The nation's overall delinquency rate declined for 7th consecutive month to the lowest level since March 2020

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for October 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220111005462/en/

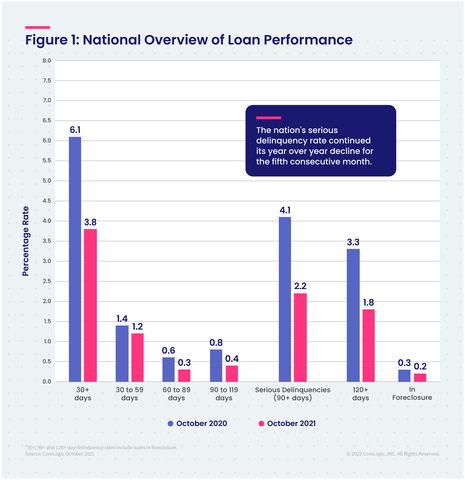

CoreLogic National Overview of Mortgage Loan Performance, featuring October 2021 Data (Graphic: Business Wire)

For the month of October, 3.8% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 2.3-percentage point decrease compared to October 2020, when it was 6.1%.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In October 2021, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.2%, down from 1.4% in October 2020.

- Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.6% in October 2020.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 2.2%, down from 4.1% in October 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% in October 2020. This remains the lowest foreclosure rate recorded since 1999.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, down from 0.8% in October 2020.

After over a year of trying conditions for borrowers, unemployment rates mark an improvement as data from the Bureau of Labor Statistics shows that by October 2021 an estimated 82% of the jobs lost in March and April 2020 were recovered, which translates to roughly 18.2 million Americans back at work. The combination of significant job market improvement, home equity increases and federal assistance programs have helped overall delinquency rates decline to 3.8%, which is close to the October 2019 rate of 3.7%.

“Improving economic security and the benefits of disciplined underwriting practices over the past decade are helping reduce or avoid mortgage delinquencies,” said Frank Martell, president and CEO of CoreLogic. “We expect to see delinquency trend down over the balance of this year as the economy continues to rebound from the pandemic, employment grows and high levels of fiscal and monetary stimulus continues.”

“Economic recovery and loan modification have helped reduce the number of loans that were in serious delinquency by just over one million from the August 2021 peak,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Nonetheless, there were about one-half million more loans in serious delinquency in October than at the start of the pandemic in March 2020.”

State and Metro Takeaways:

- In October 2021, all states logged year over year declines in their overall delinquency rate. The states with the largest declines were: Nevada (down 3.7 percentage points); Hawaii (down 3.6 percentage points); and Florida (down 3.5 percentage points).

- All except two U.S. metropolitan areas posted at least a small annual decrease in their overall delinquency rate. The two areas with annual increases in October 2021 were: Houma-Thibodaux, Louisiana (up 3.4 percentage points); and Hammond, Louisiana (up 0.2 percentage points).

The next CoreLogic Loan Performance Insights Report will be released on February 8, 2022, featuring data for November 2021. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through October 2021. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Robin Wachner at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220111005462/en/

Contacts

Robin Wachner

CoreLogic

newsmedia@corelogic.com