Cloud computing and online retail behemoth Amazon (NASDAQ:AMZN) announced better-than-expected revenue in Q3 CY2024, with sales up 11% year on year to $158.9 billion. On the other hand, the company expects next quarter’s revenue to be around $185 billion, slightly below analysts’ estimates. Its EPS of $1.43 per share was also 25.2% above analysts’ consensus estimates.

Is now the time to buy Amazon? Find out by accessing our full research report, it’s free.

Amazon (AMZN) Q3 CY2024 Highlights:

- Revenue: $158.9 billion vs analyst estimates of $157.3 billion (1% beat)

- Operating Profit (GAAP): $17.41 billion vs analyst estimates of $14.74 billion (18.1% beat)

- EPS (GAAP): $1.43 vs analyst estimates of $1.14 (25.2% beat)

- Revenue Guidance for Q4 CY2024 is $185 billion at the midpoint, below analyst estimates of $186.3 billion

- North America Revenue: $95.54 billion vs analyst estimates of $95.24 billion (small beat)

- AWS Revenue: $27.45 billion vs analyst estimates of $27.48 billion (small miss)

- North America Operating Profit: $5.66 billion vs analyst estimates of $5.41 billion (4.7% beat)

- AWS Operating Profit: $10.45 billion vs analyst estimates of $9.12 billion (14.5% beat)

- Operating Margin: 11%, up from 7.8% in the same quarter last year

- Free Cash Flow Margin: 2.1%, down from 6.9% in the same quarter last year

- Market Capitalization: $2.02 trillion

“As we get into the holiday season, we’re excited about what we have in store for customers,” said Andy Jassy, Amazon President & CEO.

Key Topics & Areas Of Debate

For many of Amazon’s megacap peers, the key areas of debate center around revenue growth. Amazon is different, as the focus is on profitable growth due to its consistent reinvestment strategy and the structurally lower margins seen in its e-commerce business, where it must hold physical inventory.

Can Amazon leverage its vast logistics investments of the last two-plus decades while automating more of its operations and leaning into advertising to increase profitability? If so, its North America segment, which consists of its consumer-facing businesses, could see double-digit operating margins in the next few years (it was 9.8% for the last 12 months).

A more profitable North America segment combined with a faster-growing and structurally higher-margin Amazon Web Services (AWS) could mean earnings power that is orders of magnitude larger. Higher earnings typically lead to higher stock prices.

Despite its scale and dominance, Amazon doesn’t operate in a vacuum. Walmart (NYSE:WMT) and Target (NYSE:TGT) - with their improving omnichannel footprints – are competitors to Amazon’s e-commerce and Whole Foods businesses. And while it has a first-mover advantage in the public cloud services market, Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) are working hard to catch up.

Revenue Growth

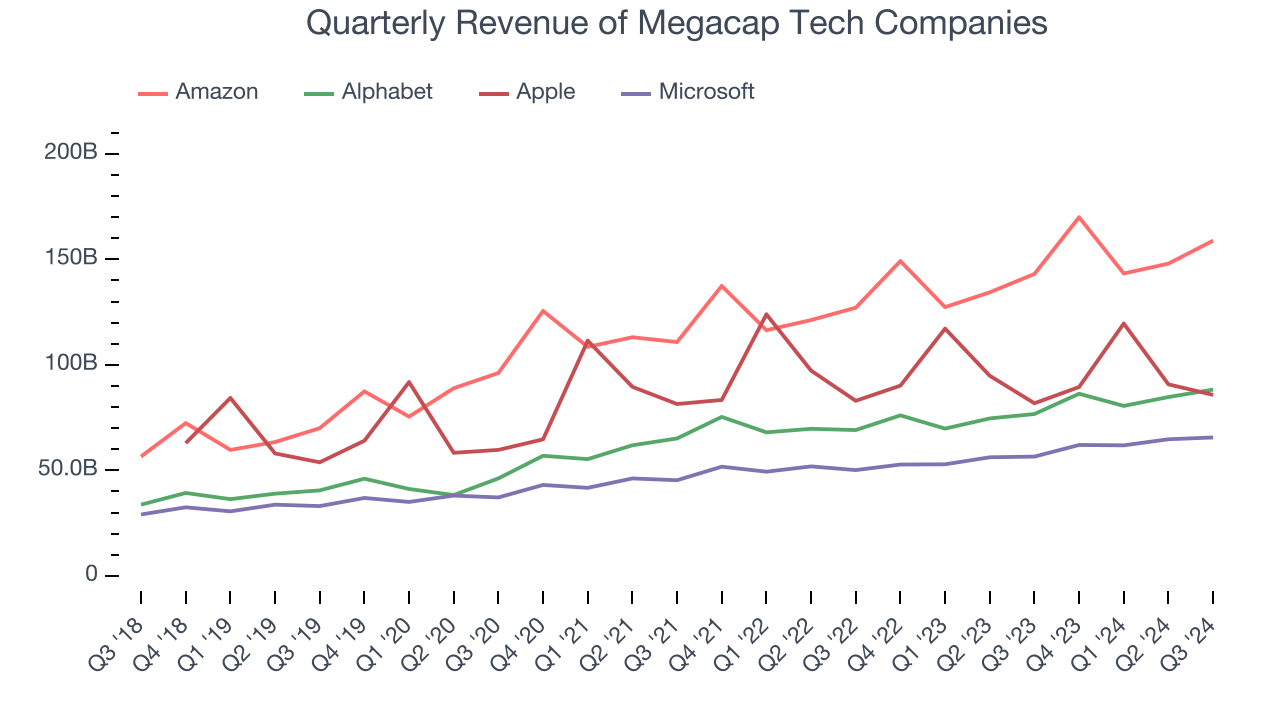

Amazon shows that fast growth and massive scale can coexist despite the conventional wisdom about the law of large numbers. The company’s revenue base of $265.5 billion five years ago has more than doubled to $620.1 billion in the last year, translating into an incredible 18.5% annualized growth rate.

Amazon’s growth over the same period was also higher than its megacap peers, Alphabet (17%), Microsoft (14.4%), and Apple (8.3%). This is an important consideration because investors often use the comparisons as a starting point for their valuations. When adjusting for these benchmarks, we think Amazon’s price is fair.

We at StockStory emphasize long-term growth, but for megacap tech companies, a half-decade historical view may miss the impact of emerging trends like AI. Amazon’s annualized revenue growth of 11.1% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Amazon reported year-on-year revenue growth of 11%, and its $158.9 billion of revenue exceeded Wall Street’s estimates by 1%. Management is currently guiding for a 8.8% year-on-year increase next quarter. Looking further ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a slight deceleration versus the last two years. This projection is still healthy, and some deceleration is natural given the magnitude of its revenue base.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Profitability: The Key Debate

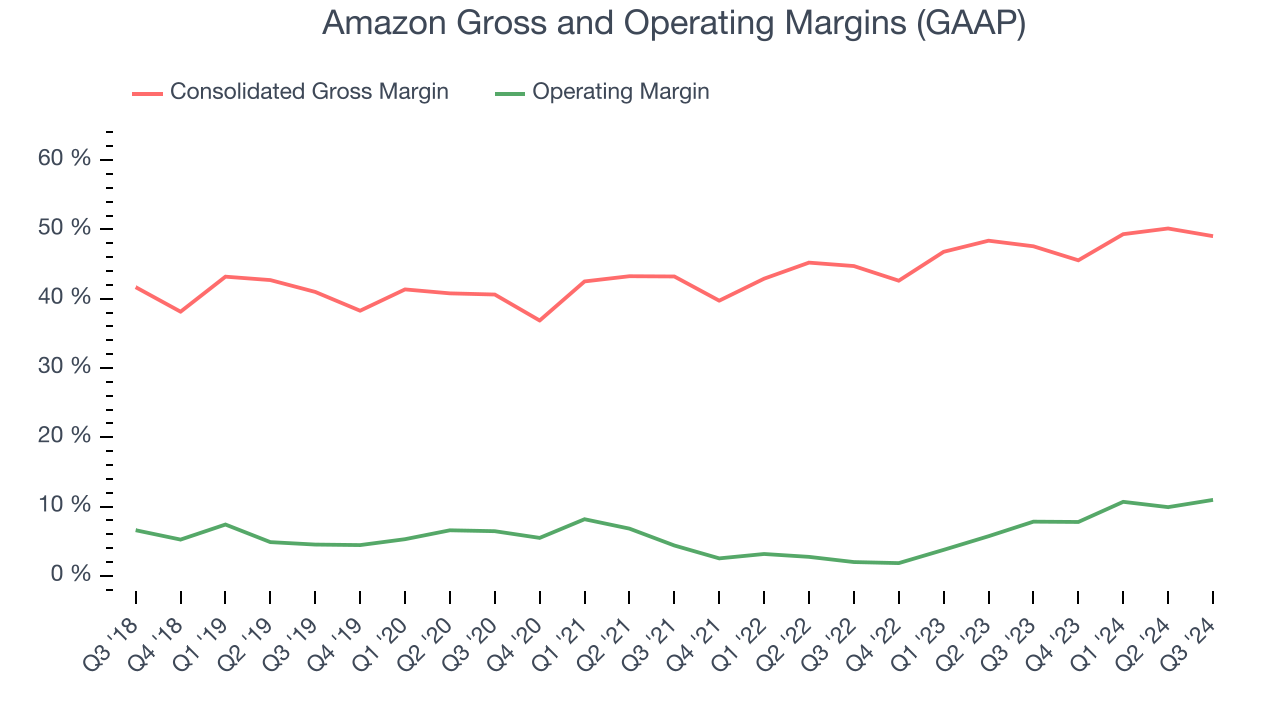

Many investors understand that Amazon’s e-commerce business caps its gross margin, which averaged 44.4% over the last five years. The company lags behind its pure-play tech peers because it sells many commoditized goods online where it must acquire and hold physical inventory.

What the market debates, however, is where Amazon’s long-term operating profitability could ultimately settle. Sure, its five-year margin of 6% was weak, but it rose by 4.1 percentage points thanks to the highly profitable AWS segment becoming a larger portion of its revenue and leverage on the fixed costs in its consumer-facing businesses. Our question is if Amazon’s momentum can continue and result in a teen’s percentage margin somewhere down the line.

The company’s North America segment holds the keys to this answer. Throughout the years, Amazon has made huge investments to not only attract hoards of customers into its ecosystem but also retain them. Some areas of focus in this effort included its unmatched delivery network and video streaming content.

Bulls will argue that Amazon can afford to ease up and begin riding its investments of the last two-plus decades. Wall Street seems to disagree somewhat and is projecting its trailing 12-month operating margin of 9.8% will stagnate in the coming year. Expectations aside, the company’s performance over the last few years supports the higher long-term profitability argument that could potentially lead to earnings and a stock price that follows.

Key Takeaways from Amazon’s Q3 Results

We were impressed by how significantly Amazon blew past analysts’ operating profit and EPS expectations this quarter. We were also excited its operating income guidance for next quarter topped Wall Street’s estimates. On the other hand, its revenue outlook was underwhelming, but it didn't matter much because the key debate for Amazon is profitability. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.9% to $195.30 immediately following the results.

Amazon may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.