- Half (48%) of Small Businesses Worry They Cannot Afford to Offer a Retirement Plan

- 83% of Owners Know They Should be Saving More for Their Own Retirement

- Fidelity Shares Retirement Resources for Businesses of All Shapes and Sizes

Faced with high inflation and market volatility, small business owners today are tasked with recruiting top talent in a tight labor market where employees are expecting more from their employers than ever before. According to Fidelity Investment’s 2023 Small Business Retirement Index, there is an opportunity for small employers to offer competitive retirement benefits with only one-third (34%) of small employers currently offering retirement savings to employees today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230511005084/en/

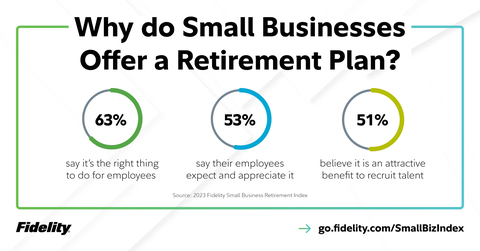

Why small businesses that offer a retirement plan choose to do so, according to Fidelity's 2023 Small Business Retirement Index. (Graphic: Business Wire)

Of those that do not offer a plan, almost half (48%) say they do not believe they can afford one. Other small business owners feel they are too busy running their company to focus on it (22%) and an equal amount (21%) don’t know how to start the process of offering a retirement plan. With nearly half of all U.S. employees working for a small business1, this could leave many individuals unprepared for the future.

“Small business owners are faced with so many challenges as they grow their business, from finding new customers to identifying their next round of funding,” says Andrew Schreiner, senior vice president, small business retirement. “While offering a retirement benefit can feel like a potentially expensive and overwhelming task, there are many retirement saving solutions available for companies of all sizes. In addition to helping their employees establish a secure financial future, a retirement benefit also can have an enormous impact in attracting and retaining top talent.”

When asked what keeps them up at night as small business owners, 54% of respondents said they are most worried about inflation when it comes to running their business, and 37% are worried about employee attraction, retention and well-being. In a tight labor market where small business owners are forced to compete with larger competitors on compensation and benefits, it makes sense that 73% of small business owners believe they can’t compete with larger companies.

Even when it comes to their own retirement, 83% of small business owners know they should be saving more for their futures, but 59% aren’t sure how to maximize their retirement savings.

Concerns Mount Among Microbusiness Owners

Those who are self-employed or are running microbusinesses (with fewer than 10 employees) are most likely to say they cannot afford to offer a retirement savings plan to employees (71%), which helps explain why 55% of these employers do not currently offer a retirement plan and do not plan to do so. While most agree that employees expect to be offered retirement benefits, the vast majority (82%) feel they can’t compete on benefits with larger companies.

When it comes to their own retirement savings, 85% of self-employed/microbusiness owners know they should be saving more for retirement, 75% aren’t sure if they are saving enough, and 42% worry they will never be able to retire. When asked what’s preventing them from saving more, the most common response is that they only earn enough to cover their expenses (42%).

“Self-employed individuals are carrying the entire weight of their business’ success on their shoulders,” says Roger Morrisette, vice president of small business retirement products. “Understandably, many feel they do not have the time or resources to administer a retirement savings plan. The good news is there are many options available. Whether you have one employee or 100, there are affordable, flexible solutions for businesses of all sizes.”

Retirement Solutions for Small Businesses

For small business owners interested in implementing a retirement savings benefit, the good news is that, no matter the size or shape of your business, there are options available to meet your specific needs, including:

- Self-Employed 401(k)s: Intended for self-employed individuals or small-business owners with no employees other than a spouse, these accounts are funded through a combination of employee deferrals and employer contributions, allowing individuals to maximize the amount they can save.

- SEP IRAs: Also intended for self-employed individuals or small-business owners with only a few employees, SEP IRAs are funded solely by employer contributions.

- SIMPLE IRAs: Funded by a combination of employee deferrals and employer contributions, SIMPLE IRAs help self-employed individuals and small-business owners gain access to a tax-deferred benefit when saving for retirement.

- Pooled Employer Plans (PEPs): Designed for small businesses, PEPs, such as the Fidelity Advantage 401(k), allow multiple unrelated employers to participate in one 401(k) plan, reducing many of the obstacles and costs they face when offering a 401(k).

Additional findings from Fidelity Investment’s 2023 Small Business Retirement Index can be found here, and resources on retirement options for small businesses can be found here, as well as in the Viewpoints piece “No 401(k)? How to save for retirement.” Individuals embarking on the entrepreneurial journey can seek guidance in this life-changing step through Fidelity’s “Becoming Your Own Boss” Life Events resources.

About the Survey

This study presents the findings of a Small Business CARAVAN survey among a sample of 504 adults who are owners or partners of U.S. businesses with 1-99 employees. This survey was conducted March 14-21, 2023 by Big Village, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all small business owners or partners meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. With assets under administration of $11.1 trillion, including discretionary assets of $4.2 trillion as of March 31, 2023, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs over 70,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Investing involves risk including the risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney to tax professional regarding your specific situation.

Fidelity Advantage 401(k) is a service mark of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

1085123.1.0

© 2023 FMR LLC. All rights reserved.

1 U.S. Small Business Administration Office of Advocacy

View source version on businesswire.com: https://www.businesswire.com/news/home/20230511005084/en/

Contacts

Fidelity Media Relations

(617) 563-5800

fidelitymediarelations@fmr.com

Kristen Andrews (Fidelity)

(617) 563-2932

kristen.andrews@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts for news from Fidelity