trend. At the start of October 2022, the share price was $253.56. By April 19, 2023, the share price had grown to $290.05, a growth rate of 14.38%. Here is a chart of MCD's price over the past 180 days.

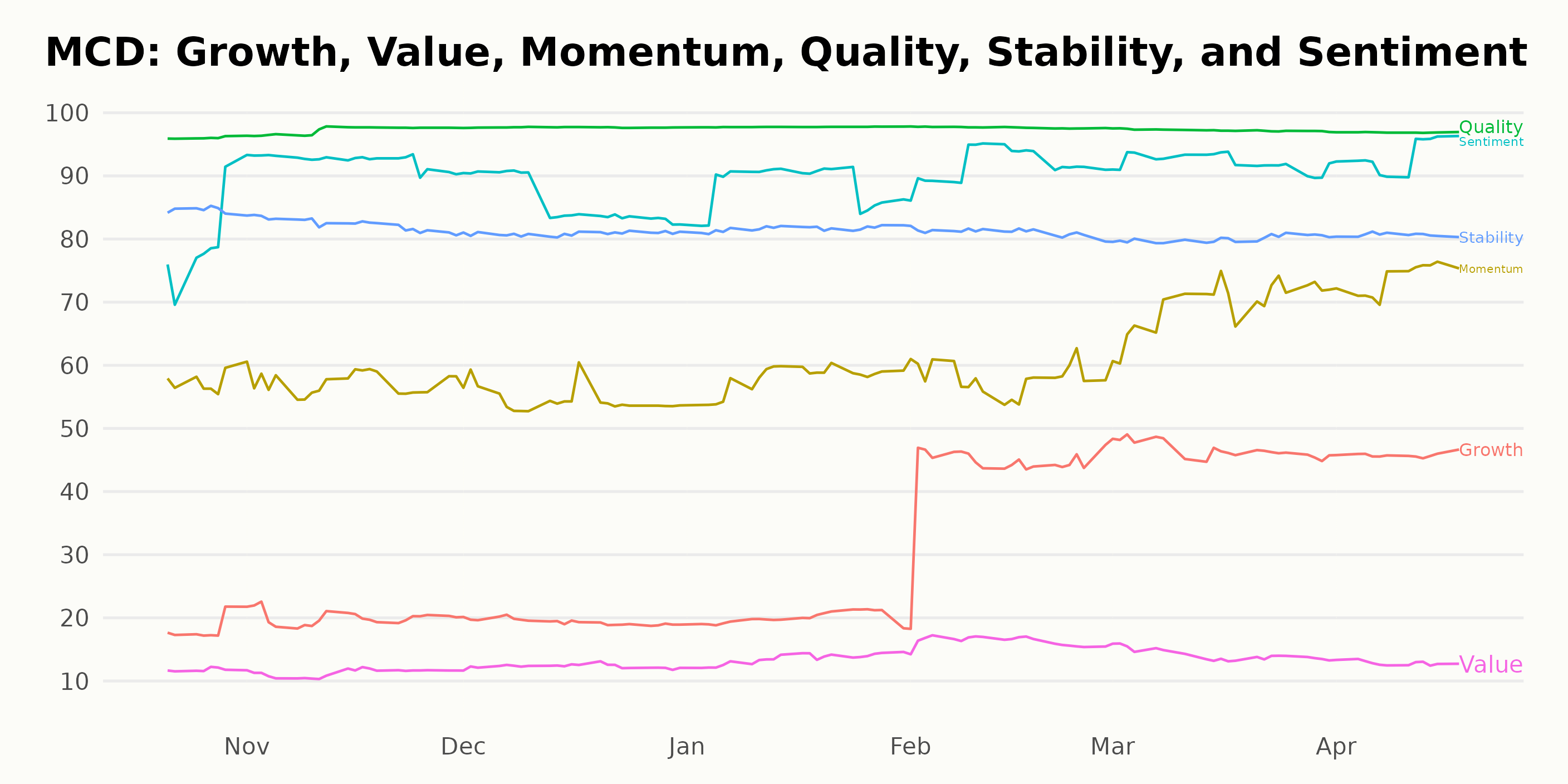

Analyzing McDonald's Corporation’s Ratings

MCD has an overall rating of B, which translates to a Buy in our POWR Ratings system. Its rank in the Restaurants category (containing 46 stocks) is currently 9, showing the stock is relatively in a better position than the median of its peers.

The three most noteworthy dimensions of MCD, according to the POWR Ratings are Quality, Sentiment, and Stability. In October 2022, the Quality dimension had an impressive rating of 96, indicating a high-performing stock. Sentiment also had a positive score of 78 that same month, indicating a positive opinion from analysts.

Finally, Stability scored 85 in October 2022, which implies that MCD is a steady performer. There has been an overall improvement in all three of these dimensions, with Quality and Sentiment both reaching ratings of 98 and 93, respectively, by April 2023, while Stability remained consistently high at 81.

How does McDonald's Corporation (MCD) Stack Up Against its Peers?

Other stocks in the Restaurants sector that may be worth considering are Arcos Dorados Holdings Inc. Class A Shares (ARCO), Nathan's Famous Inc. (NATH), and Potbelly Corporation (PBPB) -- they have better POWR Ratings.

Consider This Before Placing Your Next Trade…

We are still in the midst of a bear market.

Yes, some special stocks may go up like the ones discussed in this article. But most will tumble as the bear market claws ever lower this year.

That is why you need to discover the “REVISED: 2023 Stock Market Outlook” that was just created by 40 year investment veteran Steve Reitmeister. There he explains:

- 5 Warnings Signs the Bear Returns Starting Now!

- Banking Crisis Concerns Another Nail in the Coffin

- How Low Will Stocks Go?

- 7 Timely Trades to Profit on the Way Down

- Plan to Bottom Fish For Next Bull Market

- 2 Trades with 100%+ Upside Potential as New Bull Emerges

- And Much More!

You owe it to yourself to watch this timely presentation before placing your next trade.

REVISED: 2023 Stock Market Outlook >

MCD shares were trading at $290.44 per share on Wednesday morning, down $0.47 (-0.16%). Year-to-date, MCD has gained 10.85%, versus a 8.23% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Favorite Fast Food Stock Is Gaining Major Momentum appeared first on StockNews.com