Hospitality industry software provider Agilysys (NASDAQ:AGYS) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 16.5% year on year to $68.28 million. The company’s full-year revenue guidance of $282.5 million at the midpoint also came in 1.9% above analysts’ estimates. Its GAAP profit of $0.05 per share was 71% below analysts’ consensus estimates.

Is now the time to buy Agilysys? Find out by accessing our full research report, it’s free.

Agilysys (AGYS) Q3 CY2024 Highlights:

- Revenue: $68.28 million vs analyst estimates of $67.5 million (1.1% beat)

- EPS: $0.05 vs analyst estimates of $0.17 (-$0.12 miss)

- EBITDA: $12.19 million vs analyst estimates of $10.3 million (18.4% beat)

- The company lifted its revenue guidance for the full year to $282.5 million at the midpoint from $277.5 million, a 1.8% increase

- Gross Margin (GAAP): 63.3%, up from 59.9% in the same quarter last year

- Operating Margin: 6%, in line with the same quarter last year

- EBITDA Margin: 17.9%, up from 13.7% in the same quarter last year

- Free Cash Flow Margin: 8.7%, up from 0.4% in the previous quarter

- Market Capitalization: $3.03 billion

Ramesh Srinivasan, President and CEO of Agilysys, commented, “We are pleased to report another set of excellent results with record revenue for the 11th consecutive quarter at $68.3 million and 16.5% higher than the comparable prior year quarter, 36.6% total subscription revenue growth and Adjusted EBITDA of 17.9% of revenue. Fiscal 2025 second quarter July to September sales, measured in annual contract value terms, were the second highest in the company’s history. We have also made good progress with integrating Book4Time into the business and with the strides made towards realizing anticipated synergies and added value.

Company Overview

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

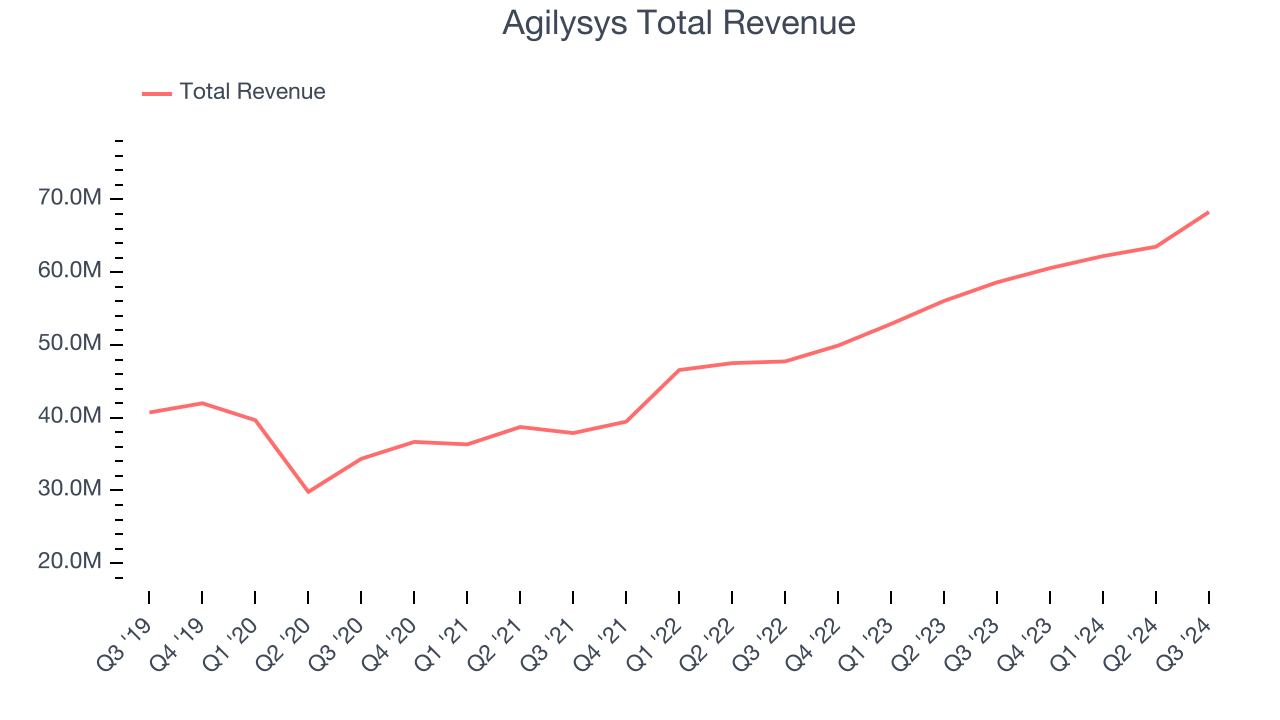

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Agilysys’s 19.4% annualized revenue growth over the last three years was mediocre. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

This quarter, Agilysys reported year-on-year revenue growth of 16.5%, and its $68.28 million of revenue exceeded Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 19.2% over the next 12 months, similar to its three-year rate. This projection is noteworthy and illustrates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

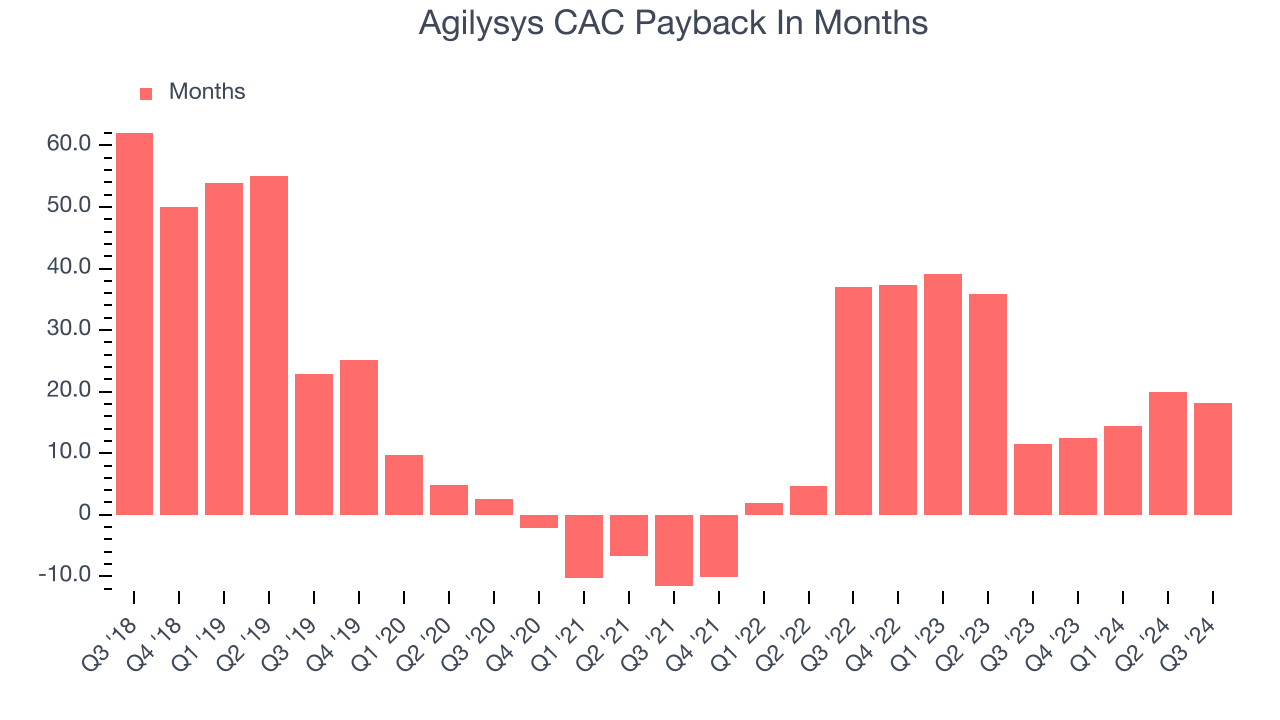

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Agilysys is extremely efficient at acquiring new customers, and its CAC payback period checked in at 18.2 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from Agilysys’s Q3 Results

We were impressed by how significantly Agilysys blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.3% to $118.31 immediately following the results.

Agilysys had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.