- Fidelity Offers Eligible Employees up to $15,000 to Reduce Student Loan Burden, Available from Day One of Employment

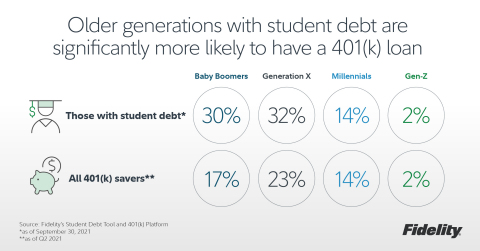

- New Data from Fidelity’s Student Debt Tool Reveals Nearly One-in-Three Boomer and Gen-X Borrowers Also Have Outstanding 401(k) Loans

- Gen-Z Enters Adulthood with $27,900 in Student Debt, Less Than Half of What Baby Boomers Owe

As more than 40 million Americans with federal student loans prepare for the return of required monthly payments and interest accrual, new data from Fidelity Investments, a leading provider of student loan debt solutions to individuals and employers across the country, reveals the true impact of the nation’s student debt burden. An analysis of loans from Fidelity’s Student Debt Tool shows Gen-Z joining the ranks of workers increasingly burdened by debt, while Boomers hold more than twice as much debt as these younger borrowers. To help tackle the issue, Fidelity today announced it will expand eligibility and increase the lifetime maximum loan payment offered to its own associates paying down student debt by 50%, effective in December.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211013005232/en/

Older generations with student debt are significantly more likely to have a 401(k) loan. (Graphic: Business Wire)

“Employers play an important role in helping employees manage the often-overwhelming debt they’ve taken on for education,” said Tom Vogel, head of financial benefits for Fidelity Investments. “We’re excited to provide an expanded Student Loan Assistance program to our associates, as we know these programs can help put people on a path to achieving their long-term financial goals. We expect more than 5,000 Fidelity associates may benefit from this competitive program, which includes a waived waiting period to become eligible so new hires can enroll on day one, and a $15,000 lifetime maximum payment.”

In addition to relieving the financial and emotional pressure on those with student debt, new data from early adopters of the Student Debt Benefits Program for Fidelity’s plan sponsor clients shows a 78% decrease in turnover among employees with student loans, demonstrating the power of student loan assistance when it comes to attracting and retaining top talent1.

“It’s clear that student loan borrowers are juggling multiple priorities above and beyond paying down their debt,” added Jesse Moore, head of Fidelity Investments’ student debt program for Workplace Investing. “Whether it’s Gen-Z borrowers landing their first jobs and starting an emergency fund, or Gen-X and Boomers nearing retirement, student debt can be both a financial and mental barrier to investing and achieving life goals. It’s encouraging to see employers increasingly coming to the table with solutions that meet the changing needs of their workforce, including student loan repayment assistance.”

The National Conversation

As student debt gains attention at the national level, proposed legislation like the SECURE Act 2.0 could provide additional support to student debt borrowers. This legislation would provide opportunities so employees could both pay off student debt and save for retirement by allowing their employer to contribute to their retirement account in the amount they are paying towards their student loans. This holds the potential to help Americans tackle their student loan payments today without sacrificing retirement contributions that will help with their future. Importantly, Fidelity data indicates those with student loan debt are more likely to withhold retirement contributions or take a loan out against their 401(k), which can significantly impact their ability to retire comfortably2.

No Generation Spared: Americans of all Ages Face Debt Burden

While Gen-Z and Millennials continue to battle debt from recent undergraduate and graduate programs, data from Fidelity’s Student Debt Tool reveals Baby Boomers are the most heavily burdened generation when it comes to average monthly payments, total balances, and interest rates. This is likely due to a combination of factors, including career changes that require additional education, as well as loans taken out to finance a child or grandchild’s education, which often carry higher interest rates.

Top 3 Things Borrowers Should Do before Repayment Pause Ends

To prepare for the end of the repayment pause on January 31, 2022, borrowers can take steps to ensure a smooth transition:

- Review the budget to ensure payments will fit back into monthly spending. Data from Fidelity’s Student Debt Tool shows borrowers paying an average of $515 per month against their loans, so borrowers will want to avoid any surprises when repayments resume.

- Confirm that the loan service provider has up-to-date personal and financial information. Many borrowers have moved or had other life changes during the nearly two-year pause on payments, so it’s important to make sure the loan servicer has accurate banking information, especially if automatic payments were used in the past.

- Review the financial plan to see how student debt fits into overall goals. Balancing student debt payments with saving and investing for the long-term can be daunting, so it’s important to take the time to make sure the right repayment strategy is in place.

Fidelity Offers Tools and Resources for Student Loan Borrowers and their Employers

- Aligned with how it approaches student debt with its own employees, Fidelity offers a Student Debt Benefits program that allows companies to design a program that best serves the needs of their specific workforce, which can help with recruiting, improve retention and boost productivity, including: Student Debt: Direct℠, which helps employees with monthly payments toward their loans—these payments can be tax free and integrated with Tuition Reimbursement based on client need; and Student Debt: Retirement℠, which allows employers to make retirement contributions based on student loan payments.

- For borrowers, Fidelity’s free Student Debt Tool allows you to create a singular view of all of loans and view strategies for repayment. Additionally, through the tool borrowers also have access to a student debt refinancing platform, Credible.com3, giving users the ability to compare actual pre-qualified rates from up to thirteen refinancing lenders without affecting their credit score. Fidelity users may be eligible for a $750 bonus when refinancing through Credible—if refinancing your current student debt is a good fit for your situation.4

- For those considering taking on debt for education or working to repay it, Fidelity provides insights online, including Strategies for those Taking on or Paying Down Debt. And to help families avoid taking on more debt than is necessary, these Pre-College Planning Resources can help plan, save, and pay for college.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.2 trillion, including discretionary assets of $4.3 trillion as of August 31, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 38 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 wealth management firms and institutions with investment and technology solutions to drive growth. Privately held for 75 years, Fidelity employs more than 52,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

The Student Debt Contribution Benefit is not a product or service of Fidelity Brokerage Services.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

998679.1.0

© 2021 FMR LLC. All rights reserved.

1 Fidelity analysis of 60 early adopters of the Student Debt: Direct Benefit representing more than 250,000 employees. The overall turnover results were calculated from March 2020–March 2021.

2 The data is derived from over 60,000 Fidelity tool users with over 210,000 loans who shared student loan information representing over 6,000 companies, as of September 30, 2021.

3 Credible Operations, Inc. is not affiliated with Fidelity Brokerage Services, member NYSE, SIPC or its affiliates. Credible is solely responsible for the information and services it provides. Fidelity disclaims any liability arising from use of this information.

4 Residents of California, Connecticut, Louisiana, Maine, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, North Dakota, Ohio, Pennsylvania, Rhode Island, Tennessee, Washington DC, West Virginia, Wisconsin, and Vermont are not eligible for the bonus; bonus paid via e-gift card.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211013005232/en/

Contacts

Contact for Media Only:

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Deanna Spaulding

(617) 563-8359

Deanna.spaulding@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom