Household products company Reynolds (NASDAQ:REYN) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 4.6% year on year to $892 million. Next quarter’s revenue guidance of $965 million underwhelmed, coming in 1.2% below analysts’ estimates. Its non-GAAP profit of $0.37 per share was also 11.2% below analysts’ consensus estimates.

Is now the time to buy Reynolds? Find out by accessing our full research report, it’s free.

Reynolds (REYN) Q3 CY2024 Highlights:

- Revenue: $892 million vs analyst estimates of $903 million (1.2% miss)

- Adjusted EPS: $0.37 vs analyst expectations of $0.42 (11.2% miss)

- EBITDA: $171 million vs analyst estimates of $170.2 million (small beat)

- Revenue Guidance for Q4 CY2024 is $965 million at the midpoint, below analyst estimates of $977.1 million

- Management reiterated its full-year Adjusted EPS guidance of $1.68 at the midpoint

- EBITDA guidance for the full year is $678 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 24.8%, down from 26.6% in the same quarter last year

- Operating Margin: 15.5%, up from 14.3% in the same quarter last year

- EBITDA Margin: 19.2%, up from 17.6% in the same quarter last year

- Free Cash Flow Margin: 10.4%, down from 20.3% in the same quarter last year

- Organic Revenue fell 3% year on year, in line with the same quarter last year

- Sales Volumes were flat year on year (-4% in the same quarter last year)

- Market Capitalization: $6.20 billion

“We are building on our leadership across household products and delivered another quarter of strong financial performance as a result,” said Lance Mitchell, President and Chief Executive Officer of Reynolds Consumer Products.

Company Overview

Best known for its aluminum foil, Reynolds (NASDAQ:REYN) is a household products company whose products focus on food storage, cooking, and waste.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Reynolds carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

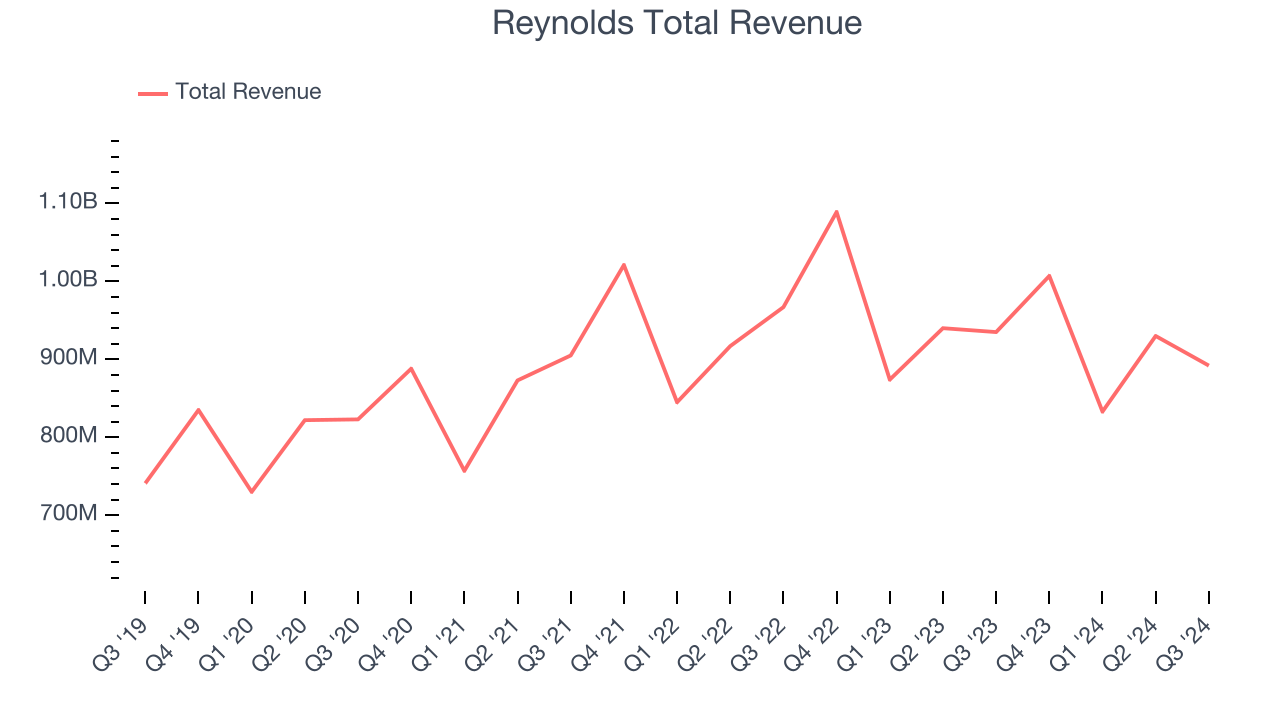

As you can see below, Reynolds’s sales grew at a sluggish 2.3% compounded annual growth rate over the last three years as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Reynolds missed Wall Street’s estimates and reported a rather uninspiring 4.6% year-on-year revenue decline, generating $892 million of revenue. Management is currently guiding for a 4.2% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates the market thinks its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Volume Growth

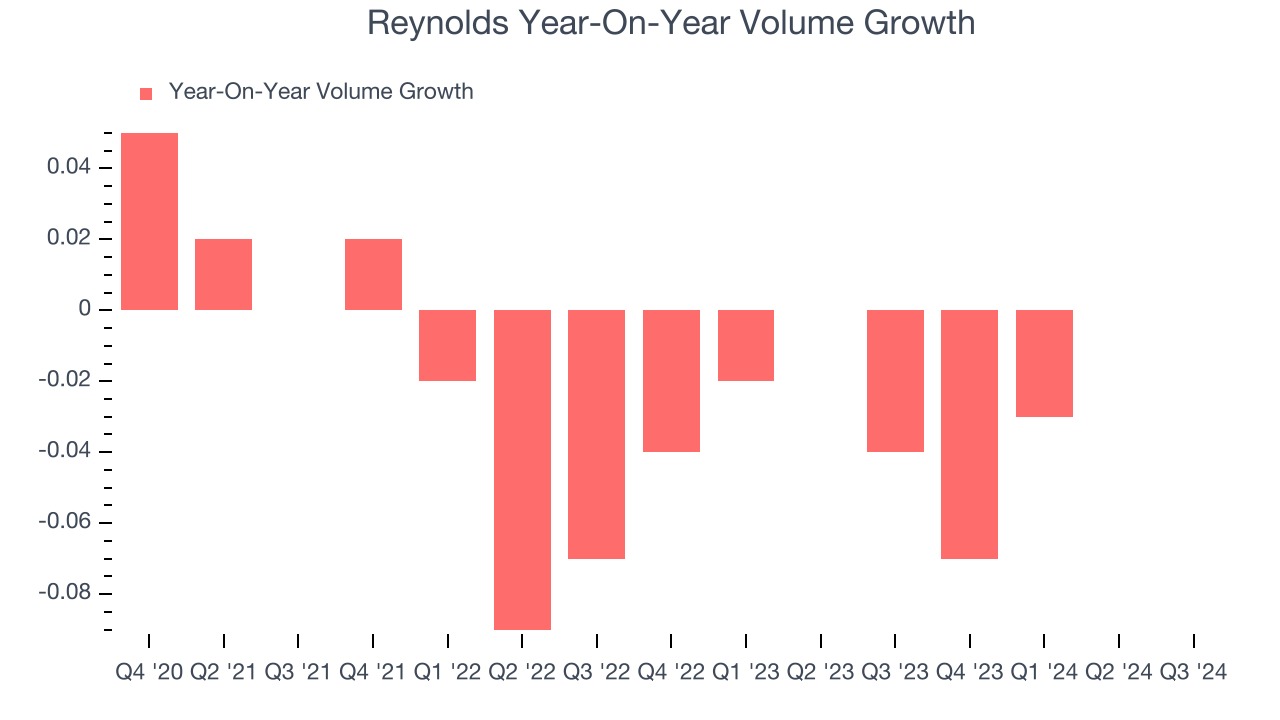

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Reynolds generated its growth (or lack thereof) from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Reynolds’s average quarterly sales volumes have shrunk by 2.5%. This isn’t ideal for a consumer staples company, where demand is typically stable.

In Reynolds’s Q3 2024, year on year sales volumes were flat. This result was a well-appreciated turnaround from the 4% year-on-year decline it posted 12 months ago, showing the company is heading in the right direction.

Key Takeaways from Reynolds’s Q3 Results

We were impressed by how significantly Reynolds blew past analysts’ organic revenue growth expectations this quarter. On the other hand, its gross margin missed analysts’ expectations and its EPS missed Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.4% to $28.50 immediately following the results.

Reynolds may have had a tough quarter, but does that actually create an opportunity to invest right now?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.