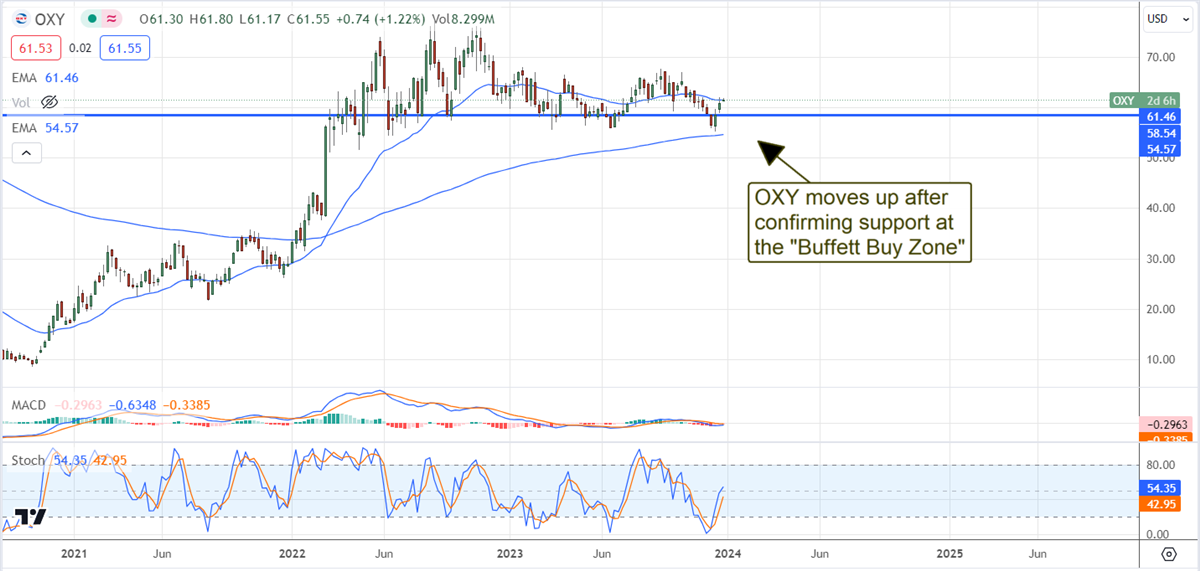

The price action in Occidental Petroleum (NYSE: OXY) has been range-bound for the last two years and may not break out of the range soon. However, the stock retreated to the low end of the range in December and sparked another round of purchases by Berkshire Hathaway. This is not surprising; the $58.50 level has marked the “Buffett Buy Zone” for the last two years and triggered multiple purchases by the same.

The question is, if Buffett is an investing genius (he is) and he keeps buying Oxy stock, there must be a reason, and if there’s a reason for him to buy it, it makes sense there’s a reason for the average investor to own some, too.

That reason is cash flow. Like all the major oil companies, Occidental is experiencing some of the healthiest cash flow in its history. The combination of tightened OPEC supply, stable and growing energy demand, and record non-OPEC production has the industry set up to do the same in 2024. What this means for Occidental is an opportunity to pay down debt, improve its capital structure, strengthen its balance sheet, buy back shares and pay dividends—a total package for investors.

Occidental has a robust cash flow and uses it to enhance value

Highlights from the Q3 results include $3.1 billion in operating cash flow minus working capital and more than $1.7 billion in free cash flow. The free cash flow and balance sheet strength allowed the repurchasing of $600 million of shares and the redemption of $342 million in preferred stock. The preferred stock redemption brings the YTD repayments to about 15% of the total debt, significantly impacting the balance sheet and shareholder value. Net debt is down 9% YOY, with shareholder equity up 20%.

Because Berkshire Hathaway owns the preferred stock, and we expect OXY to continue paying down debt, we can also expect the company to buy more OXY. As it is, Berkshire owns almost 28% of the company and can purchase another 22% before maxing out its authorization.

Occidental will report Q4 results in late February. The analysts expect another quarter of YOY decline and sequential weakness that may underestimate demand and operational quality. The company has outperformed production estimates all year, and demand has been solid if the outlook is cloudy. In 2024, the company is expected to grow revenue by 8%, widen margins, and grow earnings by 20%.

The salient point is that Occidental is set up to return to growth in F2024 and may significantly outperform current estimates if the Fed starts cutting rates. Regardless, Occidental is only expected to improve operational results in 2024, and its current cash flow is sufficient to support a robust outlook for shareholder value and capital returns. The dividend is a low yield at roughly 1.15% but incredibly safe and expected to grow as debt comes down and cash flow improves.

Analysts sentiment shifts; OXY tailwind begins to blow

The analyst activity in OXY has been mixed this year and continues to be mixed, but the trend has shifted. The consensus sentiment lifted to Moderate Buy from Hold following an upgrade by Morgan Stanley. The consensus price target is still down compared to last year but has begun to rise, implying a 15% upside. Assuming this continues, analysts' sentiment should help lift the market as we get into 2024 and the year progresses.

The price action in OXY is moving higher after confirming support at the bottom of its range. The bottom of the range is the Buffett Buy Trigger; current action shows the market moving up from that level. The first target for significant resistance is near $67.50 and may be reached soon. A move up to $75 is likely if the market gets above. Beyond that, it depends on the 2024 results.