Online real estate marketplace Zillow (NASDAQ:ZG) will be reporting earnings tomorrow afternoon. Here’s what to look for.

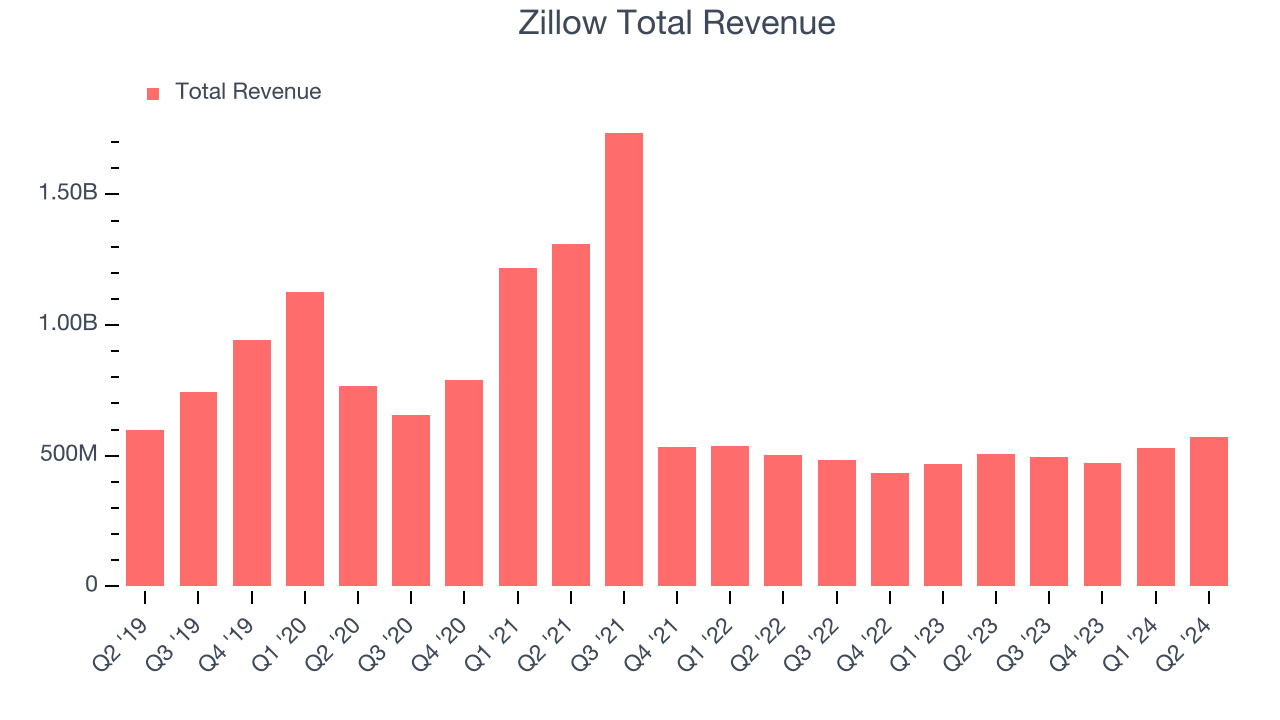

Zillow beat analysts’ revenue expectations by 6.3% last quarter, reporting revenues of $572 million, up 13% year on year. It was an exceptional quarter for the company, with an impressive beat of analysts’ EBITDA estimates.

Is Zillow a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Zillow’s revenue to grow 11.9% year on year to $555.2 million, improving from the 2.7% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.29 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Zillow has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 5.7% on average.

Looking at Zillow’s peers in the real estate services segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Compass delivered year-on-year revenue growth of 11.7%, meeting analysts’ expectations, and CBRE reported revenues up 14.8%, topping estimates by 2.7%. Compass’s stock price was unchanged after the results, and CBRE’s price followed a similar reaction.

Read our full analysis of Compass’s results here and CBRE’s results here.

Investors in the real estate services segment have had steady hands going into earnings, with share prices up 2% on average over the last month. Zillow’s stock price was unchanged during the same time and is heading into earnings with an average analyst price target of $64 (compared to the current share price of $58.75).

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.