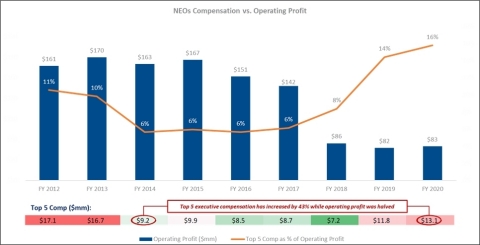

Believes Compensation Committee Leaders Matthew C. Diamond and Joanna Barsh Have Failed for Years to Align Exec Comp With Tangible Business Improvements and Shareholder Value

Highlights Exec Comp has Consistently Risen as Margins have Deteriorated

Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners” or “we”), which collectively with the other participants in its solicitation beneficially owns approximately 5.9% of the outstanding common shares of Genesco, Inc. (NYSE: GCO) (“Genesco” or the “Company”), today issued the below open letter to shareholders regarding the Company’s misaligned executive compensation structure. Learn more about Legion Partners’ case for change and the four highly-qualified candidates it is seeking to elect to Genesco’s Board of Directors (the “Board”) by visiting www.GCOForward.com.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210614005239/en/

Source: SEC Filings, Legion Partners’ estimates. Note: FY 2018 Operating Profit excluded $182mm of goodwill impairments.

***

June 14, 2021

Dear Fellow Shareholder,

Legion Partners and the other participants in its solicitation beneficially own approximately 5.9% of the outstanding common shares of Genesco, making us one of the Company’s largest shareholders. We are asking you to vote on the WHITE proxy card to elect our slate of four highly-qualified nominees – Marjorie L. Bowen, Margenett Moore-Roberts, Dawn H. Robertson and Hobart P. Sichel – as replacements for four long-serving incumbents at the 2021 Annual Meeting of Shareholders.

Notably, two of the directors we are seeking to replace are long-standing members and leaders of the Board’s Compensation Committee:

- Matthew C. Diamond was Chair of the Compensation Committee from 2005 through 2019 and remains a member. He also currently serves as Lead Independent Director and Chair of the Nominating and Governance Committee. Mr. Diamond has served on the Board for more than 20 years.

- Joanna Barsh is the current Chair of the Compensation Committee and has served as a member since 2015. She has spent 40 years at McKinsey & Company, where current Genesco Chairman and Chief Executive Officer Mimi Vaughn worked for several years and former Chairman and Chief Executive Officer Robert Dennis worked for 13 years. Ms. Barsh has served on the Board for nearly eight years.

As key members of the Compensation Committee for years, we believe Mr. Diamond and Ms. Barsh have presided over a misaligned executive compensation structure, effectively rewarding management with unjustified increases in pay during periods of long-term stagnation and sustained underperformance.

We believe one of the Board’s most critical roles as a steward of shareholder capital is to ensure efficient and well-aligned executive compensation structures. This role is especially important at Genesco, which has a combined Chairman and Chief Executive Officer position and apparent interconnectivity among insiders. The way in which directors execute their compensation oversight responsibilities reflects how seriously they take their duties to shareholders and how much they respect our capital.

We Urge Shareholders to Closely Assess Genesco’s Broken Executive Compensation Criteria.

Genesco’s own compensation philosophy states that its program is intended to help the Company achieve its financial and strategic objectives and motivate Genesco’s management through the use of appropriate incentives tied to performance and market value. The Company punctuates its philosophy by claiming it has “the ultimate objective of building shareholder value.”

Unfortunately, we believe Genesco’s program has failed miserably in relation to its intended goals. We also believe the incumbent directors have neglected to take action to correct this clear deficiency despite years of unmistakable evidence of dramatic underperformance. Rather than “building shareholder value,” Mr. Diamond and Ms. Barsh have been key members of a Compensation Committee that created and maintained a program which has driven deteriorating operational performance, lagging total shareholder returns and an increasingly inefficient cost structure – to us, Genesco’s executive compensation program lacks meaningful ties to actual business performance.

Genesco’s annual incentive program is based on a concept known as Economic Value Added (“EVA”), which on its face appears to be an attractive concept. However, as is typically the case, the devil is in the details. The reality is that Genesco’s EVA program is overly complex and has had seemingly little positive impact on operating performance or ultimate shareholders returns, as evidenced by our analysis.

|

|

GCO Relative TSR over Tenure vs. |

|||||||||

Relevant Tenure Periods |

|

Core Peer

|

|

ISS Peer

|

|

|

S&P 1500

|

|

S&P 500 |

|

Russell

|

5-Year |

|

(271%) |

|

(136%) |

|

|

(164%) |

|

(150%) |

|

(147%) |

10-Year |

|

(214%) |

|

(61%) |

|

|

(478%) |

|

(260%) |

|

(185%) |

16-Year (Diamond Chaired Comp. Committee) |

|

(838%) |

|

(251%) |

|

|

(877%) |

|

(326%) |

|

(286%) |

20-Year (Diamond Joined the Board) |

|

(3446%) |

|

(1204%) |

|

|

(1440%) |

|

(246%) |

|

(388%) |

Source: SEC Filings, Legion Partners’ Estimates, Capital IQ – Data as of 04/09/2021 |

(1) Core Peer Group includes BOOT, DBI, FL, SCVL, CAL, DKS, HIBB, WWW, CROX, DECK, SHOO, SKX. |

(2) ISS Peer Group includes ANF, GES, SCVL, BKE, CROX, HIBB, SHOO, ZUMZ, ANF, CAL, DBI, URBN, CHS, EXPR, PLCE, WWW. |

(3) S&P 1500 Footwear Index includes CROX, DECK, NKE, SKX, SHOO, WWW. |

Note: Total Shareholder Return (“TSR”) figures as of respective Board appointment date through 04/09/2021. Assumes that Matthew C. Diamond was appointed on January 1st in his year of appointment due to lack of detailed information. |

What is worse, however, is the Board’s astonishing belief that its EVA program provides sufficient alignment and that there is no need to tie equity awards to performance-based vesting requirements. During Mr. Diamond and Ms. Barsh’s tenures on the Compensation Committee, the Board has granted more than $70 million in equity awards to the Named Executive Officers, and none have included any performance requirements.

As Charlie Munger once stated, “[i]f the incentives are wrong, the behaviors will be wrong. I guarantee it.” In the case of Genesco, Mr. Munger’s prediction rings true, as the utter lack of long-term performance-based requirements in the compensation plan appear to have resulted in predictably poor performance. In fact, if you examine the Company’s performance from the top-line to the bottom-line since Mr. Diamond became the Chair of the Compensation Committee in 2005, you can see that gross margins have declined, operating costs have gone up, and both operating income margin and return on invested capital (“ROIC) have been cut in half or worse.

|

Fiscal Year |

|

'06-'20 |

|||

($mm) |

2006 |

|

2020 |

|

Change |

|

Net Sales |

$1,284 |

|

$2,197 |

|

|

|

Gross Profit |

$652 |

|

$1,063 |

|

|

|

Gross margin % |

50.8% |

|

48.4% |

|

(243bps) |

|

Selling and administrative expenses |

$537 |

|

$966 |

|

|

|

% of Net Sales |

41.9% |

|

44.0% |

|

214bps |

|

Operating income |

$113 |

|

$83 |

|

|

|

Operating income margin % |

8.8% |

|

3.8% |

|

(500bps) |

|

Net earnings (loss) |

$63 |

|

$61 |

|

|

|

Net earnings (loss) margin % |

4.9% |

|

2.8% |

|

(209bps) |

|

ROIC (1) |

21.0% |

|

10.7% |

|

(1,025bps) |

|

Source: Company SEC Filings as reported. Legion Partners’ Estimates |

Note: 1. ROIC is defined as: ROIC = NOPAT / 4Q Trailing Average Debt & Equity, where NOPAT = Reported Operating Profit – Tax Expenses and 4Q Trailing Average Debt & Equity = 4Q Average of Net Debt + Shareholders Equity. Assuming consistent tax rate of 25% |

Legion Partners’ Slate Possesses a Vision for Helping Fix Genesco’s Misaligned Executive Compensation Program.

Shareholders cannot expect a new day at Genesco without first electing the right directors for this pivotal moment in time. Fortunately, the candidates we have nominated have the independence, objectivity and public company experience to help improve the Company’s compensation practices, long-term alignment, and overall operational rigor and performance.

If elected, our nominees will pursue specific improvements to Genesco’s executive compensation program in an effort to provide greater transparency to shareholders and better alignment of interests. Our slate believes this can be accomplished by replacing the Company’s opaque and unnecessarily complicated annual incentive program with straightforward metrics that tie a significant majority of long-term executive compensation to rigorous performance-based equity vesting requirements.

We encourage all shareholders seeking to protect their investment to vote on the WHITE proxy card for our full slate. If you have any questions or require assistance as you consider how to vote, please contact our proxy solicitor (Kingsdale Advisors) at GCO@kingsdaleadvisors.com.

Sincerely,

Chris Kiper |

Ted White |

||||||||

Managing Director |

Managing Director |

||||||||

Legion Partners Asset Management |

Legion Partners Asset Management |

***

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, California. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and high-net-worth investors. Learn more at www.LegionPartners.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210614005239/en/

Contacts

For Investors:

Kingsdale Advisors

Michael Fein / Lydia Mulyk, 646-651-1640

mfein@kingsdaleadvisors.com / lmulyk@kingsdaleadvisors.com

For Media:

Profile

Greg Marose / Bela Kirpalani, 347-343-2999

gmarose@profileadvisors.com / bkirpalani@profileadvisors.com