Equipment distribution company Alta Equipment Group (NYSE:ALTG) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 3.7% year on year to $448.8 million. Its non-GAAP loss of $0.72 per share was also 700% below analysts’ consensus estimates.

Is now the time to buy Alta? Find out by accessing our full research report, it’s free.

Alta (ALTG) Q3 CY2024 Highlights:

- Revenue: $448.8 million vs analyst estimates of $479.9 million (6.5% miss)

- Adjusted EPS: -$0.72 vs analyst estimates of -$0.09 (-$0.63 miss)

- EBITDA: $43.2 million vs analyst estimates of $48 million (10% miss)

- Gross Margin (GAAP): 27.8%, in line with the same quarter last year

- Operating Margin: 1.5%, down from 3% in the same quarter last year

- EBITDA Margin: 9.6%, down from 10.9% in the same quarter last year

- Free Cash Flow was $69.5 million, up from -$4.5 million in the same quarter last year

- Market Capitalization: $280 million

LIVONIA, Mich., Nov. 12, 2024 (GLOBE NEWSWIRE) -- Alta Equipment Group Inc. (NYSE: ALTG) (“Alta”, "we", "our" or the “Company”), a leading provider of premium material handling, construction and environmental processing equipment and related services, today announced financial results for the third quarter ended September 30, 2024.

Company Overview

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

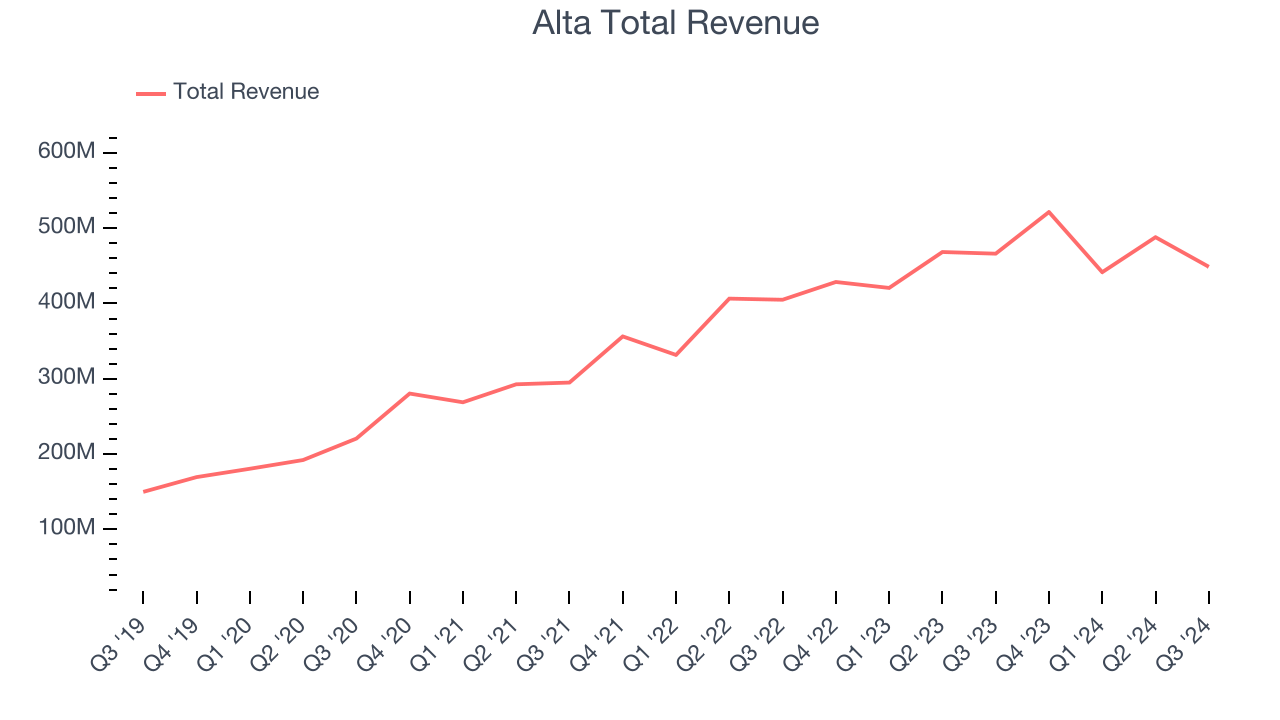

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Luckily, Alta’s sales grew at an incredible 30.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Alta’s annualized revenue growth of 12.6% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Alta missed Wall Street’s estimates and reported a rather uninspiring 3.7% year-on-year revenue decline, generating $448.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

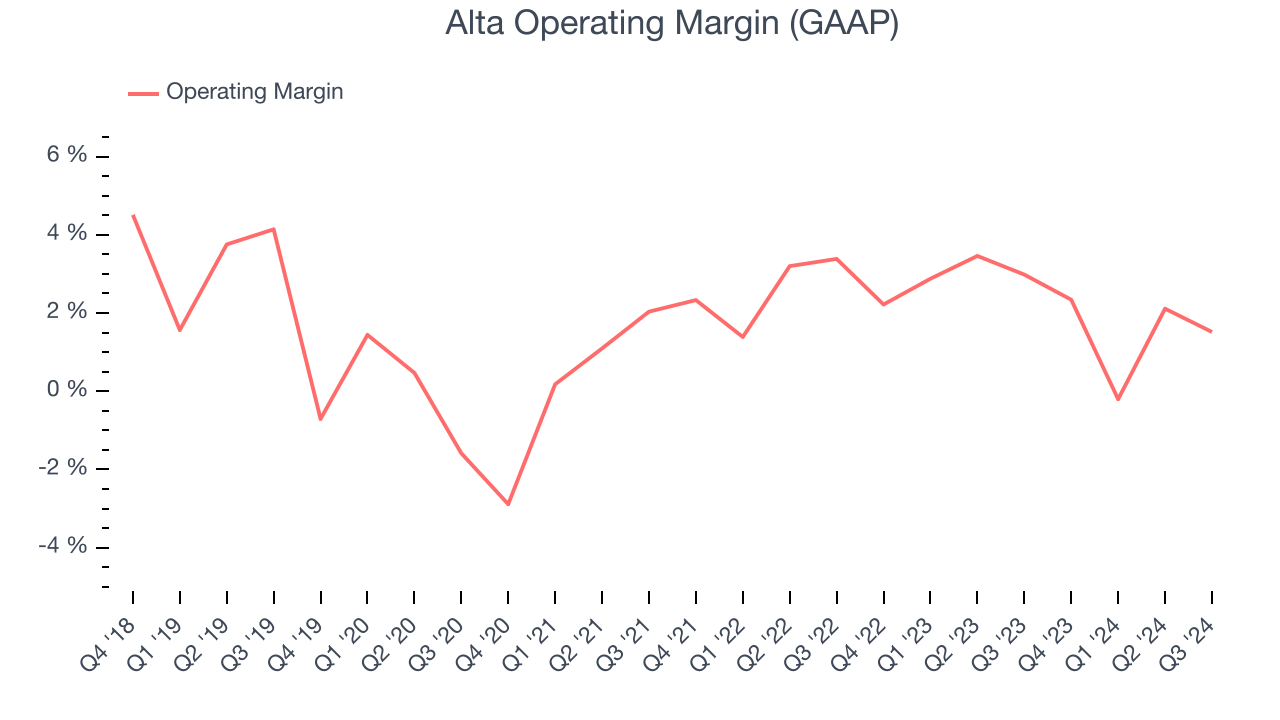

Operating Margin

Alta was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Alta’s annual operating margin rose by 1.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Alta generated an operating profit margin of 1.5%, down 1.5 percentage points year on year. Since Alta’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

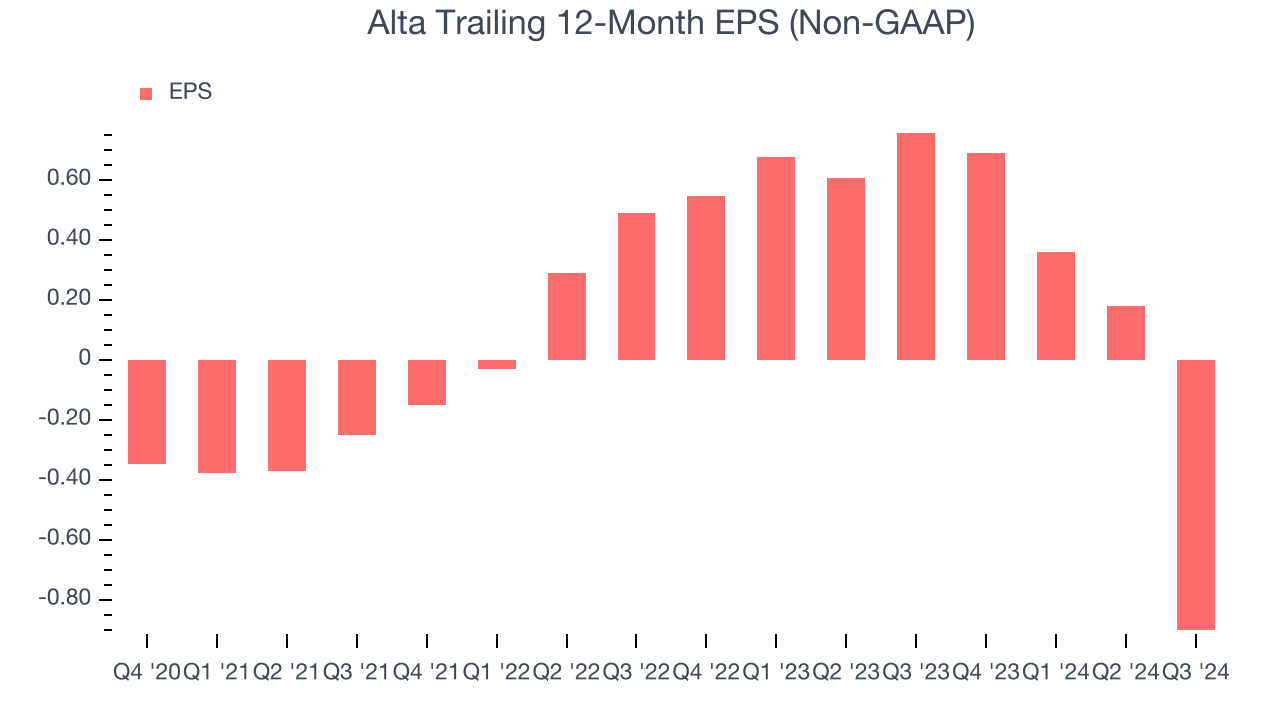

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Alta’s earnings losses deepened over the last four years as its EPS dropped 34% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Alta’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

Sadly for Alta, its EPS declined by 95.9% annually over the last two years while its revenue grew 12.6%. This tells us the company became less profitable on a per-share basis as it expanded.

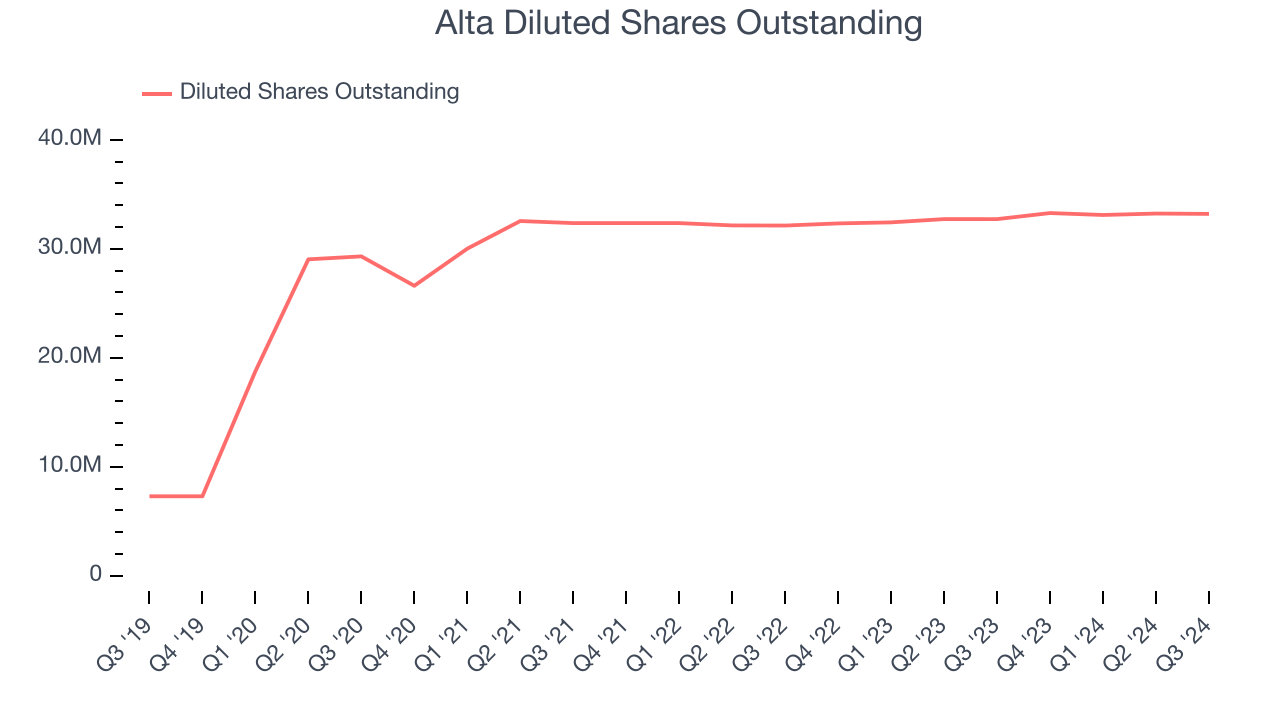

We can take a deeper look into Alta’s earnings to better understand the drivers of its performance. Alta’s operating margin has declined by 1.9 percentage points over the last two yearswhile its share count has grown 3.3%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Alta reported EPS at negative $0.72, down from $0.36 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Alta’s full-year EPS of negative $0.90 will reach break even.

Key Takeaways from Alta’s Q3 Results

We struggled to find many resounding positives in these results as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. This was a weaker quarter, and the stock traded down 15.9% to $6.75 immediately after reporting.

Alta’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.