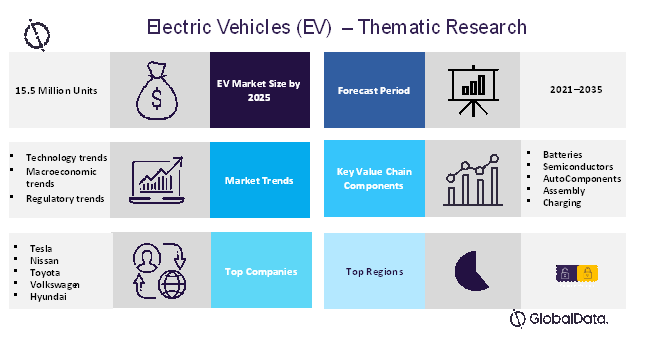

The latest publication titled Electric Vehicles (EV) – Thematic Research by GlobalData Plc has evaluated the electric vehicles market to rise by over 15.5 million units by 2025. The report further predicts the market to grow to 24.1 million annual units by 2028 while occupying a 22.5% share of the total light vehicle production. This percentage will continue to grow into the 2030s when EVs will ultimately account for most light vehicle production.  View Report Outlook for Unlocking More Report Features The widely reported environmental damage from combustion-powered transport has led governments around the world to announce cut-off dates for the sale of combustion-powered light vehicles. This is being met by growing consumer demand for EVs led by desirable models from both novel startups and established players. China’s ascent in the electric vehicles market growth was driven by favorable government incentives that pushed buyers toward electrified options. Furthermore, companies including Tesla, Ford, GM, and Stellantis are expected to invest in North American production capacity in the coming decade, and the continent’s regional share of EV production will trickle back up and settle at around 19% of the total by 2031 and hold that position through to 2036. Read a FREE Sample Report for additional regional insights Electric Vehicle Market Trends

View Report Outlook for Unlocking More Report Features The widely reported environmental damage from combustion-powered transport has led governments around the world to announce cut-off dates for the sale of combustion-powered light vehicles. This is being met by growing consumer demand for EVs led by desirable models from both novel startups and established players. China’s ascent in the electric vehicles market growth was driven by favorable government incentives that pushed buyers toward electrified options. Furthermore, companies including Tesla, Ford, GM, and Stellantis are expected to invest in North American production capacity in the coming decade, and the continent’s regional share of EV production will trickle back up and settle at around 19% of the total by 2031 and hold that position through to 2036. Read a FREE Sample Report for additional regional insights Electric Vehicle Market Trends

- Technology Trends

- Speed of battery technology improvement

- Competing cathode chemistries

- Tesla’s rivals are closing in

- EV technology as a competitive advantage

- Threat from hydrogen fuel cells

- Improving battery management systems

- Battery swapping stations

- Battery price parity with combustion engines

- Battery pack rightsizing

- Macroeconomic Trends

- Chip shortage

- COVID-19

- Employment moving towards EVs and EV components

- Raw material supply

- Infrastructure expenditure

- Regulatory Trends

- Agreements to ban sales of combustion-powered cars

- Drive to lower CO2 emissions

Request for a Sample PDF to know more about each trend in detail! Electric Vehicle Value Chain Components In this value chain, traditional auto suppliers must rapidly retool and gather new product knowledge to serve this new category of vehicle or risk losing market share as EVs become more prevalent. New players will also seek to jump into the mix—many from adjacent tech fields—tempted by the promise of big rewards for supplying key components to the brace of new electric vehicle projects that will launch in the coming years. The main value chain components are:

- Batteries

- Battery raw materials

- Battery components

- Battery cells

- Semiconductors

- Auto semiconductors

- Auto components

- Electric drivetrains

- Tier-1 auto components

- Assembly

- EV assembly

- Charging

- EV charging stations

- EV charging equipment

To understand each value chain component in detail, Fetch Sample Report Right Here! Electric Vehicle Market Vendor Landscape For established players, we expect stress and strain on their bottom lines as the cost of converting vehicle lineups to battery-electric power begins to bite. Startups will also present significant disruption thanks to fielding ‘clean sheet’ EV designs that do not have to compromise to factor in legacy strategies of repurposing existing ICE-powered platforms. All legacy automakers including Toyota, Volkswagen, Tesla, and GM among others have now launched EV strategies. Notable examples include GM with its Ultium range of batteries and EV components that will begin to trickle down through the range from the GMC Hummer EV, BMW’s new iX and i4 electric models, and Daimler with its Tesla-baiting EQS and EQE sedans. Top EV Market Players

- Arrival

- BAIC

- BMW

- BYD

- Byton

- Canoo

- Chang’an

- Dongfeng

- FAW

- Ford

- Foxconn

- GAC

- Geely

- General Motors

- Great Wall Motors

- Honda

- Hyundai

- Jaguar Land Rover

- Li Auto

- Lucid

- Mazda

- Mercedes-Benz

- Nikola

- NIO

- Nissan

- Renault

- Rimac

- Rivian

- SAIC

- SAIC-GM-Wuling

- Stellantis

- Tesla

- Toyota

- Volkswagen

- Volvo

- Weltmeister

- Xpeng

Get a Sample PDF to know about the product offerings of each contributing vendor Related Reports: Electric Vehicles Market Size, Share and Trend Analysis by Sales, Charging Infrastructure, Policies, Incentives, Key Countries, and Forecast, 2020-2030 Autonomous Vehicles Market and Trend Analysis by Technology, Key Player, and Forecast, 2021-2036 About GlobalData GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. As a leading information services company, thousands of clients rely on GlobalData for trusted, timely, and actionable intelligence. Our mission is to help our clientele ranging from professionals within corporations, financial institutions, professional services, and government agencies to decode the future and profit from faster, more informed decisions. Continuously enriching 50+ terabytes of unique data and leveraging the collective expertise of over 2,000 in-house industry analysts, data scientists, and journalists, as well as a global community of industry professionals, we aim to provide decision-makers with timely, actionable insights. Media Contacts: Mark Jephcott Head of PR EMEA mark.jephcott@globaldata.com cc: pr@globaldata.com +44 (0)207 936 6400