Supply chain optimization software maker Manhattan Associates (NASDAQ:MANH) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 11.8% year on year to $266.7 million. The company expects the full year’s revenue to be around $1.04 billion, close to analysts’ estimates. Its non-GAAP profit of $1.35 per share was also 26.8% above analysts’ consensus estimates.

Is now the time to buy Manhattan Associates? Find out by accessing our full research report, it’s free.

Manhattan Associates (MANH) Q3 CY2024 Highlights:

- Revenue: $266.7 million vs analyst estimates of $263.2 million (1.3% beat)

- EPS (non-GAAP): $1.35 vs analyst estimates of $1.06 (26.8% beat)

- The company reconfirmed its revenue guidance for the full year of $1.04 billion at the midpoint

- Management raised its full-year EPS (non-GAAP) guidance to $4.61 at the midpoint, a 8.2% increase

- Gross Margin (GAAP): 55.5%, up from 53.3% in the same quarter last year

- Free Cash Flow Margin: 19.6%, down from 26.8% in the previous quarter

- Billings: $257.6 million at quarter end, up 13.9% year on year

- Market Capitalization: $18.1 billion

“Manhattan delivered record third quarter and year-to-date results. Our fundamentals are strong, and we continue to deliver a balanced financial performance across top-line growth and profitability and industry leading innovation each quarter,” said Manhattan Associates president and CEO Eddie Capel.

Company Overview

Boasting major consumer staples and pharmaceutical companies as clients, Manhattan Associates (NASDAQ:MANH) offers a software-as-service platform that helps customers manage their supply chains.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

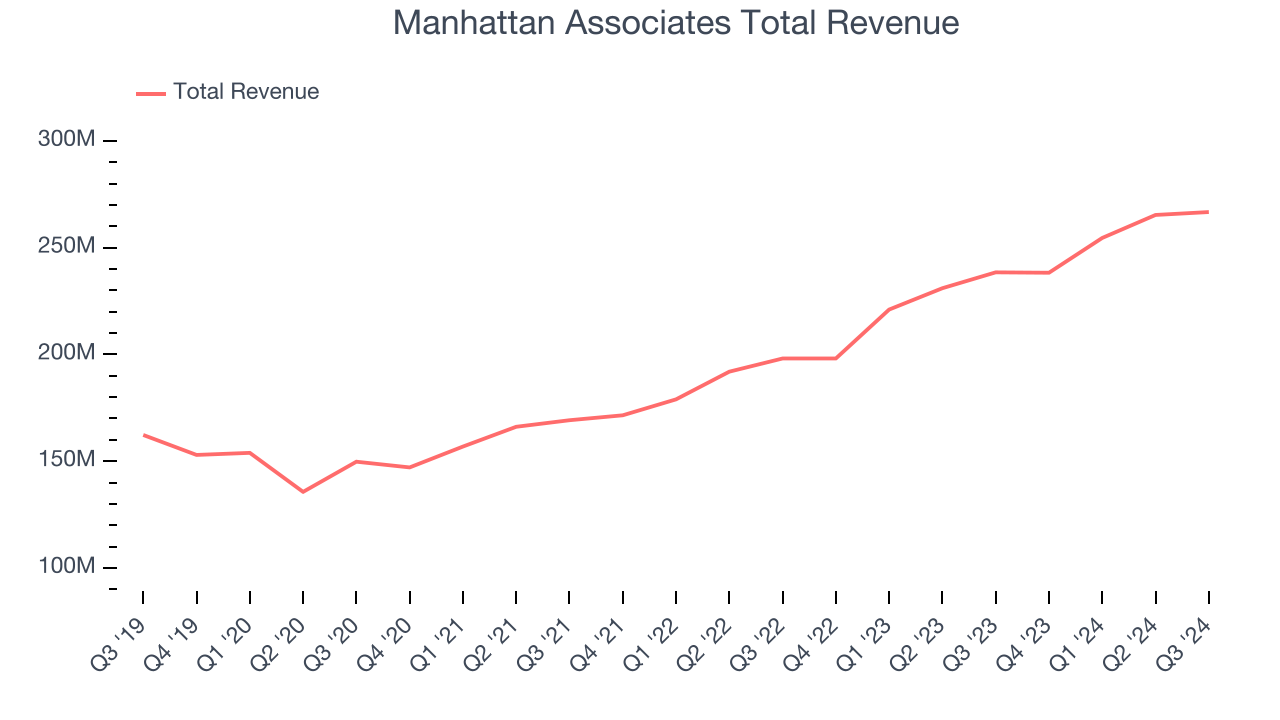

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, Manhattan Associates’s sales grew at a mediocre 17% compounded annual growth rate over the last three years. This shows it couldn’t expand in any major way and is a tough starting point for our analysis.

This quarter, Manhattan Associates reported year-on-year revenue growth of 11.8%, and its $266.7 million of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 9.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and illustrates the market believes its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Manhattan Associates’s Q3 Results

We were impressed by how significantly Manhattan Associates blew past analysts’ EPS expectations this quarter. We were also glad it raised its full-year EPS guidance. Zooming out, we think this was a solid quarter. The stock remained flat at $292.32 after reporting.

Is Manhattan Associates an attractive investment opportunity at the current price?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings.We cover that in our actionable full research report which you can read here, it’s free.