UDF IV is Monitoring Lawsuit Involving NexPoint Founder James Dondero and Trustee Nominee John Good

Urges Shareholders to Vote FOR the Board’s Highly Qualified Trustee Nominees on the WHITE Proxy Card

IRVING, Texas, Nov. 18, 2024 (GLOBE NEWSWIRE) -- United Development Funding IV (“UDF IV” or the “Trust”) mailed a letter to shareholders highlighting NexPoint-managed fund NexPoint Diversified Real Estate Trust’s troubling recent performance and a lawsuit involving NexPoint founder James Dondero and NexPoint trustee nominee John Good.

The full text of the letter to shareholders follows:

Dear UDF IV Shareholders,

Your vote in the trustee elections to be held at the Annual Meeting of Shareholders (the “Annual Meeting”) on December 10, 2024 will determine the future of your investment in United Development Funding IV (“UDF IV” or the “Trust”). As we’ve shared in previous letters, NexPoint Real Estate Opportunities, LLC, an indirect subsidiary of NexPoint Diversified Real Estate Trust (NXDT, and collectively with its affiliates, “NexPoint”) is attempting to take control of the Trust for its own gain.

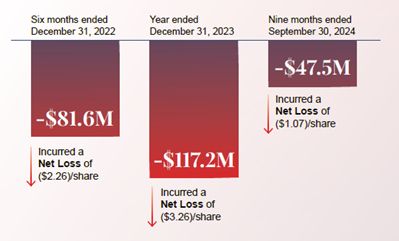

NXDT’s recently reported financial results for the third quarter of 2024 are a troubling sign for what may lie ahead should NXDT succeed in securing control of the Trust’s Board. According to their publicly filed disclosures, NXDT continues to deliver concerning financial results. To make matters worse, to date, NXDT has not issued a press release or held an investor call to discuss its poor performance in the third quarter.

Shareholders should view this as a cautionary tale. If NexPoint is unable to successfully and transparently manage its own fund, how could it be trusted to manage UDF IV?

NXDT Delivered Another Poor Performance in Q3 20241…

- $5.9 million operating loss

- $15.4 million net loss

…Racking Up More Losses for Shareholders

According to its own financial reports, NXDT has lost over $246 Million since July 2022.1 2

Concerns Regarding Allegedly False & Misleading Disclosure

We’ve also been monitoring a shareholder class action lawsuit3 involving James Dondero, NexPoint’s founder, and John Good, one of the trustee candidates NexPoint has nominated for election to your Board. Good previously served as CEO and Board Chair of Jernigan Capital (“JCAP”), which was acquired by NexPoint and renamed NexPoint Storage partners, where Good still serves as CEO today. Dondero was a member of JCAP’s Board of Directors.

Alleged Withholding of Material Information

The lawsuit alleges that JCAP’s merger proxy statement was materially false and misleading. The lawsuit alleges, among other things, that the merger proxy statement withheld material information from shareholders in order to facilitate the sale of JCAP to NexPoint at a discounted price. Specifically, the lawsuit alleges that the merger proxy statement failed to disclose that a competing REIT was providing $300 million to finance the transaction in exchange for seats on the board of the new company and property management rights for 37 JCAP facilities. The lawsuit argues that if shareholders had been aware of this development, they may have pushed for a higher sale price.

Conflicting Financial Projections

The lawsuit also claims that JCAP’s merger proxy statement provided financial projections that conflicted with those used in a February 2020 transaction where shareholders approved JCAP’s internalization of its external manager. The financial projections in the merger proxy statement suggested there would be a significant downturn in JCAP’s performance compared to the earlier projections used for the internalization; however, the merger proxy statement failed to disclose enough information for shareholders to reconcile this disparity. The lawsuit alleges that both sets of projections were advantageous to JCAP management: optimistic projections were used for the internalization transaction and pessimistic projections were used for the merger, which triggered additional “earn-out” benefits for JCAP management.

Protect Your Investment by Voting “FOR” The UDF IV Board Trustee Nominees TODAY

You can stop NexPoint’s nefarious and self-serving campaign. Vote on the enclosed WHITE proxy card “FOR” ONLY the Board’s four nominees – Lawrence S. Jones, Phillip K. Marshall, Steven J. Finkle, and J. Heath Malone – today to support the Board that continues to act in your best interest.

Thank you again for your continued support.

Sincerely,

The UDF IV Board of Trustees

UDF IV shareholders with questions or who require assistance with respect to voting their shares are encouraged to contact UDF IV’s proxy solicitor:

INNISFREE M&A INCORPORATED

Shareholders may call:

1 (877) 750-9496 (toll-free from the U.S. and Canada) +1 (412) 232-3651 (from other countries)

About United Development Funding IV

United Development Funding IV is a Maryland real estate investment trust. UDF IV was formed primarily to generate current interest income by investing in secured loans and producing profits from investments in residential real estate. Additional information about UDF IV can be found on its website at www.udfiv.com. UDF IV may disseminate important information regarding its operations, including financial information, through social media platforms such as Twitter, Facebook and LinkedIn.

Forward-Looking Statements

This release contains forward-looking statements relating to, among other things, the Annual Meeting, the continued actions of the current UDF IV Board and the potential future of UDF IV under NexPoint’s control. These forward-looking statements are based on management’s current expectations and are not guarantees of future performance or future events. Such forward-looking statements generally can be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” or other similar words. Readers should be aware that there are various factors, many of which are beyond UDF IV’s control, which could cause actual results to differ materially from any forward-looking statements made in this release including, among others, the results of the trustee elections at the Annual Meeting. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this letter. UDF IV undertakes no obligation to update its forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Contact:

Investor Relations

1-800-859-9338

investorrelations@umth.com

Media Contact:

Mahmoud Siddig / Lucas Pers / Dylan O’Keefe

Joele Frank, Wilkinson Brimmer Katcher

(212) 895-8668

1 NXDT Form 10-Q for the quarterly period ended September 30, 2024

2 NXDT Form 10-K for the fiscal year ended December 31, 2023

3 Complaint, Erickson v. Jernigan Capital, Inc. et al, Case 1:20-cv-09575-JLR-KHP (SD New York, filed 11/13/2020) and Erickson v. Jernigan Capital, Inc., 692 F. Supp. 3d 114 - Dist. Court, SD New York 2023

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0da2a11d-b721-4292-8401-0ac709a6dba4