As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the real estate services industry, including Opendoor (NASDAQ:OPEN) and its peers.

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The 14 real estate services stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 7.8% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

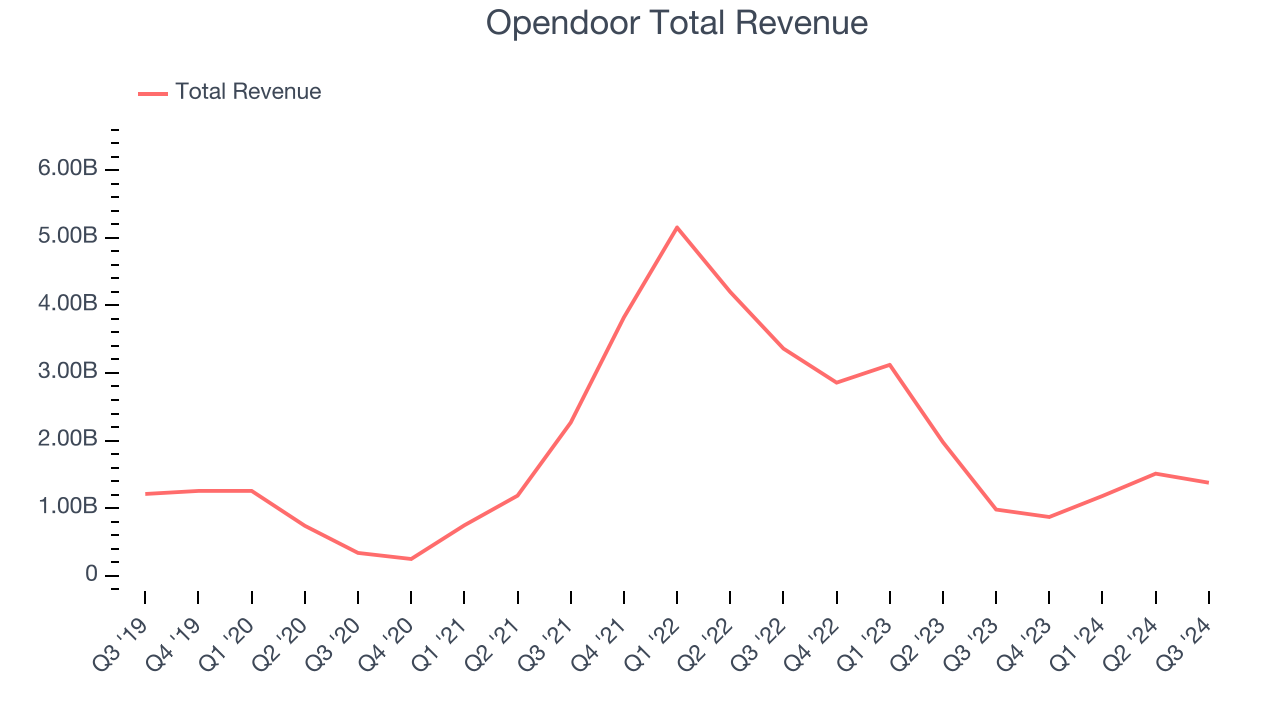

Opendoor (NASDAQ:OPEN)

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Opendoor reported revenues of $1.38 billion, up 40.5% year on year. This print exceeded analysts’ expectations by 8.3%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

“Opendoor’s third quarter acquisition volumes, revenue, Contribution Profit, and Adjusted EBITDA all exceeded our guidance, notwithstanding persistent housing market headwinds. In August, many anticipated that interest rate cuts would bring buyers and sellers back to the market. However, mortgage rates remain stubbornly high and the housing market continues to be challenged by high delistings, low clearance, and strained affordability,” said Carrie Wheeler, CEO of Opendoor.

Opendoor achieved the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 15.4% since reporting and currently trades at $1.59.

Is now the time to buy Opendoor? Access our full analysis of the earnings results here, it’s free.

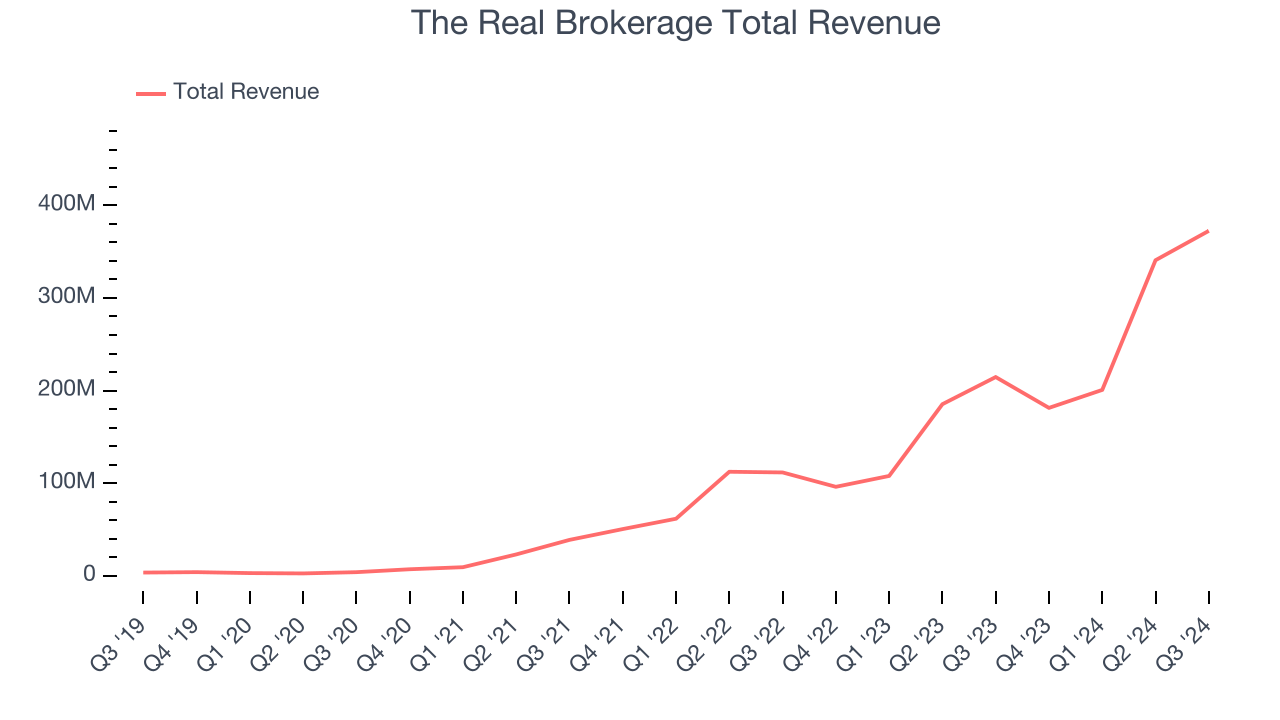

Best Q3: The Real Brokerage (NASDAQ:REAX)

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

The Real Brokerage reported revenues of $372.5 million, up 73.5% year on year, outperforming analysts’ expectations by 7.4%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The Real Brokerage scored the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11.2% since reporting. It currently trades at $5.01.

Is now the time to buy The Real Brokerage? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Anywhere Real Estate (NYSE:HOUS)

Formerly known as Realogy Holdings, Anywhere Real Estate (NYSE:HOUS) is a residential real estate company with a network of brokerages, franchises, and settlement services.

Anywhere Real Estate reported revenues of $1.54 billion, down 3.1% year on year, falling short of analysts’ expectations by 5.7%. It was a disappointing quarter as it posted a miss of analysts’ transacted dollars estimates.

Anywhere Real Estate delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 3.2% since the results and currently trades at $4.13.

Read our full analysis of Anywhere Real Estate’s results here.

CBRE (NYSE:CBRE)

Established in 1906, CBRE (NYSE:CBRE) is one of the largest commercial real estate services firms in the world.

CBRE reported revenues of $9.04 billion, up 14.8% year on year. This number beat analysts’ expectations by 2.7%. It was a very strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates and a decent beat of analysts’ Investment Management revenue estimates.

The stock is up 6.5% since reporting and currently trades at $131.11.

Read our full, actionable report on CBRE here, it’s free.

Compass (NYSE:COMP)

Fueled by its mission to replace the "paper-driven, antiquated workflow" of buying a house, Compass (NYSE:COMP) is a digital-first company operating a residential real estate brokerage in the United States.

Compass reported revenues of $1.49 billion, up 11.7% year on year. This print met analysts’ expectations. Overall, it was a very strong quarter as it also produced EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

The stock is up 11.4% since reporting and currently trades at $6.20.

Read our full, actionable report on Compass here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.