In November, home prices across the United States rose at a slower pace than the month prior (October 2021) but continued to appreciate at higher than 2021 average monthly rates. According to the Radian Home Price Index (HPI) released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN), home prices nationally rose from the end of October 2021 to the end of November 2021 at an annualized rate of +17.1 percent. The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211228005120/en/

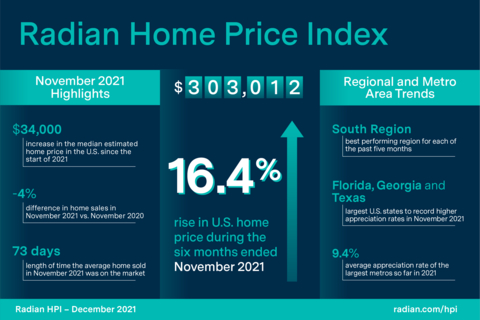

Radian Home Price Index (HPI) Infographic December 2021 (Graphic: Business Wire)

The Radian HPI also rose +13.4 percent year-over-year (November 2020 to November 2021). Through the first eleven months of 2021, the average monthly annualized increase was also +12.8 percent with each of the last five months reporting above average appreciation. Nonetheless, the last two months have been slower than the prior months, falling from this year’s peak (September) of 17.6 percent. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“Typically, going into the winter months the U.S. housing market sees lower sales and less upward pressure on price appreciation, however 2021 has not turned out to be typical. Going into the final months of 2021, we continue to see substantially higher counts of sales transactions than normal, paired with record low seasonal counts of listings,” noted Steve Gaenzler, SVP of Product, Data and Analytics. “2021 appears to be on the precipice of breaking a number of real estate records and while we are unsure what the potential for higher mortgage rates will bring in 2022, the imbalances in demand and supply have exacerbated price movements this year as opposed to normalizing them. We will watch the recent declines in appreciation rates in many areas closely, looking for non-seasonal patterns that may signal winds of change.”

NATIONAL DATA AND TRENDS

- Median home price in the U.S. rose above $300,000 for the first time ever

- Home prices rose an annualized +17.6 percent over the last three months

Nationally, the median estimated price for single-family and condominium homes eclipsed the $300,000 mark for the first time ever, rising to $303,012, representing a more than $34,000 increase so far in 2021. Across the U.S., home prices nationally rose +16.4 percent over the last six months, a strong increase over the prior six-month appreciation rate of +9.6 percent. Ongoing imbalances between housing supply and demand continue to provide solid support for home prices. On the demand side, while November 2021 recorded the lowest level of monthly home sale transactions since March 2021, it still represented the second most sold homes in any November on record. In November of 2021, home sales were only -4 percent lower than the all-time record notched last year (November 2020) even though active listings were more than -15 percent below the prior year. The supply of homes in November, as measured by the count of listings of homes for sale, was the 4th lowest month over the last ten (10) years. The very strong absorption of homes helped keep days on market to sell a home near all-time lows. Last month, the average home sold was on the market for only 73 days, one day longer than October and 5 days above the all-time low recorded earlier this year. Homes listed but not sold averaged 100 days on market, an increase of 6 days from the prior month.

REGIONAL DATA AND TRENDS

- Home price appreciation lower in all but one Region

- Over the last twelve months, South is the strongest U.S. Regional gainer

In November, all but one U.S. region reported slower price appreciation in residential markets. While the slowdowns were generally modest (ranging from a decline of 11 to 60 basis points lower), the Northeast reported a one-month (annualized) appreciation rate of +16.1 percent, 158 basis points lower than the one-month rate of +17.7 percent recoded last month. The South has been the best performing region for each of the past 5 months and recorded month-over-month appreciation rates above +20 percent for the third consecutive month.

In November, twenty-nine (29) of the 51 U.S. states and the District of Columbia reported slower appreciation as compared to the prior month, while the remaining 22 accelerated. Florida, Georgia and Texas were the largest states to record higher appreciation rates in the month, while California, New York, and Illinois were the most populous states recording slower appreciation. While momentum of home price appreciation differs by state, with month-over-month appreciation rates ranging from +3.5 (RI) to +28 (GA) percent, all states are still recording positive home price appreciation. With the exception of Florida and Georgia, smaller states with larger populations of lower-priced homes, more open space, and fewer large metros areas are appreciating the most as compared to states with the largest cities.

METROPOLITAN AREA DATA AND TRENDS

- Large metro area appreciation rates falling

- 2021 is on pace to be one of the most active on record

Across the 20-largest metro areas of the U.S, the second half of the year has recorded more pronounced deterioration of appreciation rates than states or regions, indicating more recent softness in large urban versus smaller urban or rural areas. The average appreciation rate of the largest metros so far in 2021 has been +9.4 percent compared to the average appreciation rate last month of +8.8 percent. When compared to the peak monthly appreciation rate of 2021 by metro, November 2021 is only 62% of the peak, on average. Additionally, for 13 of the top 20 metros, November was the 3rd consecutive month of slower appreciation rates. While a pattern of slower home price appreciation in the winter months is common, we will continue to monitor for non-seasonal changes in metro performance.

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at www.radian.com/hpi, along with information on how to access the full library of indices. Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers subscription access to the entire Radian HPI data set and the Radian HPI Portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance its customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk. Visit www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211228005120/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com