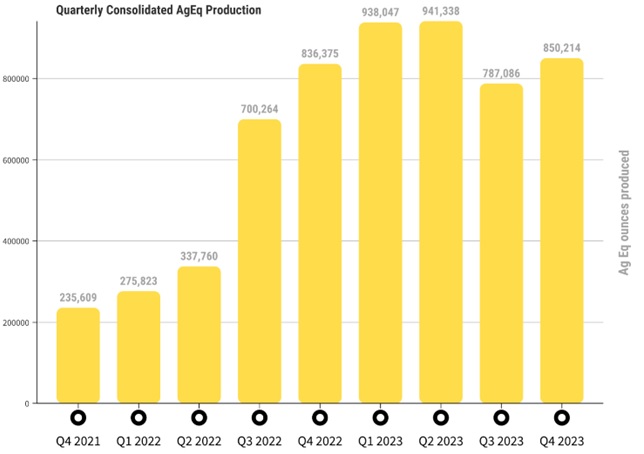

~Silver-Equivalent Production Up 8% from Previous Quarter~

VANCOUVER, BC / ACCESSWIRE / January 9, 2024 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(OTCQX:GSVRF) is pleased to announce consolidated production results for the three months ended December 31, 2023. Production results are generated from the Company's wholly-owned El Cubo Mines Complex ("El Cubo"), Valenciana Mines Complex ("VMC"), and San Ignacio Mine ("San Ignacio") in Guanajuato, Mexico, and the Topia Mine ("Topia") in Durango, Mexico.

Q4 2023 Production Highlights

- Production during the quarter of 850,214 silver-equivalent ounces ("AgEq*") is the 3rd best quarter in the Company's history, and is derived from 394,971 ounces of silver; 4,395 ounces of gold; 837,230 pounds of lead; and 960,206 pounds of zinc.

- Tonnes milled increased 3.6% from Q3 to Q4; during the fourth quarter; a total of 137,339 tonnes were milled across GSilver's four producing silver mines.

- Average silver and gold recoveries were 84.5% and 88.8% respectively for Q4 as compared to 83.3% silver recovery and 81.6% gold recovery in Q3, 2023. Current metallurgical recoveries reflect historical all-time highs.

- Gold production was up 27.7% over the previous quarter driven by higher gold grades, better recoveries, and the inclusion of gold-rich material from the recently added production of the El Horcon mine.

- 2023 AgEq* Production of 3,516,685 ounces falls within revised guidance figures and represents a 63% increase over the previous year.

*See footnote to table below for assumptions associated with the calculation of AgEq ounces.

James Anderson, Chairman and CEO, said, "Performance in the quarter demonstrated increasing improvement driven by the successful implementation of a number of modifications designed to improve overall efficiencies at our Mexican mining operations. The adjustment of various operating procedures, such as improving the stope rotation at El Cubo, the shifting of our business model at Topia, and the addition of a new source of mineralized material from El Horcon, have improved production figures at all of our assets. With the impact of significant capex investments still to be realized, such as the dewatering at El Cubo targeting higher-grade mineralized zones located in deeper areas of the mine, we expect to be able to resume the trend of quarter-over-quarter increases in precious metals production throughout 2024."

- Silver equivalents are calculated using an 85.10:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q4 2023, an 81.83:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for Q3 2023, an 82.91:1 (Ag/Au), 0.04:1 (Ag/Pb) and 0.05:1 (Ag/Zn) ratio for YTD 2023 and an 82:78:1 (Ag/Au) ratio for YTD 2022.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

Q4 Production Demonstrates Significant Improvements Over Previous Quarter

Total tonnes mined during Q4 was 133,497 tonnes; this was down nominally from Q3 production of 134,865 tonnes primarily due to the change of business model at Topia; however, total tonnes milled during Q4 of 137,330 tonnes represents an increase of 3.7% over Q3. The increase in total milled tonnage during the quarter was partly due to the commencement of the processing of mineralized material from the Company's El Horcon mine located approximately 60km northwest of the Valencian Mines Complex (See GSilver news release dated November 27, 2023 - "Guanajuato Silver Initiates Processing of Mineralized Material from El Horcon Mine").

Gold production of 4,395 ounces in Q4 denotes a 27.7% increase from the previous quarter. This increase was the result of higher gold grades in Q4, which were up over 15%, and superior gold recoveries of 88.8%, which is an 8.8% improvement over Q3.

At Topia, lead and zinc grades during the quarter improved dramatically compared to Q3; in Q4 lead grade increased by 33.5% and zinc grades increased by 61.4%, though silver grades at Topia were somewhat lower. Lead and zinc recoveries also increased compared to the previous quarter; lead recovery in Q4 was up 2% to 91.7% recovery - also to all-time highs, whereas zinc recovery increased by 5.8% to 82.5% recovery. Within GSilver's mine portfolio, Topia is the only polymetallic mine; all the Company's other mines are pure precious metals producers.

*See footnote to table above for assumptions associated with the calculation of AgEq ounces.

Technical Information

Hernan Dorado Smith, a director and officer of GSilver and a "qualified person" as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine Complex, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

Gsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, growth of the Company's operating presence within Mexico, improvement in overall efficiencies at its Mexican mining operations, the addition of a new source of mineralized material from El Horcon, the impact of significant capex investments still to be realized, such as the dewatering at El Cubo targeting higher-grade mineralized zones located in deeper areas of the mine, the resumption of the trend of quarter-over-quarter increases in precious metals production throughout 2024, and the Company's status as one of the fastest growing silver producers in Mexico.

Such forward-looking statements and information reflect management's current beliefs and expectations and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: our estimates of mineralized material at El Cubo, VMC, San Ignacio and Topia and the assumptions upon which they are based, including geotechnical and metallurgical characteristics of rock conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; the ability of the Company to ramp up processing of mineralized material at Cata at the projected rates and source sufficient high grade mineralized material to fill such processing capacity; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital cost estimates; decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, future prices of gold, silver and other metals, currency rate fluctuations, rising inflation and interest rates, actual results of production, exploration and development activities, actual resource grades and recoveries of silver, gold and other metals, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, geopolitical conflicts including wars, environmental risks, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to successfully discover and mine sufficient quantities of high grade mineralized material at El Cubo, VMC, San Ignacio and Topia for processing at its existing mills to increase production, tonnage milled and recoveries rates of gold, silver, and other metals in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from El Cubo, VMC, San Ignacio, Topia and its other mines is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected production of silver, gold and other metals will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about the continued spread and severity of COVID-19, the ongoing war in Ukraine and rising inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, supplies, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com including the Company's annual information form for the year ended December 31, 2022. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

View the original press release on accesswire.com