TORONTO, ON / ACCESSWIRE / October 15, 2024 / Lahontan Gold Corp. (TSXV:LG)(OTCQB:LGCXF) (the "Company" or "Lahontan" ) is pleased to announce an updated Mineral Resource Estimate ("MRE") for its flagship Santa Fe Mine, a past-producing open pit, heap leach, gold and silver mine, located in Nevada's prolific Walker Lane. The MRE for Santa Fe is based upon 988 drill holes totaling 97,281 metres, including 79 drill holes totaling 19,151 metres drilled by Lahontan since 2021.

Highlights of the MRE include:

Project-wide pit constrained resources increase significantly: Indicated Mineral Resources of 1,539,000 contained gold equivalent ("Au Eq") ounces and Inferred Mineral Resources of 411,000 contained Au Eq ounces (assumptions for Au Eq are described in the Notes to Table 1).

Indicated Resources increased by 427,000 Au Eq ounces compared to the 2023 MRE, an increase of 38% .

Project-wide average grade for the Indicated Mineral Resource is 0.99 g/t Au Eq ; the average grade of the Project-wide Inferred Mineral Resource is 0.76 g/t Au Eq (please see Table 1).

Shallow Slab-Calvada-York oxide resources expand dramatically: Indicated Oxide Resources total 9.72 Mt grading 0.65 g/t Au Eq for 204,000 Au Eqounces and Inferred Oxide Resources total 11.55 Mt grading 0.53 g/t Au Eq for 198,000 Au Eq ounces, accounting for 47% of the total oxide gold and silver resources at the project and nearly double the number ounces reported in the 2023 MRE.

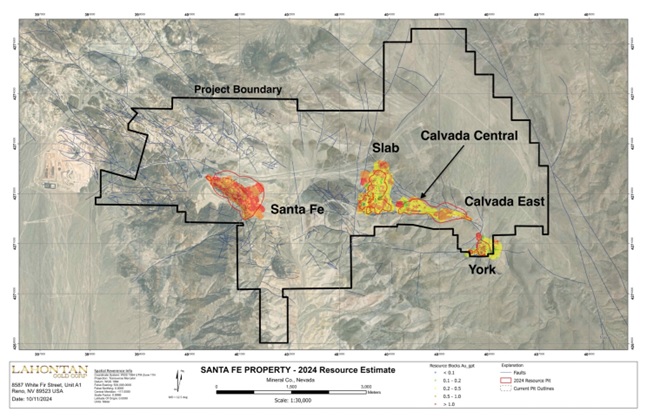

The MRE block model shows that gold and silver mineralization extends well beyond the conceptual pit shells, generating high-quality targets for additional drilling and resource growth, especially the northern extension of the Slab deposit (please see map below).

Kimberly Ann, Founder, Executive Chair, CEO, and President of Lahontan Gold Corp commented: "Lahontan is excited by the results of this updated MRE for the Santa Fe Mine, particularly the large growth of Indicated Resources and the continued expansion of the shallow Slab and Calvada oxide gold and silver deposits. The MRE will form the basis of a Preliminary Economic Assessment ("PEA") of the Santa Fe Mine. The PEA will examine mining and process options for resuming production utilizing low-cost open-pit mining and heap leach processing. Our technical consultants, Kappes, Cassiday and Associates ("KCA") and RESPEC Company LLC ("RESPEC"), both based in Reno, Nevada, are well advanced at project planning, mine design, finalizing the process flow sheet, and optimizing crushing throughput. The Company has been using these preliminary designs to begin its State level mine permitting process while simultaneously completing it Exploration Plan of Operation ("EPOO") with the Federal Bureau of Land Management ("BLM"). Once the EPOO is submitted to the BLM, a draft Mine Plan of Operations ("MPOO") will be completed utilizing all the technical sections from the EPOO and both documents can proceed in parallel. With the release of the updated MRE and the soon to be completed PEA, Lahontan is at an exciting inflection point in its growth and we look forward to continuing our evolution from a junior explorer to a mine development company."

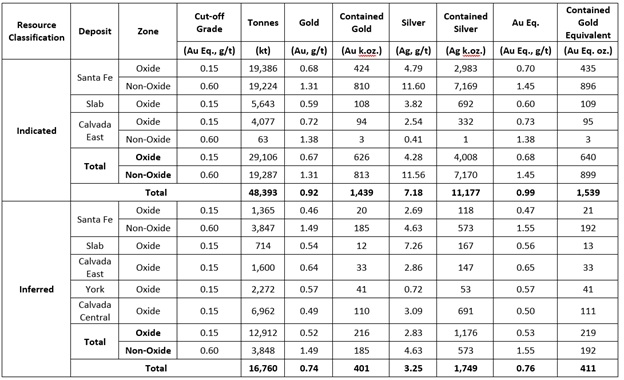

Table 1: Project-wide Resources, Santa Fe Mine, Mineral County, Nevada.

Notes to Table 1:

Mineral Resources have an effective date of October 9, 2024. The Mineral Resource Estimate for the Santa Fe Mine was prepared by Trevor Rabb, P.Geo., of Equity Exploration Consultants Ltd., an independent Qualified Person as defined by NI 43-101.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as Mineral Reserves. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Resources are reported in accordance with NI43-101 Standards of Disclosure for Mineral Projects (BCSC, 2016) and the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

Mineral Resources were estimated for gold, silver, and gold equivalent (Au Eq) using a combination of ordinary kriging and inverse distance cubed within grade shell domains.

Mineral resources are reported using a cut-off grade of 0.15 g/t Au Eq for oxide resources and 0.60 g/t Au Eq for non-oxide resources. Au Eq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and oxide gold recoveries ranging from 45% to 79%, oxide silver recoveries ranging from 10% to 30%, and non-oxide gold and silver recoveries of 71%, mining costs for resource and waste of US$2.50/t, processing cost (oxide) US$3.49/t, processing cost (non-oxide) US$25/t.

An optimized open-pit shell was used to constrain the Mineral Resource and was generated using Lerchs-Grossman algorithm utilizing the following parameters: gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and selling costs of US$29.25/oz gold. Mining costs for resource and waste of US$2.50/t, processing cost (oxide) US$3.49/t, processing cost (non-oxide) US$25/t, G&A cost US$1.06/t. Royalties for the Slab, York and Calvada deposits are 1.25%, and maximum pit slope angles of 50 degrees.

Totals may not sum due to rounding.

About the Santa Fe Mine:

The Santa Fe Mine is in the Walker Lane mineral belt of western Nevada approximately 50 km from the town of Hawthorne in Mineral County. Nearby operating gold and silver mines include Isabella Pearl (Fortitude Gold) and Borealis (Borealis Mining). The Santa Fe Mine consists of four past-producing open-pits, including the Santa Fe, Slab, Calvada East, and York deposits, within a 26.4 km 2 land package 100% controlled by Lahontan. The Santa Fe Mine had past production of 356,000 ounces of gold and 784,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Division of Minerals, www.ndomdata.com) Mineralization occurs as disseminated gold and silver hosted by Triassic age calcareous rocks. Strong stratigraphic and structural controls of mineralization is evident. Considerable exploration potential remains at Santa Fe and the Company intends to continue its aggressive exploration and permitting program in 2024 and into 2025.

Santa Fe Oxide Resources:

Oxide resources at the Santa Fe Mine occur at both the Santa Fe deposit and the Slab-Calvada Complex which includes the Slab, Calvada East, York, and Calvada Central deposits. The contained Au Eq oxide ounces for the Slab-Calvada Complex accounts for approximately 32% of the total Indicated Au Eq oxide ounces and over 90% of the total Inferred Au Eq oxide ounces. Mineral Resources at the Slab-Calvada Complex are shallow and locally exposed at surface, leading to potentially very low strip ratios. Oxide resources are open to the north and northeast of the Slab open pit, along the Calvada Fault, and at the York open pit.

The balance of the oxide resources are within the Santa Fe deposit, accounting for 68% of Indicated contained Au Eq oxide ounces, and 10% of Inferred AuEq oxide ounces. Oxide Mineral Resources within the Santa Fe deposit are primarily located in the northeast high wall of the Santa Fe open pit. The average grade of the Santa Fe deposit Indicated oxide resource is 0.70 g/t Au Eq, with locally higher grade zones that may serve as a starting point for future mining operations. Oxide resources at the Santa Fe deposit are open to the northeast, south, and southeast.

Santa Fe Non-Oxide Resources:

Non-oxide resources at the Santa Fe Mine are principally located in the Santa Fe deposit below the oxide resources and within the resource pit shell. The average grade of the Santa Fe deposit Indicated non-oxide resource is 1.45 g/t Au Eq and the Santa Fe deposit Inferred non-oxide mineral resource is 1.55 g/t Au Eq. Gold is very fine-grained and associated with pyrite. Within the southeastern portion of the Santa Fe deposit, higher-grade gold and silver resources may positively influence future project economics. Higher grade gold and silver mineralization extends to the southeast of the Santa Fe deposit, along strike and down-rake, providing excellent exploration opportunities to grow the non-oxide resources at Santa Fe.

Metallurgical Domains:

Modelling criteria for the oxide metallurgical domain is based on the ratio of gold by fire assay to gold by cyanide leach (extraction values). The ratio thresholds for the oxide metallurgical domain in the Santa Fe deposit used values of 80% and greater, and 60% and greater for Calvada (Slab, Calvada Central, Calvada East and York). Modelling the transitional metallurgical domain used ratios of less than 80% and greater than 50% for Santa Fe, and less then 60% to 30% for Calvada. The non-oxide metallurgical domain ("fresh" rock) was defined by ratios of less than 50% for Santa Fe and less than 30% for the Calvada area deposits.

Estimation Approach:

Lithology and gold and silver bearing domains were modelled using Leapfrog 2024. These domains are mainly defined by logged jasperoid and limestone-breccia lithologies and continuity of gold grades above 0.1 g/t gold. Metallurgical domains for oxide, transition and non-oxide were modelled based on ratio of cyanide leachable gold assay values to fire assay gold values in addition to drillhole logs recording abundance of pyrite and oxidation intensity. Transition material represents approximately 25% of oxide tonnes and comes almost entirely from the Santa Fe deposit. Transition domain material is included in the oxide resource. Domains representing lithology, weathering and mineralization models were assigned to a block model with a block size of 5 m x 5 m x 6 m. Average bulk densities representative of the mineralization and lithology models were assigned to the block model and vary from 2.4 t/m 3 to 2.6 t/m 3 .

Grade capping and outlier restrictions were applied to gold and silver values and interpolation parameters respectively. Top cut values for gold and silver were evaluated for each domain independently prior to compositing to 1.52 m lengths that honor domain boundaries. Estimation was completed using Micromine Origin with Ordinary Kriging (OK) and Inverse Distance cubed (ID 3 ) interpolants. Blocks were classified in accordance with the 2014 CIM Definition Standards. The nominal drillhole spacing for Indicated Mineral Resources is 50 m or less. The nominal drillhole spacing for Inferred Mineral Resources is 100 m or less.

Prospects for eventual economic extraction were evaluated by performing pit optimization using Lerchs-Grossman algorithm with the following parameters: gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, selling costs of US$29.25/oz gold. Mining costs for resource and waste of US$2.50/t, processing cost (oxide) US$3.49/t, processing cost (non-oxide) US$25/t, G&A cost US$1.06/t. Royalties for the Slab, York and Calvada deposits are 1.25%. Maximum pit slope is 50 degrees. Processing recoveries range from 45% to 79% for oxide, silver recoveries range from 10% to 30% for oxide and non-oxide gold and silver recoveries are 71%.

About Lahontan Gold Corp and Filing of Report:

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 26.4-km 2 Santa Fe Mine project, had past production of 356,000 ounces of gold and 784,000 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing (Nevada Division of Minerals, www.ndomdata.com). The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq(grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Lahontan Press Release dated October 15, 2024). The Company will continue to aggressively explore Santa Fe during 2024 and complete a Preliminary Economic Assessment ("PEA") evaluating development scenarios to bring the Santa Fe Mine back into production.

To support this Santa Fe MRE, a technical report prepared according to National Instrument 43-101 ("Report") will be filed on SEDAR within the next 45 days. The independent Qualified Person responsible for the MRE disclosure for the Santa Fe Mine is Trevor Rabb, P.Geo., of Equity Exploration Consultants Ltd., in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., is the Qualified Person for the Company and approved the technical content of this news release.

On behalf of the Board of Directors

Kimberly Ann

Executive Chair, Founder, CEO, and President

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Executive Chair, Founder, CEO, and President

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com

SOURCE: Lahontan Gold Corp

View the original press release on accesswire.com