BUENOS AIRES, ARGENTINA / ACCESSWIRE / March 11, 2024 / Central Puerto S.A ("Central Puerto" or the "Company") (NYSE:CEPU), the largest private sector power generation companies in Argentina, reports its consolidated financial results for the Fiscal Year 2023 and Fourth Quarter 2023 ("FY 2023" or "FY23", and "4Q23", respectively), ended on December 31st , 2023.

A conference call to discuss the FY 2023 and 4Q23 results will be held on March 11th , 2023, at 11 AM Eastern Time (see details below). All information provided is presented on a consolidated basis, unless otherwise stated.

Financial statements as of December 31st , 2023, include the effects of the inflation adjustment, applying IAS 29. Accordingly, the financial statements have been stated in terms of the measuring unit current at the end of the reporting period, including the corresponding financial figures for previous periods reported for comparative purposes. Growth comparisons refer to the same periods of the previous year, measured in the current unit at the end of the period, unless otherwise stated. Consequently, the information included in the Financial Statements for the period ended on December 31st , 2023, is not comparable to the Financial Statements previously published by the company. However, we presented some figures converted from Argentine Pesos to U.S. dollars for comparison purposes only. The exchange rate used to convert Argentine Pesos to U.S. dollars was the reference exchange rate (Communication "A" 3500) reported by the Central Bank for U.S. dollars for the end of each period. The information presented in U.S. dollars is for the convenience of the reader only and may defer in such conversion for each period is performed at the exchange rate applicable at the end of the latest period. You should not consider these translations to be representations that the Argentine Peso amounts actually represent these U.S. dollars amounts or could be converted into U.S. dollars at the rate indicated.

Definitions and terms used herein are provided in the Glossary at the end of this document. This release does not contain all the Company's financial information. As a result, investors should read this release in conjunction with Central Puerto's consolidated financial statements as of and for the period ended on December 31st , 2023, and the notes thereto, which will be available on the Company's website.

A. Regulatory Updates and Relevant Facts

Resolution SE N°869/2023 : On November 2nd , 2023 , the Secretariat of Energy issued Resolution SE No. 869/2023, which updates remuneration prices for energy and capacity of generation units not committed in a PPA. Remuneration values increased by 28% since November 2023.

Resolution SE N°9/2024 : On February 8th , 2024 , the Secretariat of Energy issued Resolution SE No. 09/2024, which updates remuneration prices for energy and capacity of generation units not committed in a PPA. Remuneration values increased by 74% since February 2024.

Resolution SE N°621/2023: On July 26th , 2023 , the National Secretariat of Energy, through Resolution 621/2023, announced a national and international open call "Terconf" for the submission of offers for new thermal plants or used with certain characteristics, with the aim of incorporating firm and reliable thermal power to the national interconnected system.

The tender was divided into:

- Thermal Generation for reliability and supply of interconnected system ("SADI") targeting 2,250 MW to 3,000 MW, and,

- Thermal Generation to replace and make the Tierra del Fuego power generation system more efficient. Targeting 30 MW to 70 MW.

And into subcategories that have a limit power to be awarded:

- Line 1.0: Power increase of existing combined cycles.

- Line 1.1: Improvement of supply reliability in critical areas.

- Line 1.2: Improvement of regional supply reliability.

- Line 1.3: Improvement of general supply reliability.

As part of the bidding process, the group presented projects in Central Puerto for 312 MW and in Central Costanera for 516 MW.

Submission of bids took place on September 26th , while the technical qualification was carried out on October 25th , and the opening of economic bids on October 27th . Finally, on November 29, CAMMESA announced the projects awarded, resulting in the awarding of the 2 projects presented by Central Costanera for a total of 516 MW. However, as of the date of this document, the contracts have not been signed and the TerConf bidding process is under review of the new administration.

Proener acquires solar power plant "Guañizuil II A".

On October 18th , Proener S.A.U., an affiliate controlled by Central Puerto, directly acquired 100% of the capital votes and stock of Cordillera Solar VIII S.A. and Scatec Equinor Solutions S.A., owner, and operator respectively of the solar power plant "Guañizuil II A".

The Guañizul II A solar power plant is located in the province of San Juan and has a nominal rated power capacity of 104.6 AC, generating approximately 300 GWh/year. The plant counts with 358,560 solar panels and covers a total area of 270 hectares, being the third largest solar park in Argentina.

In addition, the Guañizul II A solar power plant has a capacity factor of 33%, exceeding the average for the region and positioning it as one of the farms with the best capacity factor in the world, which allows it to produce energy to supply the demand of approximately 86,000 homes.

The remuneration scheme of the power plant is a PPA with CAMMESA under the Program Renov.ar 2.5 for 20 years.

The Company considers the acquisition of its first photovoltaic technology park represents another milestone in the diversification of its energy matrix within the framework of the Company's expansion strategy and consolidation in the renewable energy market. Thus, Central Puerto will generate 9.6% of the country's total solar energy and will reach a capacity of 475 MW of renewable energy, of which 80% corresponds to wind energy and 20% to solar energy.

Debt issuances

- On October 17th ,2023 the company issued the Class B notes (10% Senior note due 2025), denominated, integrated and payable in U.S. dollars, by an amount of US$50,000,000 and with 24 months of maturity.

- On October 20th ,2023 the company reopened the Class A notes seeking for additional financing. As a result of this process, Central Puerto issued an additional amount of US$10,000,000, with an issue price of 102.9%.

Partial pre-payment of syndicated loan

On October 19th ,2023 the company partially prepaid the Syndicated loan signed with Citibank N.A., JP Morgan Chase Bank N.A. and Morgan Stanley Senior Funding INC., by an amount of US$49,043,078, which released the restriction on dividend payments. On January 12th ,2024 the Company duly paid the US$6.1 million balance of the loan.

Dividend payments

- On November 2nd , 2023 , the company announced the payment of dividends equivalent to AR$29.72 per share payable 93% in sovereign bonds and 7% in cash in AR$, distributed on November 16th .

- On December 1st , 2023 , the company announced the payment of dividends equivalent to AR$32.431222 per share payable 91.68% in sovereign bonds, 7% in cash in AR$ and 1.32% in cash in US$ distributed on December 18th .

- On December 15th , 2023 , the company announced the payment of dividends equivalent to AR$11.00 per share payable 93% in cash in US$ and 7% in cash in AR$ distributed on December 27th .

- On January 2nd , 2024 , the company announced the payment of dividends equivalent to AR$5.75 per share payable 93% in cash in US$ and 7% in cash in AR$ distributed on January 11th .

B. Argentine Market Overview

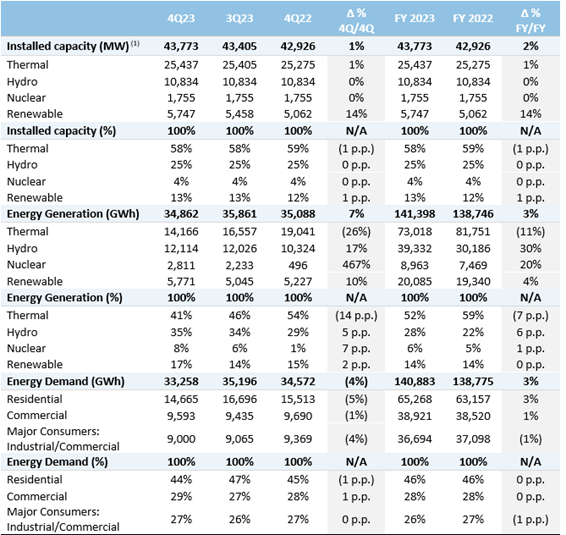

The table below sets forth key Argentine energy market data for 4Q23 compared to 3Q23 and 4Q22 and FY 2023 compared to FY 2022.

Source: CAMMESA; company data.

(1) As of December 31st , 2023.

Installed Power Generation Capacity: During 2023 , the country's installed generation capacity increased by 2% or 847 MW reaching 43,773 MW, compared to 42,926 MW in 2022. The increase in system's capacity was mainly due to the incorporation of 685 MW (+14%) from renewable sources of which 396 MW corresponds to new wind farms, 280 MW to solar photovoltaic projects, 6 MW to biogas and 3 MW of biomass. In turn, thermal capacity sources recorded a net increase of 162 MW (+1%) as a combination of an addition of 735 MW on new combined cycles and a decrease of 537 MW and 36 MW in gas turbines and diesel engines respectively.

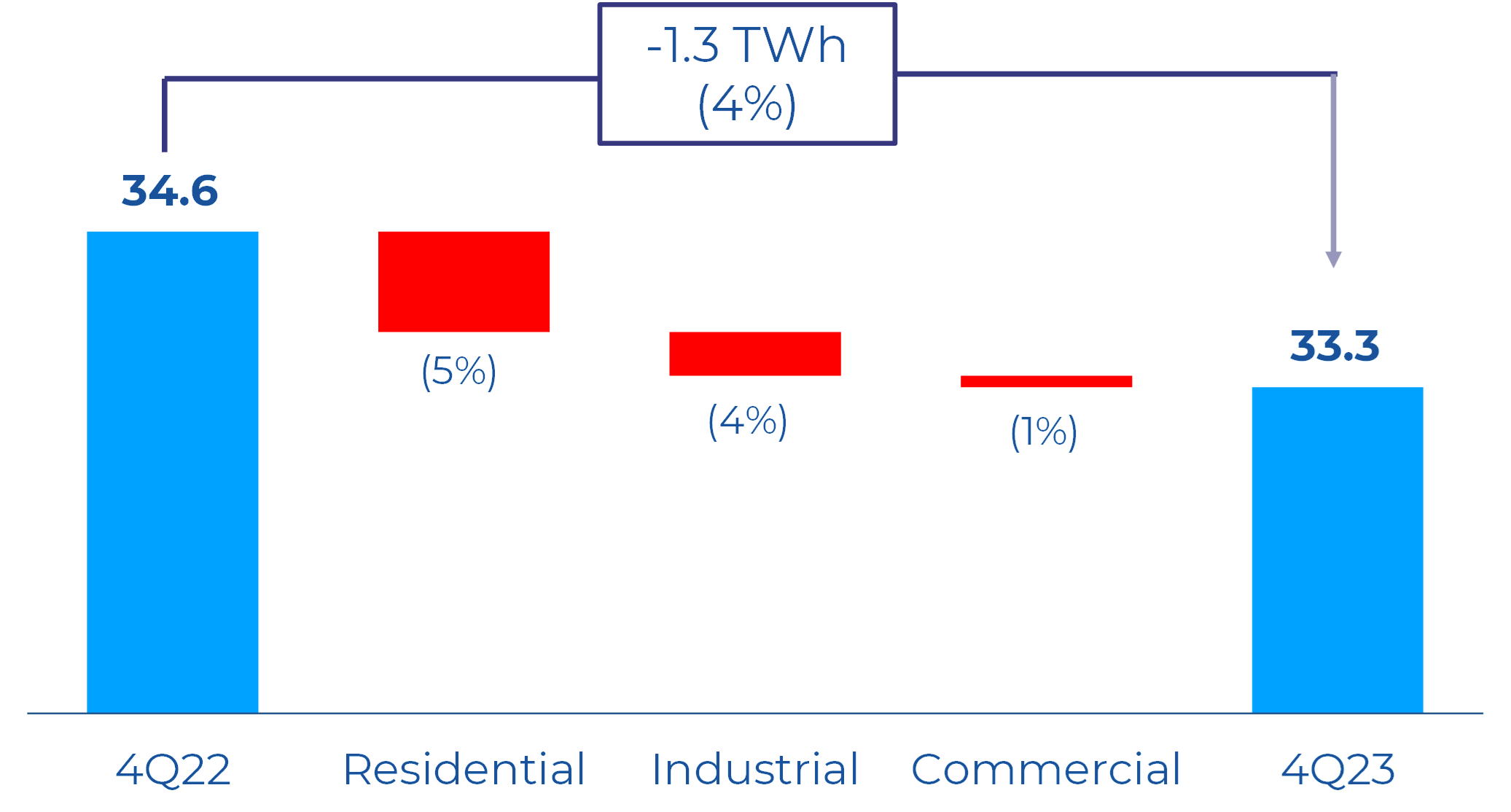

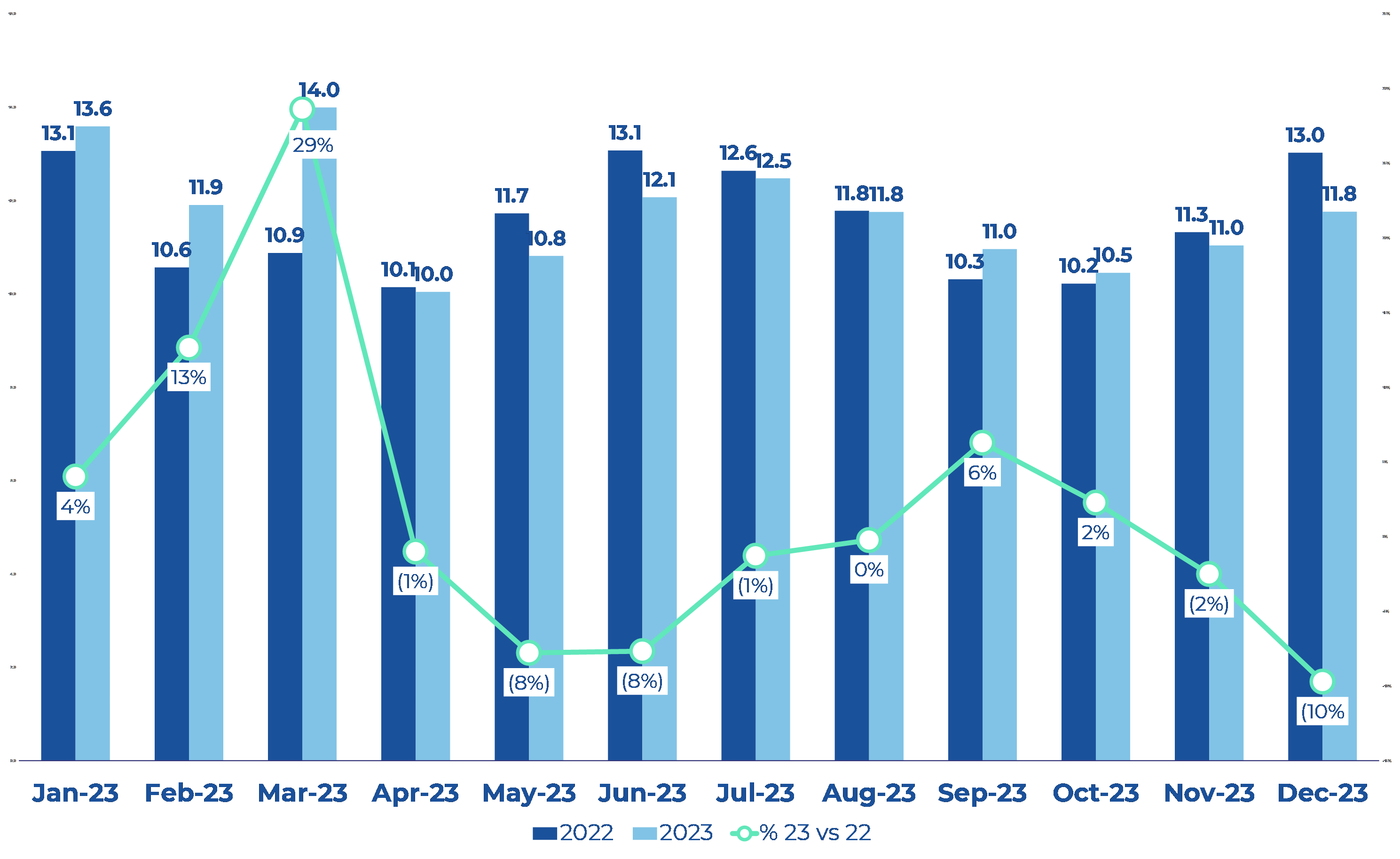

Power generation & demand: In 4Q23 , energy generation dropped 4% to 33,258 GWh, compared to 34,572 GWh in 4Q22, in line with the 4% decrease in energy demand, which was essentially driven by a 5% decline in residential consumption on the back of milder temperatures during the period.

The lower demand of the period was mainly covered with an increase in nuclear (+7% y/y), hydro (+5% y/y) and renewable (+2% y/y) generation, resulting in a lower thermal requirement (-14% y/y).

In the first case, the increase in generation was a direct result of the re-commissioning of the Atucha II power plant as previously explained and the higher generation from Embalse, which was in maintenance shutdown during the same period 2022. With regards to the increase hydro generation, this was mainly due to the higher river flow rates, especially the Uruguay River, which recorded a 484% increase in flow after the severe drought recorded during 2022, while the rivers of the Comahue basin also recorded higher flows, with the Nequén and Limay rivers standing out with increases of 49% and 37%, respectively.

Energy Demand per type

(TWh)

2023 Local energy Demand

(TWh)

C. Central Puerto S.A.: Main operating metrics

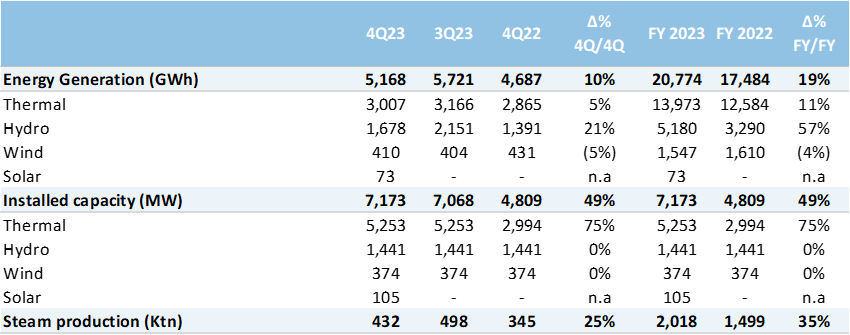

The table below sets forth key operating metrics of the Central Puerto group for 4Q23, compared to 3Q23 and 4Q23, and FY 2023, compared to FY 2022:

Source: CAMMESA; company data.

(1) On February 22, 2024, it was published in the Official Gazette of the Republic of Argentina, the request submitted by Central Costanera for the decommissioning of steam generation units COSTTV04 and COSTTV06, for a total installed capacity of 120 MW and 350 MW, respectively.

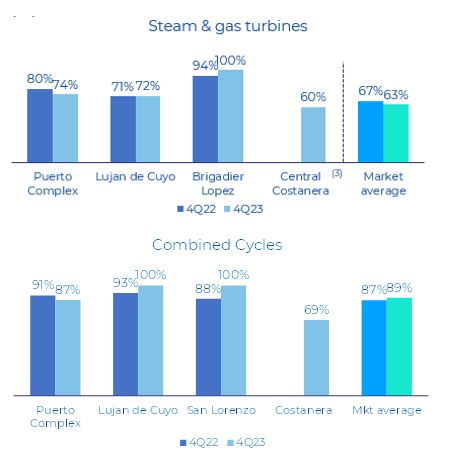

Thermal availability (1)(2)

(%)

(1) Availability weighted average by power capacity. Off-time due to scheduled maintenance agreed with CAMMESA is not considered in the ratio.

(2) Central Costanera figures does not consider the power capacity values of the steam generation units COSTTV04 and COSTTV06

During 4Q23, Central Puerto's operated power generation increased by 10% to 5,168 GWh, compared to 4,687 GWh in 2022.

It should be noted that this increase includes the consolidation of the energy generated by Central Costanera (+856 GWh) and Guañizuil II A solar plant (+73 GWh).

In 4Q23, the increase in hydro energy generation from Piedra del Aguila was once again noteworthy, reaching 1,678 GWh and standing 21% above 4Q22 levels, as a direct result of the increase in the flows of Limay and Collon Curá rivers (+37% and +13%, respectively) compared to 4Q22, when river flows were still affected by the drought that impacted the country in 2022.

With regards to renewables, energy generation increased by 12% in 4Q23 vís-a-vís 4Q22, being fully explained by the incorporation of the 73 GWh generated by Guañizuil II A solar plant and being partially offset by a 5% contraction in wind generation as a result of lower wind resource during the period.

Regarding thermal generation, it increased by 5% in 4Q23 compared to 4Q22, as a result of the acquisition of Central Costanera. Excluding this power plant from the analysis, thermal power generation would have recorded a 25% decrease vís-a-vís 4Q22, as a result of a higher availability of hydro generation, as previously stated, and the lower energy demand of the period, resulting in a lower thermal dispatch, particularly in the Puerto complex, Lujan de Cuyo and Brigadier Lopez sites.

Finally, steam production increased 25% during 4Q23, explained by a 29% increase in San Lorenzo cogeneration plant and a 23% increase in Lujan de Cuyo. In the first case, the increase is mostly explained by an increase in must-run operations, while in the second case the result is basically explained by higher availability of gas turbines (maintenance finished by mid-2023, which highly improved 4Q23 operation performance).

D. FY & 4Q23 Analysis of Consolidated Results

Important notice: "The results presented for the annual period 2023 and 4Q23 are negatively affected, at a non-cash level, as a consequence of the sharp devaluation of the local currency occurred in mid-December, in Central Puerto's accounting methodology. Given that the functional currency of the company is the Argentine peso, our Financial Statements are subject to inflation adjustment, while Company's figures are converted into US dollars using the end of period official exchange rate. Thus, given the significant disparity between inflation and devaluation for the period, it might affect comparability".

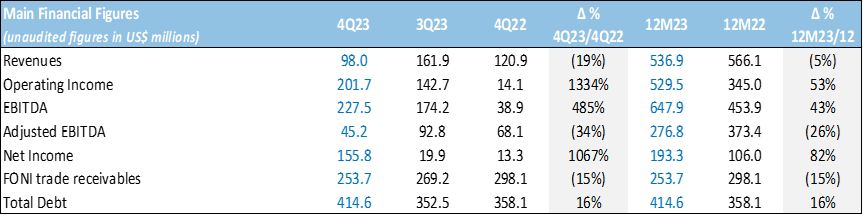

Main financial magnitudes of continuing operations (1)

(1) The FX rate used to convert Argentine Pesos to U.S. dollars is the reference exchange rate (Communication "A" 3500) reported by the Central Bank for U.S. dollars as of Dec-31st of AR$ 808.48 to US$1.00.

(2) See "Disclaimer-EBITDA & Adjusted EBITDA" on page 21 for further information.

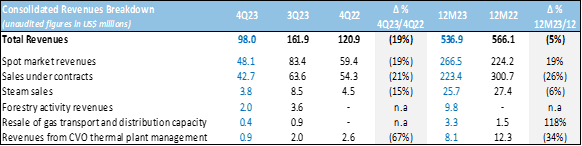

During 4Q23, revenues totaled US$98.0 million decreasing 19% compared to US$120.9 million in the 4Q22.

This was mainly due to a combination of:

i. A US$4.3 million sales from the Forestry companies acquired in December 2022 and May 2023.

ii. A 21% or US$11.6 million decrease in sales under contracts, which totaled US$42.7 million in 4Q23 compared to US$54.3 million in 4Q22, mainly explained by the aforementioned effect between inflation and currency devaluation and to a lower generation from our wind farms on the back of a lesser wind resource, being partially offset by the recent acquisition of the solar farm Guañizul II A which contributed with sales of US$2.7 million in the quarter.

iii. A 19% or US$11.3 million decrease in Spot/Legacy energy sales which amounted to US$40.4 million in 4Q23 compared to US$59.4 million in the 4Q22, driven by a combination of the consolidation of Central Costanera's figures which contributed with sales of US$13.4 million, and a higher energy dispatch from Piedra del Aguila hydro power plant, being fully offset by the aforementioned effect between inflation and currency devaluation, a lower remuneration measured in US dollars, a lower generation from thermal units on the back of the lower demand of the period and the higher availability of hydro resource,

iv. A 15% or US$0.7 million decrease in steam sales, which totaled US$3.8 million in the 4Q23 compared to US$4.5 million in the 4Q22, despite a 25% increase in volumes being fully explained by the aforementioned non-cash effect between inflation and currency devaluation.

Operating cost, excluding depreciation and amortization, in 4Q23 amounted to US$40.4 million, decreasing by 13% or US$5.8 million when compared to US$46.3 million in 4Q22.

The decrease is basically explained by the aforementioned effect between inflation and currency devaluation and the reclassification of consumption of materials and spare parts allocated to the maintenance works carried on the cogeneration units of Lujan de Cuyo plant.

Other than the aforementioned effects, production costs increased by 11% or US$3.7 million primarily due to: (i) higher purchases of energy and power, (ii) other long-term employee benefits and (iii) consumption of material and spare parts.

In addition, SG&A, excluding depreciations and amortizations, increased by 9% or US$1.1 million in the year over year comparison due to: (i) an increase in compensation to employees and (ii) tax on bank account transactions.

Other operating results net in 4Q23 were positive in US$128.3 million, increasing 133% or US$73.2 million compared to 4Q22 . This is mainly explained by the higher exchange rate differences and interest accrued from the FONI program for a total net increase of US$71.9 million in 4Q23.

In addition, during the quarter a recovery of impairment of property, plant and equipment and intangible assets was recorded for US$54.4 million as opposed to the negative charge of US$79.2 million recorded in 4Q22.

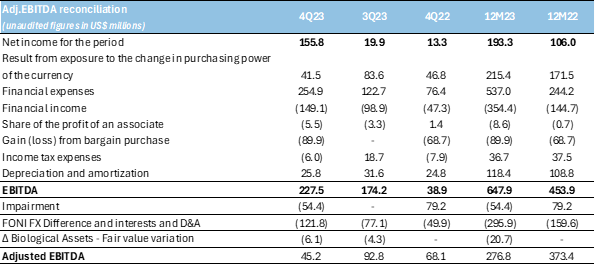

Consequently, Consolidated Adjusted EBITDA ( [1] ) amounted to US$45.2 million in 4Q23 , compared to US$68.1 million in 4Q22.

Consolidated Net financial results in 4Q23 were negative in US$105.8 million compared to a loss of US$35.0 million in 4Q22 mainly driven by higher negative foreign exchange differences on financial liabilities partially offset by better results from holding financial assets at fair value.

Loss on net monetary position in 4Q23 measured in US dollars amounted to US$41.5 million being 11% lower to the US$46.8 million loss in 4Q22, driven by the impact of the higher inflation of the period on a lower balance of monetary assets in Argentine pesos.

Profit on associate companies was positive on US$5.5 million compared to a US$1.4 million loss in 4Q22.

In addition, during 4Q23 the Company recorded a gain as a result of the valuation at fair value of the companies acquired during the period for US$89.9 million.

Income tax in 4Q23 resulted in a positive US$6.0 million compared to, also positive, US$7.9 million in 4Q22.

Finally, Net Income in 4Q23 amounted to US$155.8 million, compared to US$13.3 million of 4Q22.

FONI program collections associated to the receivables from the Vuelta de Obligado plant totaled US$11.2 million in 4Q23. This amount is composed by US$10.8 million corresponding to Central Puerto and US$0.4 million to Central Costanera.

Adjusted EBITDA Reconciliation (1)

(1) See "Disclaimer-EBITDA & Adjusted EBITDA" on page 21 for further information.

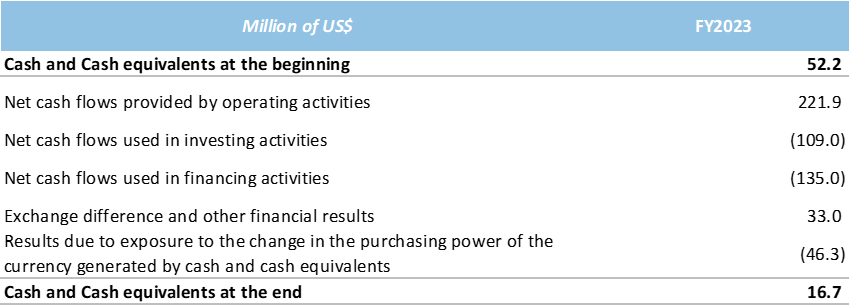

Financial Situation

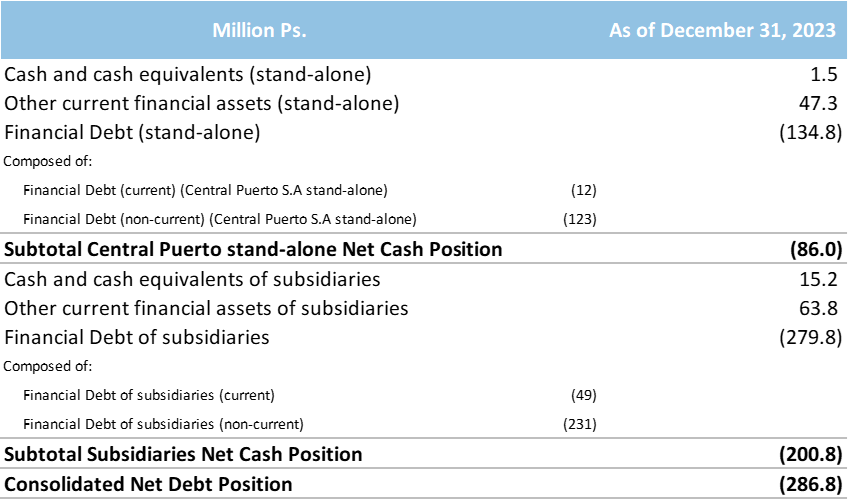

As of December 31st, 2023, the Company and its subsidiaries had Cash and Cash Equivalents of US$16.7 million, and Other Current Financial Assets of US$111.1 million.

The following chart breaks down the Net Debt position of Central Puerto (on a stand-alone basis) and its subsidiaries:

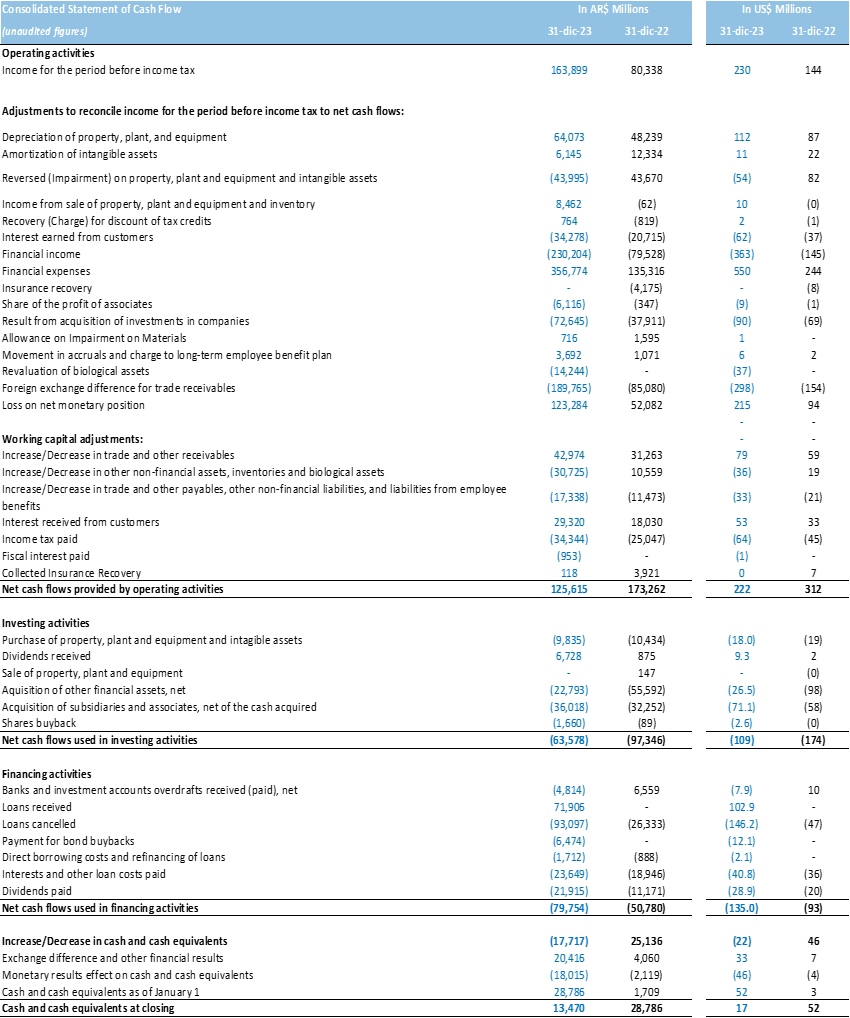

Net cash provided by operating activities was positive in US$221.9 million during 2023. This cash flow arises mainly from (i) US$230.0 million of net income for the period before income tax; (ii) US$9.9 million in positive working capital variations (account payables, account receivables, inventory and other non-financial assets and liabilities); (iii) US$52.5 million in collection of interest from clients, including FONI, being all partially offset by; (iv) adjustments to reconcile profit for the period before income tax with net cash flows of US$5.5 million; (v) Income tax payments of US$65.0 million.

Net cash used in investing activities was negative in US$109 million during the FY 2023. This amount is mainly explained by (i) approximately US$71.1 million for the acquisitions of companies made during the period; (ii) US$18.0 million investments in property, plant, equipment and inventory, (iii) US$26.5 million from investments in short-term financial assets net, and (iv) US$2.6 million from the share buyback program implemented in the quarter, being all partially offset by (vi) US$9.3 million in dividends collected.

Net cash used in financing activities was negative in US$135.0 million in the FY 2023. This is basically the result of (i) US$148.3 million in debt service amortizations, primarily related to the Brigadier Lopez loan and the principal maturity of the Manque and Olivos dollar linked bond; (ii) US$40.8 million in interest and other financing costs related to long-term loans; (iii) US$12.1 million related to the Manque and Olivos bond buybacks, (iv) US$7.9 million in the cancellation of overdrafts in checking accounts, and, (v) US$28.9 in dividends paid, being all partially offset by US$102.9 million in financing obtained in the period, mainly from the issuance of the Class A notes for US$47.2 million and Class B notes for US$50.0 million.

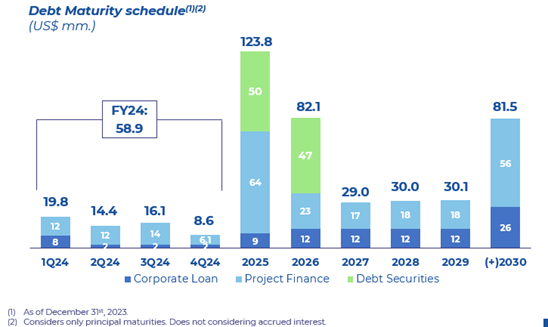

The following table shows the company's principal maturity profile as of December 31, 2023, expressed in millions of dollars.

E. Tables

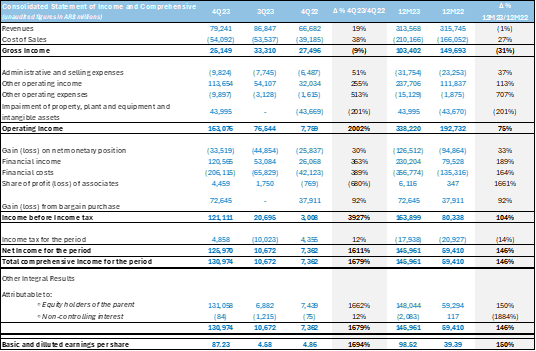

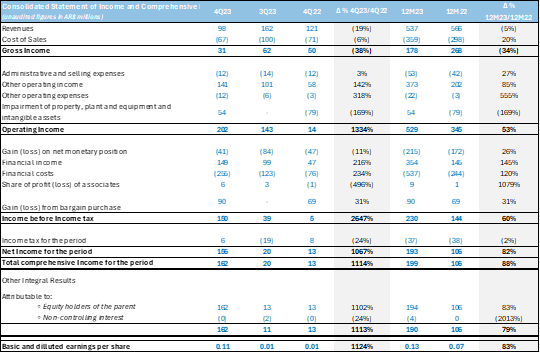

a. Consolidated Statement of Income

The exchange rate used to convert Argentine Pesos to U.S. Dollars is the reference exchange rate (Communication "A" 3500) reported by the Central Bank for U.S. Dollars as of December 31, 2023 and December 31, 2022 of AR$ 808.48 and AR$ 147.32 per US$ 1.00, respectively. In turn, the accumulated results for the twelve months 2023 and 2022 result from the sum of the quarterly results in Argentine Pesos converted at the closing exchange rate of each period.

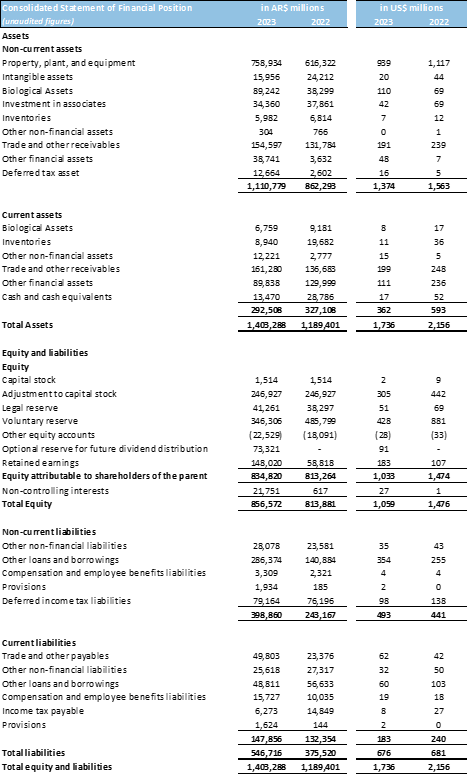

b. Consolidated Statement of Financial Position

The exchange rate used to convert Argentine Pesos to U.S. Dollars is the reference exchange rate (Communication "A" 3500) reported by the Central Bank for U.S. Dollars as of December 31st ,2023 and December 31st ,2022 of AR$ 808.48 and AR$ 147.32 per US$ 1.00, respectively. In turn, the accumulated results for the twelve months 2023 and 2022 result from the sum of the quarterly results in Argentine Pesos converted at the closing exchange rate of each period.

c. Consolidated Statement of Cash Flow

The exchange rate used to convert Argentine Pesos to U.S. Dollars is the reference exchange rate (Communication "A" 3500) reported by the Central Bank for U.S. Dollars as of December 31st , 2023 and December 31st , 2022 of AR$ 808.48 and AR$ 147.32 per US$ 1.00, respectively. In turn, the accumulated results for the twelve months 2023 and 2022 result from the sum of the quarterly results in Argentine Pesos converted at the closing exchange rate of each period.

F. Information about the Conference Call

There will be a conference call to discuss Central Puerto's FY 2023 and 4Q 2023 results on March 11, 2024, at 11:00 AM Eastern Time .

The conference will be hosted by Mr. Fernando Bonnet, Chief Executive Officer, Enrique Terraneo, Chief Financial Officer and Mr. Pablo Calderone, Finance Manager and IRO.

To access the conference call, please dial:

Toll Free: +1 888-506-0062

International: + 1 973-528-0011

Participant Access Code: 634456

Webcast URL : https://www.webcaster4.com/Webcast/Page/2629/50008

The Company will also host a live audio webcast of the conference call on the Investor Relations section of the Company's website at www.centralpuerto.com . Please allow extra time prior to the call to visit the website and download any streaming media software that might be required to listen to the webcast. The call will be available for replay on the Company's website under the Investor Relations section.

You may find additional information on the Company at:

Glossary

In this release, except where otherwise indicated or where the context otherwise requires:

- "BCRA" refers to Banco Central de la República Argentina , Argentina's Central Bank,

- "CAMMESA" refers to Compañía Administradora del Mercado Mayorista Eléctrico Sociedad Anónima ;

- "COD" refers to Commercial Operation Date, the day in which a generation unit is authorized by CAMMESA (in Spanish, "Habilitación Comercial") to sell electric energy through the grid under the applicable commercial conditions;

- "Ecogas" refers collectively to Distribuidora de Gas Cuyana ("DGCU"), Distribuidora de Gas del Centro ("DGCE"), and their controlling company Inversora de Gas del Centro ("IGCE") ;

- "Energía Base" (legacy energy) refers to the regulatory framework established under Resolution SE No. 95/13, as amended, currently regulated by Resolution SE No. 9/24;

- "FONINVEMEM" or "FONI", refers to the Fondo para Inversiones Necesarias que Permitan Incrementar la Oferta de Energía Eléctrica en el Mercado Eléctrico Mayorista (the Fund for Investments Required to Increase the Electric Power Supply) and Similar Programs, including Central Vuelta de Obligado (CVO) Agreement;

- "p.p.", refers to percentage points;

- "PPA" refers to power purchase agreements.

Disclaimer

Rounding amounts and percentages : Certain amounts and percentages included in this release have been rounded for ease of presentation. Percentage figures included in this release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this release may vary from those obtained by performing the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this release may not sum due to rounding.

This release contains certain metrics, including information per share, operating information, and others, which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company's performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to the performance in previous periods.

OTHER INFORMATION

Central Puerto routinely posts important information for investors in the Investor Relations support section on its website, www.centralpuerto.com . From time to time, Central Puerto may use its website as a channel of distribution of material Company information. Accordingly, investors should monitor Central Puerto's Investor Relations website, in addition to following the Company's press releases, SEC filings, public conference calls and webcasts. The information contained on, or that may be accessed through, the Company's website is not incorporated by reference into, and is not a part of, this release.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This release contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to in this Earnings Release as "forward-looking statements") that constitute forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words ‘‘anticipate'', ‘‘believe'', ‘‘could'', ‘‘expect'', ‘‘should'', ‘‘plan'', ‘‘intend'', ‘‘will'', ‘‘estimate'' and ‘‘potential'', and similar expressions, as they relate to the Company, are intended to identify forward-looking statements.

Statements regarding possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition, expected power generation and capital expenditures plan, are examples of forward-looking statements. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, and contingencies, whichmay cause the actualresults, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The Company assumes no obligation to update forward-looking statements except as required under securities laws. Further information concerning risks and uncertainties associated with these forward-looking statements and the Company's business can be found in the Company's public disclosures filed on EDGAR (www.sec.gov www.sec.gov ).

EBITDA & ADJUSTED EBITDA

In this release, EBITDA , a non-IFRS financial measure, is defined as net income for the period, plus finance expenses, minus finance income, minus share of the profit (loss) of associates, plus (minus) losses (gains) on net monetary position, plus income tax expense, plus depreciation and amortization, minus net results of discontinued operations.

Adjusted EBITDA refers to EBITDA excluding impairment on property, plant & equipment, foreign exchange difference and interests related to FONI trade receivables and variations in fair value of biological asset.

Adjusted EBITDA is believed to provide useful supplemental information to investors about the Company and its results. Adjusted EBITDA is among the measures used by the Company's management team to evaluate the financial and operating performance and make day-to-day financial and operating decisions. In addition, Adjusted EBITDA is frequently used by securities analysts, investors, and other parties to evaluate companies in the industry. Adjusted EBITDA is believed to be helpful to investors because it provides additional information about trends in the core operating performance prior to considering the impact of capital structure, depreciation, amortization, and taxation on the results.

Adjusted EBITDA should not be considered in isolation or as a substitute for other measures of financial performance reported in accordance with IFRS. Adjusted EBITDA has limitations as an analytical tool, including:

- Adjusted EBITDA does not reflect changes in, including cash requirements for, working capital needs or contractual commitments;

- Adjusted EBITDA does not reflect the finance expenses, or the cash requirements to service interest or principal payments on indebtedness, or interest income or other finance income;

- Adjusted EBITDA does not reflect income tax expense or the cash requirements to pay income taxes;

- although depreciation and amortization are non-cash charges, the assets being depreciated or amortized often will need to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for these replacements;

- although share of the profit of associates is a non-cash charge, Adjusted EBITDA does not consider the potential collection of dividends; and

- other companies may calculate Adjusted EBITDA differently, limiting its usefulness as a comparative measure.

The Company compensates for the inherent limitations associated with using Adjusted EBITDA through disclosure of these limitations, presentation of the Company's consolidated financial statements in accordance with IFRS and reconciliation of Adjusted EBITDA to the most directly comparable IFRS measure, net income. For a reconciliation of the net income to Adjusted EBITDA, see the tables included in this release.

Contact information:

Corporate Finance & IR Manager

Pablo Calderone

- Tel: (+54 11) 4317 5000 Ext: 2519

- Email: inversores@centralpuerto.com

- Investor Relations Website: https://investors.centralpuerto.com/

([1]) See "Disclaimer-EBITDA & Adjusted EBITDA" on page 21 for further information.

SOURCE: Central Puerto

View the original press release on accesswire.com