What once started as a simple online store selling books, Amazon.com Inc (NASDAQ: AMZN) is now at the top of the E-commerce realm and still expanding into what has been called the ‘oil of the 21st century’.

As artificial intelligence trends take off and give businesses greater insight and opportunities, Amazon’s expansion into data centers and cloud computing creates a multi-generational opportunity for investors.

Once strictly a consumer discretionary play, Amazon stock now offers an investment in everyday necessities with the lower risk profile of consumer staples stocks.

In this analysis, investors will gain insight into Amazon’s exposure to some of the largest and fastest-growing trends in the global economy. In addition to its business ventures, Amazon has also looked into healthcare and even groceries to expand its reach, which, in the end, is all about data.

More than that, as the global economy becomes more digitized, it will be less about E-commerce and business services and more about data and quantum computing that will interest investors looking to compound their wealth.

Amazon’s Dominance in E-Commerce and Cloud

Several YouTubers and financial ‘gurus’ became advocates for Amazon’s business model. The fulfillment by Amazon (FBA) structure allows everyday entrepreneurs to set up shop and sell products online.

Amazon’s platform is a business-to-consumer (B2C) platform, and its value chain from wholesale to retail makes it attractive in today’s global marketplace.

Not to be confused with another worthy opponent, Alibaba Group (NYSE: BABA), since the Chinese E-commerce player focuses on business-to-business (B2B) models. Amazon’s consumer obsession and strategic exposure to small businesses earned it the throne it sits on today.

In the U.S., this throne represents a 37.6% (as of 2023) market share of retail E-commerce companies. The gap to second place is significant, as Walmart Inc. (NYSE: WMT) takes only 6.4% of the market. This deep market penetration came about from the core online model, connecting buyers to sellers and adopting the fulfillment center.

Building a logistics network nationwide and expanding internationally, Amazon’s delivery and logistics efficiency is bar none to competitors like Walmart and even traditional shipping companies like United Parcel Service Inc. (NYSE: UPS).

The dominance didn’t stop there; Amazon understood the importance of the online economy from an early age. Amazon Web Services (AWS) is now the benchmark for large corporations to gain insights and solutions for their business processes.

As of the fourth quarter of 2023, AWS took 31% of the global cloud infrastructure. Microsoft Co. (NASDAQ: MSFT) took second place at 24% through its Azure offering. Alibaba’s Cloud took 4% of the global market share, showing investors who the boss is in this area.

Amazon’s cloud computing solutions are the backbone of global online businesses, which is precisely the bet Amazon wanted to win. The world’s economy lives in the cloud. AWS’s flexible pay-as-you-go structure, reliability, and brand loyalty justify its market share today.

Financial Performance Overview

[content-module:CompanyOverview|NASDAQ:AMZN]

Being a $1.8 trillion market capitalization company would typically make achieving high growth digits in financial performance difficult, but that’s not an obstacle for Amazon’s business.

In the fourth quarter of 2024, in the press release of the quarterly results, investors can see the leading headline pointing to 14% revenue growth over the year. Microsoft’s revenue jumped 18% over the year. However, investors must remember that Amazon’s philosophy focuses more on the long term.

Long-term focus means sacrificing profits today to take over more market share so it can be monetized more monopolistically in the future. Not raising prices and keeping shipping and other costs low keeps Amazon’s revenue growth at bay, but not to worry.

AWS sales jumped by 13% over the year, compared to Azure’s 30% increase during the same period. Investors will see this constantly in Amazon’s financials, though management keeps investors happy through what matters.

Amazon's earnings per share (EPS) jumped from $0.03 in 2022 to $1.00 in 2023, a stratospheric rise. Microsoft’s EPS rose by 33% during the year, showing that Amazon—while giving up some of the inflationary revenue growth—is the better-managed and arguably the more profitable business.

Regarding profitability, Amazon’s return on equity (ROE) stood above 17% during the past five years. Amazon’s net profit margin is only 5% to 7%, and it still generates market-leading ROE; as market share keeps increasing and pricing power is acted upon, investors could expect returns and profitability to double or even triple.

While speculative, it isn’t far from Amazon’s historic financial performance. A business that burned through cash for years as it undercut competitors to gain market share is now one of the largest empires in the world’s leading economies. Its mission remains the same: Give up profits to gain more control.

Here is where the multi-generational factor comes in. It may be a few years before management decides to turn on the monetization button and rake in the true margins the company could have.

Technological Innovations and Market Expansion

Artificial intelligence is at the heart of Amazon’s business. Without robotics and A.I., Amazon’s structure would surely fall behind other aggressive competitors.

Investing up to 13% of its revenues into technology and infrastructure, Amazon focuses not on releasing the best-looking quarterly profits but on securing its position as a global technological leader.

Some recent improvements have been made in Amazon warehouses, such as the Sparrow robotic system. This robotics infrastructure improved the handling and efficiency of the fulfillment process, as the A.I.-based system works alongside Amazon’s inventory handlers to reduce costs and push for productivity.

Amazon’s exclusive deals with custom electric vehicles (EVs) from Rivian Automotive Inc. (NASDAQ: RIVN) significantly boost the delivery experience. These delivery vans come equipped with Fleet Edge, an integrated GPS system that keeps Amazon delivery partners (ADP) on a safer and faster route for customer satisfaction.

Taking a page from a sci-fi book, Amazon is now entering Prime air drone delivery services. Advertising faster-unmanned delivery services and receiving Amazon orders could be a reality for customers when the U.S. government deems it safe for the overall population.

Last, Amazon started the Amazon Clinic, a chat-based virtual care platform focused on data collection and exposure to health and consumption preferences insights.

This opens up Amazon to a world of new revenue potentials, as healthcare providers and government entities may call upon AWS to help them understand new insights into diseases and other disorders.

Analysis of Amazon Stock Trends

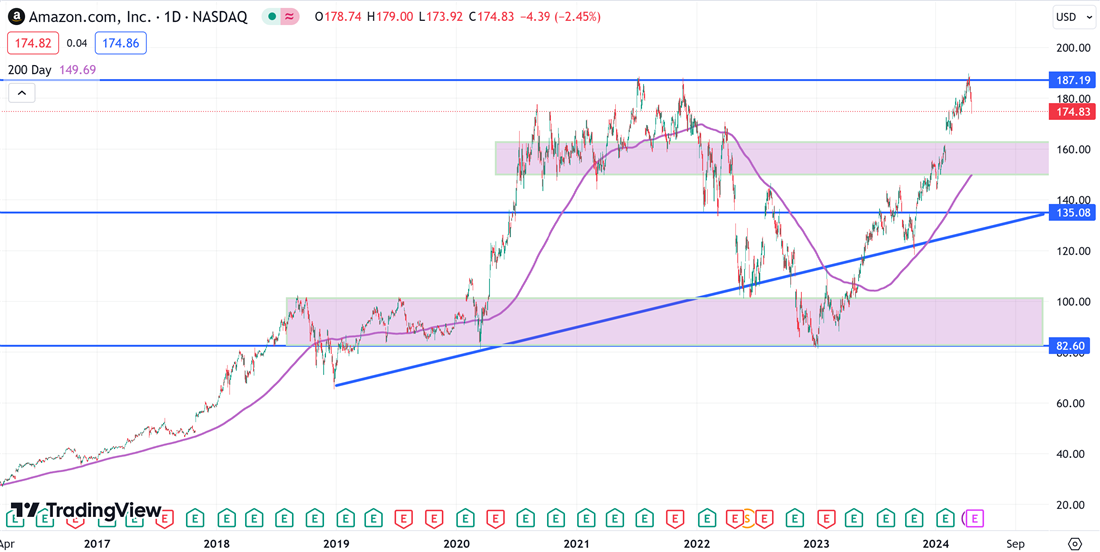

Now that the stock is flirting with new all-time highs, investors may be wary of a potential peak ahead. Though unlikely, an inflation-choked consumer could pose a threat to Amazon’s business, and potential buyers could wish to wait for better prices.

Following historical price action, investors can identify (purple boxes) significant demand zones for the stock. The most proximate zone, also acting as a 23% Fibonacci retracement, is $150 through $163 a share. A stock like Amazon isn’t likely to retrace past these Fib levels, portraying a potential entry point for bargain hunters.

Fundamentally, the break could come as markets await a more apparent trend in the U.S. business cycle. Now that the ISM services PMI index is slowing down for the quarter, business services like AWS could see a hiccup in demand.

However, now that the Federal Reserve (the Fed) is proposing interest rate cuts for the year, the business cycle could see a reboot to expansion, stipulated to be as soon as September 2024, according to the CME’s FedWatch tool.

On a more technical level, the company's average true range (ATR) acts as the S&P 500's volatility index (VIX). During the uncertain times of 2022 and 2023, when the markets digested the Fed's interest rate hikes and stubbornly high inflation rates, Amazon's ATR rose to a cyclical high of 5%.

Now that the market is more confident of the economy’s direction, this measure declined to 1.5%. Despite a recent market sell-off and a rising VIX, Amazon stock participants remain rooted in the stock’s direction. Where this direction could go is up to debate, though Wall Street has a good idea.

Current Investor Sentiment and Analyst Ratings

Analyst price targets stand at a consensus of $202.8 a share, with those at Wells Fargo & Co. (NYSE: WFC) pushing as high as $217 a share, calling for a net upside of 24% upside from today’s prices.

On a sentiment basis, Amazon’s score of 0.78 stands higher than the retail/wholesale sector average score of 0.49. As was mentioned, Amazon’s flexible business exposure gives the stock a relatively low beta of 1.16.

Microsoft’s 0.88 beta comes from being a more established and niched business, and investors have a much higher upside potential with Amazon’s beta and diversified company, which are exposed to some of the world’s fastest-growing industries.

Investors can gauge this sentiment further through institutional investment levels. Over the past 12 months, Amazon stock has attracted up to $87.8 billion in institutional investments, bringing total institutional ownership up to 72.2%.

Despite proposing a potential double-top pattern, bears have made no attempt to short this stock. Short interest declined by 3.1% over the past month, and the net percentage of shares shorted stood at a dismal 0.7%. Bulls dominate sentiment for Amazon stock.

Projections and Future Outlook

Looking ahead for Amazon stock, investors can expect secular trends to keep increasing the company’s valuation. Today, the stock’s price-to-earnings (P/E) valuation reached levels not seen since 2010, building the foundational pillar of undervaluation every value investor looks for.

Wall Street analysts expect the company’s earnings per share (EPS) to rise by 30% this year, beating Microsoft’s projections of 13.3%. Because of these optimistic projections, markets are premium-valuing these earnings through the forward P/E method.

Valued at 32.8x forward P/E, Amazon stock is 56% premium to internet commerce’s average 21x valuation. There must be a reason why markets are willing to overpay for Amazon stock relative to peers, and now investors have a good idea why.

Investors should also remember that the potential interest rate cuts this year could create a new bull cycle for consumers and small businesses that rely on both AWS and FBA. Now that the U.S. consumer sentiment is at a three-year high, investors may have the best odds in their favor by siding with Amazon stock.