Itron trades at $119.35 per share and has stayed right on track with the overall market, gaining 8.5% over the last six months. At the same time, the S&P 500 has returned 13%.

Is there a buying opportunity in Itron, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We're swiping left on Itron for now. Here are three reasons why there are better opportunities than ITRI and a stock we'd rather own.

Why Is Itron Not Exciting?

Founded by a small group of engineers who wanted to build a more efficient way to read utility meters, Itron (NASDAQ:ITRI) offers energy and water management products for the utility industry, municipalities, and industrial customers.

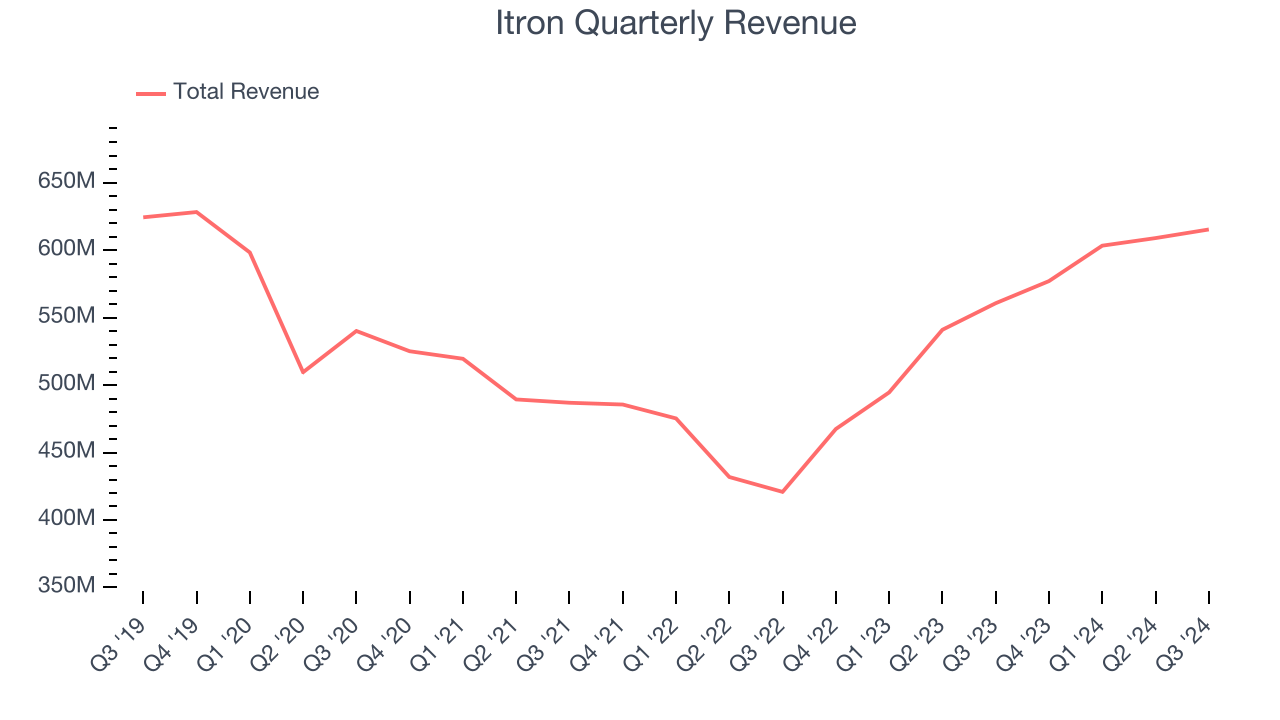

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Itron struggled to consistently increase demand as its $2.41 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of lacking business quality.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Sell-side analysts expect Itron’s revenue to grow by 1.5% over the next 12 months, a deceleration versus its 15.2% annualized growth rate for the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

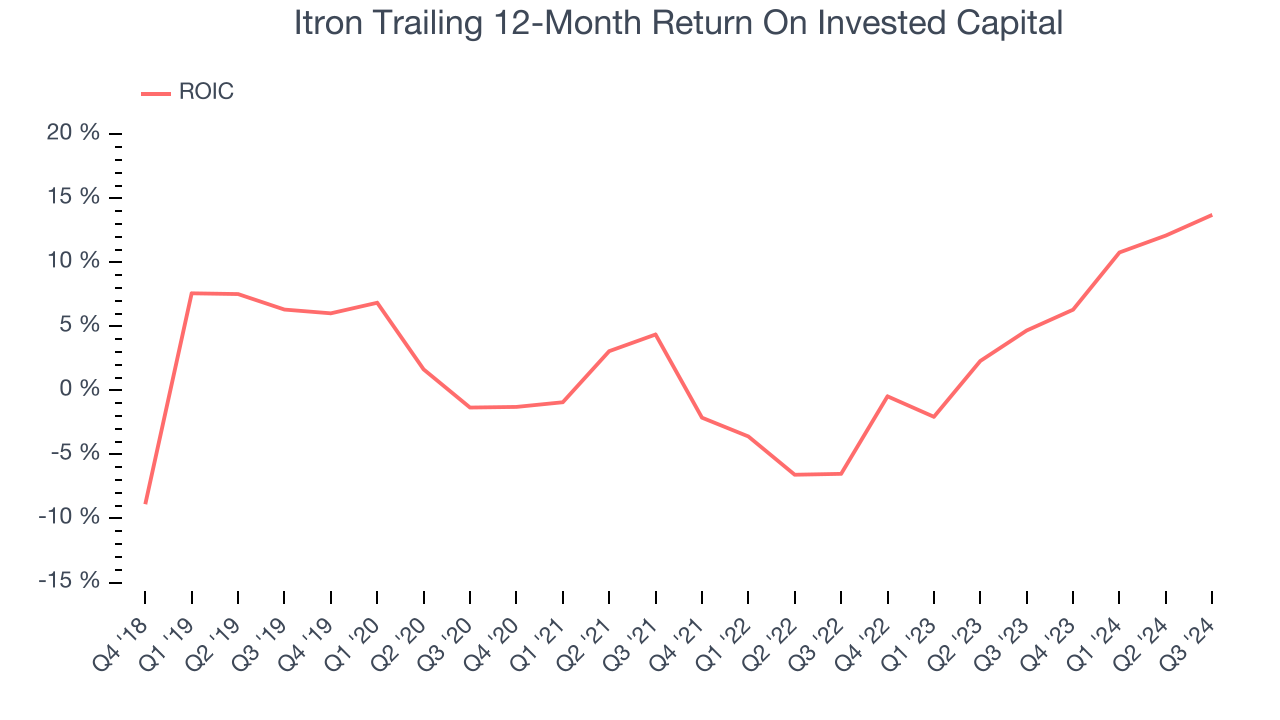

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Itron’s five-year average ROIC was 3%, somewhat low compared to the best industrials companies that consistently pump out 20%+. Its returns suggest it historically did a mediocre job investing in profitable growth initiatives.

Final Judgment

Itron isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 25.9x forward price-to-earnings (or $119.35 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d suggest looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Itron

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.