“We are drilling both Homestake deposits with ‘oriented core’, which gives us the structural measurement of the vein, how it sits in real space. We are using that to develop a model.”

—

Global Stocks News – On January 16, 2024 Dolly Varden Silver (TSXV:DV) (OTC:DOLLF) released exceptional drill results from its 2023 program at the Homestake Silver deposit in BC's Golden Triangle, including an intersection of 357 grams/tonne silver equivalent, the length of city block (93.95 meters).

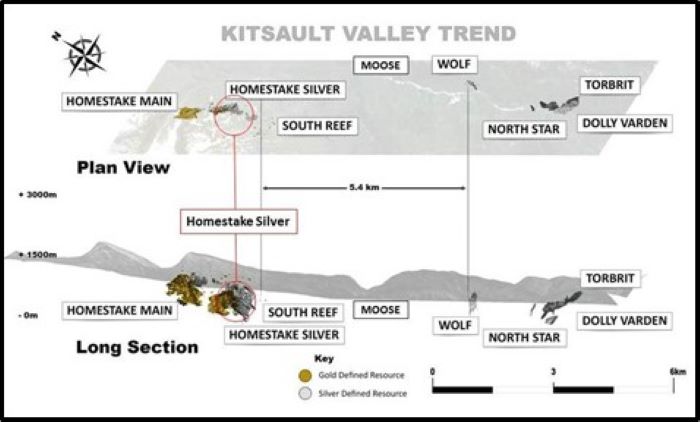

DV Silver is developing its 100% held Kitsault Valley Project located in the Golden Triangle of British Columbia, Canada, 25 kilometers by road to tide water. It also has a new consolidated copper-gold porphyry project in the Golden Triangle, similar to other deposits in the region (Red Mountain, KSM, Red Chris).

“We acquired Homestake at the beginning of 2022, and it doubled the size of our project,” Rob Van Egmond, V.P. DV Silver’s VP of Exploration told GSN’s CEO Guy Bennett. “It had about million ounces of gold, mainly in the inferred category, and about 18 million ounces of silver all in the inferred category.”

“Homestake is split between three deposits,” Egmond continued. “The main two are Homestake Main and Homestake Silver. The first year we did infill drilling at Homestake Main to make sure the continuity and grade lined up with the stated resource. That was successful. The infill holes had higher grades than the resource.”

“We are drilling both Homestake deposits with ‘oriented core’, which gives us the structural measurement of the vein, how it sits in real space. We are using that to develop a model.”

The 23 drillholes reported total 12,150 meters of drilling targeting priority zones within the deposit and have significantly expanded the width and extent of the reinterpreted high-grade silver and gold mineralized plunge.

Highlights from Homestake Silver (intervals shown are core length**):

- HR23-419: Mineralized envelope: 315 g/t AgEq (2.57 g/t Au and 102 g/t Ag) over 79.20 meters.

- HR23-416 Mineralized envelope: 357 g/t AgEq (1.74 g/t Au, 213 g/t Ag) over 93.95 meters.

- HR23-415: Mineralized envelope: 630 g/t AgEq (5.11 g/t Au and 206 g/t Ag) over 22.80 meters

- HR23-413: Mineralized envelope: 226 g/t AgEq (1.40 g/t Au and 110 g/t Ag) over 40.00 meters.

- HR23-407: Mineralized envelope: 246 g/t AgEq (2.32 g/t Au and 54 g/t Ag) over 55.90 meters.

- HR23-411: Expansion step out hole to the southeast; 445 g/t AgEq (0.91 g/t Au and 369 g/t Ag) over 10.55 meters.

**Estimated true widths vary depending on intersection angles and range from 65% to 85% of core lengths, further modelling of the new interpretation is needed before true widths can be calculated

"The 2023 drilling at Homestake Silver has identified a substantial zone of exceptional precious metal grades, often typified by multiple phases of silver and gold mineralization, over wide, continuous intervals that are potentially amendable to bulk underground mining methods," stated Shawn Khunkhun, CEO of Dolly Varden Silver.

Bulk mining generally has lower mining costs associated with it, allowing for a lower cut off grade bringing in more material, increasing the tonnage per day and number of ounces mined.

“Some of these old, narrow vein deposits don't work in the modern era,” Khunkhun told Guy Bennett, the CEO of GSN. “You don’t want to be chasing narrow veins, hand sorting material. Our goal is that Dolly Varden Silver will create an efficient, highly mechanized mine with a low All-In-Sustaining-Cost (AISC).”

Drilling targeted the high-grade plunge within the Homestake Silver deposit. These holes focused on defining and expanding the wide gold and silver (+/- lead and zinc) mineralized zone.

The reinterpretation concluded that the wider mineralization zone at Homestake Silver is at a similar plunge orientation as that of the Homestake Main deposit, located 300 meters to the northwest.

The average grades are higher, on a precious metal silver equivalent basis, than the average grade of the silver deposits at the Dolly Varden property to the south due to the increased gold content at the Homestake Ridge deposits.

Results from additional step-out holes to the north of the intercepts reported on January 16, 2024 are being finalized and are expected to be announced shortly.

On November 2, 2023 Dolly Varden Silver announced that it has closed a deal where Hecla Canada invested $10 million in DV Silver, raising its stake in DV Silver from 10.6% to 15.7%.

Hecla Mining has a market cap of USD $2.59 billion and trades on the New York Stock Exchange (NYSE). It produced 14.2 million ounces of silver in 2023.

“Hecla has demonstrated it is a sticky shareholder,” Khunkhun told Bennett, “They're looking to expand their North American silver portfolio.”

“Global industrial demand for silver in 2023 is expected to set a record leading to another big market deficit, according to preliminary projections by the Silver Institute,” reports FX Street on January 8, 2024.

“Falling silver production in Mexico seems to be developing as a trend. The country has historically ranked as the world's top silver producer, but Mexican mine output has dropped 25% in the last two years,” continued FX Street.

“The photovoltaic industry is essentially recession-proof due to support from governments around the world. While industrial offtake accounts for roughly half of global silver demand, at its core, silver is a monetary metal. It tends to track with gold over time.”

“The current silver-gold ratio is just over 87-1. That means it takes over 87 ounces of silver to buy an ounce of gold. The average in the modern era has been between 40:1 and 50:1. Historically, the ratio has always returned to that mean. And when it does, it does it with a vengeance,” added FX Street.

“The latest results from Homestake Silver - including 93 meters at 357 grams AgEq per tonne - indicate that the mineralised envelope is wider and higher grade than we had thought,” Van Egmond told Bennett.

“The drill comes in at angle, so the true width is about 50-60 meters,” Egmond continued. “This suggests a deposit that is amenable to bulk underground mining, which would bring the cut-off grade down, add more tonnes, and lower mining costs.”

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the "Qualified Person" as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this GSN news update and supervises the ongoing exploration program at the Dolly Varden Project

Contact: guy.bennett@globalstocksnews.com

Contact Info:

Name: Guy Bennett

Email: Send Email

Organization: Global Stocks News

Website: http://www.globalstocksnews.com

Release ID: 89119046

In the event of any inaccuracies, problems, or queries arising from the content shared in this press release, we encourage you to notify us immediately at error@releasecontact.com. Our diligent team will be readily available to respond and take swift action within 8 hours to rectify any identified issues or assist with removal requests. Ensuring the provision of high-quality and precise information is paramount to us.