Third Quarter 2023 GAAP Revenue of $21.9 million and Pro Forma1 Revenue of $28.9 million, up 6.2% Year-Over-Year on a Pro Forma Basis and On Track To Meet Full-year 2023 Guidance

LOS ANGELES–Surf Air Mobility Inc. (NYSE:SRFM) (“Surf Air”), the air mobility platform transforming regional flying through electrification, today reported its third quarter results and announced that it remains on track to meet its full year 2023 guidance. Please visit the Surf Air Mobility investor relations website at investors.surfair.com for more information and to listen to the accompanying earnings call.

BUSINESS HIGHLIGHTS

- Completed public listing on the NYSE, allowing Surf Air to close our merger with Southern Airways and solidify our contractual agreements with strategic partners Textron Aviation, Jetstream Aviation Capital, and GEM Global Yield.

- Confirmed our order with Textron Aviation and paid the deposit for the purchase of 100 Cessna Grand Caravan EX aircraft, with 11 to be delivered into service during 2024.

- Purchased a number of spare engines to mitigate the industry-wide supply chain issues and return the fleet to normal operations over the next one to two quarters.

- Saw a sizable increase in our On-Demand business with 63% growth in flights year-over-year for the third quarter on a pro forma basis, and 55% growth in flights year-over-year for the nine months year-to-date on a pro forma basis.

- Made significant progress on the buildout of our Electrification business by finalizing a data license agreement with Textron Aviation, thus de-risking the electrification timeline.

- Advanced the engineering and design specifications of our electrification program in collaboration with our lead partner, AeroTEC. Additionally, we are actively engaging with supply chain vendors to source the key components for our electrified powertrain.

- Finalized our exclusive sales and marketing agreement with Textron Aviation that Surf Air anticipates will activate a viable channel to significant market share with our electrified powertrains.

- Forged a partnership with REGENT – a company pioneering all-electric Seaglider airships – to be their launch customer in Hawaii, and to establish a base of operations for passenger service in South Florida, the Bahamas, and the Caribbean.

- Restructured our funding facility with GEM with new terms providing more flexibility in how, and when, Surf Air makes cash draws, providing on-going access to up to $400 million of capital.

“We are making solid progress toward our long-term goal of expanding the airline network and advancing our electrified aircraft program with proprietary powertrain technology. Over time, this will enable us to bring other innovative electric aircraft to market, lowering operating costs and driving growth for the entire regional air mobility market,” said Stan Little, Surf Air’s chief executive officer.

THIRD QUARTER FINANCIAL HIGHLIGHTS

Our acquisition of Southern Airways closed on July 27, 2023, and Surf Air Mobility has reflected the results of Southern Airways operations in our financial statements included in our quarterly report Form 10-Q as of the acquisition date according to GAAP. Additionally, Surf Air Mobility is providing unaudited pro forma results for the period ended September 30, 2023, on a quarterly and year-to-date basis, which assumes the Southern acquisition closed as of the beginning of the fiscal year.

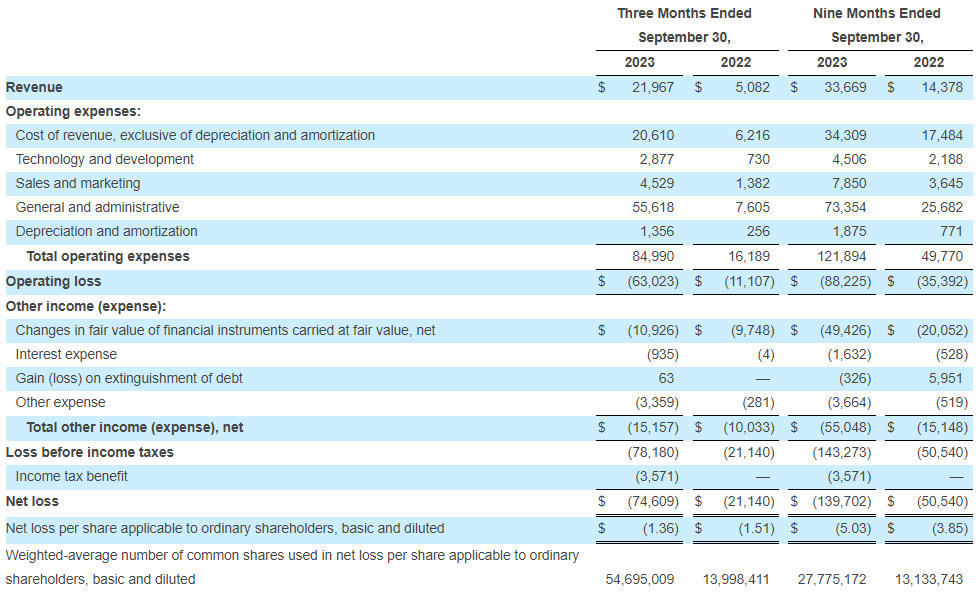

- Revenue

- GAAP revenue of $21.9 million and Pro forma1 revenue of $28.9 million for 3Q23, up 6.2% year-over-year on a pro forma basis, and GAAP revenue of $33.7 million and Pro forma1 revenue of $85.4 million for the nine months year-to-date, up 17.3% year-over-year on a pro forma basis.

- Net Loss

- GAAP Net loss of $(74.6) million for 3Q23, compared to $(21.1) million for the same period of the prior year. GAAP Net loss of $(139.7) million for nine months year-to-date, compared to $(50.5) million for the same period of the prior year.

- Pro forma Net loss of $(50.8) million for 3Q23, compared to $(13.3) million for the same period of the prior year. Pro forma Net loss of $(77.5) million for nine months year-to-date, compared to $(72.1) million for the same period of the prior year.

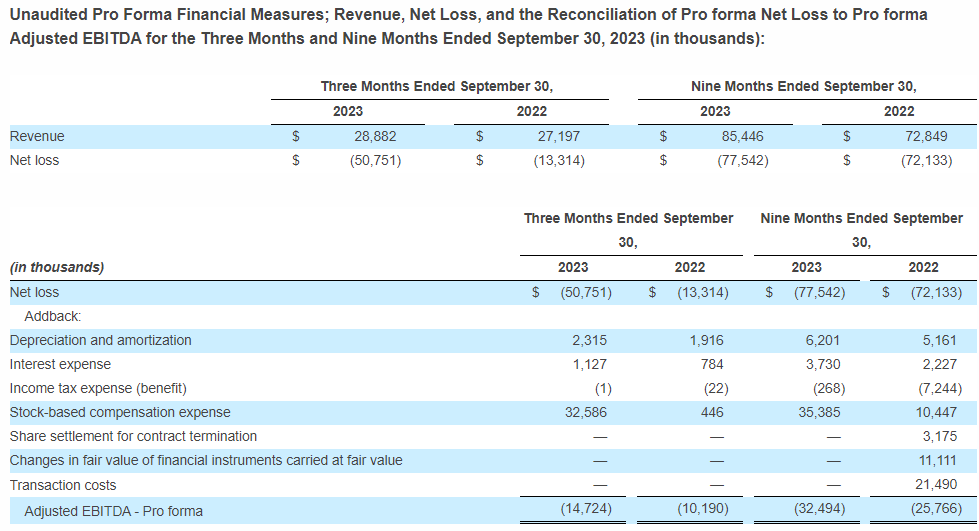

- Pro forma Adjusted EBITDA2

- Pro forma Adjusted EBITDA of $(14.7) million for 3Q23, compared to $(10.2) million for the same period of the prior year.

- Pro forma Adjusted EBITDA of $(32.5) million for nine months year-to-date, compared to $(25.8) million for the same period of the prior year.

- See the Pro forma Adjusted EBITDA table for the reconciliation from Pro forma Net Loss to Pro forma Adjusted EBITDA.

FULL YEAR 2023 FINANCIAL OUTLOOK

- GAAP Revenue, which assumes operating results for Surf Air for the full year 2023 period and Southern for the period July 28, 2023 through December 31, 2023, in the range of $54.5 million to $59.5 million.

- Pro forma1 Revenue, which assumes pro forma operating results for both Surf Air and Southern for the full year of 2023, in the range of $107.5 million to $112.5 million, as compared to $100.6 million for the full year 2022, up 6.9% – 11.8%. As mentioned in the Company’s second quarter earnings release, our guidance reflects lower growth for the second half of 2023; primarily due to supply chain constraints; the closure of the Marianas Joint Venture in Guam effective March 31, 2023; and, limited fleet expansion due to aircraft availability. We expect this to be resolved as part of the Textron Aviation fleet order.

- Pro forma Adjusted EBITDA2, which assumes pro forma operating results for both Surf Air and Southern for the full year of 2023, in the range of $(46.3) million to $(56.3) million, which excludes the expected impact of stock-based compensation, and one-time direct listing related expenses, as compared to $(28.8) million for period year of 2022. The expected decrease in pro forma adjusted EBITDA in 2023, as compared to 2022, is driven by incremental investments in technology and electrification R&D, sales and marketing, and G&A expenses primarily associated with expenses related to public company readiness and the company’s Southern transaction.

ABOUT SURF AIR MOBILITY

Surf Air Mobility is a Los Angeles-based regional air mobility platform expanding the category of regional air travel to reinvent flying through the power of electrification. In an effort to substantially reduce the cost and environmental impact of flying and as the operator of the largest commuter airline in the US, Surf Air Mobility intends to develop powertrain technology with its commercial partners to electrify existing fleets and bring electrified aircraft to market at scale. The management team has deep experience and expertise across aviation, electrification, and consumer technology. For more information please see the company’s investor presentation on our investor relations website.

Forward Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements about: Surf Air Mobility’s ability to anticipate the future needs of the air mobility market; future trends in the aviation industry, generally; Surf Air Mobility’s future growth strategy and growth rate and its ability to access its financings, grow its fleet. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “could”, “might”, “plan”, “possible”, “project”, “strive”, “budget”, “forecast”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: Surf Air Mobility’s future ability to pay contractual obligations and liquidity will depend on operating performance, cash flow and ability to secure adequate financing; Surf Air Mobility’s limited operating history and that Surf Air Mobility has not yet manufactured any hybrid-electric or fully-electric aircraft; the powertrain technology Surf Air Mobility plans to develop does not yet exist; the inability to maintain and strengthen the Surf Air, Southern and Mokulele brands and their reputations as regional airlines; any accidents or incidents involving hybrid-electric or fully-electric aircraft; the inability to accurately forecast demand for products and manage product inventory in an effective and efficient manner; the dependence on third-party partners and suppliers for the components and collaboration in Surf Air Mobility’s development of hybrid-electric and fully-electric powertrains, and any interruptions, disagreements or delays with those partners and suppliers; the inability to execute business objectives and growth strategies successfully or sustain Surf Air Mobility’s growth; the inability of Surf Air Mobility’s customers to pay for Surf Air Mobility’s services; the inability of Surf Air Mobility to obtain additional financing or access the capital markets to fund its ongoing operations on acceptable terms and conditions; the outcome of any legal proceedings that might be instituted against Surf Air, Southern or Surf Air Mobility; changes in applicable laws or regulations, and the impact of the regulatory environment and complexities with compliance related to such environment; and other risks and uncertainties indicated in the prospectus. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements. Although Surf Air Mobility believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Surf Air Mobility cannot guarantee future results, level of activity, performance or achievements and there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking statements and financial projections. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Surf Air Mobility does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Additional information regarding these and other factors that could affect Surf Air Mobility’s results is included in Surf Air Mobility’s SEC filings, which may be obtained by visiting the SEC’s website at www.sec.gov or the investor relations page at https://investors.surfair.com under the “Financials—SEC Filings” section. Information contained on, or that is referenced or can be accessed through, our website does not constitute part of this document and inclusions of any website addresses herein are inactive textual references only.

The SEC’s website at www.sec.gov or the investor relations page on Surf Air’s website at https://investors.surfair.com under the “Financials—SEC Filings” section. Other information contained on, or that is referenced or can be accessed through, our website does not constitute part of this document and inclusions of any website addresses herein are inactive textual references only.

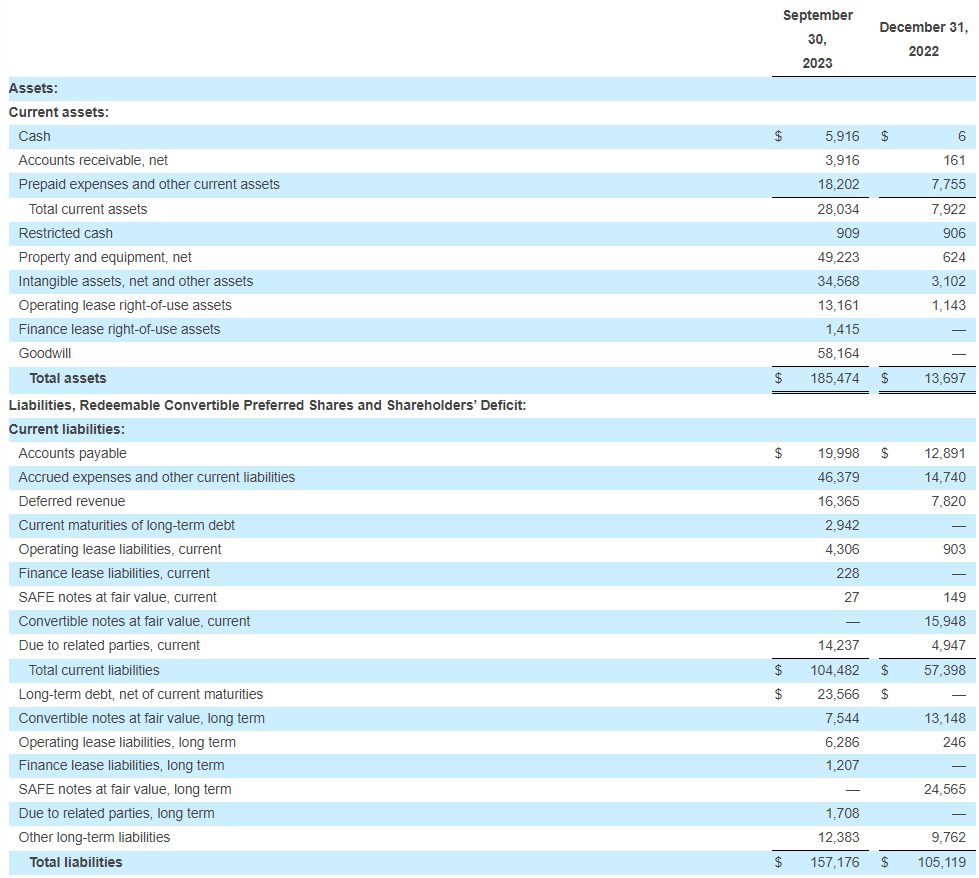

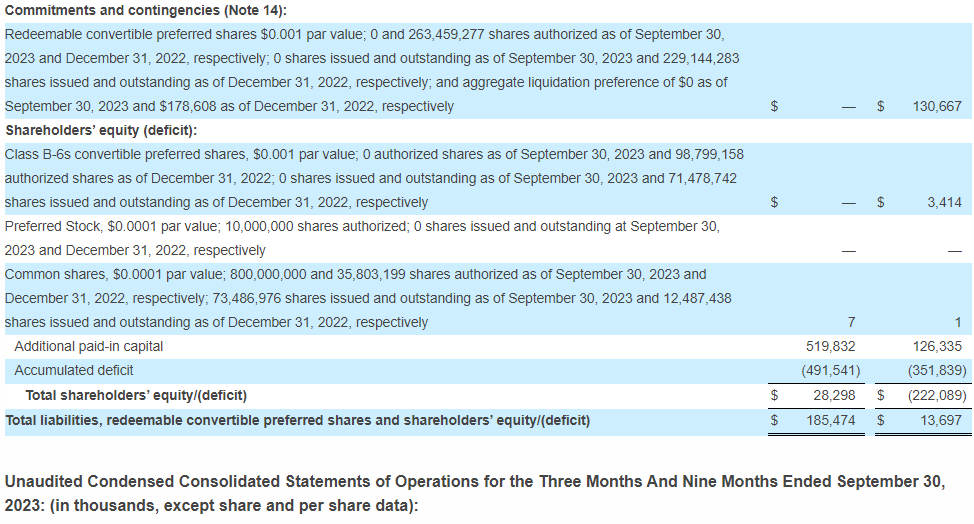

Unaudited Condensed Consolidated Balance Sheets as of September 30, 2023 and December 31, 2022:

Contacts

For Press:

press@surfair.com

For Investors:

investors@surfair.com

Featured Image @ FreePik

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Surf Air Mobility Inc. Market Jar Media Inc. has or expects to receive from Surf Air Mobility Inc..’s Digital Marketing Agency of Record (Native Ads Inc.) forty-two thousand, five hundred USD for 36 days (26 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. All investments carry risk and each reader is encouraged to consult with his or her individual financial professional. Any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on PressReach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on PressReach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Surf Air Mobility Inc.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Surf Air Mobility Inc.’s industry; (b) market opportunity; (c) Surf Air Mobility Inc.’s business plans and strategies; (d) services that Surf Air Mobility Inc. intends to offer; (e) Surf Air Mobility Inc.’s milestone projections and targets; (f) Surf Air Mobility Inc.’s expectations regarding receipt of approval for regulatory applications; (g) Surf Air Mobility Inc.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Surf Air Mobility Inc.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Surf Air Mobility Inc.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Surf Air Mobility Inc.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) the accuracy of budgeted costs and expenditures; (e) Surf Air Mobility Inc.’s ability to attract and retain skilled personnel; (f) political and regulatory stability; (g) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (h) changes in applicable legislation; (i) stability in financial and capital markets; and (j) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Surf Air Mobility Inc. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Surf Air Mobility Inc.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Surf Air Mobility Inc.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Surf Air Mobility Inc.’s business operations (e) Surf Air Mobility Inc. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Surf Air Mobility Inc. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Surf Air Mobility Inc. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Surf Air Mobility Inc. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Surf Air Mobility Inc. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Surf Air Mobility Inc. or such entities and are not necessarily indicative of future performance of Surf Air Mobility Inc. or such entities.

8) Investing is risky. The information provided in this article should not be considered as a substitute for professional financial consultation. Users should be aware that investing in any form carries inherent risks, and as such, there is a possibility of losing some or all of their investment. The value of investments can fluctuate significantly within a short period, and investors must understand that past performance is not indicative of future results. Additionally, users should exercise caution as transactions involving investments may be irreversible, even in cases of fraud or accidental actions. It is crucial to acknowledge that rapidly evolving laws and technical issues can have adverse effects on the usability, transferability, exchangeability, and value of investments. Furthermore, users must be cognizant of potential security risks associated with their investment activities. Individuals are strongly encouraged to conduct thorough research, seek professional advice, and carefully evaluate their risk tolerance before engaging in any investment endeavors. Market Jar Media Inc. is neither an investment adviser nor a broker-dealer. The information presented on the website is provided for informative purposes only and is not to be treated as a recommendation to make any specific investment. No such information on PressReach.com constitutes advice or a recommendation.

- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube