The annual report shows over 14.5 million homes impacted by hurricane, wildfire, winter storm or severe weather

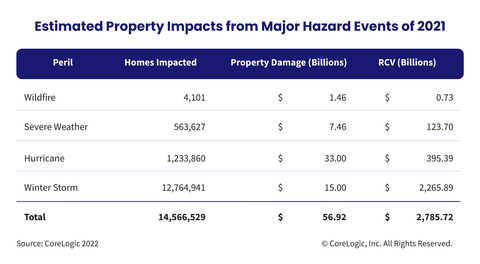

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its 2021 CoreLogic Climate Change Catastrophe Report, revealing over 14.5 million single- and multifamily homes were impacted by the largest natural catastrophe events of 2021, with an estimated $56.92 billion in property damage. This year’s report analyzed thirteen major hazard events of 2021 — from hurricanes and severe weather such as tornados and hailstorms to wildfires and winter storms — to understand how these events have disproportionate yet wide-sweeping effects on properties.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220217005368/en/

Estimated Property Impacts from Major Hazard Events of 2021 (Graphic: Business Wire)

Using its advanced risk modeling technology, CoreLogic analyzed over 120 million residential structures in the U.S. and took a closer look at defining impact. Property impact varies by event — while a wildfire has the potential to consume an entire property, there may also be damage caused by smoke, ash and odor to the neighboring structures that remain standing. While risk comes in various degrees, any sort of property damage can have a compounding effect on the homeowner and economic stability.

“By leveraging granular data for the increasing frequency and severity of catastrophes, we are able to see that more than 14.5 million homes were impacted to some degree by natural hazards in 2021. That’s about 1 in every 10 homes in the United States,” said Tom Larsen, CoreLogic’s principal, Industry Solutions. “Insurers and lenders can leverage the latest technologies and work cross-functionally to better understand this risk, protect homeowners and enable faster recovery times.”

Natural disasters are increasing in frequency and severity, impacting regions underprepared to handle an economic disruption, job displacement and the destruction of real estate assets. Community members are often unable to pay their mortgages or afford reconstruction costs. The report analyzes an area like Houma, Louisiana, which was hit head-on by Hurricane Ida, a category 4 hurricane, in August 2021. At the time of impact, delinquency rates hovered around 7.4%. The following month, the delinquency rate nearly doubled to 13.3% and hit 13.5% in October.

While recovery after a natural catastrophe continues well after the walls are rebuilt, it’s important for insurers, mortgage and financial professionals to harness technology and better anticipate the possible severity of potential disasters. Such preparedness can be meaningful to protecting homeownership, insurer portfolios and shielding the housing stock from collapse.

To download the full 2021 CoreLogic Climate Change Catastrophe Report, which includes maps, charts and images, visit this link.

To take a deeper look at CoreLogic coverage of 2021 natural disasters, visit the company’s natural hazard risk information center, Hazard HQ™, at www.hazardhq.com.

Methodology

To quantify the value of property exposure of single-family and multifamily structures, CoreLogic uses its reconstruction cost value (RCV) methodology, which estimates the cost to rebuild the home in the event of a total loss and is not to be confused with property market values or new construction cost estimation.

Reconstruction cost estimates more accurately reflect the actual cost of damage to, or destruction of, properties that would occur from each hazard peril, since they include the cost of materials, equipment and labor needed to rebuild. The reconstruction cost values in this report are based on 100% (or “total”) destruction of the residential property and do not include the property’s internal contents. The RCV is structure only; damage from an event may cause damage to furniture and interior contents producing a loss potential more than 100% of the RCV. The results illustrate three figures: the total number of residential properties at risk (“homes impacted”); the estimated damage in dollars that occurred to each property and its internal contents, which is not necessarily a total destruction of the structure (“property damage”); and the total current reconstruction cost value of those properties assuming total destruction, excluding internal contents (“reconstruction cost value”).

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220217005368/en/

Contacts

Media Contact:

Robin Wachner

CoreLogic

newsmedia@corelogic.com